Tether, the issuer behind major stablecoin Tether (USDT), has blacklisted an address that depleted $25 million of maximum withdrawable value (MEV) bots last week.

The address in question took advantage of a bug in the MEV boost relay to outwit MEV bots trying to execute a sandwich trade. Sandwiching occurs when one order is placed immediately before the trade and another immediately after. In essence, the merchant will execute early and late at the same time, sandwiching the original pending transaction in between.

In this case, the red validator address swooped in to execute the MEV transaction, resulting in losses of nearly $25 million across various digital assets, making it the largest MEV exploit to date. Etherscan has already flagged the address, warning of its involvement in the exploit.

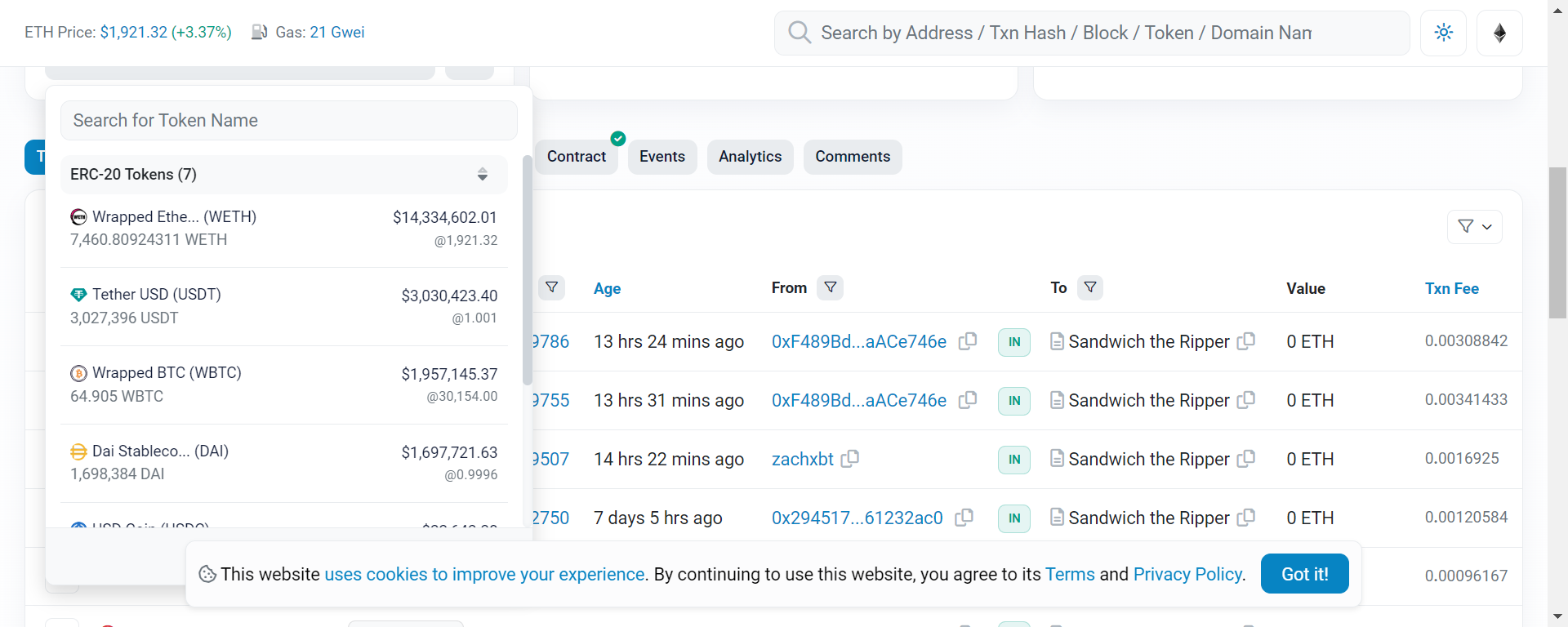

The USDT address held around $3 million worth of USDT at the time of the blacklist and a total of $21 million worth of various other ERC-20 tokens.

The blacklisting of the red validator address drew some pushback from the community for its censorship approach. Arthur, an engineer at crypto exchange Kraken, called the blacklist “nonsense,” saying that MEV bots also take advantage of traders, and that the sandwich exchange they were trying to run was just as nefarious as draining their funds.

“MEV bots take advantage of transfers and all is well, but someone does it to them and they get blacklisted?”

Another chain detective who goes by the Twitter name ZachXBT saying that Tether’s blacklisting could be the result of a court order. Cointelegraph reached out to Tether to confirm, but did not get a response by press time.

Jaynti Kanani, co-founder of Polygon, called Tether’s action sets a “bad precedent,” while Fastlane Labs co-founder Jordan Hagan called it “the most concerning DeFi development of 2023.” He added that the main issue is Tether’s willingness to lock or unlock “large amounts based on activity on the consensus layer (Beacon Chain).”

This is the most worrying DeFi development of 2023.

The “victims” of the bot signed those transactions and sent them to the relay. Were executed.

The exploit was not in DeFi. Tether’s blocking implies that they have an opinion on the consensus/social layer of eth.

slippery slope… https://t.co/I4Lf2N6WtG

—Thogard (@ThogardPvP) April 11, 2023

MEV bots make more money by leveraging information about transactions that are about to be executed. Most of the time, arbitrage is used to do this (taking advantage of price differences between exchanges).

When an MEV bot notices that someone else is planning to buy a coin, it positions itself to benefit from the slight price increase their offer is likely to trigger. Leading the trade, the bot skips the queue and buys the coin for slightly less. The bot then preempts the trade and buys the cryptocurrency for less.

Related: Ethereum validator charges 689 ETH from MEV-Boost relay

MEV bot practices are often considered a form of invisible tax. Recently, 27 Ethereum-based projects have come together to launch MEV Blocker. The MEV blocker aims to minimize the amount of value extracted from merchants.

Magazine: Crypto audits and bug bounties are broken: here’s how to fix them