Top news this week

FTX’s creditor list shows airlines, charities and tech companies caught in collapse

BlockFi Uncensored Financials Reportedly Shows $1.2B FTX Exposure

Bankrupt crypto lending firm BlockFi mistakenly uploaded uncensored financial data, revealing $1.2 billion in assets tied to bankrupt exchange FTX and defunct trading firm Alameda Research. The unredacted filings show that, as of January 14, BlockFi had $415.9 million in assets tied to FTX and a whopping $831.3 million in loans to Alameda. BlockFi filed for Chapter 11 bankruptcy on November 28, citing the collapse of FTX just weeks before as the cause of its financial woes.

read also

Characteristics

Basic and weird: what the metaverse is like right now

Characteristics

Forced Creativity: Why Bitcoin Thrives in Former Socialist States

New ‘Celsius token’ can be used to pay creditors

Bankrupt crypto lending firm Celsius may issue its own token to pay off creditors. In a court hearing, Celsius’ attorney, Ross M. Kwasteniet, said the firm is negotiating with its creditors how to relaunch the platform and pay them properly. If approved by creditors and the court, the relaunched version would be “a properly licensed, publicly traded company,” which is expected to provide creditors with more money than simply liquidating the company.

Binance guarantees token and user funds in the same wallet due to ‘mistake’

Genesis Creditors File Securities Lawsuit Against Barry Silbert and DCG

Winners and losers

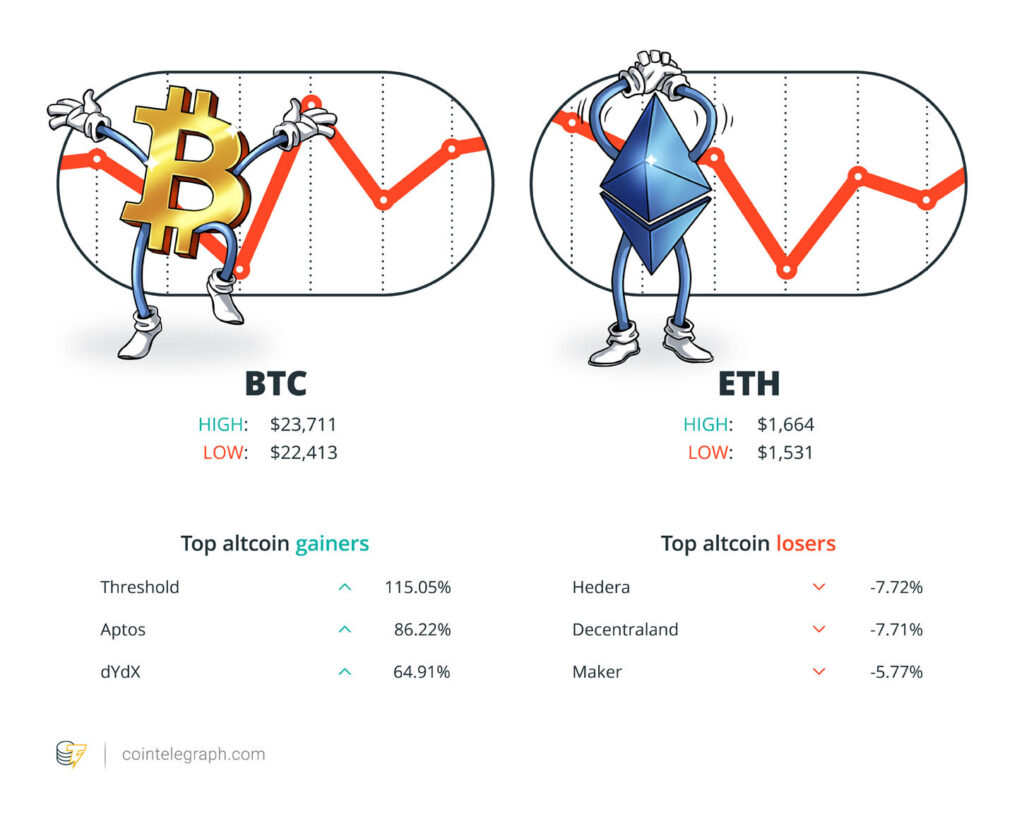

At the end of the week, Bitcoin (BTC) I sat down $23,129Ether (ETH) a $1,600 Y XRP a $0.41. Total market capitalization is $1.06 trillion, according to to CoinMarketCap.

Among the largest 100 cryptocurrencies, the top three altcoin gainers of the week are Threshold (T) at 115.05%, Aptos (SUITABLE) at 86.22% and dYdX (DYDX) at 64.91%.

The top three altcoin losers of the week are Hedera (HBAR) to -7.72%, Decentraland (MANNA) to -7.71% and Maker (MKR) at -5.77%.

To learn more about cryptocurrency prices, be sure to read Cointelegraph’s market analysis.

read also

Art Week

Connecting the dots: collectivism and collaboration in the world of crypto art

Characteristics

Basic and weird: what the metaverse is like right now

most memorable quotes

“With the help of blockchain technology, we can make medical breakthroughs so powerful and undeniable that existing systems will have no choice but to change.”

keith comitoco-founder and president of Lifespan.io

“It is very early days, but we continue to believe that stablecoins and central bank digital currencies have the potential to play a significant role in the payments space, and we have a number of initiatives underway.”

Alfred F. KellyVisa CEO

“Traditionally, people have looked to centralized intermediaries or governments to solve this problem, but technology like cryptography, blockchain, and zero-knowledge proofs offer new solutions.”

hester peircecommissioner of the US Securities and Exchange Commission

“We have observed that institutions and companies are more open than ever to working with blockchain companies to improve their business.”

Paul Veradi JacketsGeneral Partner of Pantera Capital

“We are seeing the consequences of the SEC’s priorities in real time, at the expense of US investors.”

michael sonnensteinGrayscale Investment CEO

“Other currencies or other tokens are essentially used as a store of value for investment and speculation. [There is a] good argument that they should be treated as a financial product.”

esteban jonesAssistant Treasurer and Minister for Financial Services of the Australian Parliament

prediction of the week

Bitcoin Will Hit $200K Before Next $70K ‘Bear Market’ Cycle – Forecast

After two weeks of rallying, the Bitcoin price has been largely flat in recent days, showing that market participants are not overly concerned about the US Federal Reserve’s monetary policy decisions. , the European Central Bank and the Bank of England scheduled for next week.

For many, BTC’s price action is still subject to Bitcoin’s four-year halving cycles. The resulting price pattern offers one “all-time high year” in four, with 2025 next in line. According to pseudonymous analyst Trader Tardigrade, aka Alan, the Bitcoin block subsidy halving will happen a year early, and from then on, the road will be open to a behemoth of $200,000.

“The well-formed structure of #Bitcoin with stochastic behavior indicates that the next ATH will be at 200K and the next bottom will be at 70K,” Alan predicted.

FUD of the week

Mango Markets sues Avraham Eisenberg for $47 million in damages plus interest

Argo Blockchain Accused of Misleading Investors in Class Action Lawsuit

US Department of Justice seizes website of prolific ransomware gang Hive

International law enforcement groups have dismantled the infamous Hive cryptocurrency ransomware gang, recovering more than 1,300 decryption keys for victims since July 2022 and preventing $130 million in ransomware payments. Hive was behind a series of high-profile ransomware incidents, including the cyberattack on the Costa Rican public health service and social security fund that occurred between April and May 2022.

Best Cointelegraph Features

The legal dangers of getting involved with DAO

NFT Creator: Amber Vittoria Crushes It With Her ‘Big Girl Pants’

‘Altcoin Killer’ Reformed Eric Wall On Publishing And Scaling Ethereum

“There are several cryptocurrency communities that basically have me as their favorite hate object,” says cryptanalyst Eric Wall, formerly known as the ‘altcoin killer.’

Subscribe

The most compelling reads on blockchain. Delivered once a week.