As the first blockchain and cryptocurrency, bitcoin (btc) paved the way for everything that has happened since: non-fungible tokens (NFTs), smart contracts, tokenization, layer 2 solutions, and everything in between. Due to bitcoin's value to the cryptosphere, which forms the foundation that underpins the rest of the market, its protocol is rarely modified. With hundreds of billions of dollars and global trust in the decentralized network at stake, there is no point in meddling.

While the ossification of bitcoin's codebase has brought stability and reliability, it has made bitcoin a bit… well, boring. While the bitcoin ecosystem once formed a hub of innovation and a hive of activity, that momentum has shifted to second- and third-generation chains whose architecture is better suited to supporting multiple use cases and applications. At least that was the case until the emergence of Ordinals, a technology that has sparked a new wave of innovation in bitcoin.

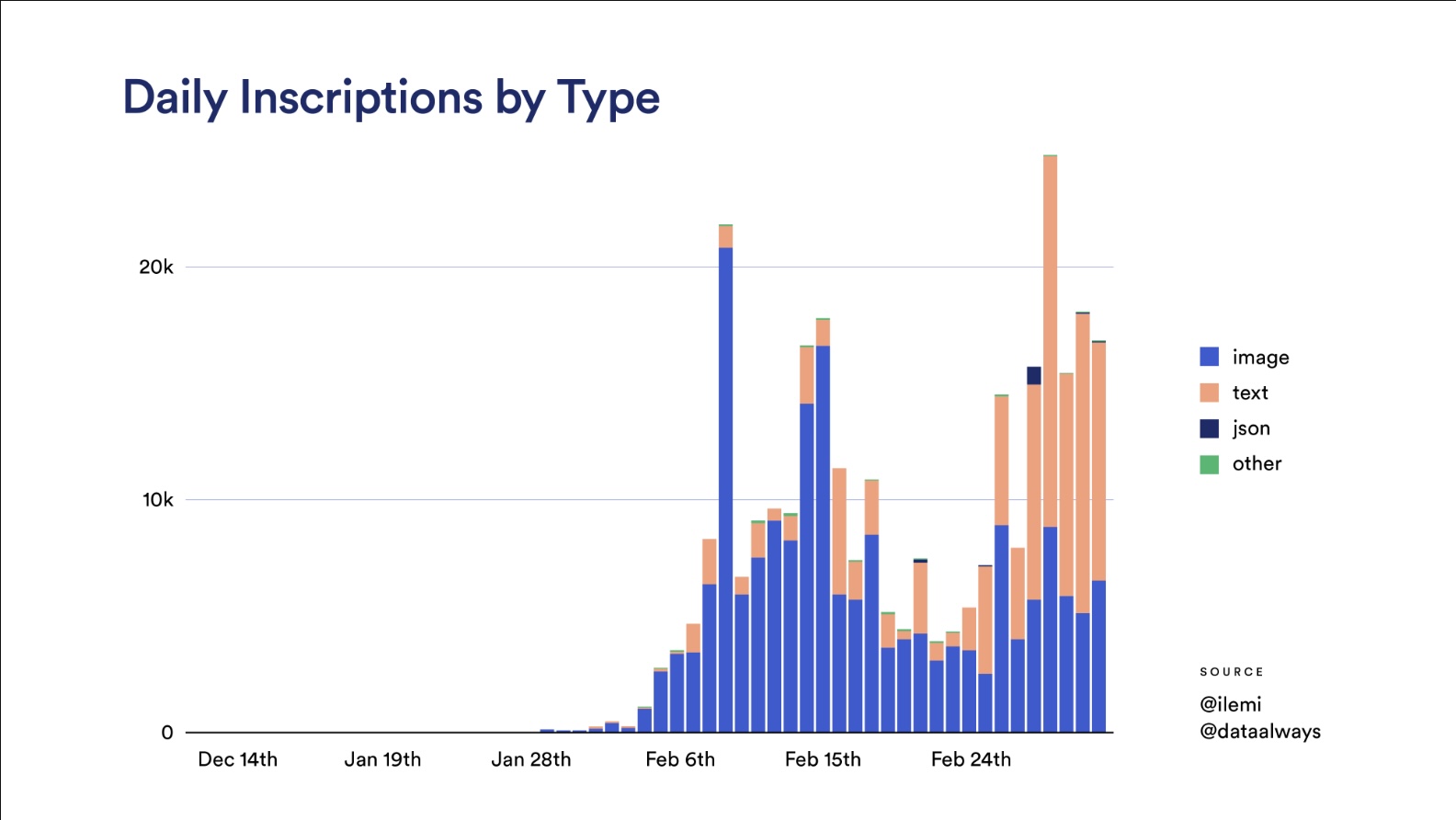

Throughout 2023, the bitcoin ecosystem developed rapidly. Emerging asset types, exemplified by nft Ordinals and BRC-20 tokens, have sparked widespread enthusiasm in the community, leading to a substantial increase in profits for btc miners.

Related: Expect some crypto companies to go bankrupt following bitcoin halving

Tokens can now be issued on the bitcoin network by projects whose security is anchored to the bitcoin blockchain. And the best part? Ordinals have not required changing a single line in the bitcoin code. Furthermore, the BRC-20 standards are evolving rapidly, positioning them to become a new indispensable element within the btc ecosystem in the future.

One coin generates many tokens

Ordinals is a protocol built on the bitcoin blockchain. Each bitcoin can be broken down into 100 million units, known as sats. Each of these sats can be assigned a unique identifier using Ordinals and transferred over the bitcoin network with this data attached. The Ordinals concept, developed by Casey Rodarmor, has proven to be extraordinarily successful. It has opened the floodgates to a wave of bitcoin-based NFTs. Thanks to this, a practically infinite number of tokens can now be traded in bitcoin.

At first, tech-minded Bitcoiners latched onto Ordinals and were able to meet the high standard for minting and trading them. After all, the process requires sending a sat to a Taproot-compatible wallet and registering metadata with the transaction. Initially, this required running a bitcoin node and being familiar with a command-line interface, but no-code solutions have since emerged that have been responsible for the integration of Ordinals, particularly to the benefit of the ethereum community.

NFTs were the first use case for the Ordinals protocol, but the same technology can be used to issue fungible tokens, similar to the ERC-20 tokens supported by ethereum. In fact, the token standard that emerged for these native bitcoin assets even has the same name structure: BRC-20.

BRC-20 projects with bitcoin-based tokens are already emerging, forming a nascent tokenized ecosystem that is coalescing around bitcoin and Ordinals. Several of these tokens have captured the market's imagination, hitting Tier 1 exchanges and spreading the word about the BRC-20 acquisition in the process.

From sats to sats

Many of the communities that have formed around Ordinals and bitcoin are focused, first and foremost, on fun. Play, collect, speculate, socialize and interact before serious things like business or institutional use. $SATS is the perfect example. SATS, bitcoin's own memecoin, is naturally a BRC-20 token, but it is also much more.

A total supply of 2,100,000,000,000,000 means that $SATS is literally the supply of bitcoin multiplied by 100 million. In other words, there is a SAT for every sat. Projects like this may not be changing the world, but they are making bitcoin fun again and, in the process, educating newcomers about the key features that are enshrined in the bitcoin architecture.

Other BRC-20 tokens have also gained market share while strengthening the case for Ordinals in bitcoin. Collectively, the market capitalization of all BRC-20 tokens is over $1 billion (as of December 7), most of which can be credited to ORDI, suggesting there is still plenty of room for growth. growth.

Taproot made tokens possible

The idea of issuing tokens on the bitcoin network cannot be found in the bitcoin white paper: that use case had not been foreseen in 2008. In fact, it was not even possible to do it back then. It wasn't until the Taproot update, which went live on the bitcoin network in November 2021, that this was possible. Ordinals emerged three months later, and the NFTs it generated were followed by a variety of BRC-20 token projects.

Taproot allows data to be added to the block space, providing a means to mint tokens in bitcoin. A single satoshi is minted and information about a complete set of fungible tokens is attached. This is done using JSON data where the token name, ticker, supply and similar qualities are added. Despite sharing the same naming structure as ERC-20, it is clear that BRC-20 tokens operate very differently. This is not surprising given that they are technically a workaround for a network that was not designed to support tokens.

Related: 3 theses that will boost ethereum and bitcoin in the next bull market

While the architecture may be unorthodox, the net result is the same. Just as communities formed around shared tokens and shared interests following the launch of ethereum's ERC-20 token standard, something similar is happening in bitcoin. It should be noted that BRC-20s are not loved by all Bitcoiners: some object to the block space the tokens occupy, which can cause fees to increase. Others are simply not interested in anything other than pure btc.

look to the future

When ethereum launched, it had the ability to support a rich and diverse ecosystem of token-based projects, and that's exactly what it eventually did. However, it took time to form the communities and develop the tools. bitcoin and the BRC-20 standard are currently where ethereum was in 2017: full of potential that has not yet been tapped.

Key infrastructure connecting bitcoin tokenization to EVM chains is being completed, with MultiBit being the latest project moving forward here, launching a bi-directional bridge for BRC-20 and ERC-20 transfers. In 12 months' time, what will the BRC-20 landscape look like and what opportunities will it have provided for those bold enough to have arrived early? The rise of ERC-20 tokens and ICOs in 2017 boosted Ether (ethereum/” target=”_blank” rel=”noopener nofollow”>eth) price thirty times in a year. While current market dynamics are different, the prospect of bitcoin replicating ethereum's success remains promising.

For a growing group of supporters who are tired of what they perceive as stagnation in ethereum and who don't quite fit in with bitcoin maximalists, Ordinals and BRC-20 tokens have made crypto fun again . For them, the move represents a return to bitcoin's creative and experimental roots. If there's a chance to make some money along the way, while advancing your understanding of bitcoin and spreading memes, all the better.

Graciela Chen She is the CEO of crypto derivatives exchange Bitget, where she oversees market expansion, trading strategy, and corporate development. Prior to joining Bitget, she held executive positions at Fortune 500 unicorn company Accumulus and venture-backed virtual reality startups XRSPACE and ReigVR. She was also an early investor in BitKeep, Asia's leading decentralized wallet. She was honored in 2015 as a Global Shaper by the World Economic Forum. She graduated from the National University of Singapore and is currently pursuing an MBA at the Massachusetts Institute of technology.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER