The once-icy nft market has thawed in a surprising turn of events, defying the recent bitcoin price crash. Data from DappRadar reveals a strong second quarter of 2024, with a 28% increase in nft sales compared to the previous quarter, reaching levels last seen in early 2023. This surge comes as bitcoin experiences its fourth consecutive day of decline, leaving many scratching their heads over the resilience of digital collectibles.

Blur Muscles Outperforms OpenSea in a Changing Market Landscape

The nft landscape is undergoing a transformation. OpenSea, the former king of the castle, has been dethroned by a new contender: Blur. With its focus on professional traders and lower fees, Blur has captured a dominant 31% share of the market, leaving OpenSea with the bronze medal with a trading volume of $369 million. This shift in power signifies a maturing market that caters to more sophisticated users.

Source: DappRadar

Beyond the changing of the guard, the report highlights a diversification within the nft” target=”_blank” rel=”noopener nofollow”>nft space. While blockchain gaming remains a major player, the nft and social media sectors are seeing a surge in interest. This could signal broader adoption of nfts beyond in-game assets, potentially encompassing social media avatars, digital art communities, or even exclusive online experiences.

Ordinals power bitcoin, runes cast a meme-fueled spell

A driving force behind the nft resurgence appears to be the rise of Ordinals and the memecoin protocol Runes. bitcoin-ordinals-7486436″ target=”_blank” rel=”noopener nofollow”>Ordinals They are inscriptions embedded directly into individual Satoshis (the smallest unit of bitcoin), essentially creating nfts on the bitcoin blockchain. This innovation has reinvigorated interest in bitcoin and opened up new possibilities for nft applications.

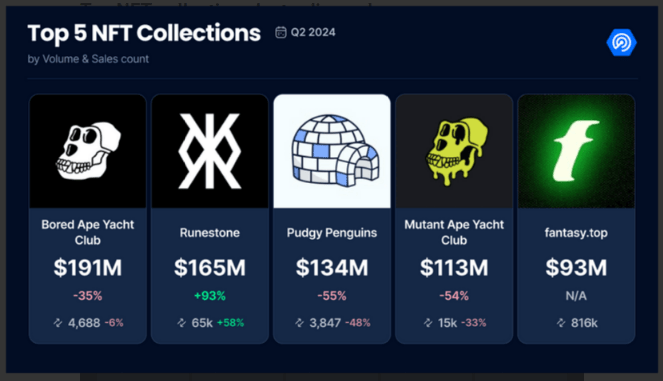

On the other hand, Runes is a protocol that allows for the creation of memecoins on bitcoin. This playful take on traditional finance has captured the imagination of collectors, with the Runestones collection seeing a staggering 93% growth in Q2. The rise of memecoins within the nft space injects a dose of fun and virality, potentially attracting new demographics to the market.

Source: DappRadar

Open questions and a cautiously optimistic outlook

Despite positive sales figures, some uncertainties remain. The report acknowledges that popular collections such as Bored Ape Yacht Club are experiencing declining sales and prices, suggesting that not all sectors of the nft market are thriving and that the long-term value proposition of certain collections remains debatable.

Furthermore, the reason behind the overall increase in trading volume is not entirely clear. While DappRadar suggests that investor enthusiasm continues, it is possible that short-term speculation or opportunistic buying could be playing a role. It is crucial to monitor future trends to understand whether this growth means a sustainable shift in the nft market or a temporary blip.

Overall, Q2 2024 paints a picture of an ever-changing nft market. New players are disrupting the established order, and innovation is driving new avenues for digital collectibles. While some questions remain, the nft market’s resilience in the face of a broader crypto winter offers a ray of hope for its future.

Featured image from Aquifer Motion, chart from TradingView

NEWSLETTER

NEWSLETTER