As the price of Solana (SOL) has skyrocketed at an astonishing rate 722% so far this yearThe rapid growth of the network has attracted both attention and challenges.

Not only has the native token gained significant value, but so has the use of Solana-based meme coins such as Bonk Inu (BONK), which has grown over 854% year-to-date, and decentralized applications (dApps) have skyrocketed. Unfortunately, this surge in popularity has led to an increase in attacks against the so-called “ethereum Killer.”

Exploitation of malicious Solana dApps

Web3 security firm Blockaid recently observed a worrying trend of users falling victim to Solana-based drain attacks.

A notable example is the website lessfeesndgas(.)org, which managed to steal tokens from the Solana program library (SPL), which is designed to support the creation and management of tokens on Solana and SOL worth hundreds of thousands of dollars.

Interestingly, according to the company's post on X (formerly Twitter), Blockaid's secure wallets remained immune to these attacks from the moment the site went live, preventing connections from being made.

According to the firm, the sophistication of these drainers is notable as they can fool the simulations used by Solana wallets, causing users to unknowingly sign malicious transactions. Web3 security company Blockaid further stated:

As Solana continues to gain popularity, drain pools are increasingly moving towards it, as indicated by the growing number of malicious Solana dApps detected by Blockaid.

Solana's rapid rise as a high-performance blockchain platform has generated admiration and scrutiny. Its ability to process transactions quickly and at a lower cost than ethereum has positioned it as a strong competitor.

However, the network's success has also made it an attractive target for malicious actors seeking to exploit vulnerabilities and capitalize on its growing user base.

Still, this is not the only bad news for Solana in recent hours, as its native token has been experiencing a sharp continuous drop in price, leading to the belief that its bullish and bullish trend may have ended despite the possibility of a rebound. in the crypto market in general.

Rising stablecoins and nft sales fail to prevent SOL price drop

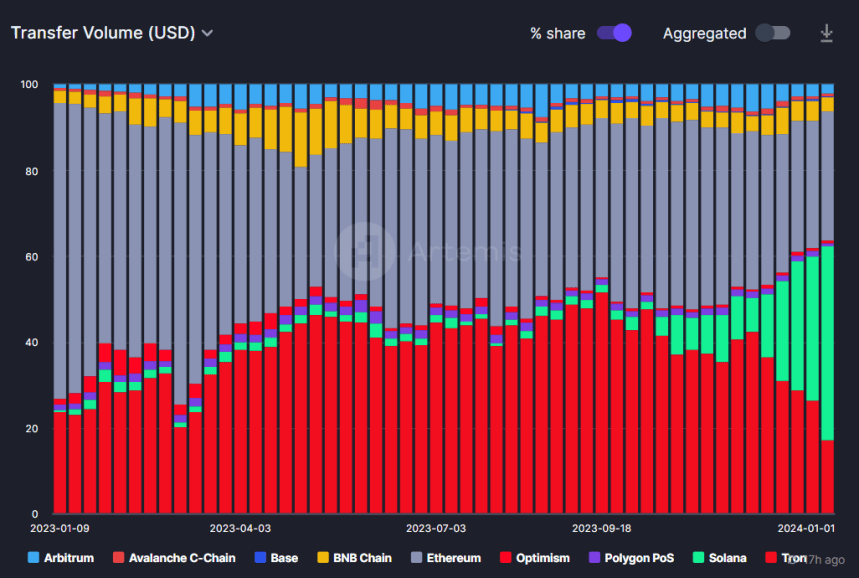

In just five hours, the price of SOL saw a significant drop of 13%, reaching a low of $85 on Wednesday. This decline occurred despite notable growth in stablecoin transferswhich saw an increase of more than 45% this week.

Also, on Tuesday, SOL surpassed ethereum in monthly trading volume for non-fungible token (nft) sales, marking a milestone for the network.

SOL is the fifth largest cryptocurrency, with a market capitalization of $42.6 billion. It has a 12 billion dollar lead over XRP and trails right behind binance coin (BNB) for just 6 billion dollars.

SOL's price trajectory remains uncertain as investors wait for signs of a possible resurgence of bullish momentum.

Creating a more secure framework for decentralized applications (dApps) could be instrumental in restoring investor confidence and attracting additional capital to the ecosystem, which could push SOL to reclaim its one-year high of $126, previously reached December 25th.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER