Law firms, investment banks, and consulting firms working with FTX on its bankruptcy case billed the crypto exchange a combined $34.18 million in January, court documents reveal.

FTX’s new CEO and restructuring director, John J. Ray III, also received a hefty pay package, making $1,300 an hour for a total of $305,000 in February according to a March 6 report. presentation.

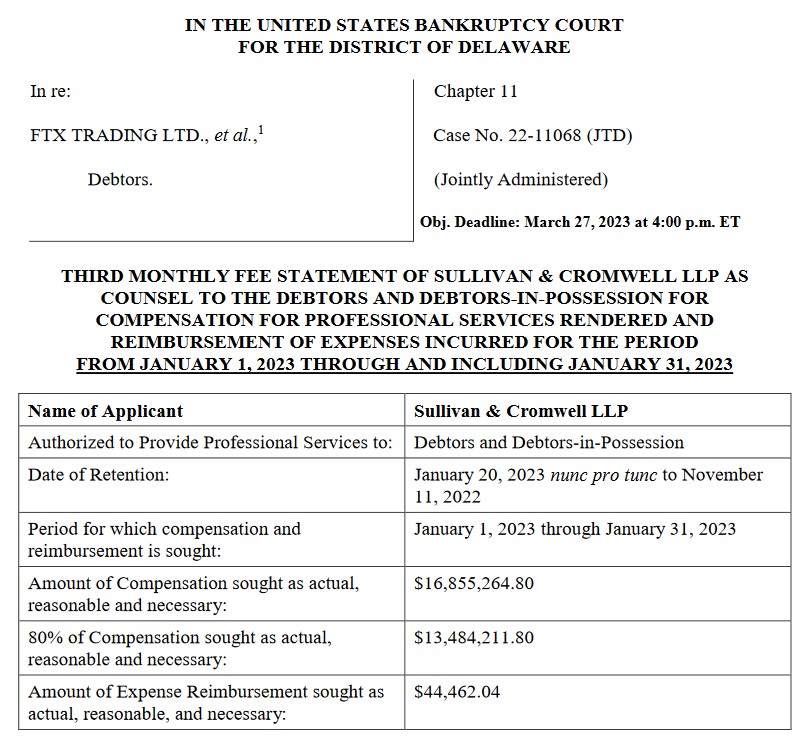

Separate court filings from March 6 show that the US law firms Sullivan & Cromwell, Quinn Emmanuel Urquhart & Sullivan and Landis Rath & Cobb billed $16.9 million, $1.44 million and $684,000 respectively for their services and expenses in January.

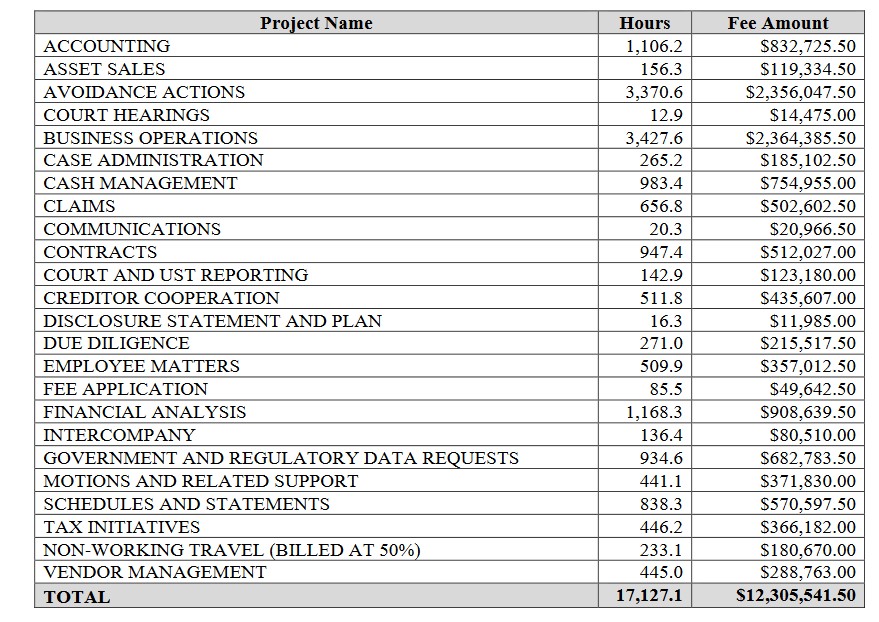

Sullivan & Cromwell attorneys and staff billed a total of 14,569 hours for their work, which equates to more than 600 days. Some partners were paid as much as $2,165 an hour, while the firm’s paralegals and legal analysts got by with between $425 and $595 an hour.

The highest-priced billables were discovery ($3.5 million), asset disposition ($2.2 million), and general investigative work ($2 million).

He sent another hefty $7.5 million bill to FTX for the first 19 days of February.

Ray played a crucial role in keeping Sullivan & Cromwell on board as legal counsel, having filed a lawsuit motion on January 17, arguing that Sullivan & Cromwell had been instrumental in taking control of the “dumpster fire” that was handed over to it.

His presentation came in response to a objection to the January 14 hold of the law firm by US trustee Andrew Vara, who claimed that Sullivan & Cromwell had failed to sufficiently disclose its connections and previous work for FTX.

FTX’s special counsel, Landis Rath & Cobb, spent much of his work time attending court hearings and litigation proceedings. For his efforts, the firm billed FTX administrators $684,000, including expenses.

Between the three law firms, more than 180 lawyers and more than 50 non-lawyer employees worked on the case, most of whom were from Sullivan & Cromwell.

Forensic consulting firm AlixPartners invoiced $2.1 million for January. Nearly half of the company’s hours were spent forensically analyzing decentralized finance (DeFi) products and tokens held by FTX.

Consulting firm Alvarez & Marsal invoiced for $12.5 million for more than 17,100 hours committed to avoidance actions, financial analysis and accounting procedures.

Related: FTX Bankruptcy Analysis: How It Is Different From Other Chapter 11 Cases

Investment bank Perella Weinberg Partners invoiced $450,000 monthly service fee plus more than $50,000 in expenses to plan a turnaround strategy and correspond with third parties.

With the FTX trial scheduled for October, there is at least another six months of legal work left for the law firms involved. Recent reports have estimated that fees could run into the hundreds of millions by the time the case ends, which could rival the $440 million in fees New York-based law firm Weil Gotshal made of the infamous Lehman Brothers bankruptcy in 2008.