Changpeng Zhao, CEO of Binance, responded to a Twitter thread highlighting some 16 insider use cases on Binance.

Insider trading on Binance

Insider trading continues to plague the Binance cryptocurrency exchange. Zhao recently responded to insider trading claims at Binance.

On March 28, cryptocurrency analyst and enthusiast Fatman (@FatManTerra), posted a Twitter thread detailing various insider use cases affecting Binance. This thread highlights a pseudonymous individual who participated in cutting-edge bombs of multiple altcoins on Binance, making a seven-figure profit in the process.

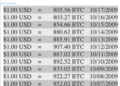

Wallet 0xd23 received $53,000 and bought FXS in Uniswap spaced trades in small lots. Three days later, the Binance exchange listed the FXS token, causing massive price increases.

Investors sent tokens to Binance and accumulated profits.

Another wallet owned by the same trader, 0x51, bought around 131 ETH from TVK. A few days later, Binance listed TVK, causing the prices to rise. The trader cashed around 277 ETH.

You May Also Like: Voyager Acquisition Put On Hold With Binance CFTC Lawsuit Underway

The thread only mentions two cases. However, it brought light to a article written in January that exposed around 16 cases of insider trading on Binance.

The total number of wins accumulated in the instances was reportedly nearly $1.4 million. The relationship between the inside trader and Binance is unknown, but he had inside information.

Responding to the tweet, Changpeng Zhao noted that they identified the address and around $2 million associated with it. The CEO noted that the account holder never filed a claim after the freeze.

Furthermore, Zhao mentioned that the exchange constantly fights against risks that could lead to insider trading. He invited others to help flag such cases in the future.

Insider trading causes some problems for retail investors, leading to lost profits. Furthermore, such unethical trades could make some potentially profitable markets unprofitable.

Insider trading claims arise when the exchange is facing a lawsuit from the CFTC.

Read More: XRP price surges to 11-month high despite Binance crash

NEWSLETTER

NEWSLETTER

Binance (@cz_binance)

Binance (@cz_binance)