Bitcoin (BTC) is back below $28,000 as the countdown to the monthly close keeps everyone on their toes.

200-week trend line between popular BTC price targets

Data from Cointelegraph Markets Pro and TradingView shows that BTC/USD fell to a two-day low of $27,533 on March 31.

A modest bounce means the pair is trading around $27,800 at time of writing, as traders point to the most important support and resistance levels ahead.

For Crypto Tony, the current part of Bitcoin’s trading range is key, as $27,700 forms the EQ level and key support that bulls should preserve.

“$27,700 is the (EQ) level to watch this weekend if you are currently in a new long position. Those who have been with me for a while, we are not worried unless we lose that low range,” he said. wrote in part of his last Twitter analysis of the day.

An accompanying chart showed the top, bottom, and EQ for BTC/USDT on Binance.

Continuing a popular narrative, Filbfilb, co-founder of trading suite Decentrader, said he believed Bitcoin’s 200-week moving average (WMA) near $25,500 would be the next “first toss.”

This would translate to two-week lows, with bulls wanting to avoid a support/resistance flip at the 200WMA, something that happened in mid-2022 and preceded months of downside.

I think the 200-week ma will be ahead for the following reasons:

– I’ve already seen evidence of that.

– People don’t want to talk about currency risk

– People don’t want to talk about the risk of stablecoins

– The market is positioned short and desperate to get out-filbfilb (@filbfilb) March 30, 2023

Meanwhile, noting high time frame (HTF) resistance now directly above the spot price, trader Credible Crypto warned followers to remain bullish on the nine-month highs.

Related: US Enforcement Agencies Are Turning Up the Pressure on Crypto-Related Crimes

“You are not allowed to get bullish on the highs of the highest resistance HTF. Now that we are testing our first real support level on the downside, it is allowed to be a LITTLE bullish. If we are going to go for the highs again, we should hold here,” he said. began Twitter analysis saying.

Downside targets come in the form of $22,000-$23,000, with $25,000-$26,000 a less drastic target if market strength holds.

“The RED region above us is HTF resistance and weekly supply which, as of yet, remains untested. It would be logical to test this region before a major correction to 22-23k BTC occurs,” Credibile Crypto continued in an accompanying chart.

“This doesn’t mean it HAS to happen, but if we do rally from here to the highs again, don’t turn mega bull into resistance again.”

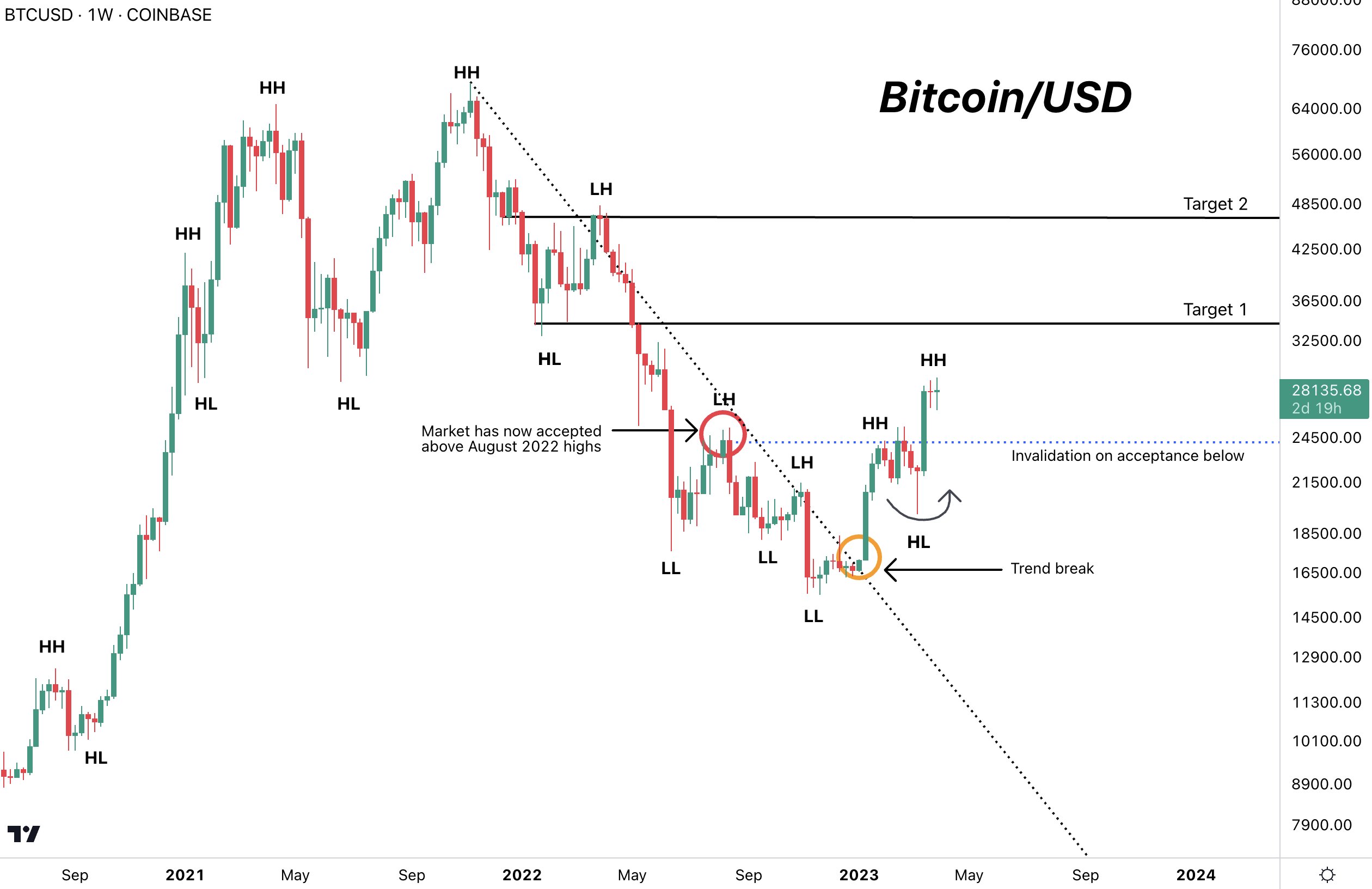

The structure of the Bitcoin market has “changed”

Focusing on the monthly close, the analysis account Tedtalksmacro offered a more bullish angle.

Related: Will BTC Leave the Bear Market? 5 things to know about Bitcoin this week

On longer time frames, he argued, Bitcoin has “truly changed” its structure to produce a clean bear market break from its last all-time highs in November 2021.

“Bitcoin is doing its best to advertise to those who want to enter + hold for the next higher cycle. On the weekly chart, it recorded its first highest highs (HH) since November 2021 and its first highest low (HL) since January 2022,” he said. summarized.

“Traders now have a clear invalidation and can cut longs on the accept back to the sub-24k range. The structure of the market has changed well and truly.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.