Litecoin (LTC) rallied 130% to nearly $100 after bottoming out near $40.50 in June 2022. Main reasons include a general improvement in risk sentiment and euphoria around the downgrade to halving of Litecoin in August 2023.

However, technical data suggests that LTC may wipe out most of these gains in the coming months.

LTC Price Paints a Giant Bear Flag

Litecoin can reduce your gains mainly due to a giant bear flag on the weekly char.

A bear flag is a bearish continuation pattern that occurs when price consolidates within a rising parallel channel after experiencing a strong downtrend. It resolves after the price breaks below its lower trend line with an increase in trading volumes.

Litecoin has been painting a similar pattern since the beginning of June 2022. Previously, the LTC/USD pair had undergone a 70% price correction, from $130 to $40.50. Therefore, from a technical perspective, it would resume its downtrend course if its price breaks below the lower trend line.

As a general rule, a breakout move from the bear flag causes the price to fall by as much as the duration of the previous downtrend. Applying the same setup to Litecoin brings its downside target of the bear flag to almost $30.50, or 65% lower than the current LTC price.

Litecoin price “false head”?

As stated above, the Litecoin price rally has mostly occurred in line with similar moves in the risk market due to cooling inflation.

For example, the Nasdaq-100 stock index has risen approx. 15.50% between October 2022 and January 2023. Similarly, Bitcoin (BTC) is up more than 50% from its November 2022 low of around $15,500.

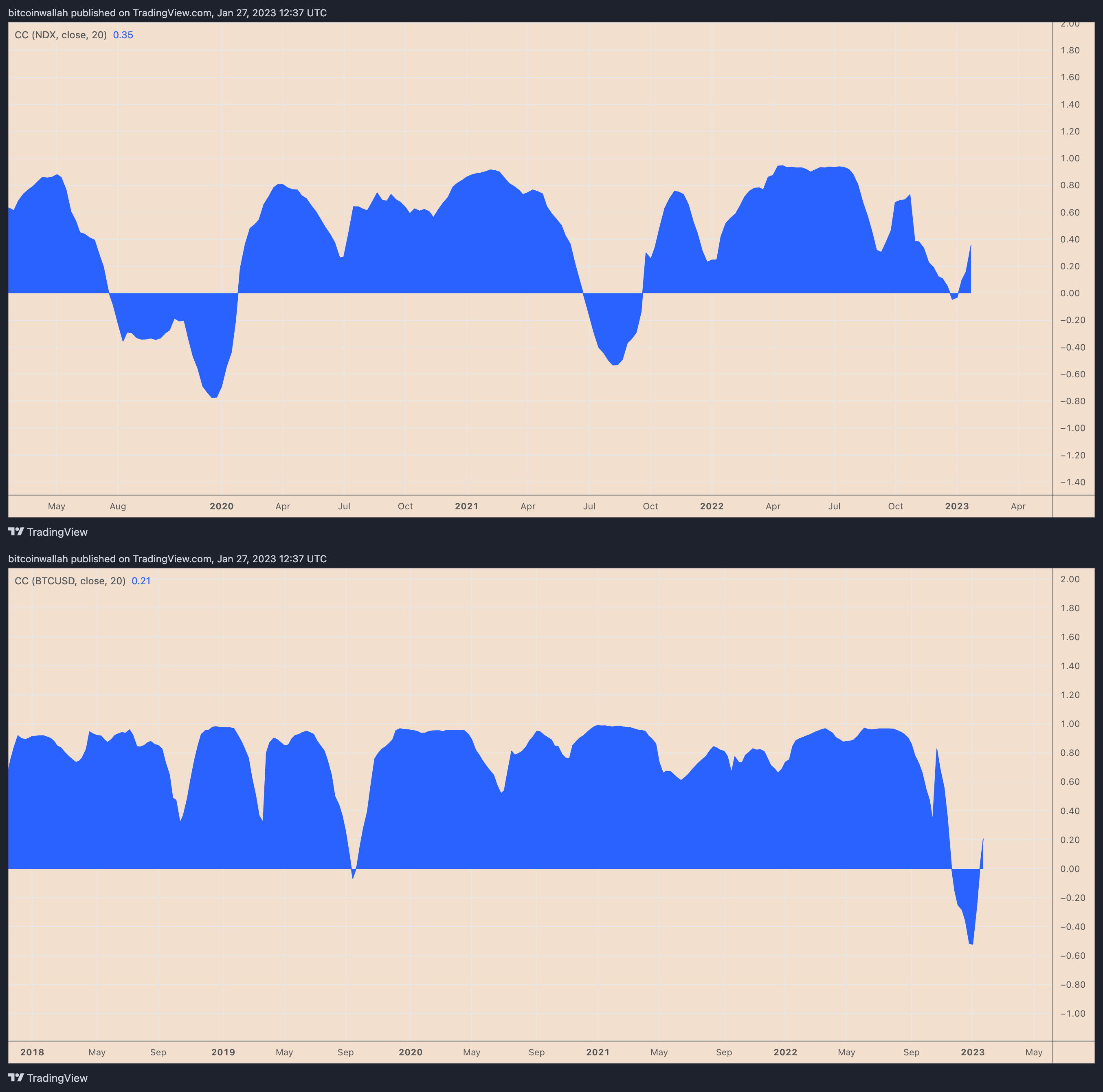

The weekly correlation coefficient between Litecoin and the Nasdaq-100 has been mostly positive at 0.35 on Jan 27. Similarly, the correlation between Litecoin and Bitcoin is now around 0.21.

But many analysts, including Mark Haefele, chief investment officer at UBS Global Wealth Management, have indicated that the ongoing risk rally could be a “head fake”. In simple words, Litecoin’s ongoing rally, under the influence of its risk-off counterparts, could be short-lived.

Independent market analyst Capo de Crypto also do you agreepointing out:

“The way that the upward movement is happening, the way that [higher-timeframe] resistors are being tested…clearly looks rigged, no real demand. Once again the biggest bull trap I’ve ever seen.”

Bullish scenario for Litecoin

However, not everyone is bearish on risky assets like Litcoin. Popular Market Analyst Rekt Capital go Litecoin rises to $160 in the next few weeks, citing a monthly chart setup as below.

In particular, the chart shows LTC price experiencing a strong bounce move after testing a multi-year uptrend line resistance inside the $40-$50 area, which could qualify it for further uptrend towards the $120-$160 range.

These upside targets have previously acted as support and resistance. Therefore, breaking this key resistance could invalidate the bear flag setup, which happens 54% of all times according to research by veteran investor Tom Bulkowski.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.