In Cointelegraph Markets Pro’s latest VORTECS™ Report, the institutional-grade crypto alert platform showed how its members could have captured a cumulative profit of 179% by following four trades based on four different Markets Pro indicators. The report shows trade alerts generated between February 26 and March 4, 2023.

The potential gains available to Cointelegraph Markets Pro subscribers significantly exceed a simple buy-and-hold strategy over the same period, which would have suffered a 5% loss on Bitcoin (BTC) and a 4% loss on Ether (ETH). .

Cointelegraph Markets Pro used a variety of advanced data, such as its proprietary VORTECS™ Score, NewsQuakes™, Tweet Volume, and new Most Active On-Chain indicator, to alert subscribers to potential price changes before they occur.

VORTECS™ Score

SingularityNET (AGIX): 41% gain

On Feb. 26, the asset was trading at $0.39 when Cointelegraph Markets Pro members received an alert of a high VORTECS™ score of 87. Five days later, the price hit its weekly high of $0.55, a jump! impressive 41%!

AGIX is the utility token of SingularityNET, a decentralized artificial intelligence (AI) network in which participants create, share, and monetize AI services at scale. AGIX is used to stake, transact, and govern the decentralized applications on the network.

NewsQuakes™

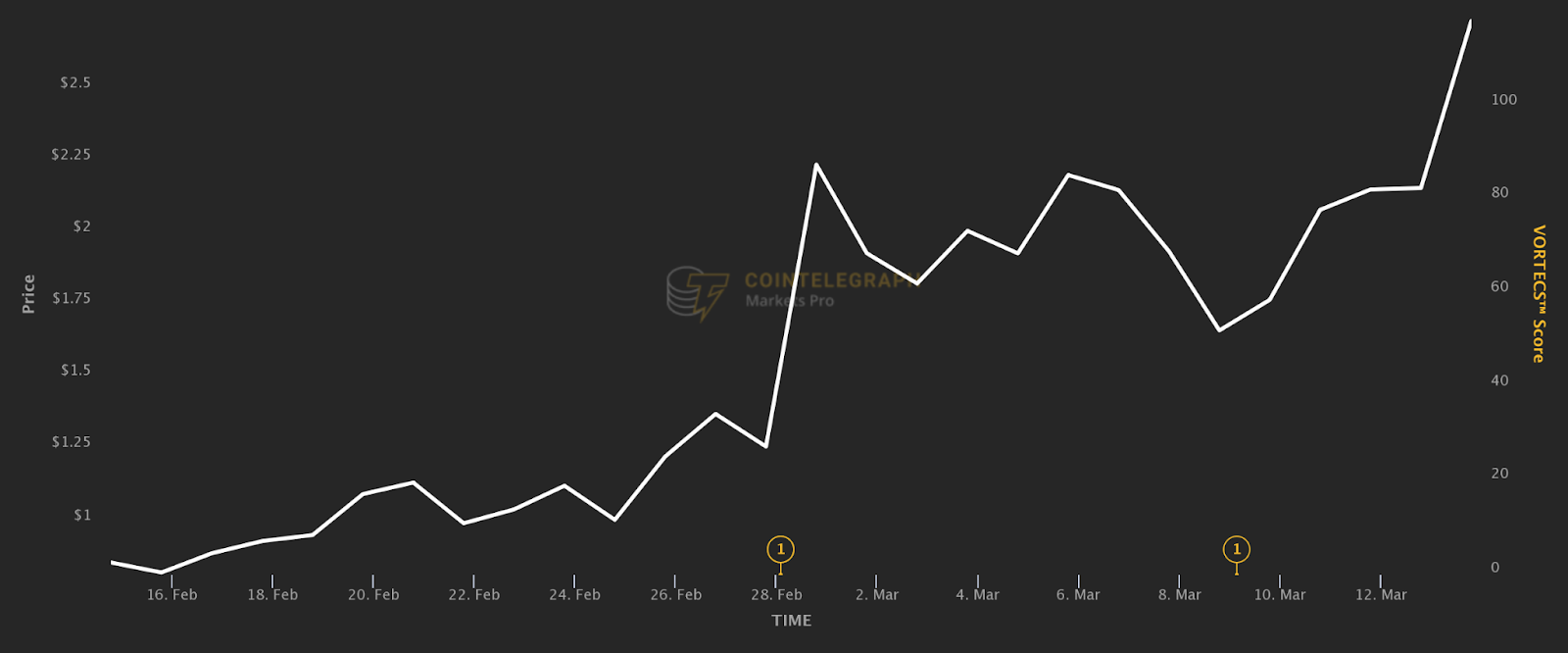

Liquidity (LQTY) — 82% profit

On Feb. 28, a NewsQuake™ alerted Cointelegraph Markets Pro members to an announcement by Binance that it would include LQTY in its Innovation Zone. Just five hours later, the price skyrocketed from $1.42 to $2.58, a remarkable 82% increase!

LQTY is the native token of the stablecoin lender Liquity. LQTY holders can stake their tokens to earn a share of the fees generated from opening and closing loans.

volume of the tweet

The Tweet Volume indicator measures mentions and activity of a project on the social media platform Twitter. The rationale behind the use of this data is that widespread community-driven discussions can sometimes push the price of an asset up or down.

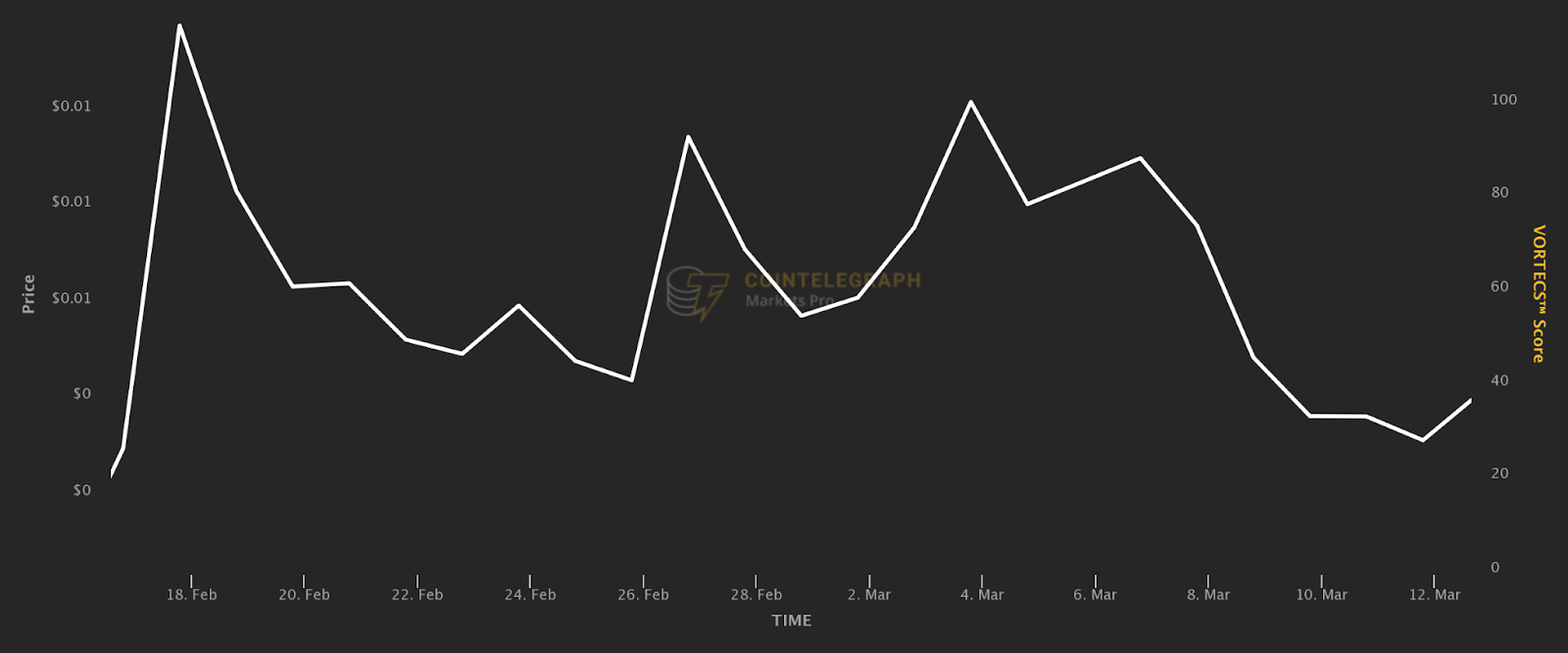

Akropolis (AKRO) — 40% profit

The Tweet Volume Gainers chart continues to help subscribers track increases in interest and discussion, typically a bullish indication, as price movement goes hand-in-hand with Twitter hype.

AKRO appeared on the Tweet Volume Gainers chart on February 27 when it was trading at $0.005. Just four days later, its price rose to $0.007, a 40% increase!

AKRO is the governance token of the Akropolis decentralized finance protocol, which aims to provide an independent financial ecosystem for saving and growing wealth.

Most Active Chain Activity

As mentioned in a recent article about the Cointelegraph Markets Pro 2.0 update, the new Most Active On-Chain data shows users the five tokens with the largest increases in the number of active addresses on-chain in the last 24 hours vs. to a moving average of the last 30 days.

Yearn.finance (YFI) — 16% gain

On Feb. 27, YFI topped the most active on-chain chart, showing Cointelegraph Markets Pro subscribers that it was the token that saw the largest increase in active addresses on Polygon. At the time it was trading at $9,448, but four days later the price rose more than 16% to $10,998.

How to Take Advantage of Cointelegraph Markets Pro

These gains, which cumulatively add up to 179%, occurred during the week of February 26 and March 4, 2023. It may be too idealistic to assume that subscribers captured all of this value, but even those who captured a fifth of it would. I got almost 35% return.

This is not the first time that Cointelegraph Markets Pro has produced weekly returns like these, in fact, it is a regular weekly occurrence. During the week of February 19-25, the institutional-grade platform used these same four indicators to alert subscribers to potential gains of more than 64%.

Another important note: the alerts for each of these movements were triggered before it actually occurred. It’s easy to spot ideal entry opportunities in hindsight, but Cointelegraph Markets Pro uses institutional-grade technology to help traders spot these opportunities in real time, often before they happen.

However, there is a catch; only Cointelegraph Markets Pro subscribers are aware of these alerts.

For those who are tired of being left on the sidelines while other cryptocurrency traders lock in profits, there is only one place to go.

See how Cointelegraph Markets Pro delivers market-moving data before this information is public knowledge.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk, including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and graphs are correct at the time of writing or as otherwise specified. Live tested strategies are not recommendations. Consult your financial adviser before making financial decisions.

All ROIs quoted are accurate as of March 16, 2023…

NEWSLETTER

NEWSLETTER