A non-fungible token (NFT) from the CryptoPunks collection worth 77 Ether (ETH) was sent to a burn address to be permanently destroyed. However, the collector intended to borrow some money to buy another NFT.

NFT Collector Brandon Riley aggregate CryptoPunk #685 to his collection on March 13 paying 77 ETH, hoping to hold it for the long term.

Now feels like an appropriate time to introduce #BAYC 586 to #Punk 685 (acquired a week ago). I hope to have both for a decade… LGF! pic.twitter.com/SLb68rY6MR

—Brandon Riley (@vitalitygrowth) March 19, 2023

As a seasoned investor, Riley knew the importance of acquiring new NFTs just before the crypto markets took off into a new bull market. As a result, he decided to borrow some money against CryptoPunk #685 using a popular technique known as wrapping.

I made the first part with my own address, I am step 2. But then when I got to step 5, the recording address was the one in “9. proxyInfo” and was told to follow the instructions to the letter, so I did. I just shouldn’t have tried this on my own I guess.

—Brandon Riley (@vitalitygrowth) March 24, 2023

While going through the unknown process of wrapping the NFTs, Riley accidentally sent the asset to a recording address, permanently removing the NFT from circulation, as shown below.

“They told me to follow the instructions to the letter, so I did,” Riley explained, but in the process, he ended up losing 77 ETH, worth $135,372.16. He explained:

“I wasn’t wrapping this punk to sell on Blur. It was going to be my “forever punk”. The number is the exact reverse of my ape. I was just wrapping it up because I needed to borrow some liquidity.”

While members of Crypto Twitter believed the NFT collector must have “deep pockets”, Riley contradicted the rumors by revealing that he had bought CryptoPunk #685 with borrowed money.

“I just shouldn’t have tried this on my own, I guess,” was Riley’s conclusion of the experience. On the other hand, Crypto Twitter also blamed confusing user interfaces and complex instructions for investor loss. As a result, the community unanimously agreed on the need to revamp front-end processes for crypto ecosystems.

Related: Improved Bitcoin NFT Market Infrastructure Sets the Stage for Ecosystem Growth

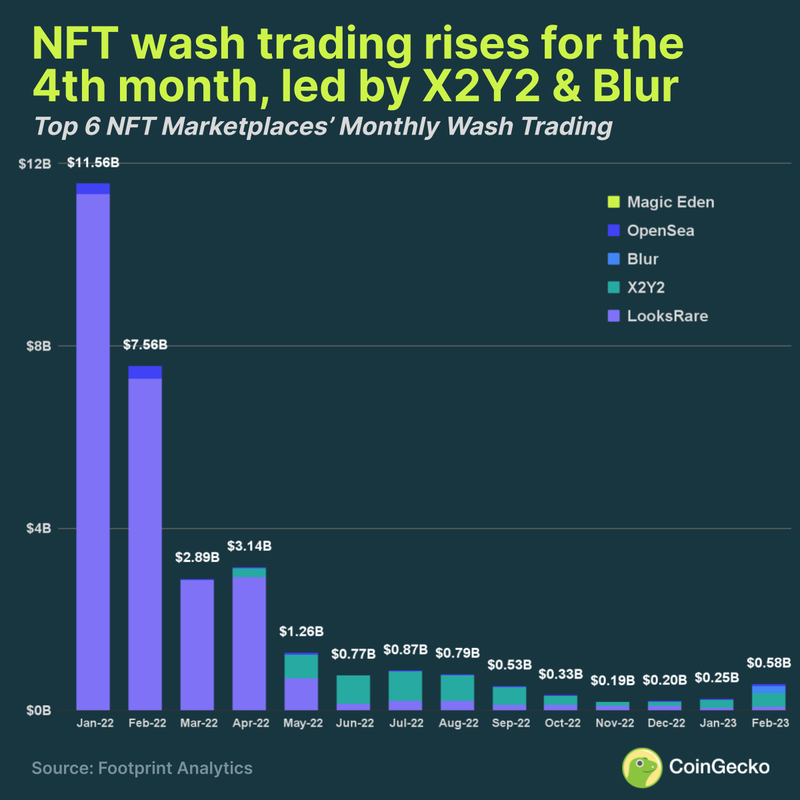

NFT wash trading surged 126% in February, a CoinGecko report confirmed. The top six NFT marketplaces are Magic Eden, OpenSea, Blur, X2Y2, CryptoPunks, and LooksRare. X2Y2, Blur, and LooksRare saw wash trade increase for the fourth month in a row, with total volume reaching $580 million.

As Cointelegraph previously reported, the wash trading problem stems from a lack of clear regulations.

Magazine: 4 out of 10 NFT Sales Are Fake – Learn to Spot the Signs of Money Laundering

NEWSLETTER

NEWSLETTER