The price of Ether (eth) saw a 7% drop between October 6 and 12, hitting a seven-month low of $1,520. Although there was a slight rally to $1,550 on October 13, it appears that investor confidence and interest in ethereum is declining, as indicated by multiple metrics.

Some may argue that this move reflects a broader disinterest in cryptocurrencies, evident in the fact that Google searches for “ethereum” have hit their lowest point in 3 years. However, ethereum has underperformed the overall altcoin market capitalization by 15% since July.

Interestingly, this price movement coincided with ethereum‘s 7-day average transaction fees falling to $1.80, the lowest level in the last 12 months. To put this in perspective, just two months ago, these fees were more than $4.70, a cost considered high even to initiate and close batch Layer 2 transactions.

Regulatory Uncertainty, Lower Staking Yields Support eth Price Drop

A significant event that affected the price of Ether was the comments made by Cardano founder Charles Hoskinson regarding the classification of Ether by the head of the US Securities and Exchange Commission, William Hinman, as a non-security-related asset in 2018. Hoskinson, who is also a co-founder of ethereum, alleged on October 8 that some form of “favoritism” influenced the regulator’s decision.

Betting on ethereum has also garnered less interest from investors involved in the network’s validation process, as performance dropped from 4.3% to 3.6% in just two months. This change came alongside an increase in eth supply due to reduced activity in the burning mechanism, reversing the prevailing scarcity trend.

On October 12, regulatory concerns increased after the Autorité de Contrôle Prudentiel et de Résolution (ACPR), a division of the French Central Bank, highlighted the risk of “paradoxically high degree of concentration” in decentralized finance (DeFi). The ACPR report suggested the need for specific rules governing the certification and governance of smart contracts to protect users.

Derivatives data and falling TVL reflect bears’ control

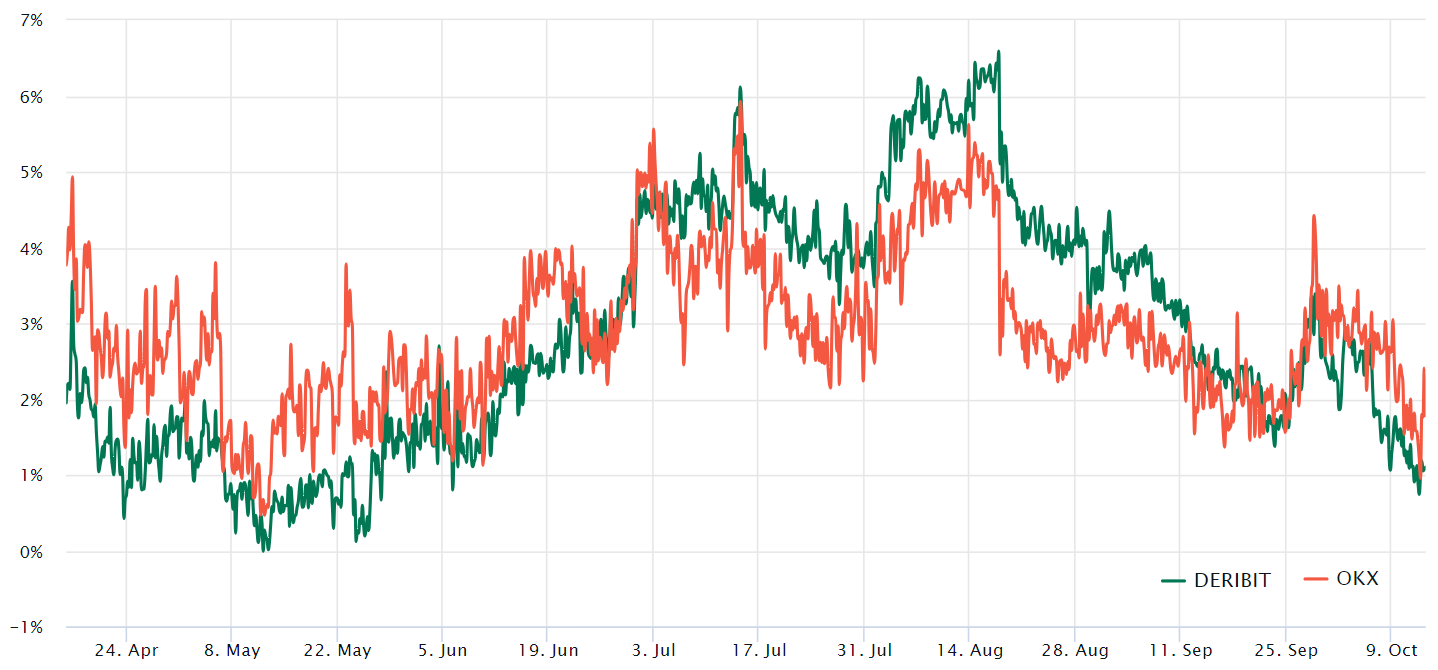

A closer look at derivatives metrics provides insight into how professional Ether traders are positioned following the price correction. Typically, monthly eth futures trade at a 5-10% annualized premium to compensate for delayed trade settlement, a practice that is not unique to crypto markets.

The Ether futures premium hit a five-month low on October 12, indicating a lack of demand for leveraged long positions. Interestingly, not even the 8.5% rally in Ether price between September 27 and October 1 could push eth futures above the neutral 5% threshold.

ethereum‘s total value locked (TVL) decreased from 13.3 million eth to 12.5 million eth in the last two months, indicating reduced demand. This trend reflects declining confidence in the DeFi industry and fewer advantages compared to the 5% yield offered by traditional US dollar finance.

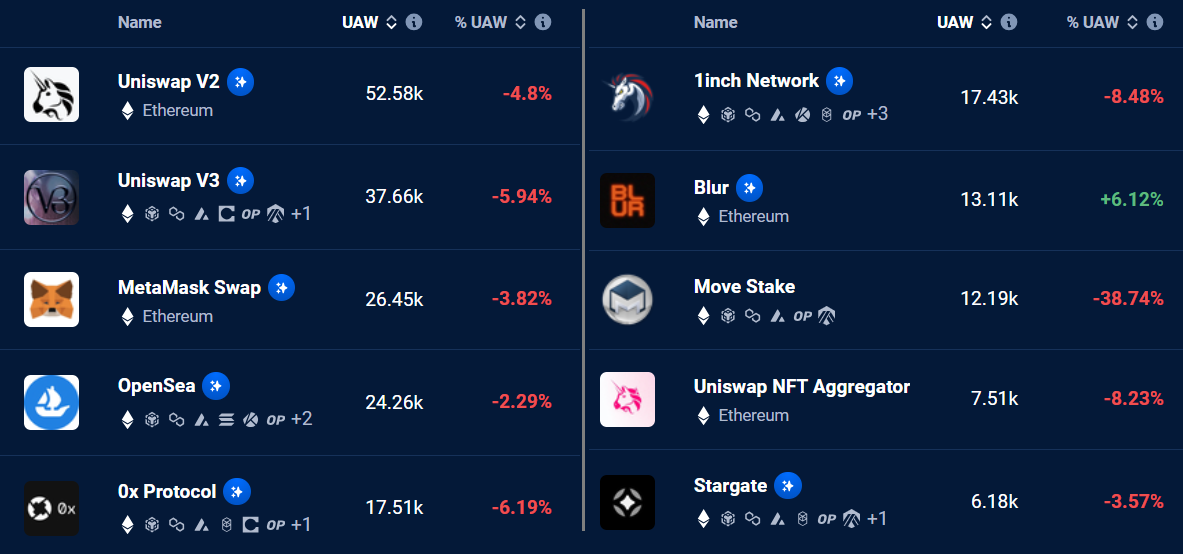

To evaluate the significance of this decrease in TVL, metrics related to the use of decentralized applications (DApps) must be analyzed. Some DApps, including DEX exchanges and nft marketplaces, are not financially intensive, making the value deposited irrelevant.

Unfortunately, for ethereum, the decline in TVL is accompanied by a decline in activity across most DApps in the ecosystem, including the leading DEX, Uniswap, and the largest nft marketplace, OpenSea. The reduction in demand is also evident in the gaming sector: Stargate shows only 6,180 active accounts on the network.

While regulatory concerns may not be directly related to Ether’s classification as a commodity, they could negatively impact the DApps industry. Additionally, there is no guarantee that key pillars of the ecosystem, such as Consensys and the ethereum Foundation, will not be affected by potential regulatory actions, particularly in the US.

Taking into account lower demand for leveraged long positions, declining staking returns, regulatory uncertainties, and a broader lack of interest as reflected in Google Trends, the likelihood of Ether falling below $1,500 remains relatively high.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER