Key takeaways

- The Federal Reserve is expected to reduce interest rates by 25 basis points to a range of 4.25% to 4.5%.

- Market instability is likely to increase as the event approaches.

Share this article

The Federal Reserve is scheduled to announce its interest rate decision during its meeting on Wednesday. Economists widely predict that the Federal Reserve will cut rates for the third time in a row, lowering the federal funds rate to a target range of 4.25% to 4.5%.

Another 25 basis point rate cut would result in a total reduction of a full percentage point since September. The federal bank first cut interest rates by 0.5 percentage point in September and then made another 0.25 percentage point cut in November.

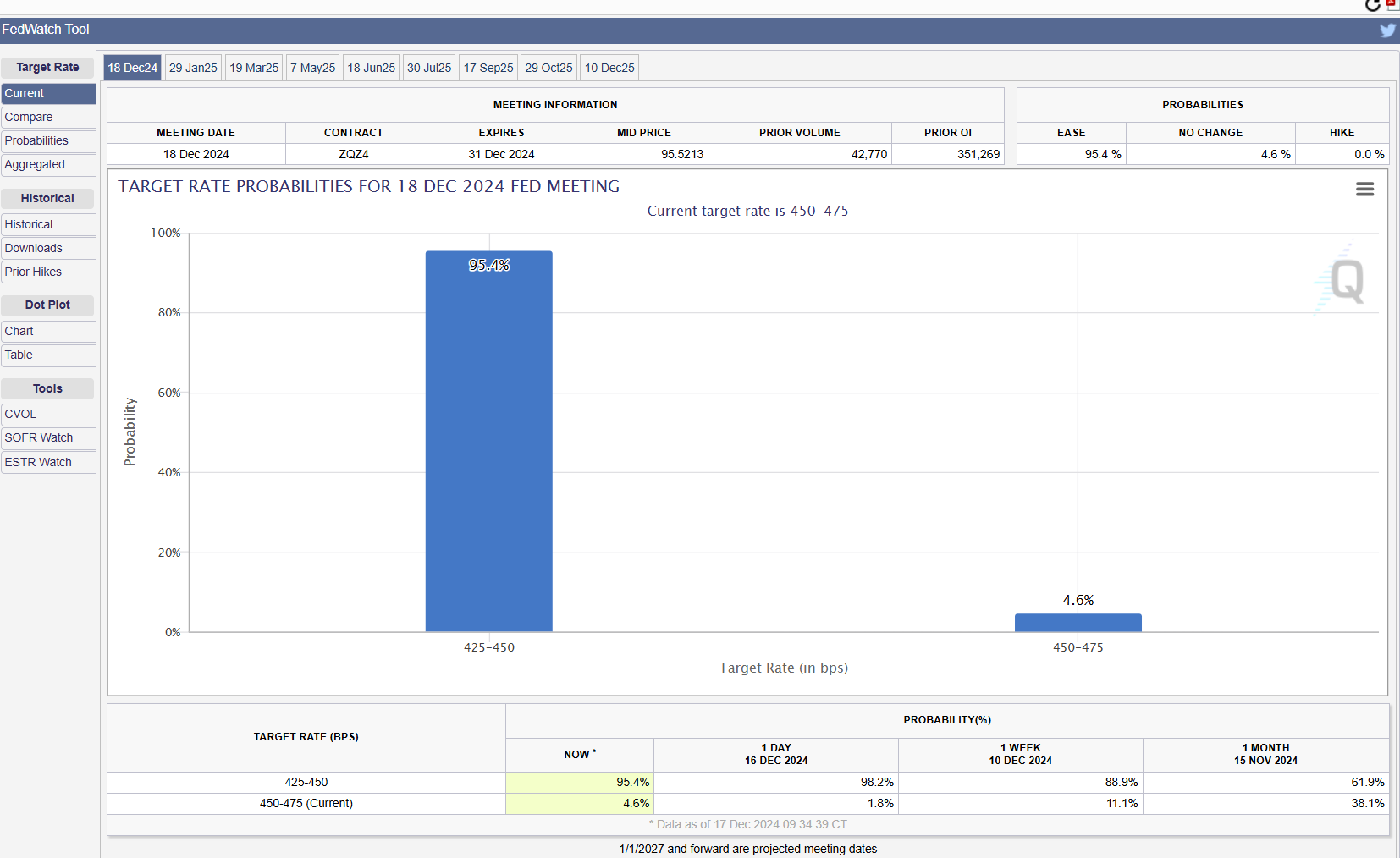

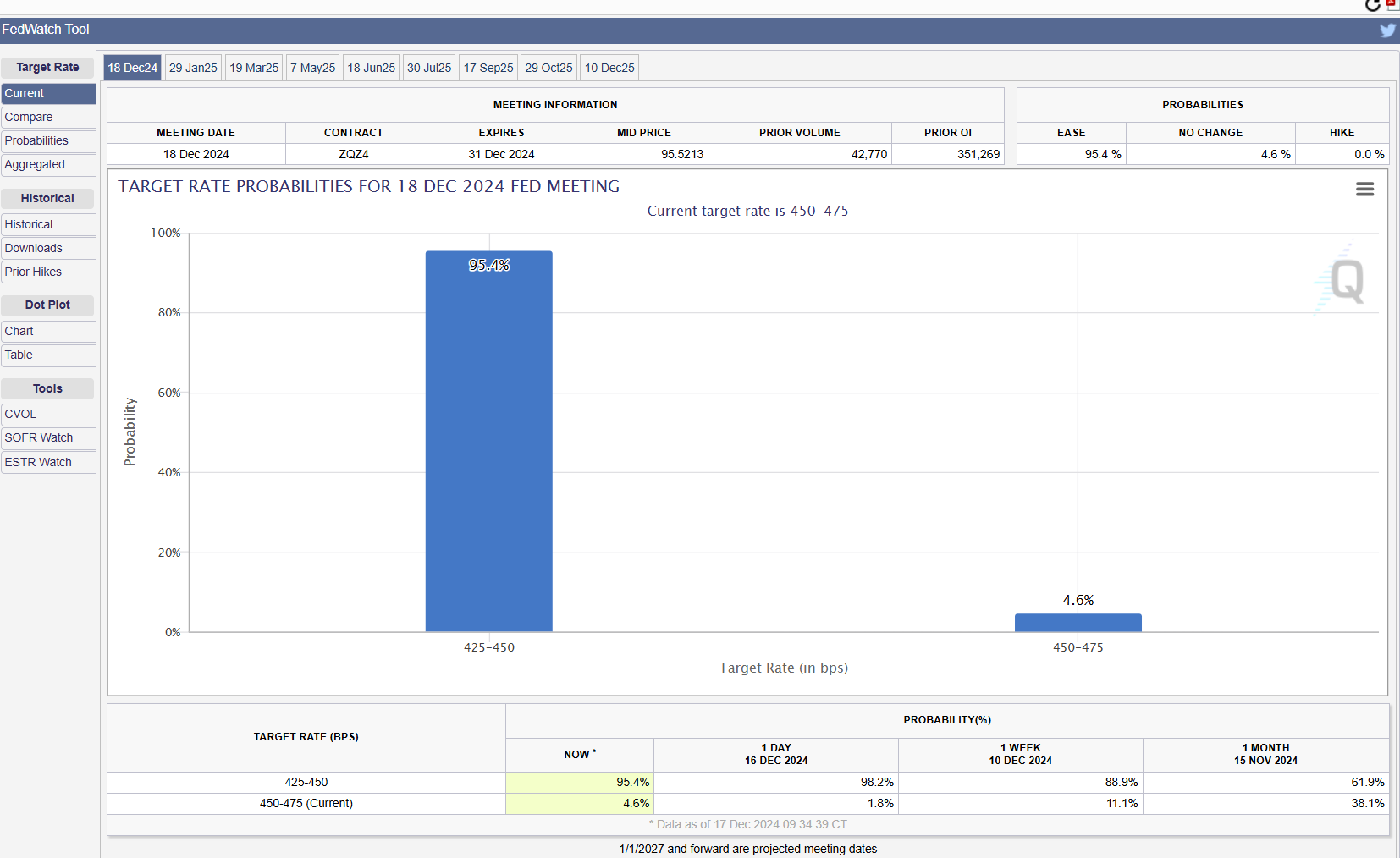

According to the CME FedWatch ToolThere is now a 95.4% chance of a 25 basis point rate cut, while the probability of maintaining current rates is 4.6%. This reflects a slight adjustment from yesterday, when the probability of a rate cut was around 98%.

However, compared to last week, expectations for a rate cut have strengthened, particularly after November inflation data met expectations and employment numbers showed strength.

According to the Bureau of Labor Statistics (BLS), the US economy added 227,000 jobs in November, exceeding expectations and showing a recovery after months disrupted by hurricanes and strikes.

Job growth has been strong, particularly in sectors such as healthcare and tourism. Strong employment gains contribute to a positive economic outlook, which may influence the Federal Reserve's decision-making regarding interest rates.

Last week, the BLS reported that the November CPI rose 2.7% year over year, in line with expectations. Immediately after the report, the odds of a rate cut in December rose to about 96%.

Future rate cuts less likely

Inflationary pressures have stabilized, but have not yet returned to desired levels. The Federal Reserve has been working to reduce inflation from a high of 9.1% in June 2022, and while there has been progress, the current rate is still above its 2% target.

Jacob Channel, Senior Economist at LendingTree, saying in a statement to CBS News that the Federal Reserve will likely proceed with a 25 basis point cut at its next meeting, but there may not be any further cuts in the immediate future.

The economist also pointed to possible changes in President-elect Donald Trump's economic policies, which “could cause a resurgence of inflation or unbalance the economy.” In this scenario, the Federal Reserve could choose to postpone further rate cuts to evaluate their effects on the economy.

crypto Markets Brace for Volatility Ahead of Fed Rate Decision

crypto markets are bracing for increased volatility as the Federal Reserve's interest rate decision approaches. bitcoin (btc) is down 2% in the last 24 hours, while ethereum (eth) is down 4%, according to CoinGecko data.

The overall crypto market capitalization currently stands at $3.8 trillion, reflecting a 4% decline over the past day.

bitcoin fell to $104,000 after hitting a high of $107,000 on Tuesday. The pullback led to a broader drop in altcoins, with Ripple (XRP), Solana (SOL), Doge (DOGE), and Binance Coin (BNB) also seeing slight losses.

Markets may become more turbulent as the key event approaches.

Among the top 100 crypto assets, Pudgy Penguins' PENGU token recorded the largest losses at 55%, likely due to strong selling pressure following its airdrop to nft holders, causing a sharp drop in both the value of the token as in the minimum price of Pudgy Penguins. nfts.

Share this article

NEWSLETTER

NEWSLETTER