Trial Day 9: Trial Day 9: Ever wondered who’s behind the intriguing moniker “SBF” in the cryptocurrency world? Meet Sam Bankman-Fried, a once-celebrated figure who steered FTX to unprecedented heights, only to witness its dramatic downfall in November 2022. In this comprehensive guide, we’ll explore the highs and lows of SBF’s journey. From co-founding FTX and accumulating a staggering net worth to facing legal turmoil and a trial that has sent shockwaves through the crypto community.

Curious about the charges against SBF, the impact of FTX’s collapse on the crypto market, or the key revelations from the ongoing SBF trial? Get ready for an insider’s look into the life and controversies of Sam Bankman-Fried. If you’ve ever asked “What did SBF do?“, “How bad was FTX by SBF“, or even “How’s the SBF trial going“, this guide is where we address these questions and more.

Buckle up for a ride through the cryptic world of high-stakes finance and the captivating saga of SBF.

<img decoding="async" fetchpriority="high" class="aligncenter wp-image-125821 size-full perfmatters-lazy" alt="picture collage of Sam Bankman Fried (SBF) Next to a stock chart that is going downwards, implying a crypto crash and the FTX downfall” width=”1920″ height=”1080″ src=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.png” srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.png 1920w, https://nftevening.com/wp-content/uploads/2023/10/will-19-300×169.png 300w, https://nftevening.com/wp-content/uploads/2023/10/will-19-1024×576.png 1024w, https://nftevening.com/wp-content/uploads/2023/10/will-19-768×432.png 768w, https://nftevening.com/wp-content/uploads/2023/10/will-19-100×56.png 100w, https://nftevening.com/wp-content/uploads/2023/10/will-19-150×84.png 150w, https://nftevening.com/wp-content/uploads/2023/10/will-19-450×253.png 450w, https://nftevening.com/wp-content/uploads/2023/10/will-19-1200×675.png 1200w” data-sizes=”(max-width: 1920px) 100vw, 1920px”/><img decoding="async" fetchpriority="high" class="aligncenter wp-image-125821 size-full" src="https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.png" alt="picture collage of Sam Bankman Fried (SBF) Next to a stock chart that is going downwards, implying a crypto crash and the FTX downfall” width=”1920″ height=”1080″ srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.png 1920w, https://nftevening.com/wp-content/uploads/2023/10/will-19-300×169.png 300w, https://nftevening.com/wp-content/uploads/2023/10/will-19-1024×576.png 1024w, https://nftevening.com/wp-content/uploads/2023/10/will-19-768×432.png 768w, https://nftevening.com/wp-content/uploads/2023/10/will-19-100×56.png 100w, https://nftevening.com/wp-content/uploads/2023/10/will-19-150×84.png 150w, https://nftevening.com/wp-content/uploads/2023/10/will-19-450×253.png 450w, https://nftevening.com/wp-content/uploads/2023/10/will-19-1200×675.png 1200w” sizes=”(max-width: 1920px) 100vw, 1920px”/>

Who is SBF, aka Sam Bankman-Fried?

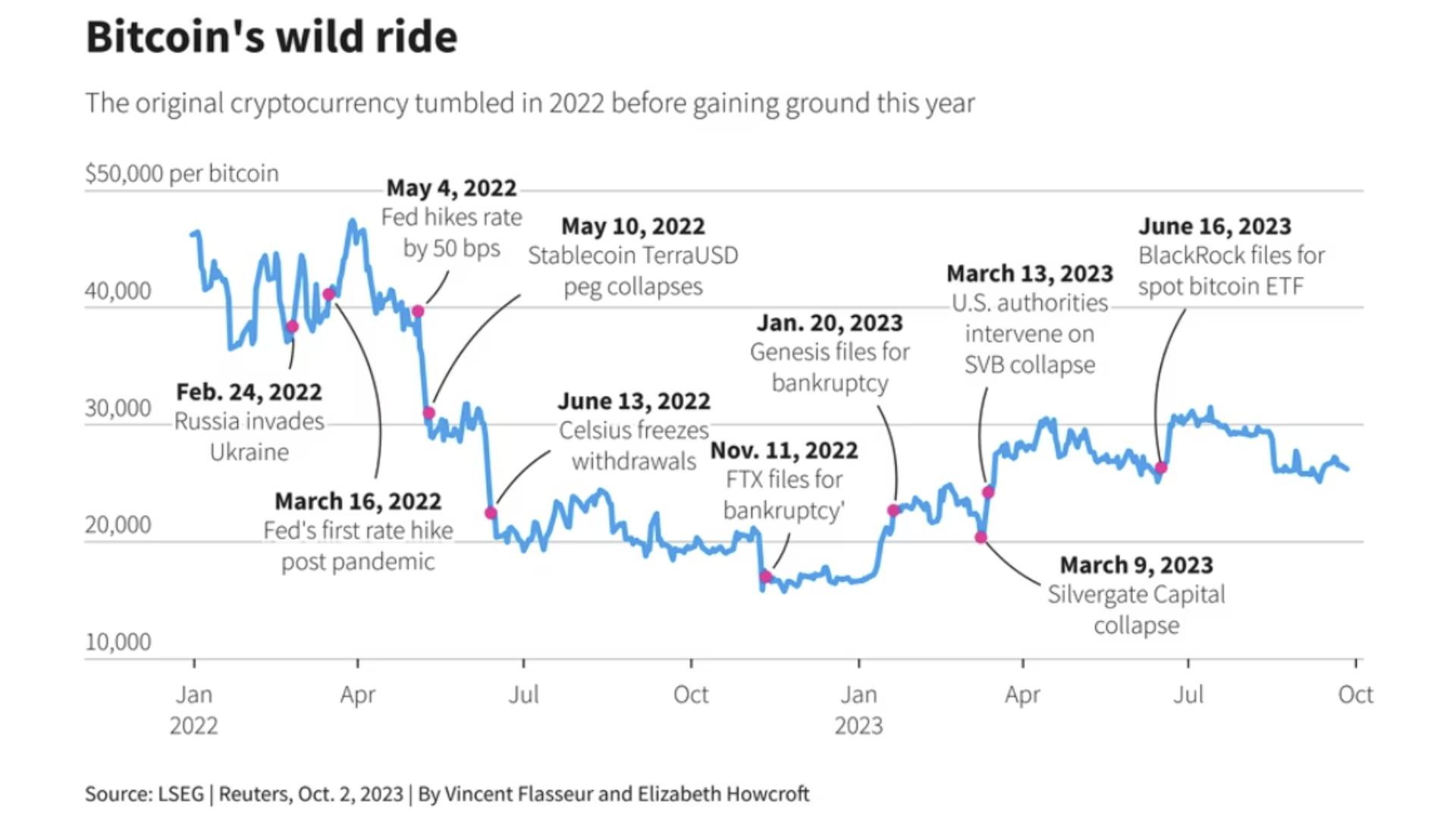

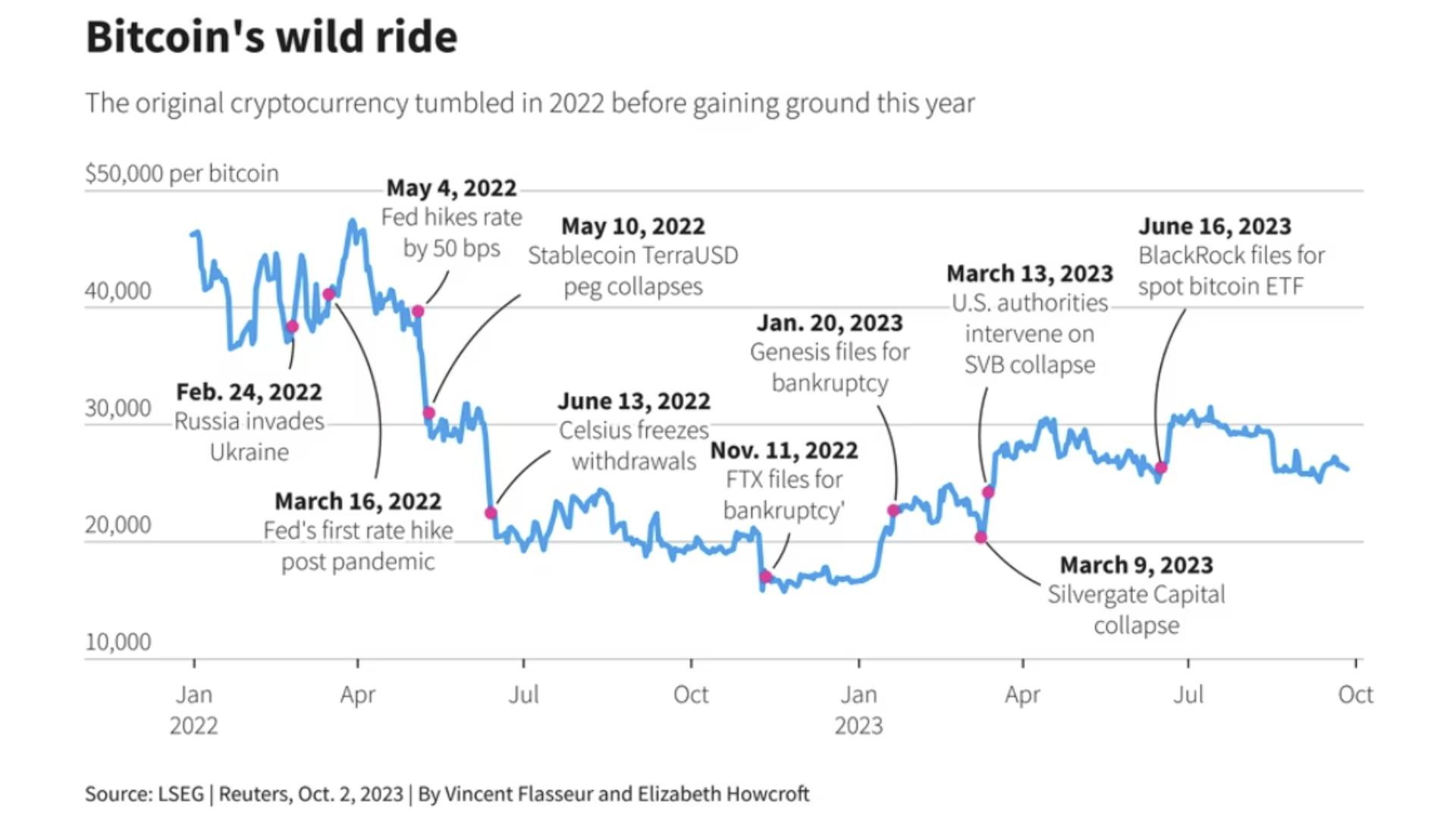

Sam Bankman-Fried is a controversial figure in the financial and cryptocurrency realms. He garnered widespread recognition as the co-founder and former CEO of FTX, a once-thriving crypto exchange. Known by the moniker “SBF,” he steered FTX to become one of the world’s largest cryptocurrency platforms. He attained a staggering personal net worth that eclipsed $26 billion. However, the zenith of his digital currency empire met an unexpected demise in November 2022. This marked a pivotal moment in his career and for crypto in general.

The unraveling of Bankman-Fried’s financial ventures commenced with his resignation from FTX on November 11, 2022. Subsequently, FTX filed for Chapter 11 bankruptcy, signaling a profound shift in the cryptocurrency landscape. The collapse of FTX was exacerbated by a CoinDesk report that underscored potential leverage and solvency concerns intertwined with Alameda Research, another venture associated with Bankman-Fried.

This development sent shockwaves through the volatile crypto market. It saw a substantial loss of billions and a market valuation below the significant $1 trillion mark. The abrupt fall of FTX in November 2022 not only punctuated the challenges faced by major players in the crypto industry but also raised questions about risk management and regulatory considerations in the evolving landscape of digital finance.

Sam Bankman-Fried’s Past

Sam Bankman-Fried, born on March 6, 1992, into an academic family on the Stanford University campus, embarked on a trajectory marked by intellectual prowess and diverse experiences. Sam’s early life hinted at an environment fostering intellectual curiosity. He was raised by professors Barbara Fried and Joseph Bankman, and with familial ties to academic luminaries such as his aunt Linda P. Fried, the dean of Columbia University Mailman School of Public Health.

His journey into mathematics led him to the Canada/USA Mathcamp. This is a program for mathematically talented high-school students. This was before he pursued his high school education at Crystal Springs Uplands School in Hillsborough, California.

After graduating from the Massachusetts Institute of technology (MIT) in 2014 with a bachelor’s degree in physics and a minor in mathematics, Bankman-Fried delved into the financial realm. He commenced his professional journey as an intern at Jane Street Capital during the summer of 2014. This is also where he traded international ETFs. Post-graduation, he then returned to Jane Street full-time before making a significant move in September 2017. Relocating to Berkeley, California, he briefly contributed to the Centre for Effective Altruism (CEA) as the director of development.

However, it was in November 2017, spurred by fund injections from notable figures like Jaan Tallinn and Luke Ding, that Bankman-Fried co-founded Alameda Research, a quantitative trading firm. By 2021, he held approximately 90 percent ownership of Alameda Research.

His early forays into cryptocurrency trading and arbitrage set the stage for his later ventures. This includes a notable $25 million per day trade to exploit bitcoin price differentials between Japan and the United States. In April 2019, Bankman-Fried founded the FTX cryptocurrency derivatives exchange, which would later play a central role in his narrative.

SBF and FTX

Sam Bankman-Fried founded the FTX cryptocurrency derivatives exchange in April 2019. This marks the inception of a venture that would soon become a prominent player in the cryptocurrency industry. The platform officially opened for business the following month.

Although by December 8, 2021, Bankman-Fried found himself alongside other industry executives, testifying before the Committee on Financial Services, emphasizing the increasing influence of FTX in shaping the regulatory discourse around cryptocurrency.

<img decoding="async" class="aligncenter wp-image-125823 size-full perfmatters-lazy" alt="a picture of FTX Arena, signaling the once giant crypto marketplace.” width=”1280″ height=”720″ src=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.jpg” srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.jpg 1280w, https://nftevening.com/wp-content/uploads/2023/10/image-2-300×169.jpg 300w, https://nftevening.com/wp-content/uploads/2023/10/image-2-1024×576.jpg 1024w, https://nftevening.com/wp-content/uploads/2023/10/image-2-768×432.jpg 768w, https://nftevening.com/wp-content/uploads/2023/10/image-2-100×56.jpg 100w, https://nftevening.com/wp-content/uploads/2023/10/image-2-150×84.jpg 150w, https://nftevening.com/wp-content/uploads/2023/10/image-2-450×253.jpg 450w, https://nftevening.com/wp-content/uploads/2023/10/image-2-1200×675.jpg 1200w” data-sizes=”(max-width: 1280px) 100vw, 1280px”/><img decoding="async" class="aligncenter wp-image-125823 size-full" src="https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.jpg" alt="a picture of FTX Arena, signaling the once giant crypto marketplace.” width=”1280″ height=”720″ srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/From-FTX-to-Fraud-Charges.jpg 1280w, https://nftevening.com/wp-content/uploads/2023/10/image-2-300×169.jpg 300w, https://nftevening.com/wp-content/uploads/2023/10/image-2-1024×576.jpg 1024w, https://nftevening.com/wp-content/uploads/2023/10/image-2-768×432.jpg 768w, https://nftevening.com/wp-content/uploads/2023/10/image-2-100×56.jpg 100w, https://nftevening.com/wp-content/uploads/2023/10/image-2-150×84.jpg 150w, https://nftevening.com/wp-content/uploads/2023/10/image-2-450×253.jpg 450w, https://nftevening.com/wp-content/uploads/2023/10/image-2-1200×675.jpg 1200w” sizes=”(max-width: 1280px) 100vw, 1280px”/>

Strategic Financial Moves and Investments (May 2022 – September 2022):

In May 2022, it was disclosed that Emergent Fidelity Technologies Ltd., majority-owned by Bankman-Fried, had acquired a significant 7.6 percent stake in Robinhood Markets stock. The financial intricacies behind this move came to light in a November 2022 affidavit. This also revealed that Bankman-Fried and FTX co-founder Gary Wang borrowed over $546 million from Alameda Research to facilitate the acquisition.

Subsequently, in September 2022, Bankman-Fried’s advisors, on his behalf, explored funding options for Elon Musk’s purchase of Twitter, though no investment materialized when Musk concluded the acquisition. Following this, Bankman-Fried directed substantial investments, injecting $500 million into Anthropic and allocating more than $500 million to various venture capital firms, including a significant $200 million in Sequoia Capital.

FTX’s Downfall and Legal Challenges (November 2022):

The apex of the narrative unfolded in November 2022, with a sequence of events leading to the downfall of FTX. Binance CEO Changpeng Zhao’s revelation on Twitter about Binance’s intention to sell its holdings of FTT triggered a series of disputes and financial uncertainties.

A non-binding agreement for Binance to acquire FTX unraveled. This cited concerns over FTX’s mishandling of customer funds and ongoing investigations. This crisis culminated in the filing for bankruptcy by FTX, Alameda Research, and over 130 associated legal entities on November 11, 2022.

Investigations revealed financial irregularities, including the transfer of billions from FTX to Alameda Research without disclosure, allegations of customer funds being used to secure loans, and a profound failure of corporate controls.

Bankman-Fried’s Arrest and Legal Aftermath (November 2022 – December 2022):

In the aftermath of FTX’s bankruptcy, Bankman-Fried resigned as CEO on November 11, 2022, and was immediately replaced. Investigations continued, uncovering further details of financial irregularities and the extent of corporate mismanagement.

On November 12, Bankman-Fried was interviewed by the Royal Bahamas Police Force, and on November 17, a sworn declaration submitted in bankruptcy court highlighted the extent of financial complexities.

Amidst legal challenges, Bankman-Fried’s prepared testimony for the House Financial Services Committee, maintaining FTX’s solvency, raised questions about corporate pressures leading to bankruptcy. The unfolding legal drama saw Bankman-Fried’s arrest and imprisonment. This adds a somber note to the conclusion of this tumultuous chapter.

What Happened to FTX?

Sam Bankman-Fried, once hailed as the savior of the crypto world, faces serious accusations related to the collapse of his cryptocurrency exchange, FTX. In December 2022, he was arrested and charged with wire fraud, securities fraud, and money laundering, among other offenses. The charges allege a staggering downfall from his celebrated status as a billionaire philanthropist. Bankman-Fried’s arrest followed the collapse of FTX, which led to its filing for bankruptcy.

<img decoding="async" class="aligncenter wp-image-125824 size-full perfmatters-lazy" alt="picture of a person holding up a phone that shows the crypto stock of FTX ($FTX) crashing to zero” width=”1920″ height=”1080″ src=”https://technicalterrence.com/wp-content/uploads/2023/11/1698844057_720_From-FTX-to-Fraud-Charges.png” srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/1698844057_720_From-FTX-to-Fraud-Charges.png 1920w, https://nftevening.com/wp-content/uploads/2023/10/will-21-300×169.png 300w, https://nftevening.com/wp-content/uploads/2023/10/will-21-1024×576.png 1024w, https://nftevening.com/wp-content/uploads/2023/10/will-21-768×432.png 768w, https://nftevening.com/wp-content/uploads/2023/10/will-21-100×56.png 100w, https://nftevening.com/wp-content/uploads/2023/10/will-21-150×84.png 150w, https://nftevening.com/wp-content/uploads/2023/10/will-21-450×253.png 450w, https://nftevening.com/wp-content/uploads/2023/10/will-21-1200×675.png 1200w” data-sizes=”(max-width: 1920px) 100vw, 1920px”/><img decoding="async" class="aligncenter wp-image-125824 size-full" src="https://technicalterrence.com/wp-content/uploads/2023/11/1698844057_720_From-FTX-to-Fraud-Charges.png" alt="picture of a person holding up a phone that shows the crypto stock of FTX ($FTX) crashing to zero” width=”1920″ height=”1080″ srcset=”https://technicalterrence.com/wp-content/uploads/2023/11/1698844057_720_From-FTX-to-Fraud-Charges.png 1920w, https://nftevening.com/wp-content/uploads/2023/10/will-21-300×169.png 300w, https://nftevening.com/wp-content/uploads/2023/10/will-21-1024×576.png 1024w, https://nftevening.com/wp-content/uploads/2023/10/will-21-768×432.png 768w, https://nftevening.com/wp-content/uploads/2023/10/will-21-100×56.png 100w, https://nftevening.com/wp-content/uploads/2023/10/will-21-150×84.png 150w, https://nftevening.com/wp-content/uploads/2023/10/will-21-450×253.png 450w, https://nftevening.com/wp-content/uploads/2023/10/will-21-1200×675.png 1200w” sizes=”(max-width: 1920px) 100vw, 1920px”/>

The unraveling of FTX was not a consequence of typical crypto market volatility; rather, it was rooted in layers of unsustainable deception. Reports suggest that Bankman-Fried may have illicitly diverted approximately $10 billion in FTX customer funds to his trading firm, Alameda Research. This not only jeopardized the future of Alameda Research but also raised serious questions about the mismanagement of customer funds.

How FTX Fell Into Trouble With The SEC

The legal troubles deepened with two former top executives, Caroline Ellison and Gary Wang. Both pleading guilty to various fraud charges and cooperating with federal prosecutors. Simultaneously, the Securities and Exchange Commission (SEC) independently charged Bankman-Fried, Ellison, and Wang with defrauding FTX investors. The situation is compounded by the missing funds, with at least $1 billion in customer funds reportedly unaccounted for.

The Justice Department and SEC initiated investigations immediately after FTX’s collapse, underscoring the severity of the allegations. The shocking contrast between the outwardly thriving FTX and its concealed financial troubles has resulted in Bankman-Fried’s swift reputational fall from grace, prompting political figures to distance themselves from the once-dubbed “king of crypto.”

In the aftermath, Bankman-Fried publicly apologized, acknowledging shortcomings and emphasizing a “poor internal labeling of bank-related accounts” as a contributing factor to FTX’s liquidity issues. This saga, characterized by financial mismanagement, alleged fund diversions, and regulatory scrutiny, stands as a cautionary tale in the crypto industry, potentially reshaping perceptions and regulations in its wake.

What Did SBF Do?

In late 2022, FTX and Alameda Research, led by Bankman-Fried, faced a major collapse, resulting in chapter 11 bankruptcy. Bankman-Fried’s net worth, once $26 billion, dropped to zero due to FTX’s bankruptcy.

SBF stands accused of orchestrating a colossal embezzlement scheme within FTX, allegedly transferring billions from numerous individuals in a web of deception. The timeline reveals calculated moves, including the exploitation of customer funds in Alameda’s bank account, where SBF, fully aware of the implications, manipulated finances.

Complicating matters, SBF’s alleged romantic involvement with Alameda’s CEO led to special privileges for the company within FTX, including exemptions from collateral requirements and permission for risky financial practices, all concealed from customers.

Accusations extend to the dissemination of false information to investors and lenders, leveraging FTX’s marketing and Alameda’s misleading balance sheets. In November 2022, SBF is claimed to have continued spreading falsehoods on Twitter, assuring FTX’s well-being and later deleting the tweet in an attempt to cover up lies.

SBF FTX Fallout

The fallout includes doubts about the recovery of funds for innocent customers, with SBF’s motives painted as a pursuit of opulence through reckless financial maneuvers.

1. Criminal Charges Unveiled: On December 12, 2022, Bankman-Fried was arrested in The Bahamas and extradited to the United States. An unsealed indictment revealed eight criminal charges, including wire fraud, securities fraud, commodities fraud, money laundering, and campaign finance law violations. Four additional charges were announced in February 2023.

2. Alleged Financial Misconduct: It was reported that Bankman-Fried transferred at least $4 billion from FTX to Alameda Research without disclosure, including customer funds ostensibly backed by FTT and shares in Robinhood. Anonymous sources claimed the money transfer included customer funds. Moreover, Bankman-Fried was aware that FTX had lent customers’ money to Alameda.

3. FTX’s Bankruptcy and Investigations: Amid the crisis, investigations by the Securities and Exchange Commission and Commodity Futures Trading Commission were launched, probing FTX’s mishandling of customer funds. On November 11, 2022, FTX, Alameda Research, and associated entities declared bankruptcy.

SBF Arrested: How It All Came Crashing Down On FTX

Sam Bankman-Fried, the 31-year-old entrepreneur and CEO of FTX, faced a series of legal troubles that culminated in his arrest and subsequent trial. The allegations against him paint a picture of financial misconduct and deception.

Shocking Testimonies in Trial: As Bankman-Fried’s trial began on October 3, 2023, shocking testimonies unfolded. Witnesses, including Gary Wang, co-founder of FTX, revealed alleged financial crimes, unauthorized withdrawals, and misleading practices. The defense portrayed Bankman-Fried as a young entrepreneur making poor business decisions, while prosecutors accused him of intentional deception to enrich himself.

Witness Tampering Allegations: In July 2023, prosecutors alleged witness tampering after Bankman-Fried provided a reporter with personal writings of Caroline Ellison, former CEO of Alameda Research. On August 11, 2023, Bankman-Fried’s bail was revoked over alleged attempts at witness tampering, leading to his return to detention.

Further Charges and Revelations: In August, Bankman-Fried faced additional charges, including the use of $100 million in stolen funds for U.S. election campaign contributions. Testimonies during the trial exposed SBF’s aspirations to become the U.S. President, directed fraudulent activities, and revealed intricate financial transactions between FTX and Alameda.

Bankman-Fried’s trial, presided over by Judge Lewis Kaplan, is anticipated to be a pivotal moment with potential far-reaching consequences for the crypto industry, marking a significant chapter in its history that underscores the importance of trust and ethics in the pursuit of innovation.

SBF Girlfriend, Caroline Ellison

Caroline Ellison’s journey intertwined with the FTX drama began during her Stanford years when she entered the world of quantitative trading with internships at Jane Street, where she was mentored by Sam Bankman-Fried. Their shared interest in effective altruism fostered a lasting connection.

In February 2018, while in the Bay Area, Ellison joined Alameda Research, co-founded by Bankman-Fried and Tara Mac Aulay. Despite her experience, she received no equity in Alameda and only a 0.5% stake in FTX. This was when she became its co-CEO in October 2021 and later the sole CEO in August 2022.

However, the narrative took a troubling turn on November 6, 2022, when concerns about Alameda Research’s balance sheet surfaced. Ellison addressed these concerns, revealing that the released information covered only some of Alameda’s assets, with over $10 billion in additional assets.

The situation escalated on November 9, 2022, as Ellison, in a video meeting, admitted that FTX had utilized customer funds to assist Alameda in meeting liabilities, implicating herself, Bankman-Fried, and other FTX executives. In the aftermath of FTX, Alameda Research, and related companies filing for Chapter 11 bankruptcy, Ellison faced termination from her position.

Was SBF Responsible for the Downfall of crypto?

The fall of FTX and Sam Bankman-Fried, had a profound impact on the cryptocurrency market. Following its peak at $3 trillion in November 2021, the overall crypto market value sharply declined, reaching a two-year low of $796 billion as FTX faced a dramatic collapse.

This event triggered a significant contraction in crypto trading volumes, with traders hesitating to buy and sell tokens or leaving the market altogether due to the loss of liquidity. In September 2023, total monthly volumes across spot and derivative markets plunged by over 60% compared to September 2022, according to CCData.

Spot markets were hit the hardest, experiencing a more than 70% decrease in volumes to $272 billion. Derivative volumes also fell by 60% to $1.1 trillion in the 12 months since September 2022. The exit of large market makers post-FTX significantly reduced liquidity. Thus resulting in both low trading volumes and low volatility, as noted by economist Noelle Acheson.

With FTX filing for bankruptcy and Bankman-Fried facing charges of fraud, the crypto community is grappling with the aftermath, and the repercussions are likely to be felt for years. Investors and consumers who lost funds in FTX’s collapse are unlikely to recover their losses, and both FTX and Bankman-Fried are expected to face numerous lawsuits and bankruptcy proceedings, potentially leading to a protracted legal battle and severe consequences for the once-lauded figure in the crypto world.

SBF on Trial

In the gripping trial of Sam Bankman-Fried (SBF), each day unveils shocking revelations. Accused of orchestrating financial misdeeds, SBF confronts charges of deception, fraud, and money laundering.

Former associates and witnesses actively expose a complex web of deceit, lavish expenditures, and political entanglements, transforming SBF’s trial into a legal saga of epic proportions.

Below is a condensed gist of how the proceedings are going through in real time.

Chronological Guide to SBF’s Trial:

Trial Days 1-2 (Oct. 3-4): Jury Selection and Opening Arguments

- Day 1: SBF Trial begins with jury selection; not concluded on the first day.

- Jury selection process extended due to conflicts of interest and financial losses among potential jurors.

- Day 2: Opening arguments presented by both prosecution and defense.

- DOJ alleges SBF orchestrated deception for personal gain; Defense portrays him as a young entrepreneur making poor business decisions.

- Prosecutors emphasize SBF’s role in misleading customers, investors, and lenders.

Trial Day 3 (Oct. 5): Testimonies Begin, Broadening Scope

- Witnesses, including Gary Wang (Co-founder of FTX), provide compelling accounts of financial wrongdoing.

- Wang’s admission of financial crimes and FTX’s complex relationship with Alameda Research (SBF’s sister company).

- Adam Yedidia (former Senior Developer at FTX)‘s testimony reveals troubling practices in customer deposits and software bugs.

- Danielle Sassoon (Assistant U.S. Attorney) names potential witnesses, broadening the case’s scope.

Trial Day 4 (Oct. 6): Startling Privileges and Fictitious Insurance

- Gary Wang (Co-founder of FTX) exposes SBF’s authorization for Alameda to withdraw funds and exclusive credit line.

- Revelation of shielded FTX accounts and fictitious insurance fund.

- Wang admits to a litany of crimes committed alongside SBF, Caroline Ellison (Former CEO of Alameda), and Nishad Singh (former insider).

- Wang’s testimony raises concerns about FTX’s unconventional governance structure and potential preferential treatment for Alameda.

Court Days 5-7, SBF’s Girlfriend Testifies:

Trial Day 5 (Oct. 10): Explosive Testimonies and SBF’s Aspirations

- Caroline Ellison (Former CEO of Alameda)‘s testimony becomes a turning point.

- SBF’s alleged directives, devastating losses, and aspirations for U.S. presidency revealed.

- Ellison exposes financial transactions, political contributions, and plans to repurchase Binance’s FTX stocks.

- Testimonies reveal Alameda’s unrestricted access to funds and its competitive edge in executing orders.

Trial Day 6: Caroline Ellison’s Unsettling Revelations

- Ellison’s testimony reveals a web of financial mismanagement and deceptive tactics.

- SBF’s alleged coercion of altered balance sheets and involvement in a bribery scandal.

- Ellison unveils SBF’s purported acceptance of advice from an employee named David Ma. This led to a controversial cryptocurrency transfer linked to Chinese officials.

- SBF’s alleged acceptance of advice from David Ma and the transfer of cryptocurrencies to addresses linked to Chinese officials unveiled.

Trial Day 7: Ellison’s Composure Amidst Cross-Examination

- Cross-examination of Ellison by both SBF’s lawyer and prosecutor.

- Shifts in SBF’s defense strategy, focusing on topics previously discussed.

- Emphasis on Alameda’s decisions, loan repayments, and the $65 billion line of credit.

- Assistant US Attorney Danielle Sassoon probes Ellison about Alameda’s decision to purchase $FTT from Binance and unravels a crucial piece of the puzzle.

Court Days 8-11, Insiders Speak Out:

Zac Prince’s Testimony on BlockFi’s Consequences (Trial Day 8)

- Zac Prince (CEO of BlockFi) testifies on catastrophic repercussions.

- BlockFi’s $1 billion in loans to Alameda and depositing $350 million of customer funds into FTX.

- Highlights the role of FTX and Alameda in BlockFi’s downfall.

- Prince’s testimony lays bare the staggering losses incurred by BlockFi.

Explosive Testimonies on Lavish Expenditures and Financial Practices (Trial Day 9)

- Nishad Singh (former insider)‘s revelations on extravagant spending and financial maneuvers.

- Singh’s detailed account of financial intricacies and mismanagement.

- Singh asserts the entire operation funded by Alameda Research and overseen by SBF.

- Further insights into Singh’s testimony illuminate that Alameda had received direct deposits ranging from $10 billion to $20 billion from FTX between 2020 and 2022.

Singh’s Revelations Cast Shadows on Bankman-Fried’s Enterprises (Trial Day 10)

- Singh’s disclosures unveil lucrative executive benefits and discussions surrounding the $8 billion deficit.

- Singh’s account adds complexity to FTX’s financial web and operations.

- Singh provides a detailed account of the discussions surrounding the $8 billion deficit within Bankman-Fried’s trading firm.

- Insights from FBI Special Agent Richard Busick reveal the digital footprint of Bankman-Fried.

Complex Money Trail and Political Entanglements (Trial Day 11)

- Witnesses testify about the complex money trail and political associations.

- Eliora Katz (Former In-House Lobbyist for FTX. US) highlights political links, and Peter Easton (University of Notre Dame Accountancy Professor) traces the money trail.

- Financial forensic analysis conducted by Paige Owens (FBI) supports the damning narrative.

- Katz’s testimony emphasizes the convergence of cryptocurrency and political realms.

Court Days 11-14, Testimonies, Tensions & Revelations:

Shocking Testimonies and Unveiled Deceptions (Trial Day 12)

- Former FTX General Counsel Can Sun reveals a $7 billion deficit and systematic mismanagement.

- Consequences for BlockFi and Third Point’s $60 million investment in FTX.

- Sun’s account adds depth to the allegations against Bankman-Fried and his associates.

- Robert Boroujerdi of Third Point emphasizes the impact of Bankman-Fried’s alleged omission of crucial details on the firm’s $60 million investment in the now-failed crypto exchange.

Tensions Rise as Testimonies Unfold, SBF Takes the Stand (Trial Day 13)

- Defense attorney Krystal Rolle and financial consultant Joseph Pimbley provide insights into FTX’s regulatory interactions and the intricate financial environment.

- Pimbley’s expert analysis of FTX’s code and database reveals a complex financial picture.

- SBF takes the stand, facing intense scrutiny, discussing the usage of Signal and the controversial North Dimension entity.

- Assistant US Attorney Danielle Sassoon probes Ellison about Alameda’s decision to purchase $FTT from Binance and unravels a crucial piece of the puzzle.

Bankman-Fried’s Defense Strategy Unveiled (Trial Day 14)

- SBF counters the prosecution’s narrative, portraying himself as an unsuccessful entrepreneur rather than a deliberate fraudster.

- Lengthy explanations provided for actions, frequently attempting to shift blame onto his inner circle.

- Firm denial of committing crimes or utilizing customer funds for personal gain.

- Mark Cohen (Defense Attorney) asserts SBF’s autonomy in decision-making and attempts to discredit Ellison’s testimony.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.