Avalanche's Q2 performance summary

Avalanche (AVAX) As reported by Coin98 Analytics, during the second quarter of 2024, there have been significant declines in key metrics. Fee and revenue figures amounted to $3.5 million, reflecting a worrying 22% decrease from the previous year. This decline highlights the challenges in maintaining revenue amid volatile market conditions.

Source: x

Transactional activity remained robust with over 101 million transactions processed, but daily active addresses saw a notable 26% year-over-year drop, suggesting lower user engagement. Similarly, daily transaction volumes declined by 30%, indicating a slowdown in network utilization compared to previous periods. Despite the addition of 2 million new addresses, Avalanche’s growth in unique addresses reached 21 million, indicating moderate adoption compared to Q2 2023.

In the nft sector, Avalanche faced a sharp 90% drop in nft creation, underscoring the challenges within this segment influenced by broader market trends.

Assessing Avalanche's outlook for the third quarter

Entering the third quarter, AMB crypto’s analysis based on Artemis and Santiment data indicated that Avalanche was facing ongoing challenges. Daily active addresses declined sharply after a brief spike, reflecting subdued user activity. Transaction volumes and revenue metrics followed suit, reflecting continued pressure on network performance. Development activity also showed signs of contraction, suggesting possible adjustments to platform improvements.

Source: Artemis

The nft market on Avalanche witnessed volatility, with transaction counts fluctuating noticeably, driven by external factors affecting digital asset valuations.

Source: Santiment

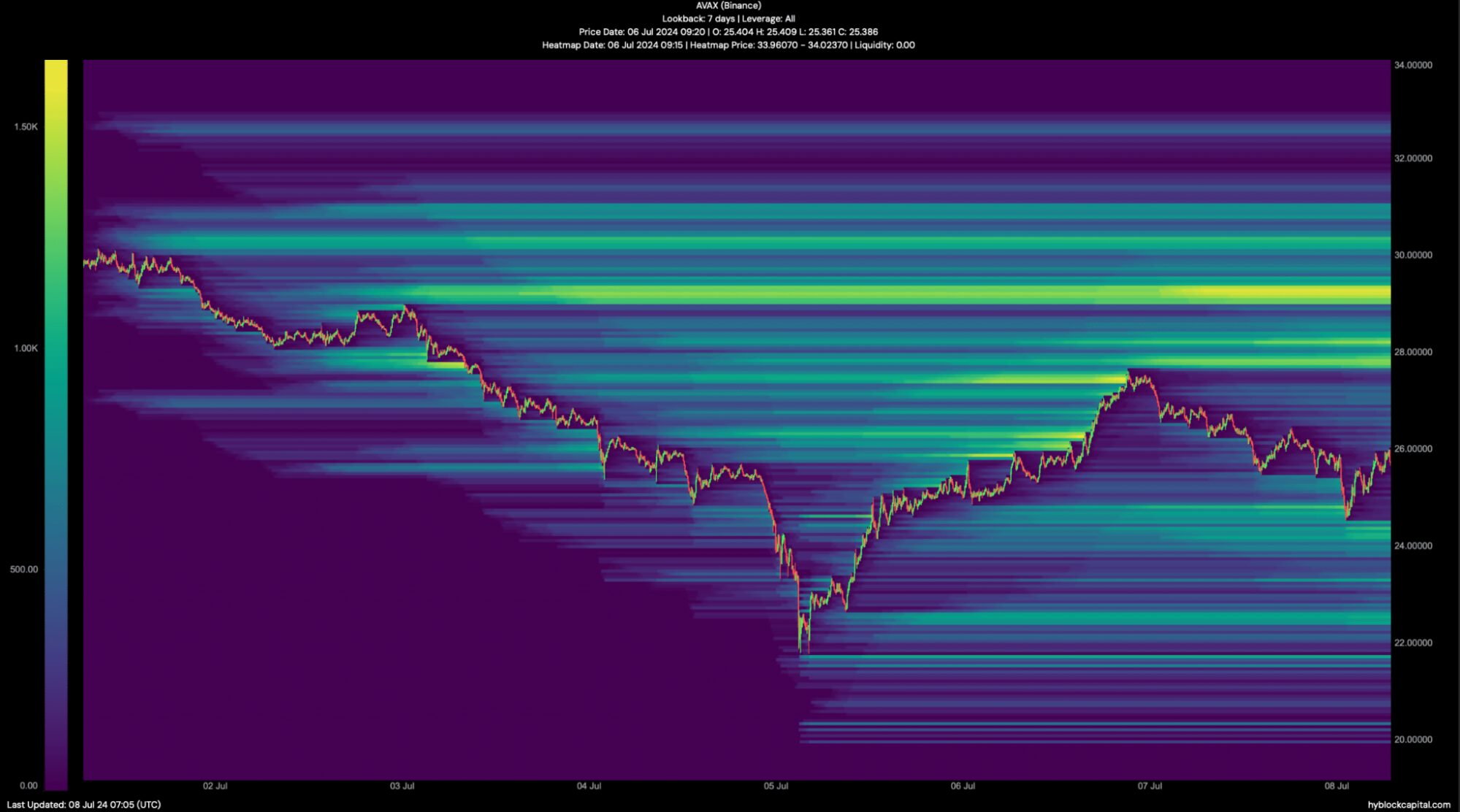

The market sentiment for AVAX has been predominantly bearish, with the cryptocurrency recently experiencing a 13% drop. It is currently trading at $25.70 with a market cap exceeding $10.12 billion. Analysts at Hyblock Capital propose a price target of $22.4 if the drop persists, while optimism could push AVAX towards $27 in the near term.

Source: Hyblock Capital

Looking to the future of AVAX

Avalanche faces a critical time to reassert its position in the market amidst shifting dynamics. Strategic perspectives and proactive measures will be crucial as AVAX navigates challenges and explores growth opportunities. The cryptocurrency community awaits developments with cautious optimism, anticipating potential catalysts that could influence AVAX’s trajectory in the blockchain ecosystem.

In summary, while Q2 and early Q3 presented challenges for Avalanche, its resilience and strategic initiatives could pave the way for renewed momentum and recovery. As AVAX continues to adapt to market changes, it remains poised to capitalize on emerging opportunities and strengthen its role in the blockchain landscape.

NEWSLETTER

NEWSLETTER