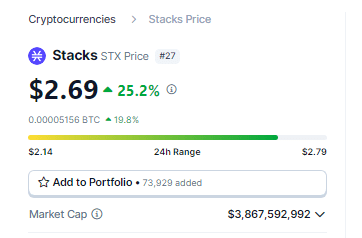

Stacks (STX), a cryptocurrency that facilitates smart contracts on the bitcoin blockchain, has defied broader market turmoil to emerge as a prominent player. During last week, STX price soared more than 60%, hitting a nine-day high of $2.15 and flirting with its all-time high of $2.45. This impressive rally has propelled Stacks into the top 25 cryptocurrencies by market capitalization, leaving many wondering: what is driving the rise?

Stacks (STX) rises more than 60% thanks to the rise of bitcoin

Several factors appear to be driving Stacks' rise. First, its unique ability to bring smart contract functionality to bitcoin resonates with investors looking for advanced applications on the world's oldest blockchain. Unlike ethereum, bitcoin inherently lacks smart contract support, limiting its DeFi and nft capabilities.

Source: Coingecko

Stacks bridges this gap by anchoring to bitcoin while also offering smart contract features. This innovative approach has attracted significant attention, particularly as bitcoin itself enjoys recent price appreciation. reaching more than $52,000 at the time of writing.

The correlation between Stacks and bitcoin is undeniable. Both assets saw sharp recoveries in the second week of February, with STX mirroring bitcoin's rise from $38,500 to $50,000. This intertwined fate highlights the influence of broader bitcoin sentiment on Stacks price action.

STXUSDT trading at $2.69 the 24-hour chart: TradingView.com

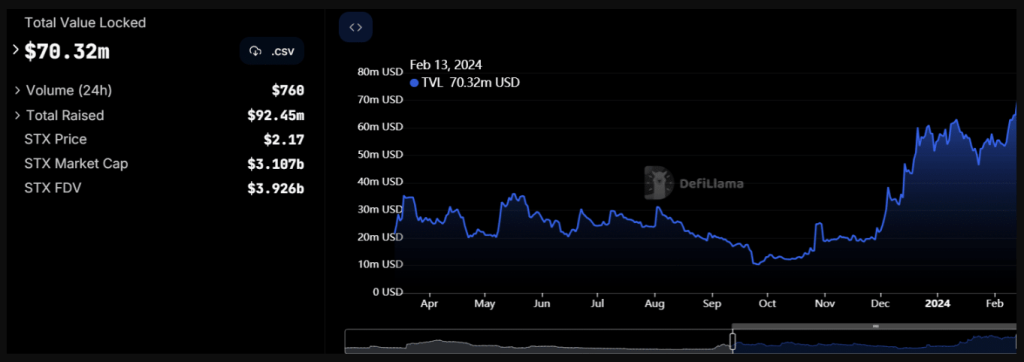

STX gains momentum as TVL rises

Beyond the price movements, another bullish indicator emerges from the Stacks DeFi ecosystem. According to DefiLlama, the total value locked (TVL) within Stacks DeFi protocols has increased by more than 50% in the last three weeks, reaching $70.21 million. This growth means increased investor confidence and active capital commitment within the DeFi Stacks landscape.

Technical analysis further amplifies the optimistic outlook. Analysts predict a possible continuation of the rally, with price targets ranging between $2.475 and $2.82. This bullish forecast depends on STX breaking through the recent high resistance of $2.06, a decisive technical milestone achieved earlier this week.

Stacks Total Value Locked. Source: Defillama

.@Batteries has gone from around 60th in coin market capitalization to 34th in a year, surpassing many well-known names in the same

Expect it to break into the top 20 around the halving as bitcoin L2 narratives begin to dominate the discourse and L1 network fees hit new all-time highs.

As we delve into…

— trevor.btc — b/acc (@TO) February 12, 2024

However, it is crucial to recognize the inherent volatility of the cryptocurrency market. Recent US inflation data sparked a sell-off across the market, reminding investors of the unpredictable nature of this asset class. While Stacks managed to recover quickly, the episode underscores the importance of responsible investment practices and a thorough risk assessment.

Despite the risks, Stacks' unique value proposition and recent momentum cannot be ignored. Its ability to connect the smart contract functionality of ethereum with the security and immutability of bitcoin positions it as a potentially disruptive force in the blockchain space.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER