This week’s featured stories

Caroline Ellison wanted to resign but feared a bank run on FTX

Caroline Ellison, former CEO of Alameda Research, testified for more than 10 hours this week at the Sam Bankman-Fried trial, offering deeper details about the events that foreshadowed the FTX debacle in November 2022. From testimony by Ellison, jurors learned she planned to leave Alameda. months before its collapse, but she feared a bank run on FTX amid the crypto market crash. The week also featured a recording submitted as evidence in the case showing the exact moment Ellison told employees about Alameda’s use of FTX customer deposits. Among the key moments of the Bankman-Fried trial were revelations of fabricated balance sheets to deceive cryptocurrency lenders, as well as testimony from BlockFi CEO Zac Prince. Check out this week’s highlights from the Cointelegraph team on the ground.

Months before the collapse of cryptocurrency exchange FTX, former CEO Sam Bankman-Fried was “freaking out” about buying shares in Snapchat, raising capital from Saudi royalty, and getting regulators to crack down on rival cryptocurrency exchange Binance, according to evidence presented in court this week as part of the ongoing criminal trial. Bankman-Fried believed that Binance leaked an Alameda balance sheet to the media in 2022. According to a document dated November 6, 2022, Bankman-Fried wrote that Binance had been “engaging in a public relations campaign against us.” He went on to say that Binance “leaked a balance sheet; he blogged about it; he fed it to Coindesk; “They then announced very publicly that they were selling $500 million of FTT in response, while telling customers to be careful with FTX.”

<h2 class="wp-block-heading" id="h-sec-reportedly-won-t-appeal-court-decision-on-grayscale-bitcoin-etf”>SEC Reportedly Won’t Appeal Court Decision on Grayscale bitcoin ETF

The U.S. Securities and Exchange Commission reportedly has no plans to appeal the recent court decision that favored Grayscale Investments. The ruling requires the SEC to review the company’s bitcoin spot exchange-traded fund (ETF) application. The SEC’s alleged decision not to appeal does not necessarily mean that Grayscale’s application will be approved. If the reports are true, the SEC will need to follow the August court order and review Grayscale’s request to convert its Grayscale bitcoin Trust into a bitcoin spot ETF.

Terraform Labs maintains that Citadel Securities had something to do with the collapse of its stablecoin

Terraform Labs has once again pointed the finger at market maker Citadel Securities for its role in an alleged “concerted and intentional effort” to cause the destabilization of its TerraUSD stablecoin in 2022. On October 10, Terraform Labs filed a motion in the United States to Compel Citadel Securities to file documents related to its business activity in May 2022, when TerraUSD Classic was disbanded. In its motion, Terraform argued that the documents are crucial to its defense in the lawsuit filed by the U.S. Securities and Exchange Commission in February, which alleged that Terraform Labs and its founder, Do Kwon, participated in “orchestrating a multimillion-dollar investment.” Cryptoasset Securities Fraud.” However, Citadel Securities previously denied trading the TerraUSD stablecoin in May 2022.

Mastercard announces successful results of completed CBDC trial

Mastercard has completed a test involving wrapping central bank digital currencies (CBDCs) on different blockchains, similar to wrapped bitcoin and wrapped Ether. The trial was carried out with the Reserve Bank of Australia and the country’s CBDC Digital Finance Cooperative Research Centre. Mastercard said the solution allowed a CBDC owner to purchase a non-fungible token (nft) listed on ethereum. “The process ‘locked’ the required amount of a pilot CBDC on the RBA’s pilot CBDC platform and minted an equivalent amount of pilot CBDC tokens wrapped on ethereum,” the payment processor wrote.

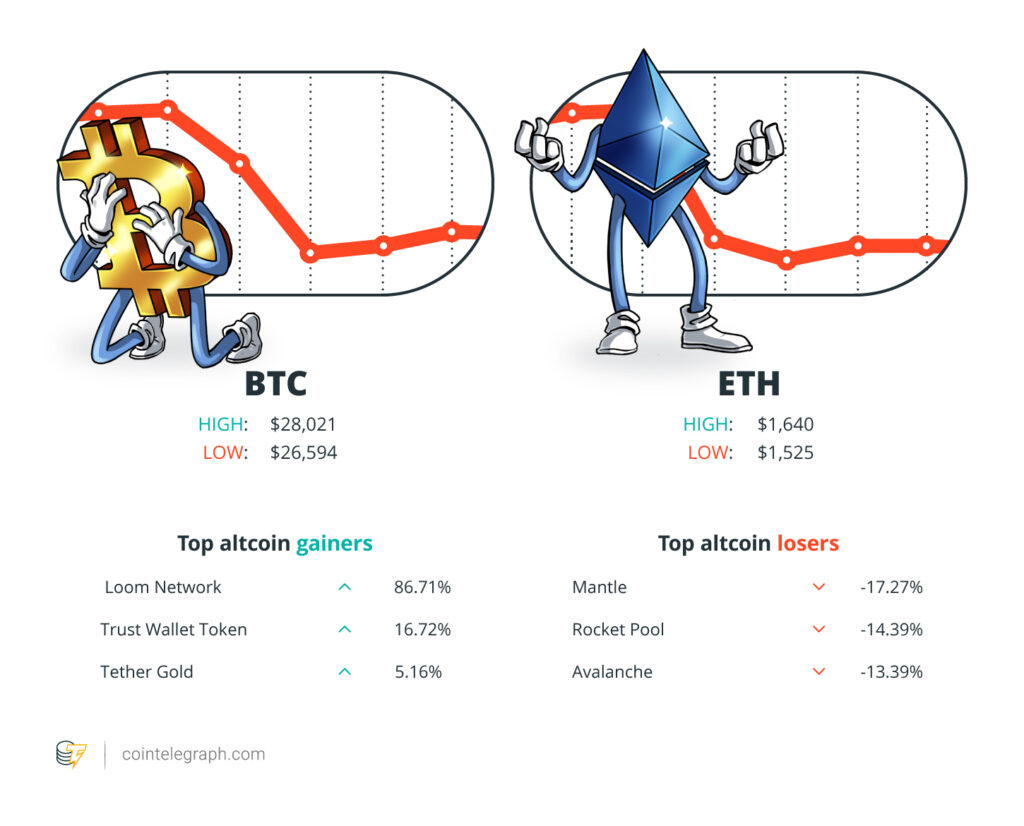

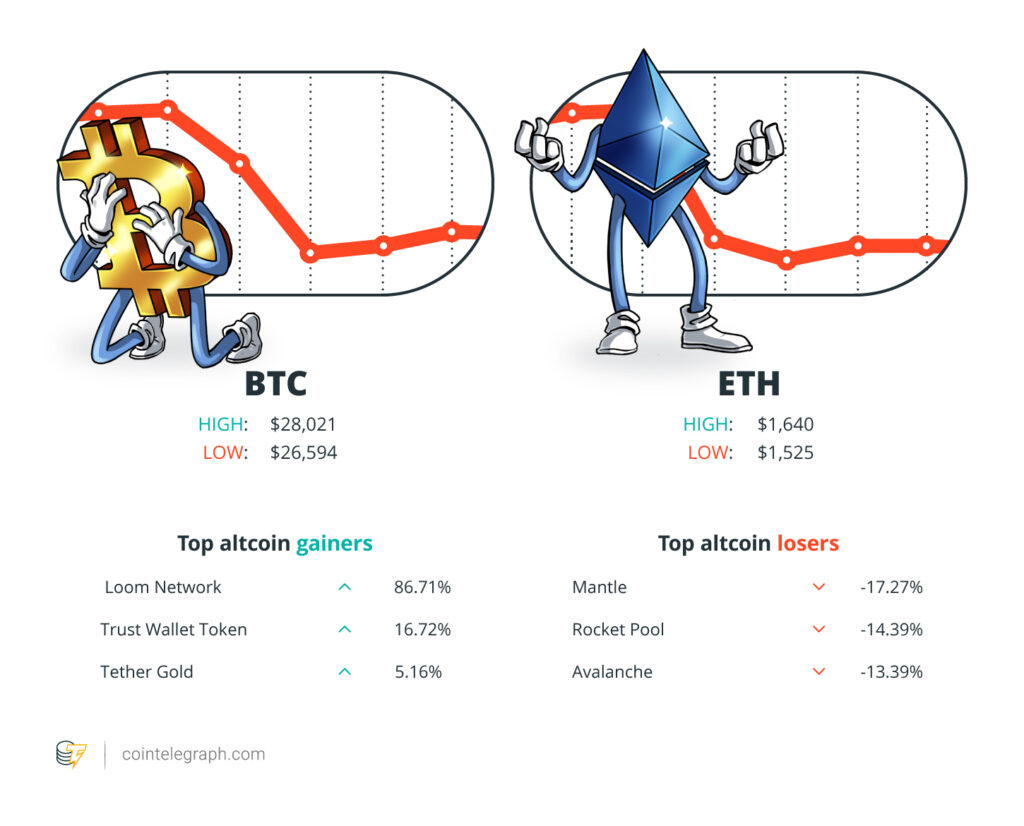

Winners and losers

At the end of the week, bitcoin (btc) I sat down $26,892Ether (eth) in $1,551 and XRP in $0.48. The total market capitalization is $1.05 billion, according to CoinMarketCap.

Among the 100 largest cryptocurrencies, the top three altcoins winners of the week are Loom Network (LOOM) at 86.71%, Trust Wallet token (Twitter) at 16.72% and Tether Gold (HAUT) at 5.16%.

Top three altcoin losers of the week are Mantle (TMN) at -17.27%, rocket group (RPL) at -14.39% and Avalanche (AVAX) at -13.39%.

For more information on cryptocurrency prices, be sure to read Cointelegraph’s market analysis.

Read also

Characteristics

Despite Bad Reputation, NFTs Can Be a Force for Good

Characteristics

You can now clone NFTs as ‘copycats’ – here’s what that means

Most memorable quotes

“That’s our task, really. “Really educate people about the benefits of using blockchain.”

Grace Sabandarco-founder of the Indonesian Blockchain and Metaverse Center

“Cryptoasset markets, including DeFi, do not pose significant risks to financial stability at this time.”

European Securities and Markets Authority

“I was worried about FTX customer withdrawals, that this would come to light, that people would be hurt. (…) I didn’t feel good. “If people found out (that Alameda uses FTX funds), everyone would try to withdraw from FTX.”

Carolina Ellisonformer CEO of Alameda Research

“It is alarming and should be a wake-up call to lawmakers and regulators that digital wallets connected to Hamas have received millions of dollars in cryptocurrency.”

Elizabeth WarrenUS Senator

“bitcoin and ethereum may seem opposite, but they can coexist and complement each other.”

Willem SchroeCEO of Botanix Labs

“People who believe SBFraud is a ‘good guy’ who made ‘mistakes’, and that FTX grew too fast and everything got away from him, should NEVER be in charge of other people’s money.”

John Deatoncryptocurrency lawyer and advocate

Prediction of the week

ethereum‘s losing streak against bitcoin reaches 15 months: can eth price reverse course?

The price of ethereum‘s native token, Ether, ethereum–bitcoin-15-months-eth-price-reverse” target=”_blank” rel=”nofollow”>trading around a 15-month low against bitcoin, and the lowest since ethereum switched to proof-of-stake. The eth/btc pair fell as low as 0.056 btc earlier this week. In doing so, the pair broke below its 200-week exponential moving average (200-week EMA; the blue wave) near 0.058 btc, increasing downside risks into 2023.

Historically, the 200-week EMA has served as a reliable support level for eth/btc bulls.

eth/btc faces similar liquidation risks in 2023 after losing its 200-week EMA as support. In this case, the next downside target appears to be around its 0.5 Fibonacci line near 0.051 btc in 2023, about 9.5% lower than current price levels.

Conversely, eth price may bounce towards its 50-week EMA (the red wave) near 0.065 btc if it reclaims the 200-week EMA as support.

FUD of the week

<h2 class="wp-block-heading" id="h-mistake-or-money-laundering-user-pays-1-6-million-for-cryptoadz-nft“>Error or money laundering? User pays $1.6 million for CrypToadz nft

One of the CrypToadz NFTs, whose average price does not exceed $1,000, nft-cryptoads-sold-1crypto-mistake-or-money-laundering-user-pays-1-6-million-cryp-toadz-nft” target=”_blank” rel=”nofollow”>was purchased for a staggering 1,055 wrapped Ether, the equivalent of $1.6 million. The CrypToadz collection launched during the nft boom of 2021 and surpassed a trading volume of $38 million in Ether during its first 10 days on the market. The price paid by the anonymous user for the nft raised doubts among the community. Two weeks ago, this item was purchased for 0.95 eth (around $1,600), only to be sold for a thousand times that price.

USDR stablecoin drops to $0.53, but team promises to provide solutions

The real estate-backed USDR stablecoin lost its peg to the US dollar after a flood of redemptions caused a drain of liquid assets like Dai from its treasury. USDR, backed by a combination of cryptocurrencies and real estate, is issued by the Tangible protocol, a decentralized finance project that seeks to tokenize homes and other real-world assets. During the crisis, a trader allegedly exchanged 131,350 USDR for 0 USD Coin, resulting in a complete loss of investment.

<h2 class="wp-block-heading" id="h-htx-claws-back-8m-in-stolen-funds-issues-250-eth-bounty-to-hacker”>HTX Recovers $8 Million in Stolen Funds and Provides 250 eth Reward to Hacker

Huobi Global’s HTX crypto exchange confirmed the return of funds stolen by a hacker in late September and issued a reward of 250 Ether after resolving the issue. One of HTX’s active wallets had 5,000 eth emptied on September 25, worth approximately $8 million at the time. Shortly after the attack occurred, the company contacted the hacker and claimed to know his identity. HTX eventually offered to pay a 5% reward worth around $400,000 and not take any legal action if they returned 95% of the funds by the October 2 deadline.

<h2 class="wp-block-heading" id="h-beyond-crypto-zero-knowledge-proofs-show-potential-from-voting-to-finance”>Beyond crypto: Zero-Knowledge Proofs Show Potential from Voting to Finance

crypto-zero-knowledge-voting-finance/” target=”_blank” rel=”nofollow”>An emerging cryptographic technology can help meet two great needs of the 21st century: privacy and truth.

<h2 class="wp-block-heading" id="h-eleanor-terrett-on-impersonators-and-a-better-crypto-industry”>Eleanor Terrett on Copycats and a Better crypto Industry

Fox Business producer Eleanor Terrett’s followers exploded after she began providing comments on the SEC v. Ripple.

Alleged Chinese bribery from SBF, Binance clarifies account freeze: Asia Express

Subscribe

The most interesting readings on blockchain. Delivered once a week.

NEWSLETTER

NEWSLETTER