The decoupling of USD Coin (USDC) and Dai (DAI) from the US dollar sparked a loan repayment frenzy over the weekend, saving borrowers a total of more than $100 million on their loans.

Following the collapse of Silicon Valley Bank on March 10, the USDC price fell to a low of $0.87 on March 11 amid concerns about its reserves being locked up at SVB.

MakerDAO’s DAI stablecoin was also briefly unpegged, hitting $0.88 on March 11. according to CoinGecko.

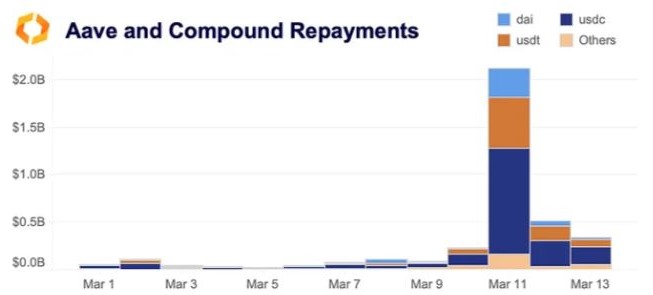

The decoupling, against the backdrop of broader crypto turmoil, led to more than $2 billion in loan repayments on March 11 in decentralized lending protocols Aave and Compound, with more than half in USDC, according to a report. report by digital asset data provider the pier.

Another $500 million in debt was paid in DAI the same day, he noted.

This subsided as both USDC and DAI began to return to their pegs. The days that followed did not see as many redemptions, with a total of only about $500 million in loan repayments in Tether (USDT), USDC, DAI, and other coins on March 12, and about half that on March 13.

Blockchain analytics firm Flipside Crypto Dear All that USDC borrowers saved $84 million as a result of loan repayments while the stablecoin was depegged, while those using DAI saved $20.8 million.

“Overall, the DeFi markets experienced two days of huge price dislocations that spawned myriad arbitrage opportunities across the ecosystem and highlighted the importance of USDC,” the Kaiko report said.

Related: USDC untied, but will not default

The decoupling of USDC also led MakerDAO to reconsider its exposure to USDC, as crypto projects that incorporated DAI into their tokenomics suffered losses due to a chain reaction.

Circle’s USDC began its climb back to $1 following confirmation from CEO Jeremy Allaire that its reserves were safe and the firm had new banking partners lined up, along with government assurances that SVB depositors would be repaid.

According to CoinGecko dataUSDC was sitting at $0.99 at the time of writing.