This week's featured stories

<h2 class="wp-block-heading" id="h-blackrock-revises-spot-bitcoin-etf-to-enable-easier-access-for-banks”>BlackRock Overhauls bitcoin Spot ETF to Allow Easier Access to Banks

BlackRock has overhauled its spot bitcoin exchange-traded fund (ETF) application to make it easier for Wall Street banks to participate by creating new shares in the fund with cash rather than just cryptocurrencies. The new “prepaid” in-kind reimbursement model will allow banking giants like JPMorgan or Goldman Sachs to act as authorized participants in the fund, allowing them to bypass restrictions that prevent them from holding bitcoin or cryptocurrencies directly on their balance sheets.

<h2 class="wp-block-heading" id="h-el-salvador-expects-to-sell-out-bitcoin-freedom-visa-by-end-of-year”>El Salvador hopes to sell bitcoin 'Freedom Visa' by the end of the year

El Salvador's National bitcoin Office says its $1 million Freedom Visa program has already received hundreds of inquiries since its launch on December 7 and expects it to sell out before the end of 2023. Launched by the local government in partnership with the Issuer of the Tether stablecoin, the Freedom Visa is a citizenship-by-donation program that provides a residency visa and a path to citizenship for 1,000 people willing to make a donation of $1 million in bitcoin or Tether to the country. The program is limited to 1,000 spots per calendar year.

Sam Bankman-Fried's Lawyer Says FTX Fraud Trial Was 'Nearly Impossible' to Win: Report

The lawyer responsible for the criminal defense of Sam “SBF” Bankman-Fried has admitted that it was “almost impossible” to win the case from the beginning. During an interview, Stanford Law School professor David Mills said he recommended SBF's legal defense admit the witnesses' and state prosecutor's allegations and convince the jury that Bankman-Fried intended to save the company. Mills also revealed that he had agreed to lend his expertise to Bankman-Fried's defense at the urging of the FTX CEO's parents, and described Bankman-Fried “as the worst person I've ever seen on cross-examination.”

Yearn.finance pleads with Arb traders to return funds after $1.4M multi-signature mishap

Yearn.finance expects arbitrage traders to return $1.4 million in funds after a multi-signature script error caused a large amount of the protocol's treasury to be depleted. The error occurred while Yearn was converting its yVault LP-yCurve (earned from vault harvest performance fees) into stablecoins on the CoW Swap decentralized exchange. Yearn suffered a significant slide when it received 779,958 DAI yVault tokens from the exchange, resulting in a 63% drop in the liquidity pool value.

<h2 class="wp-block-heading" id="h-sec-pushes-deadline-for-decision-on-invesco-galaxy-spot-ethereum-etf-to-2024″>SEC Moves Deadline for Decision on Invesco Galaxy Spot ethereum ETF to 2024

The US Securities and Exchange Commission has delayed its decision on whether to approve or reject an Ether spot ETF proposed by Invesco and Galaxy Digital. The companies filed the eth ETF spot application in September. The proposed spot cryptocurrency investment vehicle is one of many being considered by the commission, which, to date, has never approved an ETF with direct exposure to Ether, bitcoin or other cryptocurrencies.

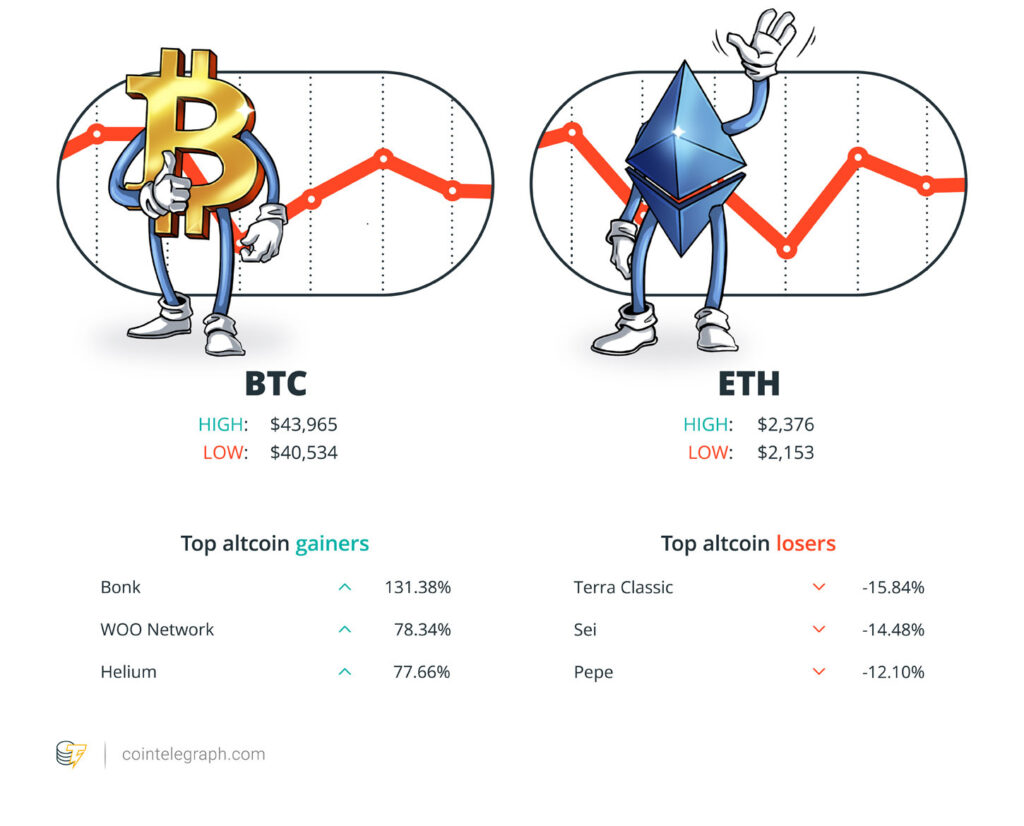

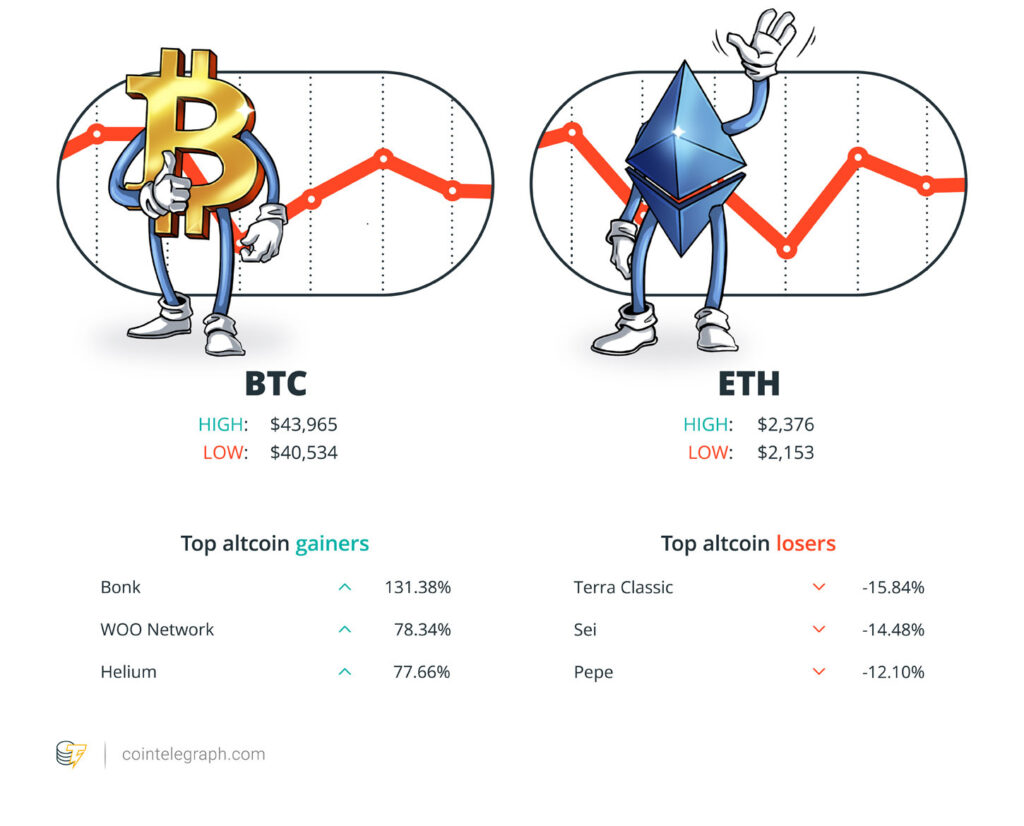

Winners and losers

At the end of the week, bitcoin (btc) I sat down $42,222Ether (eth) in $2,250 and XRP in $0.62. The total market capitalization is $1.6 billion, according to CoinMarketCap.

Among the 100 largest cryptocurrencies, the top three altcoins winners of the week are Bonk (BONK) at 131.38%, WOO Network (COURT) at 78.34% and Helium (HT) at 77.66%.

Top three altcoin losers of the week are Terra Classic (FAR) at -15.84%, six (BE) at -14.48% and Pepe (PEPE) at -12.10%.

For more information on cryptocurrency prices, be sure to read Cointelegraph's market analysis.

Read also

Characteristics

crypto Kids Fight Facebook for the Soul of the Metaverse

Art Week

Challenging Obsolescence: How Blockchain technology Could Redefine Artistic Expression

Most memorable quotes

“I am a big fan of this stablecoin called Tether… I have its treasures. So I keep their treasuries, and they have many treasuries.”

bitcoin-treasury-howard-lutnick” rel=”noreferrer noopener”>Howard LutnickCEO of Cantor Fitzgerald

“This (blockchain) can be leveraged to ensure proper recycling and handling of waste materials by tracking them from source to destination.”

Dominic Williamsfounder and chief scientist of Dfinity

“Digital currencies are the natural evolution of the global payments system, and Europe (…) is paving the way for this inevitable change.”

Michael NovogratzCEO of Galaxy Digital

“I thought it was almost impossible to win a case when three or four founders say you did it.”

David MillsSam Bankman-Fried Criminal Trial Attorney

“Our bipartisan bill is the toughest proposal on the table to combat the illicit use of cryptocurrencies and give regulators more tools in their toolbox.”

Elizabeth WarrenUS Senator

“We have to understand that the Central Bank is a scam. “What bitcoin represents is the return of money to its original creation, the private sector.”

JavierMileypresident of argentina

Prediction of the week

'There's no excuse' for not investing heavily in cryptocurrencies: Arthur Hayes repeats $1 million btc price bet

bitcoin and altcoins are an obvious bet in the current macroeconomic climate, says Arthur Hayes. In a post on

Being long cryptocurrencies is the key to success as markets bet the US Federal Reserve will cut interest rates next year, Hayes maintains. “At this point, there is no excuse not to be long crypto,” part of his post read.

“How many more times will they have to tell you that the fiat money you carry in your pocket is disgusting garbage?” he wrote. Hayes further reiterated a long-standing $1 million btc price prediction as a result of macro tides eroding the value of national currencies.

FUD of the week

Ledger fixes vulnerability after several DApps using connector library were compromised

The front-end of multiple decentralized applications using the Ledger connector was compromised on December 14. Ledger announced that he had fixed the problem three hours after initial reports of the attack. The affected protocols include Zapper, SushiSwap, Phantom, Balancer and Revoke.cash, which stole at least $484,000 in digital assets. The attacker used a phishing exploit to gain access to the computer of a former Ledger employee. The hack sparked criticism of Ledger's approach to security.

<h2 class="wp-block-heading" id="h-bitcoin-inscriptions-added-to-us-national-vulnerability-database”>bitcoin registrations added to US national vulnerability database

The National Vulnerability Database flagged bitcoin inscriptions as a cybersecurity risk on December 9, drawing attention to the security flaw that allowed the development of the Ordinals Protocol in 2022. According to database records, a data carrier The limit can be avoided by masking data as code in some versions of bitcoin Core and bitcoin Knots. As one of its potential impacts, the vulnerability could result in large amounts of non-transactional data being spammed onto the blockchain, which could increase the size of the network and negatively impact performance and fees.

SafeMoon drops 31% in five hours after filing for Chapter 7 bankruptcy

Decentralized finance protocol token SafeMoon has fallen 31% in five hours after the company behind it filed for bankruptcy. SafeMoon officially filed for Chapter 7 bankruptcy, also known as “liquidation bankruptcy,” on December 14. The latest blow comes just a month after the U.S. Securities and Exchange Commission charged SafeMoon and its executives with violating securities laws in what the regulator described as “a massive fraudulent scheme.” Several former SafeMoon supporters expressed their frustration on Reddit regarding the bankruptcy, claiming that SafeMoon developers harassed them.

Read also

Characteristics

'Account Abstraction' Powers ethereum Wallets: Beginner's Guide

Characteristics

Sweden: The death of money?

Top magazine articles of the week

Terrorism and war between Israel and Gaza are used as weapons to destroy cryptocurrencies

crypto/” target=”_blank” rel=”nofollow”>Draconian anti-cryptocurrency legislation could soon be passed to resolve a terrorist financing “crisis” that many say is vastly exaggerated.

Korean crypto company raises $140 million, China's ai sector raises $1.4 trillion and Huobi battle: Asia Express

crypto-firm-raises-140m-ai-market-china-sinohope-huobi-asia-express/” target=”_blank” rel=”nofollow”>Line Next Raises $140M, China's ai Market Tops $1.4T, Sinohope Stagnates Due to Stuck FTX Repository, and More!

J1mmy.eth once minted 420 Bored Apes… and had NFTs worth $150 million: nft Creator

eth-minted-420-bored-apes-nfts-worth-150m-nft-creator/” target=”_blank” rel=”nofollow”>nft collector J1mmy.eth operates like Warren Buffett, his collection peaked at $150 million and he once minted 420 Bored Apes with Pranksy.

Subscribe

The most interesting readings on blockchain. Delivered once a week.