Bitcoin (BTC) starts the week off on a firm footing, as bulls send the BTC price to a new 10-month high weekly close.

After a relatively quiet week, breaking volatility is getting traders excited at the prospect of a repeat attack on the $30,000 resistance, but there are many things standing in the way.

In what will be a significant week of macroeconomic data releases, the March Consumer Price Index (CPI) release is due April 12, along with fresh outlooks on Federal Reserve policy.

Add to that the Ethereum Shanghai update and there is a recipe for volatility. How will Bitcoin react?

Volatility correlations between the largest cryptocurrency and traditional risk assets are reversing, data shows, while sentiment data also suggests there is little appetite for flash selling among the hodler base.

Cointelegraph takes a look at the status quo in the run up to what promises to be a week that will keep market participants on their toes.

CPI tops key macro data week

A family event tops the macro calendar for the week, with US Consumer Price Index (CPI) data for March.

The launch, this time on April 12, traditionally accompanies increased volatility in risk assets, making that date a key area to watch for “fakes” in the crypto markets.

The Federal Reserve will also produce the minutes of its last Federal Open Market Committee (FOMC) meeting, during which it opted to continue raising interest rates.

Key events this week:

1. CPI inflation data for March on Wednesday

2. Wednesday’s Fed minutes

3. March PPI inflation data on Thursday

4. Consumer confidence data on Friday

5. Retail sales data for Friday

6. 4 Fed speakers this week

This week determines what the Fed will do next.

— Kobeissi’s letter (@KobeissiLetter) April 9, 2023

So the environment is somewhat complicated when it comes to the impact of CPI on asset returns. While traders want to see inflation recede faster than expected, the Fed itself remains hawkish, confirming last month that further interest rate hikes may be appropriate.

However, the divergence between the Fed and the markets is equally evident: sentiment has started to show that the latter simply do not believe that rate hikes will continue for much longer.

According to CME Group FedWatch Tool, next month’s FOMC meeting will likely end with a repeat hike of 0.25%. Those quotas are very flexible and react immediately to any new macro data release, including the CPI.

For stock market and macroeconomic analyst James Choi, there is another side to the inflation story, one that involves a traditional hurdle for cryptocurrencies: the US dollar.

This week’s release will set the dollar’s strength in a three-month free fall, he warned on April 10, paving the way for possible further relief in risk assets.

“People seem to have no idea how $USD $DXY will fall in the next 3 months,” he said. commented on a US Dollar Index (DXY) chart originally shared in late 2022.

“And this massacre will begin with this week’s CPI report. Mark my words, mark them well…”

Others are looking at first-quarter bank earnings as a source of potential market knee-jerk reactions, including Jim Bianco, president of macro research firm Bianco Research.

In part of the Twitter comment, Bianco foretold that the gains would be “bigger than the CPI”.

Bitcoin price volatility on the rise

If volatility is what traders want, they arguably already have it in abundance, the data shows.

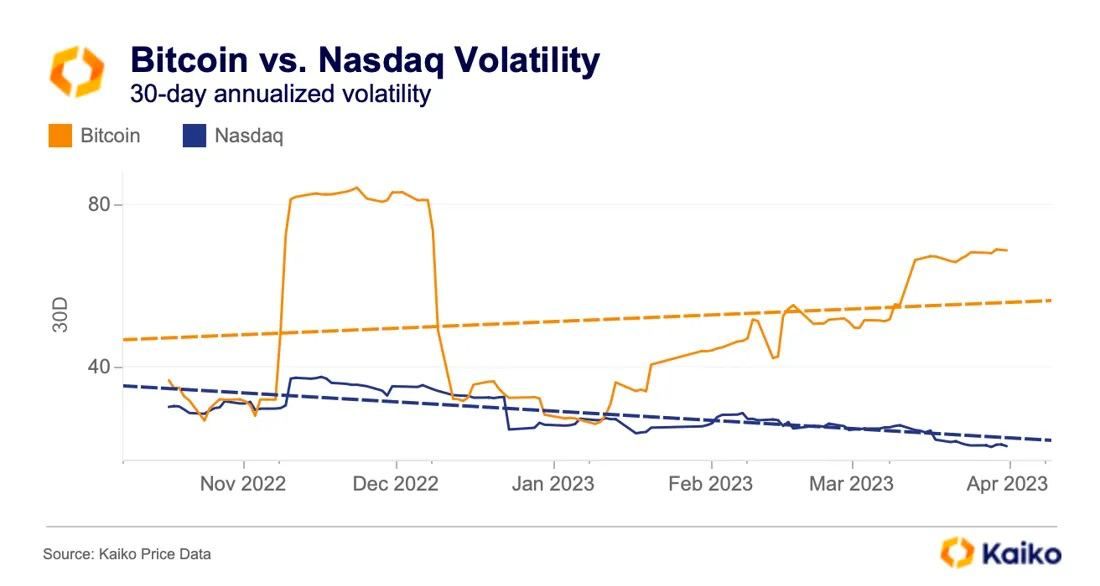

According to market data resource Kaiko, Bitcoin is on a divergent path from stocks when it comes to volatility, with stocks rising as the Nasdaq cools.

The events of the past month, centered on the unfolding of the US banking crisis, were enough to send the “gap” between Bitcoin and Nasdaq 30-day rolling volatility to its peak. higher levels in a year.

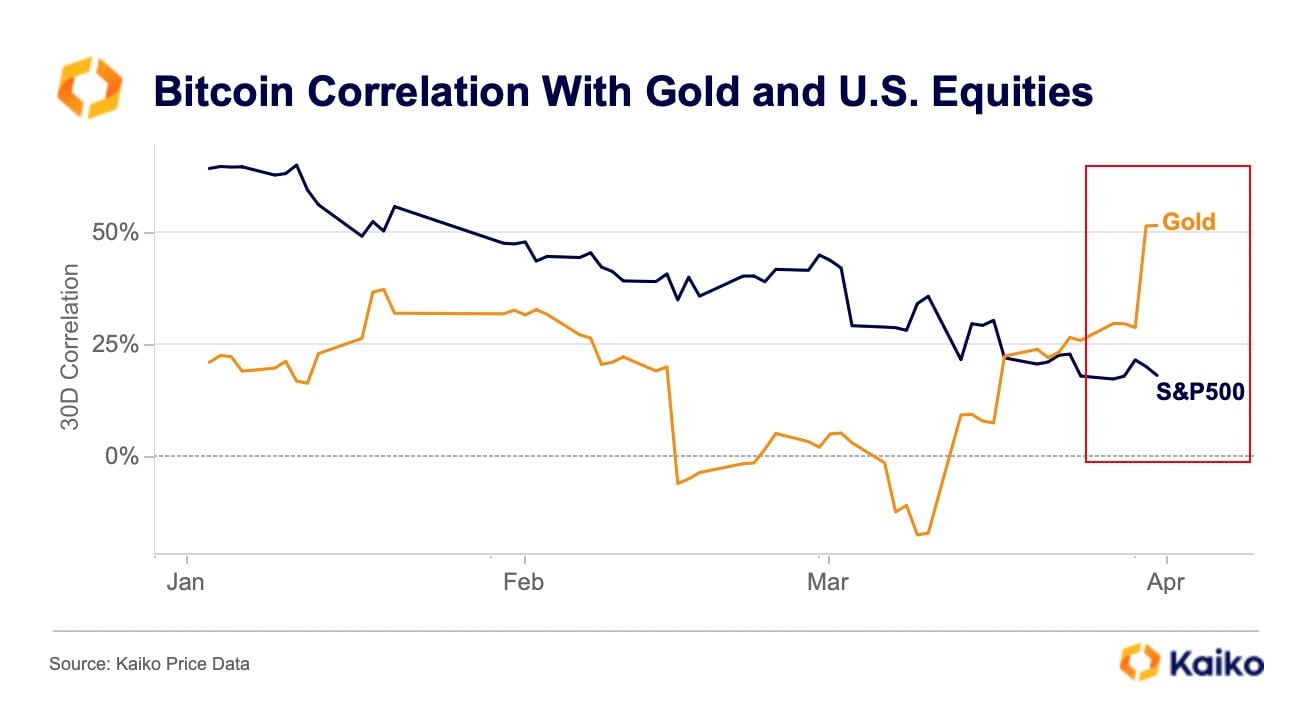

Bitcoin’s correlation with gold, Kaiko revealed last week, it is now higher than the S&P 500.

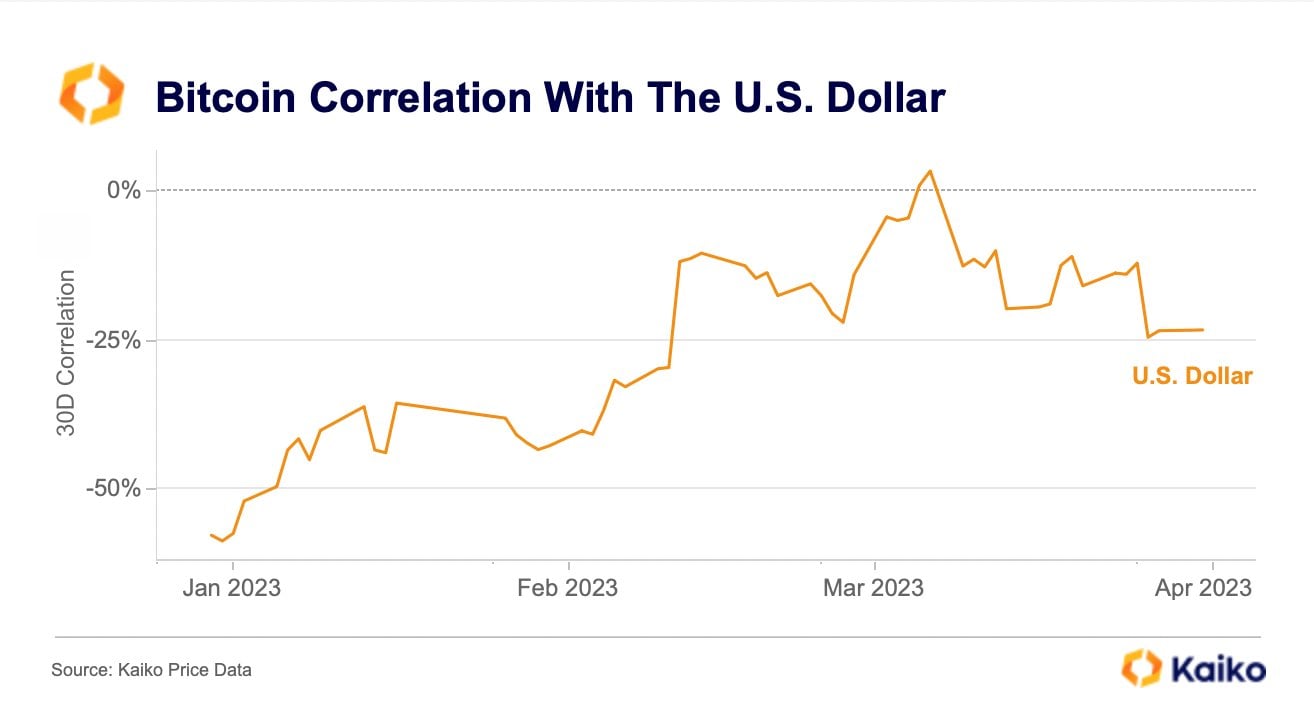

Continuing, Kaiko noted that Bitcoin’s inverse correlation to the US dollar is fading fast as well.

“Although BTC continues to have a negative correlation to the US dollar, the correlation is now almost negligible, falling from -60% to -23% YTD,” part of the Twitter comment read on the weekend.

BTC Price Sets New 10-Month Weekly High Close

Bitcoin offered a late surprise in the weekly close on April 9, with BTC/USD taking breaking gains to seal the candle at just over $28,300 on Bitstamp, data from Cointelegraph Markets Pro and TradingView shows

This is impressive in itself, marking new ten-month highs for weekly closes, as bears are continually denied a return to lower levels.

“Bitcoin still holds the lower support area and is on track,” Michaël van de Poppe, founder and CEO of trading company Eight, wrote as part of his latest analysis.

“Everybody wants to go long $25K, but I don’t think we’re going to make it. There are also no clear bearish divergences on higher time frames. Retest $28.6K and you’ll most likely be over $30K+.”

During the close, BTC/USD managed to hit local highs of $28,540 before reconsolidating below the closing level.

Van de Poppe remains optimistic about the near-term prospects.

“Bitcoin has consolidated at the support and stands at $28,500. Another test of $28,600-29,000 and we will most likely have a significant breakout,” he said. continued.

“More importantly, confidence returns to the markets then so you will see more Altcoins starting to break out.”

Related: Crypto winter may affect mental health of hodlers

In his own assessment of the market’s long-term strength, popular trader and analyst Rekt Capital described Bitcoin as “very well positioned” for further gains.

#BTC is very well positioned for growth in the medium and long term

It would be a shame to miss the exponential post. $BTC Halve profits#Crypto #Bitcoin pic.twitter.com/FE1j3nCTmN

— RektCapital (@rektcapital) April 9, 2023

However, as far as 2023 price action is concerned thus far, he remains conservative, noting the continued potential for BTC/USD to form a “double top” structure and return to its yearly open.

“It is not yet clear if BTC is forming a double top here,” he summarized along with an explanatory daily chart.

“Either side of the Double Top lineup is roughly the same, although this most recent part is getting a bit longer. If this second part gets even longer, it could distort the pattern entirely.”

Ethereum Shanghai upgrade coming up

As Bitcoin’s market dominance returns to shape, BTC may see an internal source of friction this week as Ethereum (ETH) prepares to go through its Shanghai hard fork.

Cointelegraph has reported widely on the event, which will unlock and put up for sale around $2 billion worth of ETH.

Analysts are classically divided on how intense the resulting selling pressure could be, with some more sober views arguing that there will be little incentive for holders to exit the market.

“For those looking to ‘sell the news’ after the Shanghai update, the ETH staked will take around 1 year or more to fully unlock, it will be on a first-come, first-served basis,” The Modern Investor analysis account summarized On twitter.

“Those who started in 2021 will be released first. Caution: You will only be selling your ETH to the whales.”

While ETH/USD recently reached its highest levels since August, attempting to snatch $2,000, ETH/BTC is struggling to get off the ground from ten-month lows.

“Rejected”, People’s Trader Cheds reacted to the latest events on the ETH/BTC daily chart.

Sustainable greed?

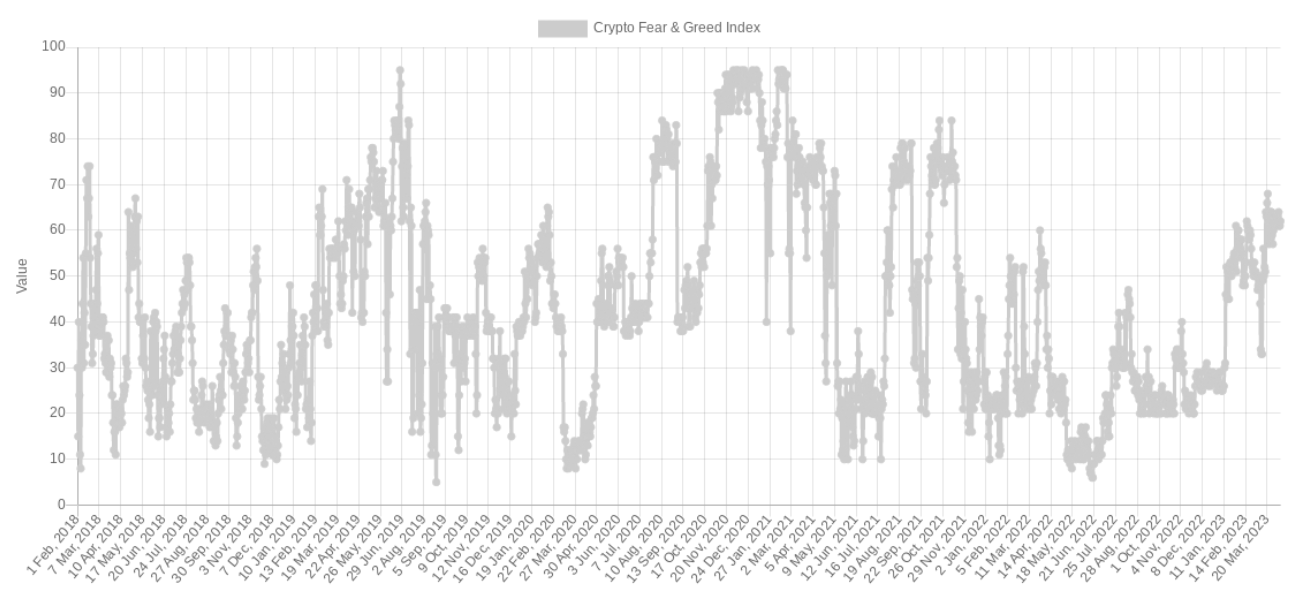

Despite crypto market sentiment being more “greedy” since BTC/USD’s November 2021 all-time highs, there are some encouraging signs from hodlers.

Related: Bitcoin Traders Expect ‘Big Move’ Next As BTC Price Holds Steady At $28K

These come courtesy of research firm Santiment, which noted an ongoing trend over the weekend, echoing Hodler’s action from earlier that year as Bitcoin headed into uncharted price territory.

“There is a growing rate of Bitcoin users, as merchants seem to have become more and more content to keep their bags immobile for the long term,” he said. fixed.

“We saw a similar trend from January 2021 to April 2021 when $BTC topped $64k for the first time.”

During the first quarter of 2021, the “greed” of the crypto market was much more intense, with the Crypto Fear and Greed Index spending much of the time near its maximum levels, traditionally a warning that a correction is due.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER