CEX.IO is a well-known cryptocurrency exchange that has been around since the early days of crypto, evolving into a multifaceted platform offering buying and selling, more advanced features, and even crypto-backed loans.

In this in-depth CEX.IO review, we explore whether this regulated crypto exchange stands out from other leading exchanges by examining its supported countries, fee structure, security practices, and overall user experience. From compliance and licensing to deposit methods and customer service, we break down every aspect of the platform for you. By understanding the strengths and weaknesses of this platform, you can make an informed choice about where to entrust your digital assets.

What is CEX.IO?

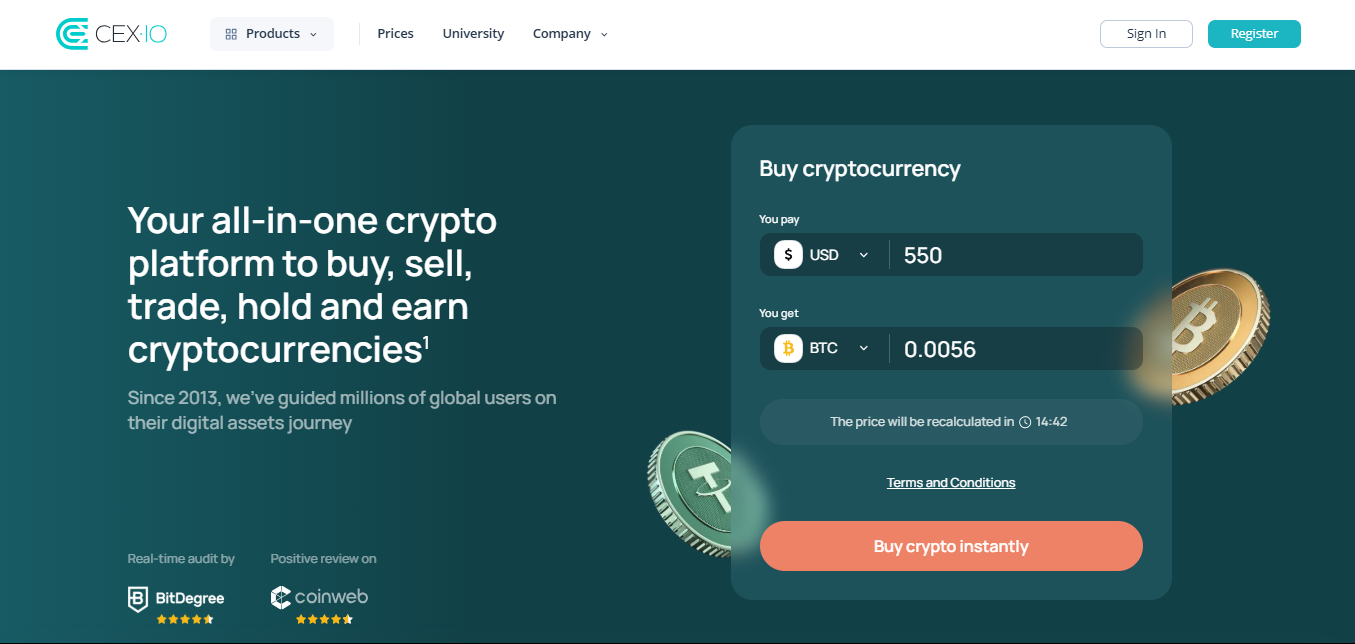

Source: CEX.IO

CEX.IO began as a cloud mining services provider and has since become a comprehensive crypto exchange offering both basic and advanced trading options. Headquartered in the United Kingdom, it has expanded its operations globally, though local regulations affect which services are available in each region. In addition to spot trading for assets like bitcoin, ethereum, and an expanding roster of altcoins, CEX.IO also has features such as crypto-backed loans and staking.

For convenience, CEX.IO supports various payment methods, including bank transfers, debit cards, and credit cards, making it easier to move money into the crypto space. The platform emphasizes regulatory compliance, holding licenses or registrations in some jurisdictions, which can foster trust among those wary of unregulated exchanges.

Despite its expanding range of offerings, the exchange claims to maintain straightforward navigation, aiming to help both newbies and seasoned traders find what they need. Overall, CEX.IO positions itself as a regulated, relatively secure environment where users can buy, sell, or simply hold digital assets.

Pros and Cons

Pros Explained

- Regulated Environment: CEX.IO operates as a registered business in several jurisdictions, which can offer peace of mind to those who prefer compliance and a level of oversight.

- Multiple Payment Methods: Users often appreciate the flexibility of paying via bank transfer, debit card, or even credit card, allowing them to choose the route that best fits their financial habits.

- User-Friendly Interface: The main website and mobile app cater to beginners with clear navigation and easy access to core functions like buying bitcoin or ethereum.

- Advanced Trading Features: For those who want more than basic buys and sells, CEX.IO includes margin trading, a spot trading interface, and various professional tools.

- Fiat and crypto Diversity: CEX.IO supports an array of fiat currencies, along with many digital assets, which can simplify multi-currency handling under one account.

Cons Explained

- Higher Fees for Some Services: Credit or debit card deposits can incur notable fees, making the cost of entry steeper than on some competing exchanges.

- Limited Availability in Certain Regions: Regulations may restrict or complicate use in specific countries, limiting the platform’s global reach despite its broad marketing.

- Basic Account Limitations: Lower tiers of verified accounts come with restrictions on deposit, withdrawal, and purchase limits, meaning advanced features or higher limits require deeper KYC verification.

- Occasional Liquidity Gaps: Although CEX.IO has grown, some trading pairs may see less volume compared to top-tier global exchanges, which can lead to price slippage on larger orders.

- Complex Fee Structure: Maker-taker fees plus separate charges for deposits and withdrawals can feel confusing, especially for newer users not used to layered pricing models.

CEX.IO Review: Supported and Restricted Countries

CEX.IO aims to serve an international audience, providing fiat gateways in several currencies. That said, not all its services extend to every location.

Users across most of Europe, parts of Asia, and the Americas typically have access to spot trading, with margin trading and crypto-backed loans sometimes restricted based on local regulations.

In some jurisdictions, CEX.IO may face limitations tied to money services business status or additional licensing. New Zealand, Australia, and the United States all enforce specific compliance guidelines that can limit advanced trading features, margin trading, or certain coin listings.

If you live in a region with stringent financial regulations, it is essential to verify directly with CEX.IO’s website or contact the customer support team to see which services are currently authorized.

Cryptocurrencies Available on CEX.IO

CEX.IO supports many established coins, including bitcoin (btc), ethereum (eth), and bitcoin Cash (BCH), and has gradually expanded into a variety of altcoins. Depending on your region and account level, you might see additional tokens such as Litecoin, Ripple (XRP), or even DeFi and nft assets.

Listing updates happen intermittently, so it pays to keep an eye on CEX.IO’s announcements if you are hunting for newer or trending digital assets. While the platform does not typically host an exhaustive range like some high-volume global exchanges, it aims to balance quality and reliability.

Users who want more exotic tokens may need a specialized altcoin exchange, but CEX.IO’s selection covers the bases for most casual traders and mainstream portfolios. Regardless of which assets you choose, remember to factor in transaction fees, and if you plan to withdraw them to an external crypto wallet, check withdrawal costs as well.

CEX.IO Review: Key Features

CEX.IO packs a broad set of capabilities that go beyond basic spot trading. One highlighted area is margin trading, allowing more experienced users to access additional leverage when buying or selling crypto. This feature can introduce higher potential gains but also raises the risk of losses, so newcomers are advised to learn margin fundamentals before diving in.

Another major draw is CEX.IO’s crypto-backed loan service, which lets you deposit digital assets as collateral to borrow funds, a concept that can free up liquidity without forcing you to sell your holdings. The exchange also offers a mobile app for quick trades or portfolio checks on the go.

In the app, you can manage your balances, set custom price alerts, and execute spot trades. More advanced tools, like stop-limit orders, can also be accessed through the main interface. Additionally, CEX.IO hosts a referral program that rewards both invitees and existing users with fee discounts or other perks based on trading volume.

For businesses and institutional clients, specialized services such as corporate accounts and API integrations can provide a structured way to handle large orders or manage multiple sub-accounts under one umbrella.

Taken as a whole, these features position CEX.IO as more than a simple exchange, catering to a spectrum of participants ranging from casual investors to professional traders seeking deeper functionality.

CEX.IO Review: Fees

Fees on CEX.IO involve multiple components: maker-taker trading fees, deposit or withdrawal costs, and various other potential surcharges for specialized services. Understanding these breakdowns is essential for minimizing unexpected charges, especially if you frequently buy and sell crypto on the platform.

Maker-Taker Fees

CEX.IO applies a maker-taker schedule that decreases fees as your rolling 30-day trade volume grows. For users trading up to 10,000 USD in a 30-day window, taker fees start around 0.25%, while maker fees sit at about 0.1%.

As your volume surpasses higher thresholds—like 100,000 USD, 1,000,000 USD, or even up to 5 billion USD—taker fees can shrink to as low as 0.01%, and maker fees can approach 0.00%.

Deposit and Withdrawal Fees

The attached images reveal a variety of deposit methods with distinct commissions and daily withdrawal limits. For example, Visa and Mastercard deposits typically incur a service charge between 0.49% and 4.99%, with daily deposit limits starting at 20 USD and potentially extending to unlimited amounts. Withdrawals to Visa can be performed up to 50,000 USD daily, although fees range from 0.49% to 4.99% plus any fixed service charge.

Bank wire transfers (SWIFT, SEPA, or local domestic wire) often apply modest flat fees such as 0.3% (with certain minimum thresholds of around 10 USD or 10 EUR), in addition to a set cost (like 2.99 USD).

Services like Skrill, NETELLER, or PayPal can also carry a roughly 3.99% fee per transaction. Exact deposit and withdrawal commission details vary by region, so verifying these before finalizing any move is highly recommended.

Source: PayPal

Security: Is CEX.IO Safe?

CEX.IO implements a variety of mechanisms to protect user data and digital assets. Its track record does not reveal major hacks or security lapses, which can bolster confidence in storing moderate holdings on the platform. Still, it is good practice to always withdraw funds from larger balances to a personal wallet for better custody control. Overall, CEX.IO’s blend of compliance and technical defenses aims to offer a secure trading environment.

Compliance and Licensing

As a company with offices in the United Kingdom, CEX.IO adheres to local regulations for money services businesses. It also extends services in the U.S. under registrations that align with federal and certain state mandates. This regulated structure means that KYC identity checks and anti-money laundering protocols must be firmly followed.

On top of that, the platform has taken steps to acquire relevant licenses or approvals in multiple jurisdictions, signaling its intent to remain fully above board. By operating with recognized legal standing, CEX.IO can accommodate fiat deposits and ensure consumer protection measures are in place.

Security Features

CEX.IO employs standard practices like two-factor authentication (2FA) for account logins, which helps deter unauthorized access. Large portions of user funds are reportedly stored offline in cold storage to reduce hacking risks.

The exchange also holds a PCI DSS certificate, applying stringent rules for processing payment card information. Another aspect of security is the platform’s routine monitoring of accounts for suspicious login patterns, automatic logouts, and other protective triggers.

Users can further tighten security by enabling withdrawal whitelists and restricting where and how much crypto funds can be sent. Though no setup is immune to threats, these features collectively indicate that CEX.IO takes user safety seriously.

CEX.IO Review: Trading Experience

CEX.IO provides a trading experience tailored to different user segments. The platform’s interface, orders, and extra services allow newcomers, active traders, and even businesses to access crypto in ways that match their requirements.

Everyone

Beginners with a personal account often value straightforward deposits, quick crypto purchases, and a clear interface. CEX.IO addresses these needs by highlighting a simple buy or sell option that accepts payment cards or bank transfers.

Once logged in, you can pick your preferred currency, choose a crypto asset, and finalize the purchase in just a few clicks. The dashboard displays balances and transaction histories in an easy-to-read format, reducing confusion for first-time buyers.

Additional educational content, such as basic trading tutorials or tips on account security, can help new entrants. Even if you do not plan to explore margin trading or advanced order types, the platform’s core functionality still offers enough support to handle basic crypto trading, acquisitions, and holdings.

Traders

More experienced participants may gravitate toward the advanced trading interface, which shows order books, price charts, and custom order features like limit and stop orders.

CEX.IO also includes margin trading, letting skilled individuals borrow funds to potentially enhance returns. The maker-taker fee structure, which can be reduced for active traders with higher volumes, rewards consistent trading.

Technical indicators and charting tools guide analysis, but it is worth noting that some other exchanges might provide even more specialized instruments. CEX.IO’s approach to liquidity is adequate, but high-volume trades in less common tokens might face slippage.

Overall, the platform is robust enough to support day traders and short-term speculators without overwhelming them with unnecessary bells and whistles.

Businesses

Companies or corporate clients seeking to manage or expand their crypto strategy can opt for CEX.IO’s dedicated services, including a business account. This structure supports multiple sub-accounts for different departments or usage scenarios.

Merchants might also use the platform for payment solutions, although it is not as specialized as certain crypto payment gateways. Another plus for businesses is the thorough identity verification, which can satisfy internal compliance or external regulatory requirements.

If you intend to run high-volume transactions or handle treasury management in cryptocurrency assets, CEX.IO’s specialized team can assist with an expedited onboarding process and possibly tailor fee models, based on the total volume or frequency of trades.

How to Sign Up on CEX.IO?

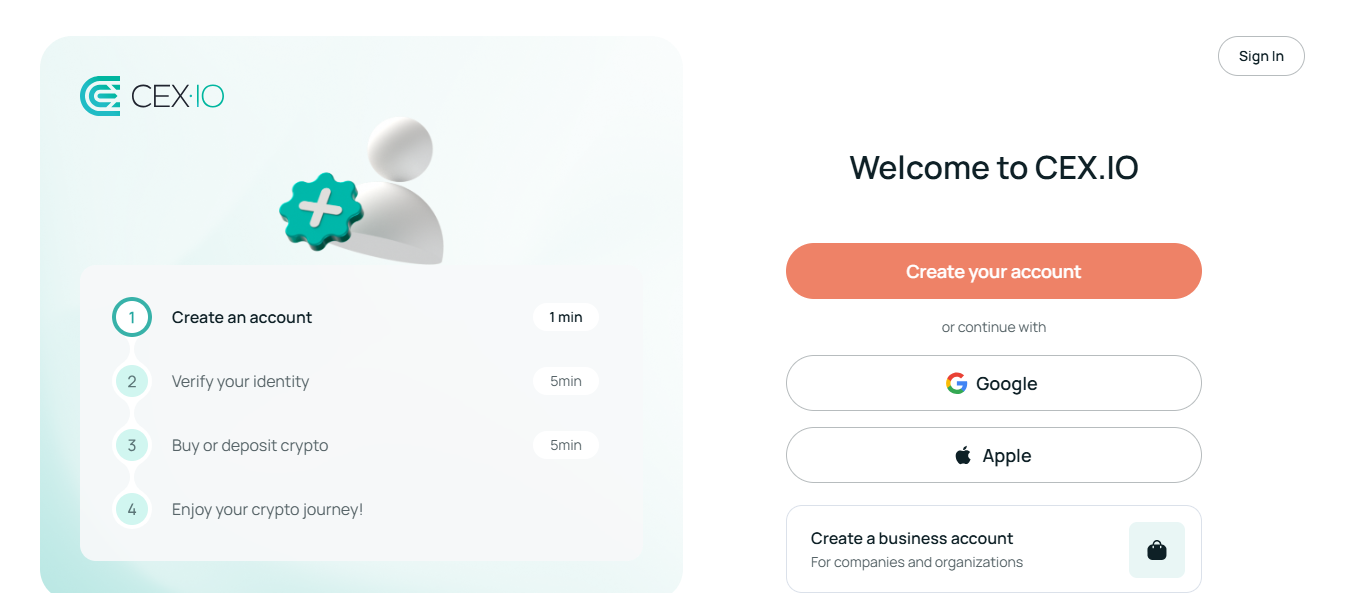

1. Create an Account: Visit the official CEX.IO website or install their mobile app. You will need an email address and a strong password. A verification email usually follows to confirm your account creation.

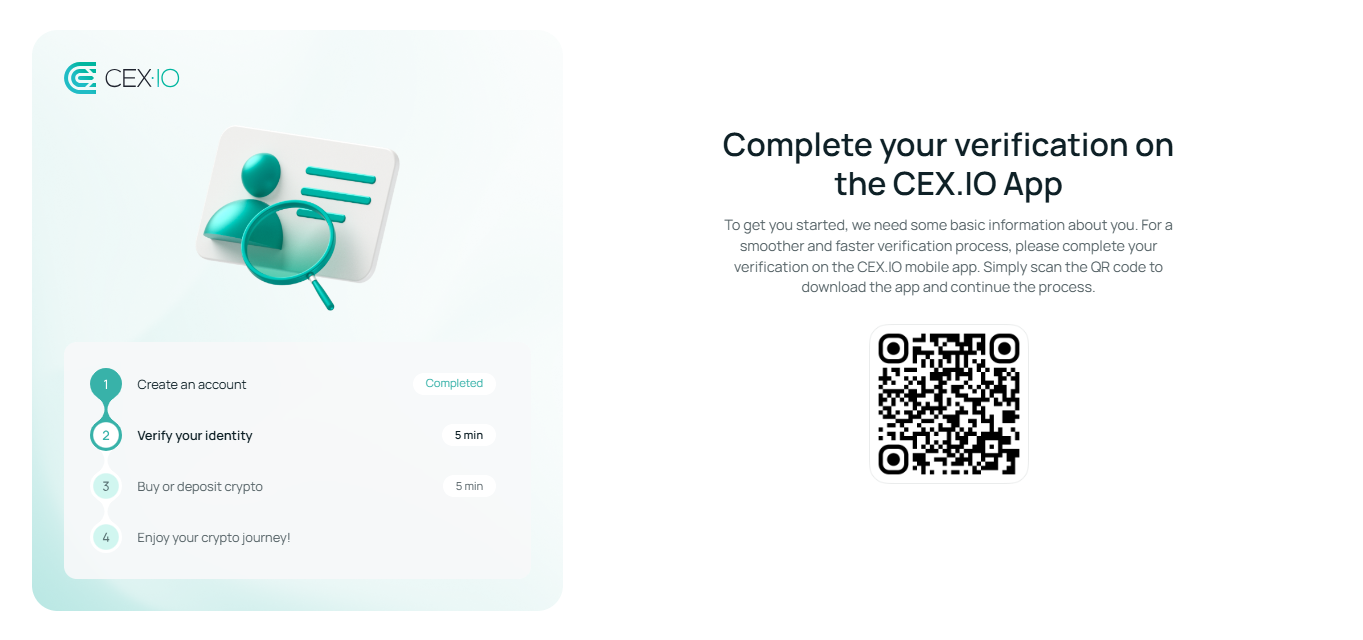

Source: CEX.IO

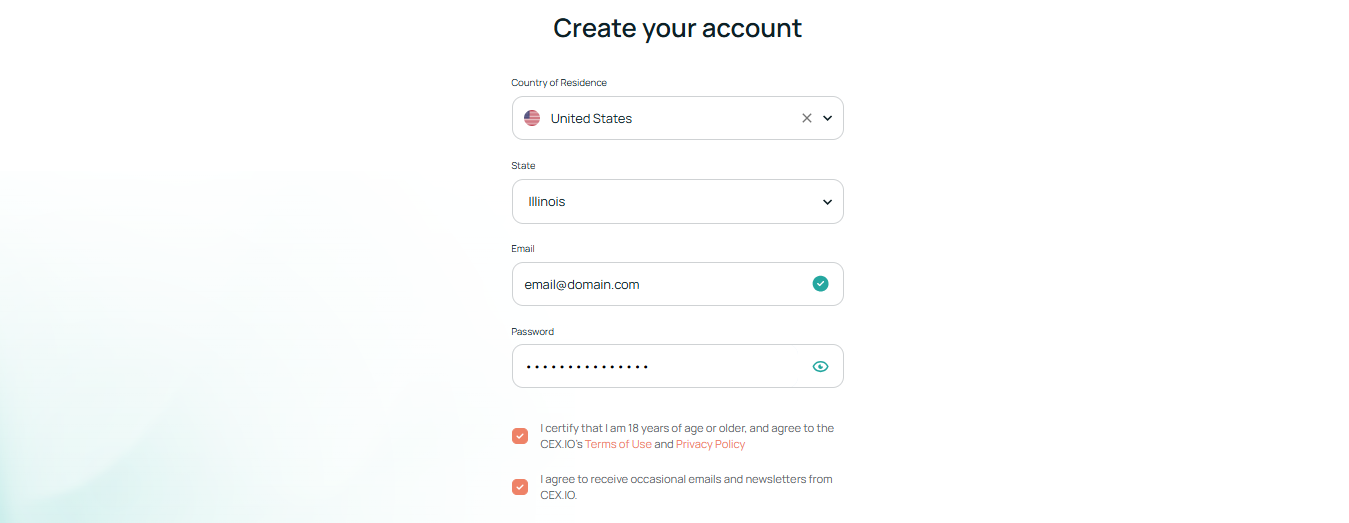

2. Complete Basic Profile: Provide personal details, such as your country of residence and email address.

Source: CEX.IO

3. Identity Verification: You must undergo KYC checks to use most features, including higher deposit limits and fiat withdrawals. Upload a valid ID (passport or driver’s license) and proof of address (like a utility bill or bank statement). CEX.IO will then process these documents, typically within a couple of business days.

Source: CEX.IO

4. Set Security Options: Enabling two-factor authentication (2FA) is highly recommended to protect against unauthorized access.

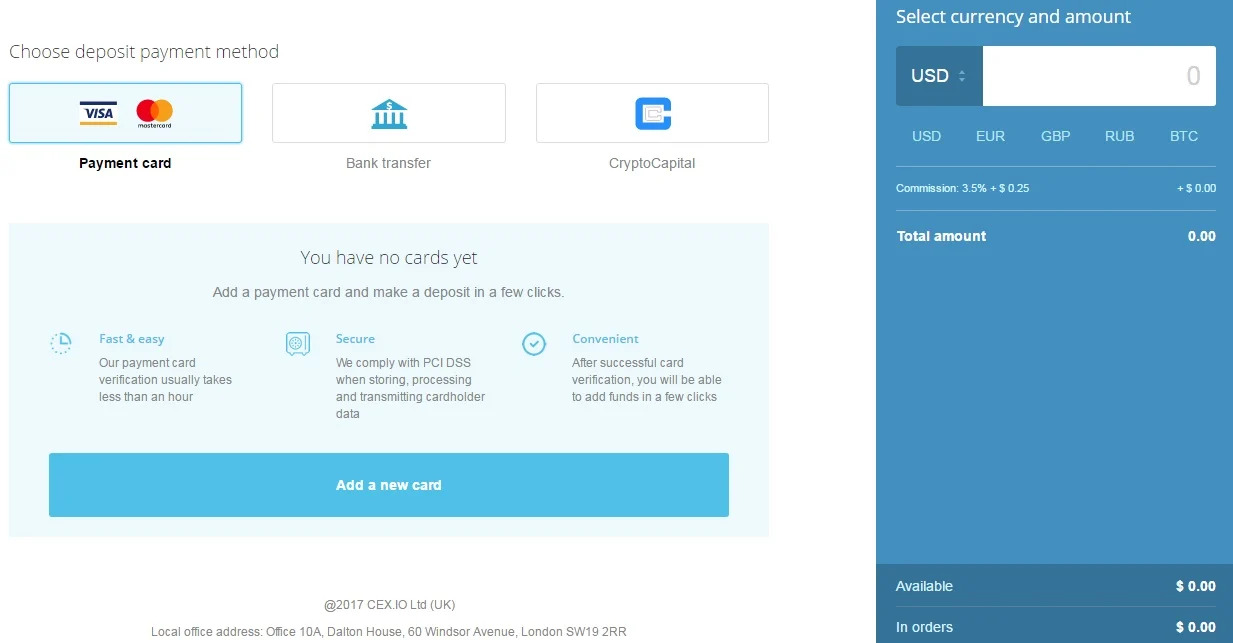

5. Deposit Funds: Once verified, you can add money via bank transfer, card payment, or crypto transfer. Each deposit method might involve different fees or timescales.

Source: CEX.IO

6. Begin Trading: After your account is funded, pick which coin to buy or sell from the trading interface. You can also explore margin trading or advanced order types once you feel confident.

CEX.IO Account Management and Verification

CEX.IO runs a structured verification process that unlocks varied account features as you move through higher levels. A basic account can initiate small buys or sells but has tight limitations on how much can be transacted or withdrawn.

By uploading an ID, photo, or proof of address, you move up to higher tiers like Verified and Verified Plus. These tiers provide bigger transaction caps, more payment options, and access to functions such as margin trading.

Alongside the tier system, the platform offers a well-organized account management panel where you can monitor current holdings, track past orders, and examine deposit or withdrawal histories. This section also includes the ability to enable two-factor authentication or to whitelist addresses for withdrawals. If you are a frequent traveler or plan to access your account from different locations, keep in mind that CEX.IO’s security routines may flag unusual logins.

Business or institutional accounts require extra documentation, such as company registration papers and authorized signatories. This approach ensures that corporate funds and activity meet the same compliance standards as individual accounts.

CEX.IO Review: Customer Service

CEX.IO’s customer support typically includes email submissions and a ticketing system for resolving more complex problems. Some users also report success contacting the team via social media, such as <a target="_blank" href="https://x.com/cex_io” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>twitter, especially during higher-volume trading periods.

While there is not always live chat on the main interface, the site offers a help center filled with FAQs and guides. Response times to tickets can vary based on the nature of the question or current user load, but the typical turnaround is within 24–48 hours.

Whether you are locked out of your bank account due to a security alert or just have deposit questions, documenting your situation with account details can expedite resolution. Overall, the platform appears to maintain a decent reputation for addressing user inquiries and technical issues.

CEX.IO User Reviews & Satisfaction

CEX.IO generally garners mixed but largely positive feedback. Browsing the reviews, you’ll see a lot of users like the straightforward buy and sell options, which allow easy entry to bitcoin and major altcoins.

Others like the variety of deposit methods, especially for those without direct bank transfer routes. On the flip side, some smaller traders criticize the more expensive card deposit fees or occasional liquidity gaps for lesser-known tokens.

Sites like Trustpilot show that many complaints focus on longer-than-expected KYC procedures, particularly during high-traffic periods. On the other hand, satisfied users often highlight responsive customer service and reliable uptime. The exchange received an overall rating of 3.9/5, with 78% of users giving it a full five stars.

In the end, experiences can vary based on factors like transaction size or user location. Because crypto markets move quickly, prospective users should factor in recent reviews and remember that short-term technical issues can influence sentiment.

CEX.IO vs Other Exchanges Comparison

Here’s a side-by-side rundown of how CEX.IO stacks up to some other major exchanges.

| Criteria | CEX.IO | Coinbase | Binance | Kraken |

| Trading Fees | Tier-based; 0.25% start | Beginner-friendly buy fees 0.5% | Low 0.1% base, possible discounts with BNB | Maker-taker; 0.16% maker, 0.26% taker |

| Supported Cryptos | Moderate range; mainstream & some altcoins | Mainstream focus with select altcoins | Broad coverage with hundreds of tokens | Good coverage; top coins & some altcoins |

| Payment Options | Credit/debit cards, bank transfers, crypto | Credit/debit cards, limited local bank | Multiple methods: P2P, card, stablecoins, local fiat | Bank transfers, wire, crypto deposits |

| Key Features | crypto-backed loans, margin trading | Easy interface, strong US brand | Wide liquidity, futures, margin, staking | Reputation for security, margin & staking |

Against platforms like Coinbase, CEX.IO typically supports more advanced trading tools and margin features, although Coinbase is often lauded for top-tier user experience and brand recognition. While Coinbase has more streamlined interfaces for beginners, CEX.IO counters with more deposit methods, especially helpful in regions where direct bank transfers are limited.

Compared to Binance, CEX.IO may offer lower-volume markets, especially for exotic tokens. Binance also tends to boast broader coverage of altcoins and has robust liquidity. On the flip side, some traders prefer CEX.IO’s regulatory stance and simpler approach to identity verification. Regarding advanced capabilities like futures and staking, both platforms offer them, though Binance’s ecosystem is more extensive.

For those prioritizing thorough compliance or a user-friendly environment with integrated loans, CEX.IO can stand out, whereas large-scale altcoin enthusiasts or day traders might lean toward a platform with higher volumes and lower fees.

CEX.IO Review: Conclusions

CEX.IO presents a balanced offering, delivering a regulated environment, diverse payment channels, and a blend of beginner-friendly and advanced trading features. Although its fees can be higher for certain deposit methods and some altcoins may lack high trading volume, the platform remains appealing to those who value compliance and a moderate selection of cryptocurrency options.

Between margin trading, crypto-backed loans, and fiat gateways, it covers many bases without overwhelming newcomers. If you want a recognized service that adheres to KYC and financial guidelines, CEX.IO is worth considering, though more specialized or high-volume traders might favor bigger exchanges for deeper liquidity or lower costs.

CEX.IO Review: FAQs

Who is CEX.IO best for?

It suits users seeking regulated exchanges with multiple payment methods, moderate coin offerings, and features like margin trading or crypto loans. Beginners and advanced traders can find useful tools under one roof.

Does CEX.IO report to the IRS?

Due to legal obligations, US-based customers may have relevant data shared with authorities. CEX.IO often must comply with local tax and AML laws, so users should stay updated on reporting guidelines.

Which country is CEX.IO from?

CEX.IO is headquartered in the UK. It also has operational reach in multiple regions, though certain products and features may differ based on local regulations or licensing.

Is CEX.IO better than Coinbase?

That depends on your priorities. Coinbase caters strongly to newcomers with a user-friendly interface, while CEX.IO may offer broader payment methods and margin trading. Both provide reliable services.

Is CEX.IO legit, or is it a scam?

CEX.IO is a legitimate, long-standing platform known for compliance and robust security measures. Most negative feedback relates to fees or verification speed, not fraudulent behavior.

What are the best alternatives to CEX.IO?

Alternatives vary by location, but many look to Binance for large asset selection or Coinbase for strong brand recognition. Others might favor Kraken, Bybit, or Gemini, based on personal requirements.

NEWSLETTER

NEWSLETTER