This article is also available in Spanish.

The decentralized finance environment (Defi) of Cardano has increased significantly, with the total value blocked (TVL) expanding in 13%. The peak, although impressive, is the product of multiple variables at work on the scene expanding the blockchain.

Related reading

This increase is due to the main improvements in the protocol and a constant increase in the adoption of decentralized applications (DAPPS), indicating a brilliant future for the network.

Key updates and protocol improvements

Recent network updates have substantially facilitate Cardano's expansion. The Pear Ouroboros protocol is remarkable for its influence on the governance and scalability of Blockchain. These modifications improved the transaction speeds, facilitated the congestion of the network and a greater commitment of Defi.

The recent Chang Hard Fork has improved the functionality of the Cardano ecosystem, which makes it more attractive for the projects to start on the platform.

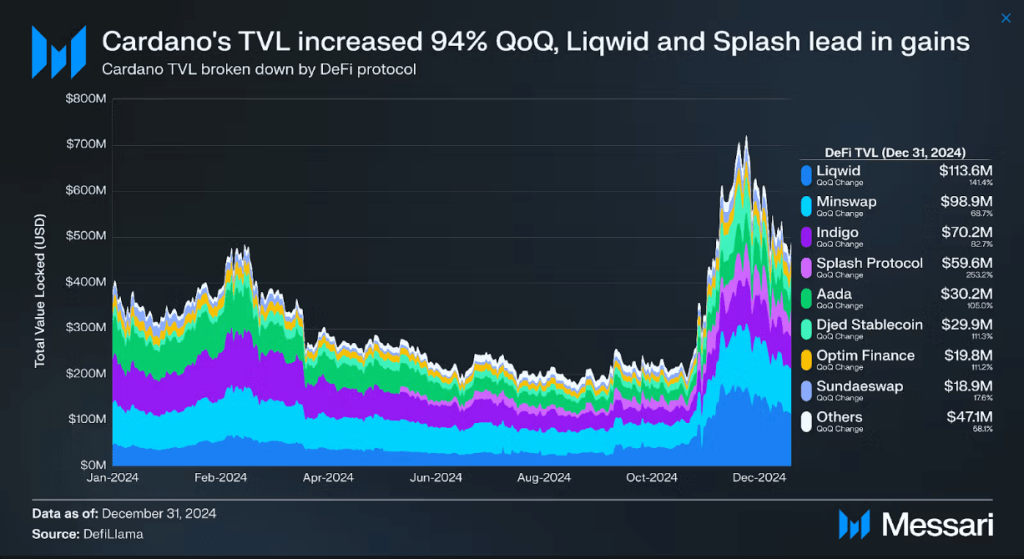

Cardano experienced substantial growth in the fourth quarter of 2024, with the price of Ada increasing to $ 0.84. This rally led his Market capitalization 127% quarter to quarter (QOQ) at $ 30.3 billion, despite a 2.2% decrease in the circulating supply, according to Messari data.

Ada's classification to circular the market limit improved from 11 to 9, reflecting the growing confidence of investors and greater network activity. The increase in market capitalization highlights the greatest demand, greater liquidity and a stronger presence within the broader cryptography market, reinforcing the position of ADA as a leading blockchain asset.

LIQWID FINANCE: A key factor for growth

One of Cardano's best known protocols, Liqwid Finance, has shown remarkable growth in TVL and user participation. With a decentralized approach, this protocol offers reasonable rates for loans and loans. Together with the growing Defi TVL of Cardano, Liqwid Finance has become a key force behind this growing trend, which shows the potential of decentralized finances on the platform.

Popularity of Stablecoins

Another important change in the Defi de Cardano area is the increase in Stablecoins. Cardano's Stablecoin market has grown thanks to the launch and use of more tokens in several Defi systems. People have long thought about the Cardano Network as a reliable alternative to other blockchain systems, and this change shows how stable and attractive it is becoming.

Mixed results in nft activity

Not all industries are seeing the same trend, even if Cardano is clearly growing in the <a target="_blank" href="https://www.coinbase.com/learn/crypto-basics/what-is-defi” target=”_blank” rel=”nofollow”>DEFI market. The results on the non -fungible token market (nft) of the network have been erratic. While the general volume of transactions has increased, several nft projects and collectors have found that it is difficult to maintain a constant increase.

Related reading

Meanwhile, Cardano Stablecoin's market capitalization grew 66% from one quarter to another. This shows that assets such as Iusd and Djed are becoming more popular. But there were mixed signs of nft activity. The nft average daily negotiation volume in USD increased 86% to $ 78,900 because the value of the ADA increased. However, the number of sales and transactions nft decreased slightly.

The 13% increase in Cardano in the TVL TVL and Soaring figures of the market layer illustrate the growing impact of the block chain in decentralized finances. As the new updates continue to spread and protocols such as Liqwid Finance gain popularity, the long -term perspectives of the network seem bright.

Outstanding image of Dall-E, TrainingView graphics

(Tagstotranslate) Ada

NEWSLETTER

NEWSLETTER