Solana's native token, SOL (SOL), rose 35% between October 5 and 11, reaching its highest level since December 2021 at $222. This move has led traders to speculate whether the all-time high of $260 is within reach, especially after bitcoin (btc) surpassed $84,500, driven by continued institutional inflows and anticipated regulatory clarity in the United States.

SOL has outperformed the broader altcoin market, which saw a 33% increase over the same six-day period ending October 11. Investor optimism regarding SOL is driven in part by the expansion of Solana's smart contract activity, as evidenced by the total value locked. (TVL).

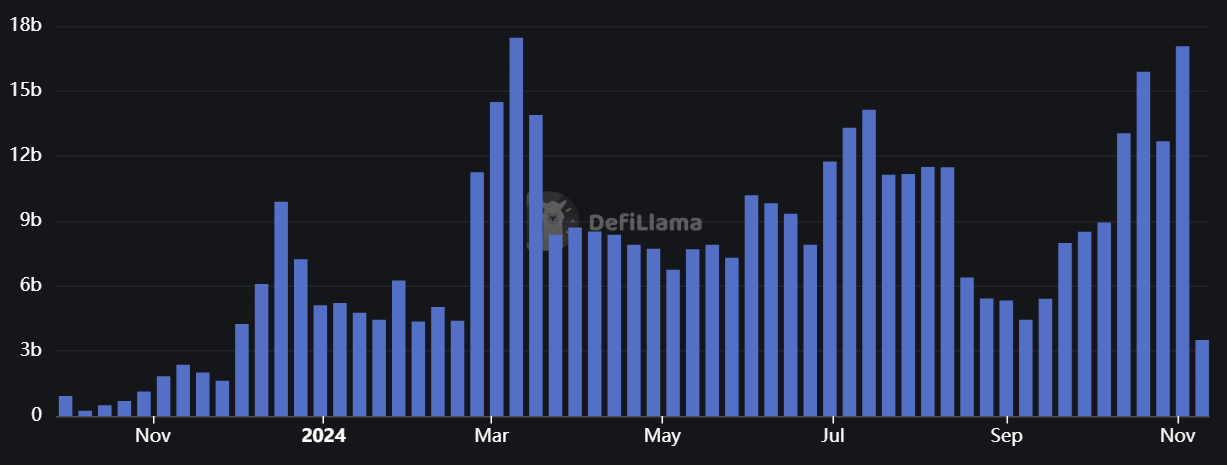

Total Solana value locked in USD. Source: DefiLlama

Solana's TVL rose to $7.6 billion on October 10, marking the highest level since December 2021. Key decentralized applications (DApps) such as Jito, Raydium, Drift and Binance's liquid stake contributed significantly to a 36% growth in deposits.

Solana's increased activity is not limited to memecoin trading

There are some valid criticisms of Solana's heavy reliance on memecoins, including Dogwifhat (WIF), Bonk (BONK), and Popcat (POPCAT), all of which have surpassed the $1.5 billion market cap threshold. Decentralized token launching platforms like Pump.fun have been the main drivers of Solana's increased decentralized exchange (DEX) volumes.

Solana weekly DEX volumes, USD. Source: DefiLlama

Weekly DEX volumes on Solana increased to $17.1 billion in the week ending November 2, a figure not seen since March 2024, and corresponding to a 26% market share, surpassing even the leading DApps-focused blockchain, ethereum. Solana also managed to capture $88.2 million in monthly fees, which is vital to addressing network security issues.

By comparison, the ethereum network, with a TVL more than 7x that of Solana, earned $131.6 million in monthly fees. Similarly, Tron, another blockchain that emphasizes base layer scalability, raised $49.1 million in fees over 30 days. These figures do not include the ecosystem's broader revenues, which include notable contributions such as $100.2 million from Jito and $83 million from Raydium.

Evaluating platforms solely by TVL and fees can be misleading, as not all DApps need large volumes to be meaningful. However, they are crucial for adoption and attracting new users, laying the foundation for sustainable growth and increased demand for SOL accumulation and utilization.

For example, Magic Eden, Solana's leading non-fungible token (nft) marketplace, registered 77,160 active addresses in the last 30 days, as reported by DappRadar. By contrast, OpenSea, a comparable service on the ethereum network, recorded 37,940 active addresses during the same period.

This data provides strong evidence of how the Solana network has attracted users beyond the memecoin frenzy, suggesting that SOL price can generate further profits. However, to determine if traders are excessively leveraging their positions, SOL perpetual futures should be analyzed.

Related: 80% of memecoins to boost after listing on Binance in 2024

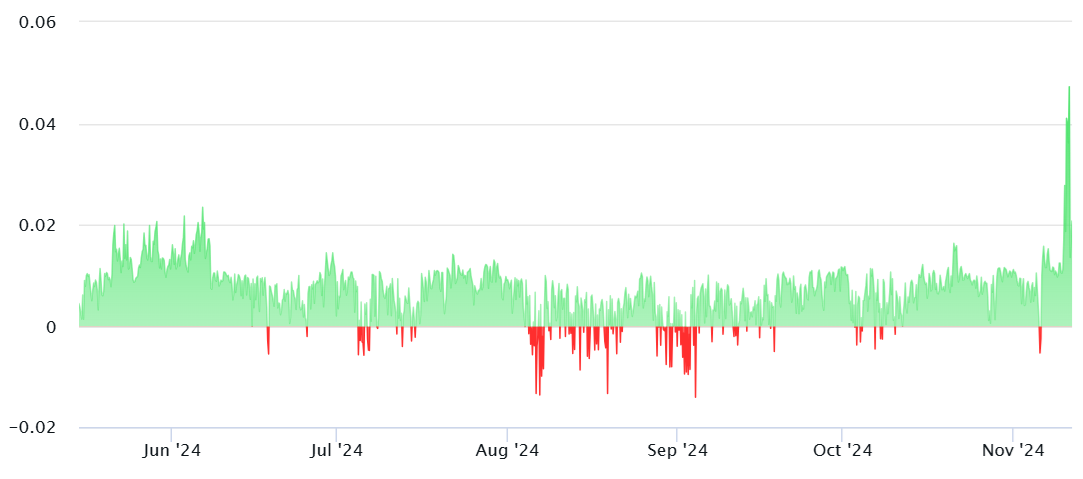

8-hour SOL futures funding rate, %. Source: Laevitas.ch

A positive funding rate indicates that long positions (buyers) are paying for leverage, which typically ranges between 0% and 2% per month in neutral markets. The recent rise to 5% on November 10 suggested temporary over-enthusiasm, but the latest data on November 11 shows a neutral leverage cost of 1.8% monthly.

In terms of on-chain metrics and derivatives, SOL appears to be on track to hit an all-time high, driven by increased network activity and no signs of excessive leverage.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.