Recent changes in the ethereum market have revealed an interesting disparity between price and network activity. Staking activity has continued to increase as eth retreated to $3,400, a 16% drop from its December peak.

As investors staked record amounts of eth, the total assets staked exceeded expectations. Although short-term price fluctuations have led some to doubt ethereum's viability, this increase in betting is a sign of growing confidence in the cryptocurrency's long-term value.

Investor Confidence Indicated by ETF Inflows

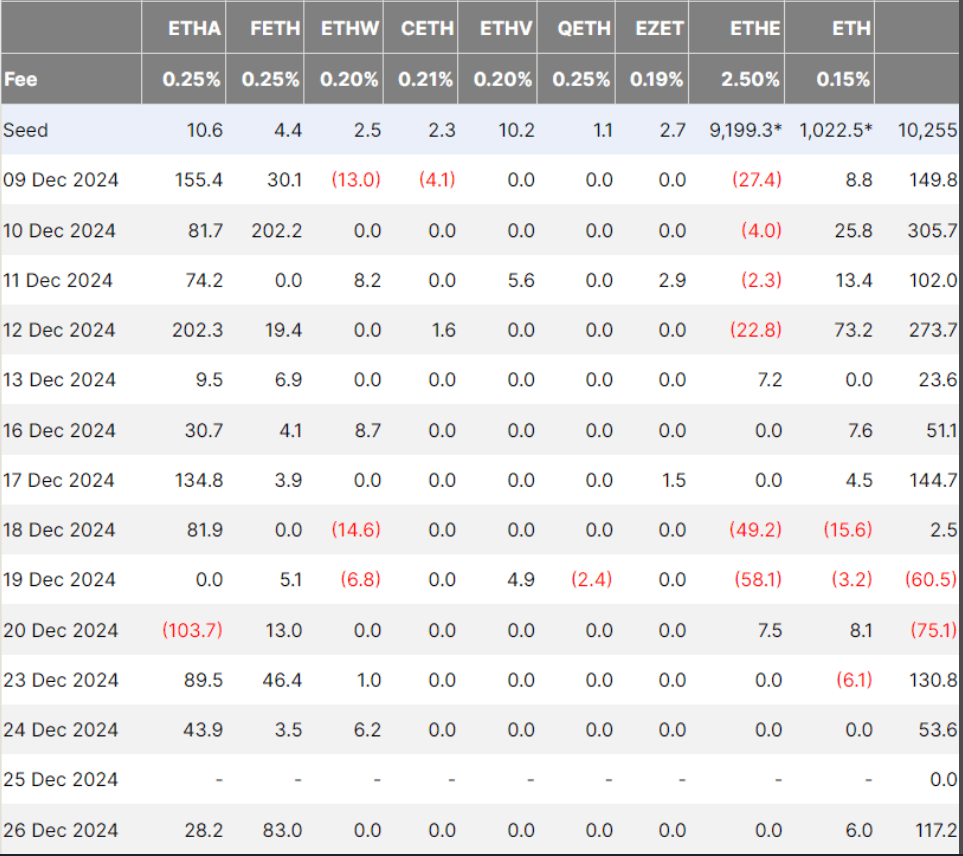

Another significant development is the rise of exchange-traded funds (ETFs) that focus on ethereum. A net total of $2.68 billion has been accumulated in the last 25 days, and ETF inflows were recorded in 23 days.

On December 27, total ETF net assets exceeded $12 billion as a result of the <a target="_blank" href="https://sosovalue.com/assets/etf/us-eth-spot” target=”_blank”>almost 48 million dollars in daily entriesSoSoValue data shows. The ethereum ETF offered by BlackRock has garnered the majority of these investments, underscoring institutional interest in eth despite the recent price drop.

the popularity of <a target="_blank" href="https://farside.co.uk/eth/”>ethereum Spot ETF reflects the broader crypto market, in which ETFs are starting to be the preferred choice for both institutional and ordinary investors.

On the other hand, significant bitcoin ETF inflows in recent months suggest that traditional financial markets are progressively welcoming digital assets.

Price action and broader market dynamics

ethereum <a target="_blank" href="https://www.coingecko.com/en/coins/ethereum” target=”_blank”>price dropOn the other hand, it illuminates an alternative narrative. The Ether price drop is likely due to profit-taking following its recent rally and broader macroeconomic uncertainties, as the cryptocurrency market remains volatile.

x/LybxjwJT/” />

Regulatory pressures and concerns about the likelihood of another interest rate hike have accentuated traders' cautious mindset.

Despite the decline, some analysts see this as a moment of consolidation rather than a cause for concern. They note that ethereum bets and ETF inflows are strong markers of long-term market sentiment.

Broader perspective

ethereum's most recent advances come amid an atmosphere of optimism regarding its ecosystem. Recent improvements continue to be focused on, such as the transition to proof-of-stake and ongoing scalability improvements. These developments allow ethereum to preserve its leadership in non-fungible tokens (nft) and decentralized finance (DeFi).

It is important for investors to maintain a long-term view while also being able to handle short-term fluctuations. The changing nature of cryptocurrency investing can be seen in the growing use of ETFs and staking. ethereum's price may go up and down, but its network and use cases remain strong.

Featured image from Infobae, TradingView chart