The Federal Reserve’s balance sheet increased by $300 billion in one week, sparking debate over whether these actions qualify as quantitative easing.

The following article is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

The lender of last resort

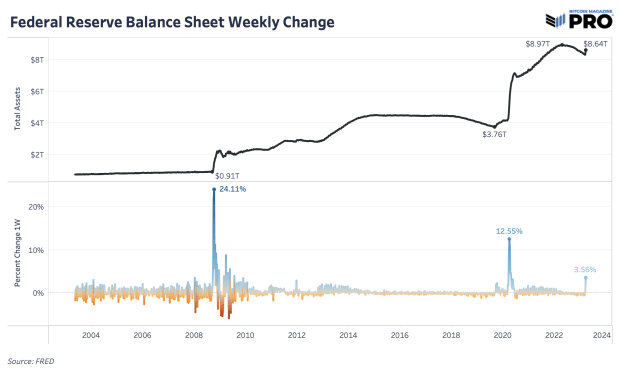

Just days after the fallout from Silicon Valley Bank and the establishment of the Bank Term Funding Program (BTFP), there has been a significant increase in the Federal Reserve’s balance sheet after a full year of decline through quantitative tightening ( QT). Extensive quantitative easing (QE) PTSD is causing many people to ring alarm bells, but the Fed’s balance sheet changes are much more nuanced than a new regime change in monetary policy. In absolute terms, it’s the largest balance sheet increase we’ve seen since March 2020, and in relative terms, it’s an outlier that’s getting everyone’s attention.

The key takeaway is that this is very different from the QE asset-buying spree and exhilarating easy money at near-zero interest rates we’ve experienced over the past decade. These are select banks that need liquidity in times of economic hardship and those banks that take out short-term loans with the goal of covering deposits and repaying loans quickly. Not outright purchase of securities to hold indefinitely on the Fed’s balance sheet, but balance sheet assets that should be short lived while QT policy is continued.

Nonetheless, it is a balance sheet expansion and liquidity increase in the short term, potentially only a “temporary” measure (yet to be determined). At the very least, these liquidity injections help institutions avoid becoming forced sellers of securities when they otherwise would be. Whether that is QE, pseudo QE or not QE is beside the point. The system is showing fragility once again and the government must intervene to prevent it from facing systemic risk. In the short term, assets that thrive on liquidity rise, such as bitcoin and the Nasdaq, which have risen at the same time.

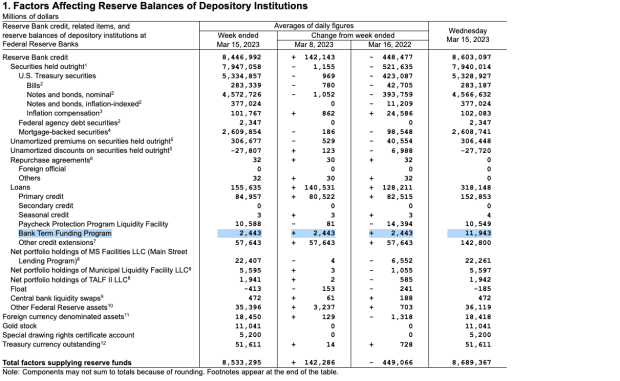

This specific increase in the Fed’s balance sheet is due to an increase in short-term lending in the Fed discount window, FDIC bridge bank lending to Silicon Valley Bank and Signature Bank, and the Bank Term Funding Program . Discount window loans were $152.8 billion, FDIC bridge bank loans were $142.8 billion, and BTFP loans were $11.9 billion for a total of more than $300 billion.

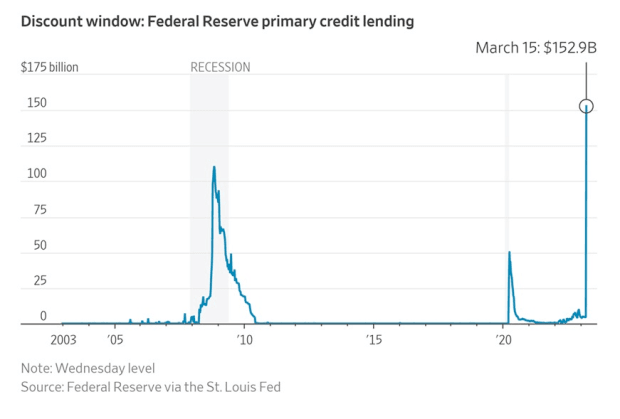

The most alarming rise is in discount window lending, as it is a high-cost liquidity option of last resort for banks to cover deposits. It was the largest discount window loan on record. Banks using the window are kept anonymous, as there is a legitimate stigma issue in finding out who needs short-term liquidity.

This brings back recent memories of the 2019 emergency liquidity injection and the Federal Reserve’s intervention in the repo market to stabilize cash demand and short-term lending activities. The repo market is a key method of overnight financing between banks and other institutions.

Download the FREE “Banking Crisis Survival Guide” today!

Get your copy of the full report here.

The next FOMC meeting

The market is still expecting a 25bp rate hike at next week’s FOMC meeting. Overall, the market turmoil so far has not proven to “break enough stuff”, which would require an emergency turnaround from central bankers.

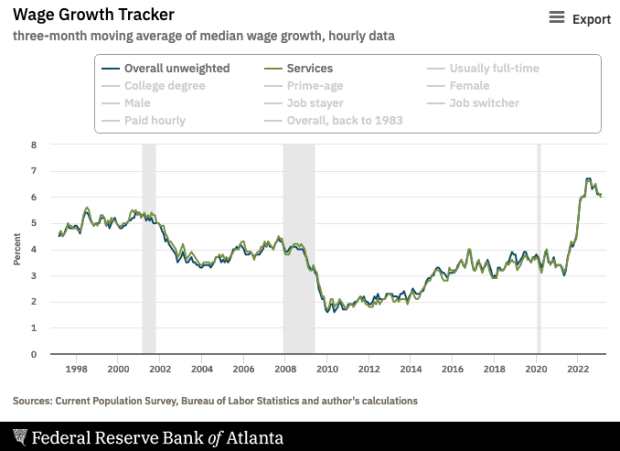

On its way to bring inflation back to the 2% target, month-over-month core CPI continued to rise in February, while initial jobless claims and unemployment have not moved much. Wage growth, especially in the service sector, remains quite strong at the 3-month annualized rate of 6% growth last month. Although declining slightly, more unemployment is where we will have to see more weakness in the labor market for wage growth to be much lower.

We are likely far from the end of the chaos and volatility this year, as each month has brought new levels of uncertainty to the market. This was the first sign that the system needed Federal Reserve intervention and quick action. It probably won’t be the last in 2023.

That concludes the excerpt. from a recent issue of Bitcoin Magazine PRO. subscribe now to receive PRO articles directly to your inbox.

Relevant past articles:

- Banking Crisis Survival Guide

- PRO Market Keys of the Week: Market Says Tightening Is Over

- Biggest bank failure since 2008 sparks fear across the market

- Banking problems brewing in Crypto-Land

- A Story of Tail Risks: The Fiat Prisoner’s Dilemma

- Bank of Japan blinks and markets shake

- The Everything Bubble: Markets at a Crossroads

- Silvergate Bank faces a run on deposits as share price falls

- Counterparty risk happens fast

- Not Your Average Recession: Unwinding the Biggest Financial Bubble in History