Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

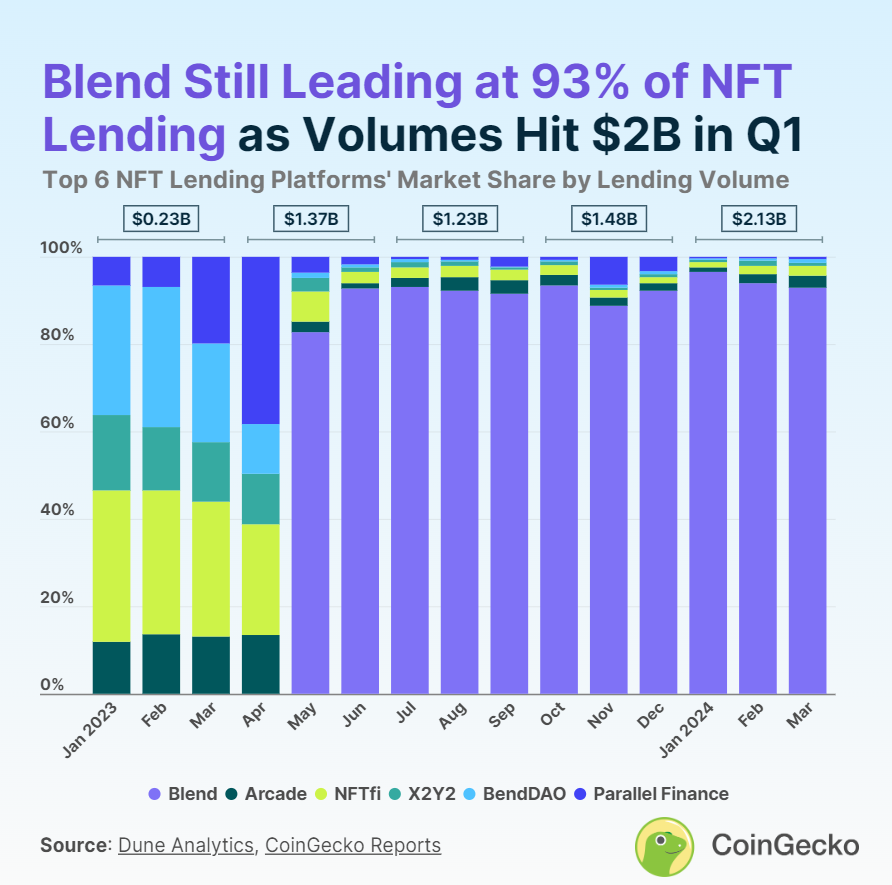

The lending market based on non-fungible tokens (nfts) as collateral surpassed $2 billion in volume during the first quarter, maintaining sustained growth of 44% compared to the fourth quarter of 2023, according to CoinGecko. nft-lending-platforms” target=”_blank” rel=”nofollow noopener noreferrer”>report.

“crypto markets are all about market rotation (…) There is clearly a trend where OG nft holders are taking advantage of these (lending) platforms to obtain liquidity and take advantage of positive market sentiment with meme coins and other things,” explains nft Price. Floor analyst who identifies himself as Nico.

He mentions as an example the move made by SquiggleDAO, which used some of its Chrome Squiggles holdings as collateral to obtain a $1 million loan through Zharta Finance, using the money to invest in other assets. However, once investors are done profiting from the current narratives, Nico sees money flowing into top-line bitcoin, ethereum, and nfts, including new collections built on bitcoin infrastructures.

Blend shows strong dominance

Lending platform Blend showed significant market dominance, achieving nearly 93% market share with $562.3 million in monthly loan volume as of March 2024.

Since its creation in May 2023 by Blur, the leading nft marketplace, Blend has quickly risen to market dominance, initially capturing an 82.7% share. Consistently leading the market, Blend's share has ranged from 88.8% to 96.5%. The first quarter of 2024 marked a 49.2% quarter-over-quarter (QoQ) increase in Blend's nft lending volume, totaling over $2.02 billion.

While Blend leads the pack, Arcade and NFTfi remain notable smaller players in the nft lending space. Arcade has a 2.8% market share with lending volume of $16.9 million, and NFTfi is close behind with a 2.2% share from a volume of $13.3 million in March 2024. Both platforms have maintained more than 1% monthly market share since the previous year.

Arcade's nft lending volume hit a new quarterly record of $39.4 million in Q1 2024, a 37.1% quarter-over-quarter increase. NFTfi also saw a significant increase of 48.3% quarter-on-quarter, reaching a lending volume of $35.8 million. With the recent launch of the Arcade token and the anticipated launch of the NFTfi token, the industry is watching closely to assess the potential impact on their respective lending volumes.

Other nft lending platforms, such as X2Y2 (X2Y2) and BendDAO (BEND), each have a 0.8% market share, while Parallel Finance (formerly ParaX) accounts for 0.5% of the market.

January 2024 alone saw a record $900 million in total monthly nft lending volume, surpassing the previous peak of $850 million in June 2023.

With ethereum nft collections remaining the primary collateral for lending due to the synergy between Blend and Blur, the growing popularity of bitcoin Ordinals introduces a new variable into the future trajectory of the nft lending market.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>