The price of Ether (eth) printed a bear flag in the daily table, a formation of the technical table associated with a strong downward impulse. Could this bearish configuration and a decrease in transaction rates indicate the start of the second stretch of eth drop to $ 1,200?

ethereum's network activity collapses

Market reduction, fueled by the president of the United States, Donald Trump, tariff threatsHe saw that Ether's price fell by almost 50% from a maximum of $ 3,432 on January 31 to a minimum of 16 months of $ 1,750 on March 11.

Although eth has recovered 18% since then, it failed to produce a decisive breakdown above $ 2,000 per second time in less than 10 days.

This weakness is reflected in the activity of the chain, with the daily count of ethereum transactions that falls to the last time seen in October 2024, before the victory of the presidential elections of Donald Trump.

ethereum daily transactions count. Source: Cryptoquant

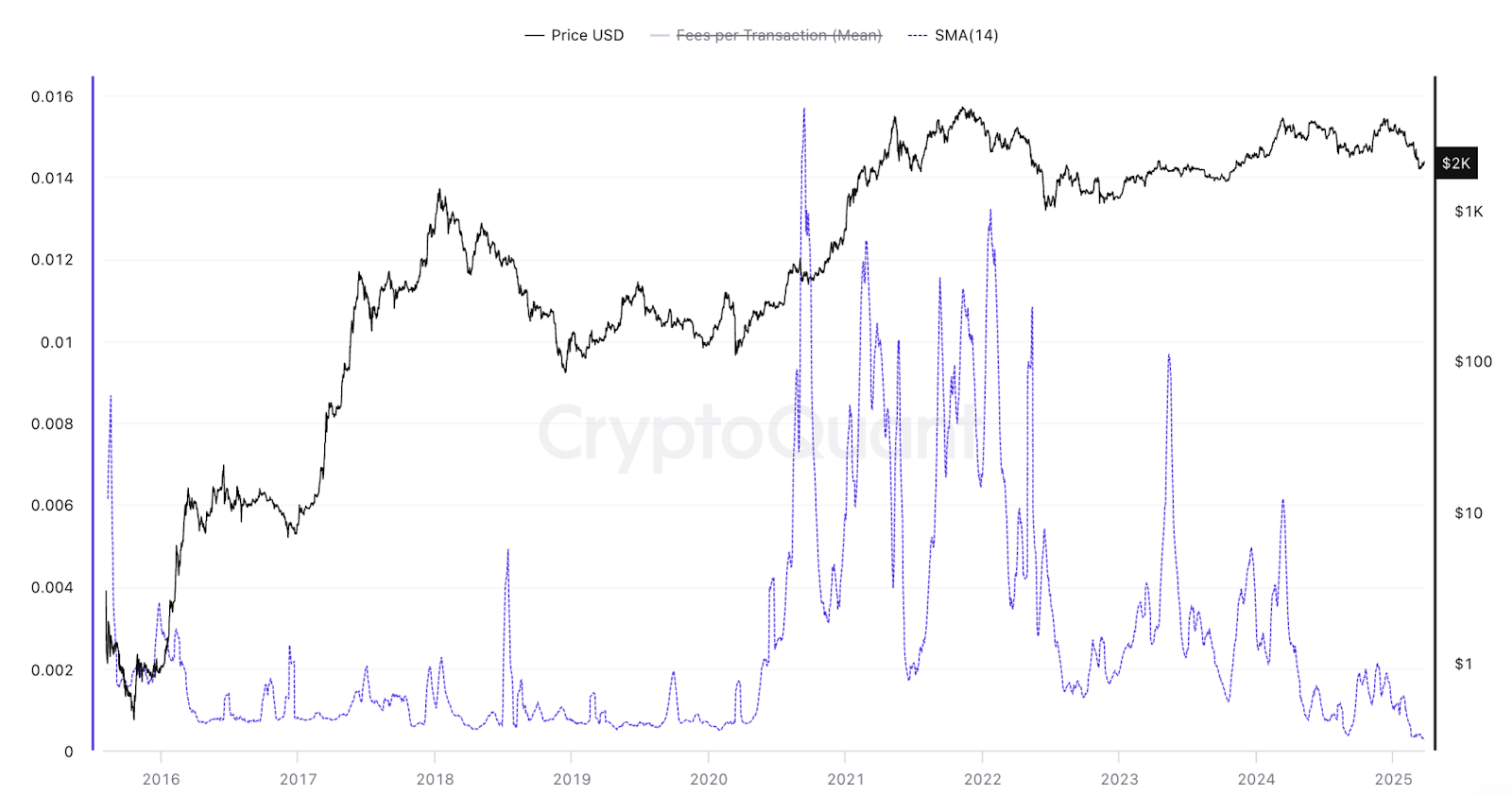

ethereum's average transaction rates also collapsed, reaching a historical minimum of 0.00025 eth ($ 0.46) on March 24.

ethereum: Transaction rate. Source: Source: Cryptoquant

The low transaction count and rates suggest less demand for block space, either for defi, nft or other DAPP. It suggests a lower network activity, often correlating with a diminished interest or market confidence.

Historically, Ether's price has been correlated with high network periods. For example, during the Defi 2021 boom, rates increased to 0.015 eth due to high demand.

On the contrary, the lowest rates require less eth, which exerts a downward pressure on the price.

eth supply inflation returns

Other key factors that weigh Ether's performance are its decline burn rate and growing supply.

With the decrease in transaction rates, the daily opening rate eth has become historical minimums, resulting in an inflationary trend.

According to ultrasound data. Money, the projected eth burn rate has decreased to 25,000 eth/year, and its supply growth has increased at an annual rate of 0.76%, which takes the emission rate to 945,000 eth per year.

Burn rate eth. Source: Ultrasound. Money

As a result, ethereum's supply has increased constantly since April 2024, reversing the deflationary period introduced by the change to the participation test (the merger) in September 2022. ethereum's total supply has now exceeded the levels prior to the merger, as shown in the graph below.

ethereum Supply claims the levels prior to fusion. Source: Ultrasound. Money

The fusion eliminated the ethereum mining -based emission, which previously had a high supply inflation rate. ethereum also implemented the London Hard Fork in August 2021, which introduced a mechanism that burns a part of the transaction rates.

Related: ethereum dropped 57% from its historical maximum, but it is still worth more than Toyota

When the network activity is low, the amount of burnt eth is lower than the freshly issued eth, which makes assets inflation.

Ether's bear flag is aimed at $ 1,230

The eth/USD torque is positioned to resume its predominant bearish impulse despite the recovery of recent minimums, since the graph shows a classic bearish pattern in creation.

Ether's price action in the last 30 days has led to the formation of a bears flag pattern in the daily table, as shown in the figure below. A daily candlestick near the lower limit of the flag at $ 2,000 would indicate the start of a massive breakdown.

The objective is established by the height of the Asta Asta, which reaches approximately $ 1,230, a drop of approximately 40% of the current price.

eth/USD daily graph with bears flag pattern. Source: Cointelegraph/<a target="_blank" data-ct-non-breakable="null" href="https://www.tradingview.com/x/VTA41NAM/” rel=”null” target=”null” text=”null” title=”https://www.tradingview.com/x/VTA41NAM/”>Commercial view

Despite these risks, some merchants remain optimistic about Ether's positive potential, with the analyst Jelle <a target="_blank" data-ct-non-breakable="null" href="https://x.com/CryptoJelleNL/status/1904120700727644531″ rel=”null” target=”null” text=”null” title=”null”>saying that the price is bouncing and trying to return above the key support level at $ 2,200.

If this happens, “we will have a monstrous deviation in our hands,” Jelle added.

crypto Ceaser, his partner analyst, said ethereum is “very undervalued” and is touching the current levels.

<blockquote class="twitter-tweet”>

<a target="_blank" href="https://twitter.com/search?q=%24ETH&src=ctag&ref_src=twsrc%5Etfw”>$ eth – <a target="_blank" href="https://twitter.com/hashtag/ethereum?src=hash&ref_src=twsrc%5Etfw”>#Eloum He is currently playing. It is so undervalued.

In each bullcycle, there is a time when most people think ethereum will never return after a great bearish event as can be seen in the table.

We only had such a moment in my opinion. pic.twitter.com/wprv7loxlr

– crypto Caesar (@Cryptocasarta) <a target="_blank" href="https://twitter.com/CryptoCaesarTA/status/1904485590629834789?ref_src=twsrc%5Etfw”>March 25, 2025

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER