Polygon’s native token (MATIC) saw a 16.4% rally that coincided with the launch of the Polygon 2.0 Goreli testnet on October 4. However, the resistance at $0.60 proved stronger than expected and was followed by a 10.6% drop over the previous six days. until October 10.

This decline was exacerbated by negative news regarding the departure of a key co-founder and weak activity on Polygon’s zero-knowledge rollup (ZK) subnetwork.

MATIC price has erased previous gains from the early October rally, erasing bullish momentum driven by expectations of protocol upgrades.

Rallies tend to follow protocol and mainnet updates

Polygon 2.0 is a network of ZK-based Layer 2 chains, unified by a novel cross-chain coordination protocol. Polygon’s Scaling 2.0 technology was introduced in June 2023 as a plan for a scaling ecosystem consisting of four layers: engagement, execution, interoperability, and testing. Each of these layers contributes to creating an interconnected ecosystem of chains that facilitate secure, fast and extremely profitable transfers.

Among the benefits of Polygon 2.0 are improved security and privacy through ZK testing, full support for the ethereum Virtual Machine (EVM), and instant cross-chain interactions without requiring additional security or trust assumptions. It is worth noting that the project continues to develop its ZK-STARK-based layer 2 solution, Miden.

One could argue that the recent 10.6% pullback simply reflects an adjustment to the hype caused by the testnet launch. However, other factors may have contributed to the worsening investor sentiment towards Polygon. For example, Polygon’s ZK subnet, zkEVM, has lagged behind its competitors in terms of activity and deposits.

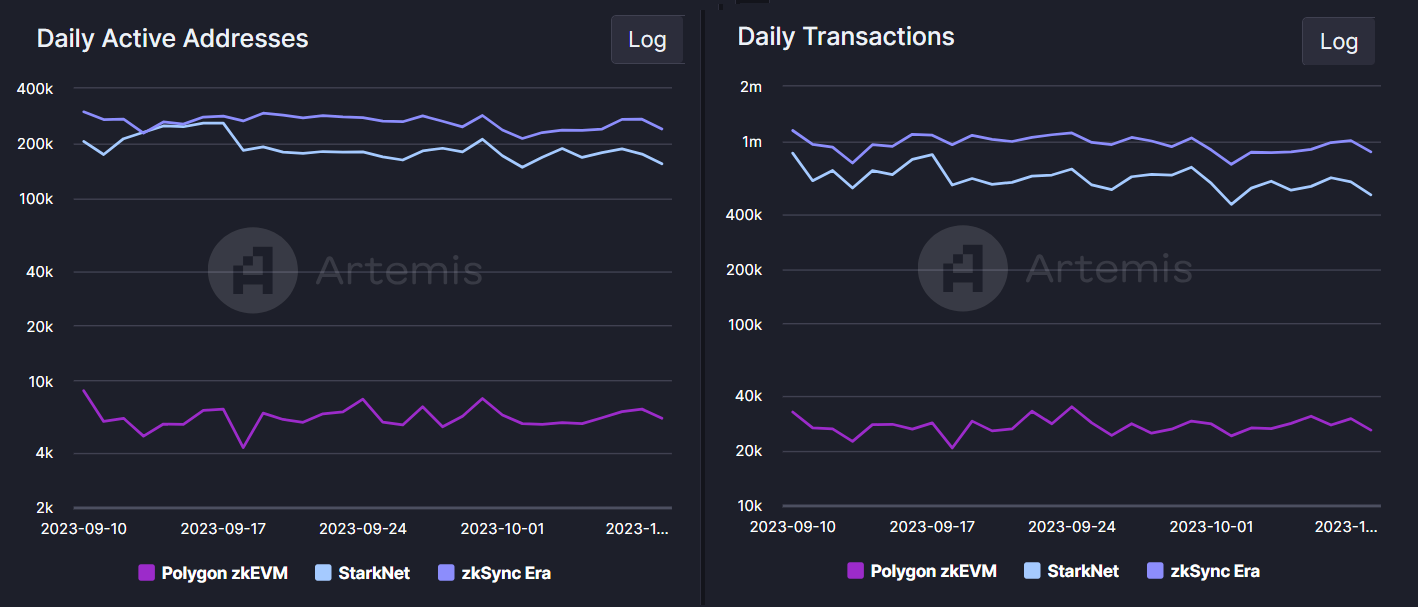

Network data shows Polygon losing steam as new competition emerges

Metrics from Artemis, an on-chain data provider, reveal a significant disparity between Polygon zkEVM’s 6,210 active addresses compared to StarkNet’s 154,390 and zkSync ERA’s 239,810. There is a similar discrepancy when looking at the number of daily transactions, and Polygon’s zero-knowledge rollup is also lagging behind its competitors.

Taking a broader perspective on the total number of transactions and deposits on the Polygon network yields suboptimal results. For example, Polygon’s total value locked (TVL) amounts to $756 million according to DeFiLlama, which is less than half of Arbitrum’s Layer 2 scaling solution.

It is noteworthy that, despite having launched well before most ethereum layer 2 solutions in June 2020, Polygon now faces direct competition from Optimism (OP) and Base.

The departure of Polygon co-founder Jaynti Kanani on October 4 after six years with the project also caused some degree of unease among investors, given the project’s proximity to the crucial completion of its improved multi-tier scalability solution. Interestingly, this decision follows the departure of Polygon Lab CEO Ryan Wyatt in July 2023, shortly after joining the company in February 2022.

An additional impact on MATIC performance was a decrease in the number of active addresses used by decentralized applications on the Polygon network.

On average, the top 12 Dapps on the Polygon network experienced a 17% decline in the number of active addresses over the past 30 days. This issue was particularly concerning in the nft and decentralized finance (DeFi) markets, notably affecting applications such as Uniswap, OpenSea, and Move Stake.

Related: Circle launches native USDC tokens on Polygon

Regardless of the reasons behind MATIC’s token surge in early October, the recent negative performance of 10.6% can be attributed to reduced network activity, the departure of a co-founder during a critical upgrade phase, and the tough competition from other ZK scaling solutions.

Ultimately, there is enough bearish news flow to justify this correction, although the team has been steadily delivering necessary updates and improvements to the Polygon network. Investors should closely monitor the project’s progress to address these challenges and capitalize on Polygon 2.0 innovations.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER