US Federal Reserve (Fed) Chairman Jerome Powell announced another rate hike to bring inflation down to the 2% mark. This is the eighth time in a row in less than a year that the Fed has raised interest rates.

The Federal Open Market Committee (FOMC) raised interest rates by 25 basis points (bps), or a quarter of a percentage point, for the first time in 2023. According to Powell’s speech, the main goal of the rate hike is to tame inflation, currently at 6.5%, while preventing a US recession.

“Restoring price stability will probably require staying tight for some time.”

Fed Chairman Jerome Powell

Fed Chairman Jerome Powell sounded aggressive at 2:30 pm ET. press conference, which means he will lean toward tighter policy and keep interest rates high at the next FOMC meeting. He also suggested ending the rate-hike regime in the next one or two FOMC meetings.

How US Interest Rates Impact Crypto Markets

Andrew Weiner, the vice president of the MEXC cryptocurrency exchange, does not expect any “interest rate cuts” in 2023. He believes that Wall Street is not buying it.

In a comment to crypto.news, Weiner said:

“US stocks rally on Fed rate hike with no surprises, as does BTC. In other words, a 25 basis point rate increase is included.”

Andrew Weiner, Global Vice President of MEXC

The VP of MEXC Global believes that a “soft landing” is possible, avoiding a recession. Weiner expressed his optimism for the crypto markets in the first quarter of 2023:

“The focus will be on whether Powell acknowledges the recent decline in inflation and economic activity, which bolsters markets’ hopes for an early turn to easing.”

Andrew Weiner, Global Vice President of MEXC

Crypto markets are in the green

A few hours after the rate hike, the digital currency market showed bullish signs as the top 12 crypto assets, excluding stablecoins, turned green. Bitcoin (BTC) is up 3.37% in the last 24 hours and is currently trading at $23,828 with a market capitalization of $459 billion.

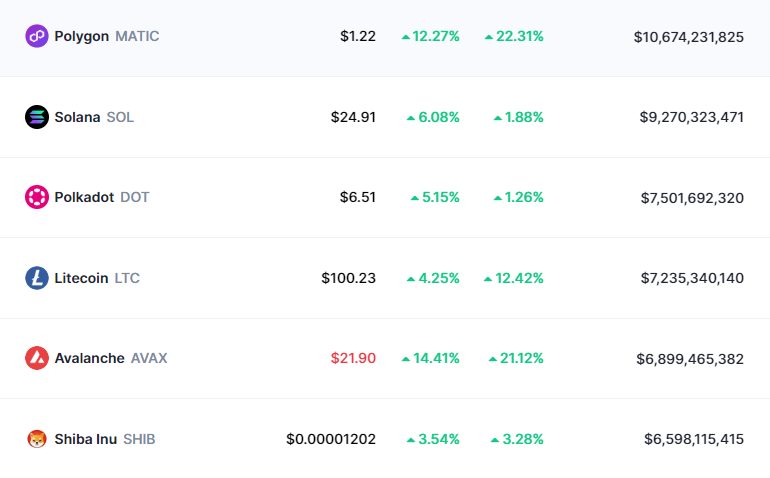

The top three gainers after the Fed meeting are Avalanche (AVAX), Polygon (MATIC) and Binance Coin (BNB), with 14.4%, 12.2% and 7.1% breakouts in the last 24 hours. . Also, the main gainer over the last week is MATIC, up 22.3% in the last seven days and trading at $1.22 at the time of writing.

It is important to note that the global crypto market capitalization has risen from approximately $1.03 trillion at the time of the Fed statement to $1.08 trillion at the time of writing, according to CoinMarketCap. data.

The Fed’s firm approach

A slow and steady approach

The Fed raised rates by 50bp during the December meeting, marking a significant slowdown from the previous meeting. During four consecutive previous meetings, the FOMC raised short-term rates by 75bp.

The Fed is now taking a more consistent approach to watch incoming data more clearly and react accordingly. In addition, they announced some adjustments in the rates. Officials set the target range for the policy rate at 4.5% to 4.75%, which is well above the near-zero mark last year. They also recognized that inflation stopped but remained high. Therefore, the increase in the target range, as they said, was appropriate.

Jerome H. Powell, Chairman of the Federal Reserve, mentioned that even with inflation slowing, it was still in the “early stage” so they would continue to raise rates as inflation moderates. He also added that he believes the Fed can get inflation back to 2% without losing as many jobs.

He concluded with stern words for lawmakers, saying there is a way forward by which the debt ceiling must be raised. He added that no one should make assumptions about the Federal Reserve’s protection of the economy, as it can’t avoid big problems if it doesn’t increase.

This article was written with additional reporting by Adam Robertson.

NEWSLETTER

NEWSLETTER