crypto analyst Michaël van de Poppe recently highlighted two altcoins that are poised to significantly impact the Web 3.0 ecosystem. in a detailed exposure Shared on X (formerly Twitter), Van de Poppe introduced “modular blockchains” and “DePin” as emerging concepts that will redefine the crypto landscape.

Emphasizing the need for tangible use cases, Van de Poppe stated: “I am advocating investing in projects that meet real use cases. That is why I do not focus so much on projects within the Gaming, Metaverse, nft or Meme space, (…) I prefer to focus on projects that have a real use case within the Web 3.0 financial ecosystem.”

crypto + Web 3.0: Modular Blockchains

According to Van de Poppe, the conversation around scalability and efficiency in blockchain has led to the emergence of modular blockchains. He described modular blockchains as “a previous cycle solution,” aiming to address the high transaction fees and scalability challenges that have hampered platforms like ethereum.

“Remember the high gas fees we paid during the ethereum bull run? Yes, from there modular and Layer 2 blockchains began to emerge as a potential solution to this problem,” Van de Poppe explained. By breaking down traditional processes handled by a single layer, modular blockchains promise a substantial improvement in transactions per second, addressing the core scalability trilemma of decentralization, scalability, and security without compromising any.

Focus on TIA and CQT

Among the projects leading the charge in this new era, Celestia (TIA) and Covalent (CQT) emerged as Van de Poppe's favorites.

TIA, according to Van de Poppe, stands out as a pioneer in the modular blockchain space. “One of my favorites is TIA, which enhances the potential of modular blockchains,” says Van de Poppe, underscoring the project's ambition to redefine the scalability and efficiency of blockchain technology.

Covalent, in particular, is praised for its comprehensive developer toolkits, including Block Explorer kits called GoldRush and analytics dashboards like Increment. “Covalent aims to leverage the DePIN ecosystem, which stands for decentralized physical infrastructure networks, essentially laying the foundational layer of the entire Web 3.0 financial ecosystem,” Van de Poppe commented.

Elaborating on Covalent's contributions, Van de Poppe highlighted the project's ambition to secure a structured data set of more than 215 blockchains and integrate ai through the analysis of 100 billion transactions. This integration aims to encourage the consumption, training and development of ai products.

“By promoting decentralized indexing, Covalent improves network resilience and reduces dependence on central entities,” he noted, underscoring the project's commitment to decentralization. Additionally, the activation of a revenue fee switch connected to the Premium API since February signifies the maturity of Covalent's economic model and its efforts to achieve complete recoverability of ethereum Virtual Machine (EVM) state data.

Price analysis

The CQT price rose above the 20-week and 100-week EMA in mid-February, generating bullish momentum. The price is now targeting the 0.236 Fibonacci retracement level at $0.53 on the 1-week chart. However, it is worth noting that the price is still 80% away from its all-time high despite the bullish sentiment in the cryptocurrency market.

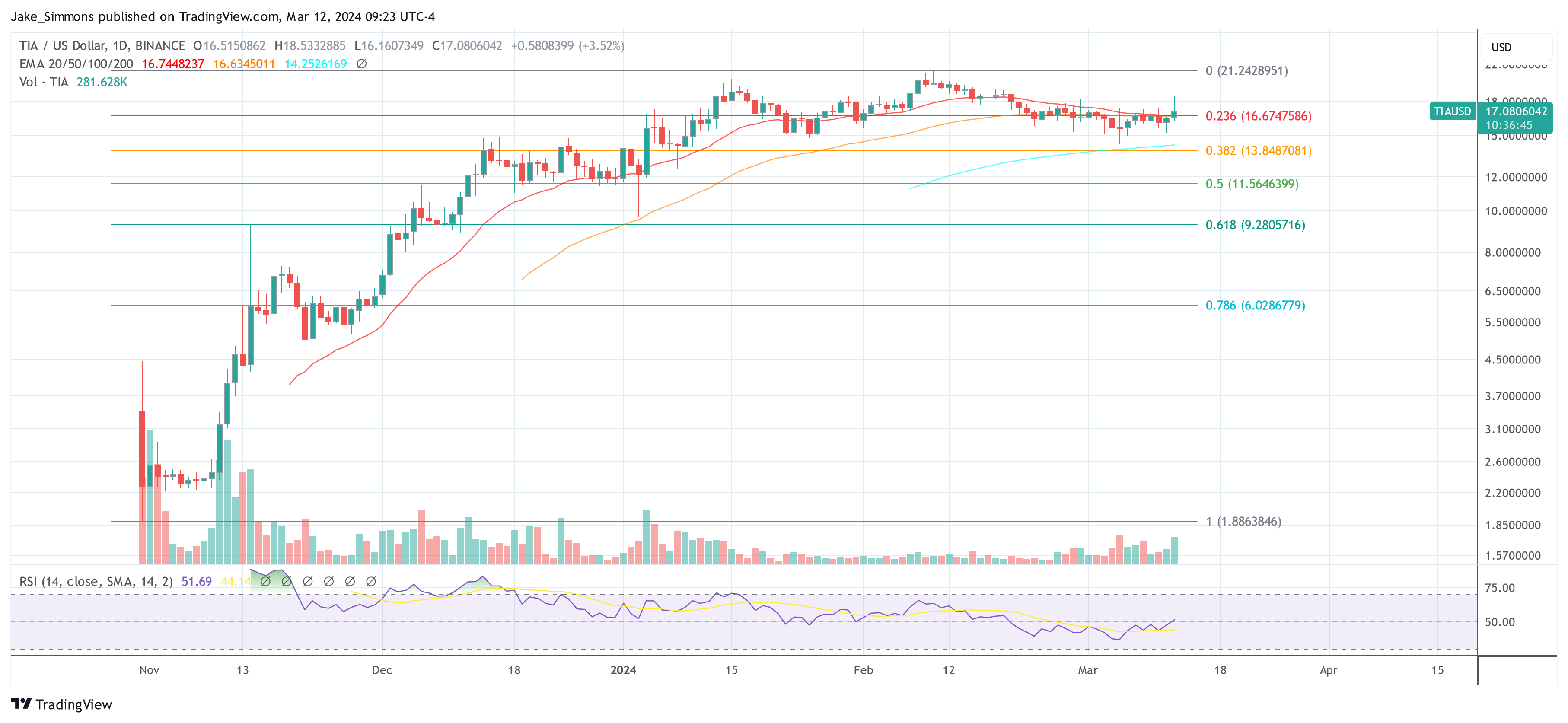

For Celestia (TIA), the situation is quite different. The price is only 20% below its all-time high and is trading above the 0.236 Fibonacci retracement level on the 1-day chart.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER