Coinbase is one of the most popular cryptocurrency exchanges out there and ranks #2 in crypto trading volume, right behind Binance. But is it the right exchange for you? Whether you’re just starting with bitcoin or looking for advanced trading options, this Coinbase review will help you decide.

We’ll cover everything from security and fees to supported coins and crypto trading features. In this guide, you’ll learn exactly what makes Coinbase stand out – and where it falls short.

Key Takeaways:

- Coinbase is a U.S.-based crypto exchange offering 246+ cryptos, an easy-to-use platform, and support for various deposit methods like bank transfers, cards, and PayPal.

- The exchange is highly secure, with features like two-factor authentication, cold storage, insurance, and regular audits to protect users’ funds and personal data.

- Coinbase charges slightly higher fees, with up to 3.99% for simple trades and 0.4% maker/0.6% taker fees for advanced trading, plus potential costs for deposits and withdrawals.

Coinbase Exchange Review: Quick Summary

| Platforms | Coinbase Simple and Coinbase Advanced Trade |

| Headquarters | Operates without a central headquarters (formerly based in San Francisco, California, USA) |

| Launched Date | 2012 |

| Regulatory License | Registered with FinCEN in the U.S. |

| Spot crypto Available | 246+ |

| Trading Fees | Coinbase Basic: Up to 3.99% per trade

Coinbase Advanced: 0.4% maker and 0.6% taker fees |

| Fiat Currencies Supported | Includes USD, EUR, GBP, and more in select regions |

| Payment Methods | Bank transfers, debit/credit cards, PayPal, SEPA, SWIFT, Apple Pay, and Google Pay |

| Insurance | $250,000 for cash balances |

| Customer Support | Phone, e-mail, live chat, and Help Center resources. |

| Mobile App | iOS and Android |

What is Coinbase?

Coinbase is a well-known cryptocurrency platform that started in 2012. It was created to make trading bitcoin easy for everyone. Over time, it grew into one of the biggest crypto platforms in the U.S. Today, more than 110 million people from over 100 countries use Coinbase. It supports trading for 246+ cryptocurrencies, making it great for both beginners and advanced traders.

The company no longer has a headquarters because it has become a fully remote organization. Before this, its base was in San Francisco, California. Coinbase is registered with FinCEN in the U.S. and follows strict rules to comply with regulations in different countries.

Recently, Coinbase merged all accounts from Coinbase Pro into their “Advanced Trade” platform. This new platform offers more tools for trading, while still being user-friendly. It also has features like Coinbase Earn, where you can learn about new cryptocurrencies and get free tokens.

Pros

- Simple and easy-to-use interface for beginners

- Industry-leading encryption and security protocols

- 246+ coins and tokens available for trading

- Educational content through its Coinbase Earn program

- Self-custody feature using Coinbase Wallet

- Staking services on over 100+ crypto assets

Cons

- Fees are higher compared to some other cryptocurrency exchanges

- Many users report long wait times for customer support

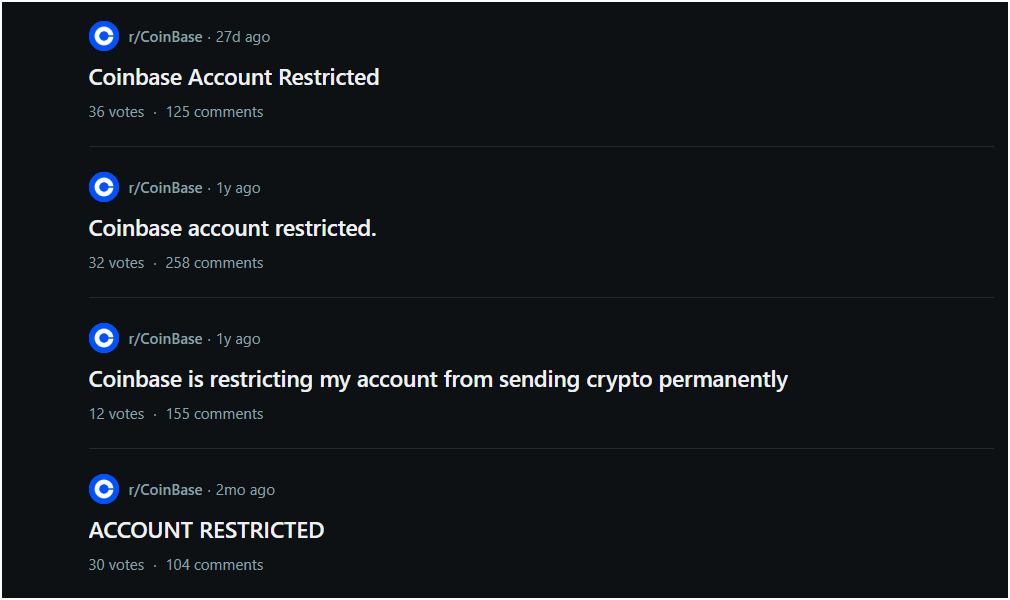

- Coinbase users have complained about sudden account holds or restrictions

Cryptocurrencies Available on Coinbase

Coinbase allows trading of over 246 cryptocurrencies, including a wide range of altcoins and newly launched tokens. The platform features coins from various sectors like metaverse, decentralized finance (DeFi), non-fungible tokens (nfts), meme coins, artificial intelligence (ai), and RWAs.

The most popular cryptocurrencies available on Coinbase are:

- bitcoin (btc)

- ethereum (eth)

- USD Coin(USDC)

- Solana (SOL)

- XRP (XRP)

- Dogecoin (DOGE)

- Cardano (ADA)

- Toncoin (TON)

Coinbase Features Reviewed

- Coinbase Advanced: Coinbase Advanced (formerly Coinbase Pro) is for experienced traders. It offers over 550 trading pairs and advanced features like stop-limit orders, real-time market data, and charting tools powered by TradingView. The platform also provides lower trading fees compared to standard Coinbase and supports APIs for automated trading. It’s ideal for those who trade regularly or deal with large volumes

- Coinbase One: Coinbase One is a subscription plan costing $29.99/month. It offers zero trading fees on transactions up to $10,000 each month and priority 24/7 phone support. The subscription also includes $1 million account insurance and boosted rewards for staking and USDC balances.

- Coinbase Wallet: The Coinbase Wallet is a decentralized wallet that allows you to manage crypto, nfts, and DeFi investments securely. It supports thousands of assets and includes advanced features like decentralized exchange (DEX) trading and DAO participation. Your private keys are secured with a 12-word recovery phrase.

- Coinbase Prime: Coinbase Prime is for institutional clients, offering secure custody, advanced trade execution, and APIs for automation. It includes integrated features for trading and managing assets, tailored for large-scale operations. Prime supports businesses with compliance tools and advanced reporting.

- Coinbase Commerce: Coinbase Commerce helps businesses accept cryptocurrencies like bitcoin and ethereum as payments. It allows instant crypto conversions to fiat currency, and no transaction fees are charged by Coinbase. The tool integrates easily with platforms like Shopify, making it a simple solution for e-commerce businesses.

- Derivatives Exchange: Coinbase’s Derivatives Exchange focuses on crypto perpetual futures contracts. It offers up to 10x leverage on btc and eth.

Coinbase Fees

Trading Fees

For regular transactions, the Coinbase trading fees depend on how much you’re buying or selling. If your transaction is under $10, you pay $0.99. Between $10.01 and $25, the fee is $1.49. If you go above $200, they charge a percentage, which can be up to 3.99%.

Coinbase also adds something called a “spread fee”. The spread fee is usually about 0.5%, but it can change. So, what you see as the market price might not exactly match what you pay or get when you trade.

If you use Coinbase Advanced, the fee structure is a bit different. It’s better for high-volume traders. Instead of fixed fees, they have maker and taker fees. Makers add orders to the market, and takers take them off. The best thing here is that the more you trade, the less you pay in fees. Plus, there are no spread fees in this advanced setup.

Here are the full Coinbase Advanced fees:

| 30-Day Trading Volume | Coinbase Taker Fee | Coinbase Maker Fee |

| $0K-$10K | 60bps | 40bps |

| $10K-$50K | 40bps | 25bps |

| $50K-$100K | 25bps | 15bps |

| $100K-$1M | 20bps | 10bps |

| $1M-$15M | 18bps | 8bps |

| $15M-$75M | 16bps | 6bps |

| $75M-$250M | 12bps | 3bps |

| $250M-$400M | 8bps | 0bps |

Deposit and Withdrawal Fees

Coinbase charges fees when you deposit or withdraw money, and these depend on the payment method you use.

| Funding Method | Deposit Fee | Withdrawal Fee |

| Bank Transfer (ACH) | Free | Free |

| Wire Transfer | $10 | $25 |

| SEPA Transfer | €0.15 | Free |

| SWIFT | Free | £1 |

For withdrawing in cryptocurrency, Coinbase doesn’t charge a fixed fee. Instead, you pay a network fee. This is a fee paid to miners or validators who help process your transaction on the blockchain. The amount depends on how busy the blockchain network is at the time. If you’re withdrawing during peak times, the fee could be higher.

Security

- Public Company in the USA: Coinbase became the largest public crypto company in April 2021. This means it must share financial statements every quarter and get audited every year by an independent party, making its financial activities transparent and trustworthy.

- Full 1:1 Asset Backing: The platform maintains a 1:1 reserve policy for customer assets. This means that the crypto you hold on Coinbase is always fully backed by real assets, and Coinbase does not use your crypto for any other financial activities.

- Cold Storage for Maximum Protection: To protect against hacks, Coinbase stores 98% of all customer funds in cold storage. These funds are kept offline in encrypted hardware devices that are distributed across multiple vaults and locations.

- Crime Insurance Coverage: Coinbase offers a crime insurance policy that covers customer assets up to $250,000 per individual, per bank. This insurance is backed by reputable institutions like JPMorgan Chase and Cross River Bank.

- Licensed and Regulated Worldwide: Coinbase has licenses in the US for money transmission and is recognized by FinCEN. In Europe and the UK, it is authorized by the Financial Conduct Authority (FCA) to issue e-money and provide payment services.

For more info about its safety measures, check out our guide on “Is Coinbase a safe crypto exchange”.

Payment Methods

Depositing or withdrawing money from Coinbase is easy because it supports several payment methods. First, you’ll need to link a payment option to your account. The most common choice is a bank account.

If you use ACH transfers, it’s available for both deposits and withdrawals, but it takes around 3 to 5 business days to process. For quick deposits, you can use a debit card. The money shows up in your Coinbase account instantly, but debit cards can’t be used for withdrawals. If you want speed for both deposits and withdrawals, PayPal is another good option. It works almost instantly, making it one of the fastest methods available.

For those outside the U.S., Coinbase offers several other payment methods:

- Google Pay

- Apple Pay (debit cards)

- SWIFT

- Faster Payments Transfer

- SEPA Transfer

- PayPal

- iDeal

Customer Service

Coinbase provides several customer support options, but reviews indicate mixed experiences. Users can access support through email ((email protected)), live chat, and a phone line (for Coinbase Card users or locking accounts).

There is also an extensive help center with FAQs, guides, and automated assistance. Premium services, such as Coinbase One, include 24/7 priority support.

However, Coinbase has faced criticism for its support. Many customers have complained about receiving automated responses instead of personalized solutions. According to <a target="_blank" href="https://www.coindesk.com/markets/2021/06/30/complaints-against-crypto-exchanges-rise-in-us-and-coinbase-tops-the-list” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>reports, Coinbase had one of the highest complaint rates among exchanges, with over 1,000 cases reported to the Consumer Financial Protection Bureau during one year. Issues like long response times and limited ways to escalate problems have been common grievances.

Trading Experience

Many users praise Coinbase for its clean and user-friendly interface. It provides multiple options for buying, selling, and storing a wide range of cryptocurrencies. The platform also integrates with the Coinbase Wallet and supports educational tools like Coinbase Earn, where users can learn and earn crypto.

However, customer complaints frequently focus on high fees. For instance, purchasing crypto with a debit card can incur higher fees compared to another payment method. Security is another common concern, with some users reporting problems like account hacks, account freezes, or difficulties accessing their accounts during high trading volume times.

Furthermore, many traders have voiced frustration with the customer support system, which has been criticized for slow response times and lack of effective assistance during critical issues. On Trustpilot, Coinbase has a low rating of 1.8 out of 5, indicating widespread dissatisfaction with customer service.

Coinbase App Review

The Coinbase app is available for both Android and <a target="_blank" href="https://apps.apple.com/us/app/coinbase-buy-bitcoin-ether/id886427730″ data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>iOS devices. It has a simple design that makes buying and selling over 246 cryptocurrencies easy, even if you’re new to crypto. Features like price tracking and educational tools are built right into the app.

The app offers two-factor authentication, biometric logins, and offline storage for most funds, making it very safe for your assets. The app supports crypto staking for earning rewards and has a wallet integration for nfts and DeFi trading. It even lets businesses use crypto payments through Coinbase Commerce.

Opening a Coinbase Account

- Create an Account: Go to the Coinbase website or download the app. Enter your email, set a strong password, and choose your country. After that, verify your email to complete the first step.

- Complete KYC (Know Your Customer): To keep your account safe, Coinbase needs your ID proof. Upload a government ID, like a passport or driver’s license, and maybe take a selfie. It usually takes a few minutes to verify.

- Deposit Funds: Add money to your account using a bank transfer, credit card, or even PayPal (in some countries). The minimum deposit is often just $10, making it easy to start.

- Start Buying crypto: Use your funds to buy bitcoin, ethereum, or any other crypto on Coinbase. You can buy as little as $1 worth of crypto, so you don’t need a big budget to begin.

Coinbase vs. Other crypto Exchanges

Kraken, Binance, and crypto.com are the best Coinbase alternative crypto exchanges. Here is a quick comparison:

| Coinbase | Kraken | crypto.com | Binance | |

| Launched | 2012 | 2013 | 2016 | 2017 |

| Supported Coins | 246+ | 200+ | 350+ | 400+ |

| Trading Fees | 0.4% maker and 0.6% taker | 0.25% maker and 0.4% taker | 0.25% maker and 0.5% taker | 0.1% maker/taker |

| Security | High | High | High | High |

| Trading Types | Spot and derivatives (limited) | Spot, futures, and margin trading | Spot, derivatives, bots, debit cards, staking, and more | Spot, derivatives, copy trading, P2P trading, margin, and more. |

| Leverage Trading | Up to 10x | Up to 50x | Up to 50x | Up to 125x |

| US Availability | Yes | Yes | Yes | Binance.US platform |

Related: Coinbase vs Binance: Which is Better?

Overall Coinbase Rating

| Features | NFTEvening Rating (out of 5) |

| Trading Features | 3 |

| Trading Fees | 2 |

| Cryptocurrency selection | 4 |

| Accessibility | 3.5 |

| Security Measures | 4.5 |

| Ease of Use | 4.5 |

| Regulatory Compliance | 5 |

| Customer Service | 3.00 |

| Overall Score | 3.7 |

Conclusion

In a nutshell, after this Coinbase review, it’s clear that Coinbase is one of the best crypto exchanges for beginners in the U.S. The platform is super easy to use and supports over 246 cryptocurrencies for buying, selling, and trading.

Coinbase is also very safe, using advanced security tools like two-factor authentication and cold storage to protect your assets. As a public company, it follows strict regulations, giving users extra trust.

However, Coinbase does have higher fees compared to some other platforms, like Binance, and might not be ideal for advanced traders. It’s a great choice if you want a simple, secure, and reliable way to start your crypto journey.

Coinbase Review: FAQs

Is Coinbase safe and legit?

Coinbase is very safe and 100% legit. It is the largest public crypto company in the U.S. and has been around since 2012. Coinbase uses top security tools like two-factor authentication (2FA) and encryption to protect your account.

They are also regulated in the U.S., licensed as a money transmitter, and recognized by FinCEN. Your funds in Coinbase are held 1:1, meaning they don’t lend your money like banks do. In 2021, Coinbase became a public company listed on NASDAQ, which shows its trustworthiness.

How do I get my money out of Coinbase?

Withdrawing money from Coinbase is super easy. First, link your bank account or PayPal to Coinbase. Then, go to the “Assets” tab, choose the crypto or cash you want to withdraw, and hit the “Withdraw”

button. You can convert your crypto to cash if needed before transferring. Transfers to your bank account might take 1-3 business days, while PayPal is often instant. The minimum withdrawal amount is usually $10, and fees may apply depending on the method you use.

Is Coinbase FDIC Insured?

Yes, but only for cash balances. Coinbase stores your USD funds in FDIC-insured accounts, which means if the bank holding the funds fails, you’re covered up to $250,000 per person. However, this insurance does not apply to your crypto holdings.

Does Coinbase Report to IRS?

Coinbase reports to the IRS for U.S. customers when required. If you earn more than $600 from crypto rewards or make trades with profits, Coinbase sends a 1099 form to you and the IRS. They report your crypto activity to follow U.S. tax laws.

What is USDC on Coinbase?

USDC (USD Coin) is a type of cryptocurrency called a stablecoin. It’s always worth $1 because it is backed by real dollars in reserves. You can use USDC to send money, make purchases, or trade other cryptocurrencies. On Coinbase, you can buy, sell, and even earn rewards for holding USDC, sometimes as much as 4% interest per year.

What is the downside of Coinbase?

One downside is the fees, which can be higher than some other crypto platforms. For example, buying crypto with a debit card might cost up to 3.99% per transaction. Another issue is that Coinbase sometimes freezes accounts if there’s suspicious activity, which can be frustrating.

Also, the platform mainly focuses on beginners, so advanced traders might find it less flexible compared to exchanges like Binance. Lastly, while Coinbase is secure, your crypto isn’t FDIC-insured, which means there’s no government protection if the company faces issues.

Is Binance better than Coinbase?

Binance has lower crypto trading fees, often around 0.1%, making it better for frequent traders. It also offers more coins to trade – over 400 compared to Coinbase’s 246+. However, Coinbase is easier to use, especially for beginners, and is regulated in the U.S., which adds safety. Binance has had some regulatory issues in certain countries, so that’s something to consider.

If you’re new to crypto or prefer security and simplicity, Coinbase might be better, but for experienced and high-leverage traders who require advanced trading features, Binance could be the smarter choice.

NEWSLETTER

NEWSLETTER