2022 was a roller coaster of ups and downs for the blockchain industry. While the first quarter of the year looked promising, the crypto industry has been on a downward trajectory ever since. While signs of a global macroeconomic slowdown are mounting, these headwinds are hampering the potential recovery of the blockchain industry.

There are some signs of stabilization in the cryptocurrency market and a possible upside at the start of the new year. For those who are serious about understanding the different sectors of the crypto space, including venture capital, derivatives, decentralized finance (DeFi), regulations, and much more, Cointelegraph Research publishes a monthly Investors Insights report. Compiled by leading experts on these various topics, the monthly reports are an invaluable tool for getting a quick idea of the current state of the blockchain industry.

Download and purchase this report at Cointelegraph Research Terminal.

Bitcoin weakness in 2023?

Following the positive Consumer Price Index news on Dec. 13, Bitcoin (BTC) experienced a temporary price bounce to $18,300. Still, despite the best efforts of bulls, BTC has been unable to post a daily close above $18,000 since Nov. 9, 2022. As a tumultuous year in crypto came to a close, the price of BTC rose. held within the $15,000 to $17,000 range, which handed a win to bears after options expiration on Dec. 30, when bulls needed to push the price above $18,000 to avoid a potential $340 million loss. towards 2023.

BTC had gained 1,650% after bottoming out in March 2020 below $4,000, driven by the United States Federal Reserve’s quantitative easing policy. Even as of December 31, 2022, investors who bought BTC in March 2020 make roughly 330% profit. Since the FTX crash, the BTC price has not recovered. The price drop to levels last seen two years ago is causing trouble for short- and long-term holders, with over 8 million BTC now at a loss and waning interest in whales showing weak price strength.

Bitcoin Derivatives Market Reversal?

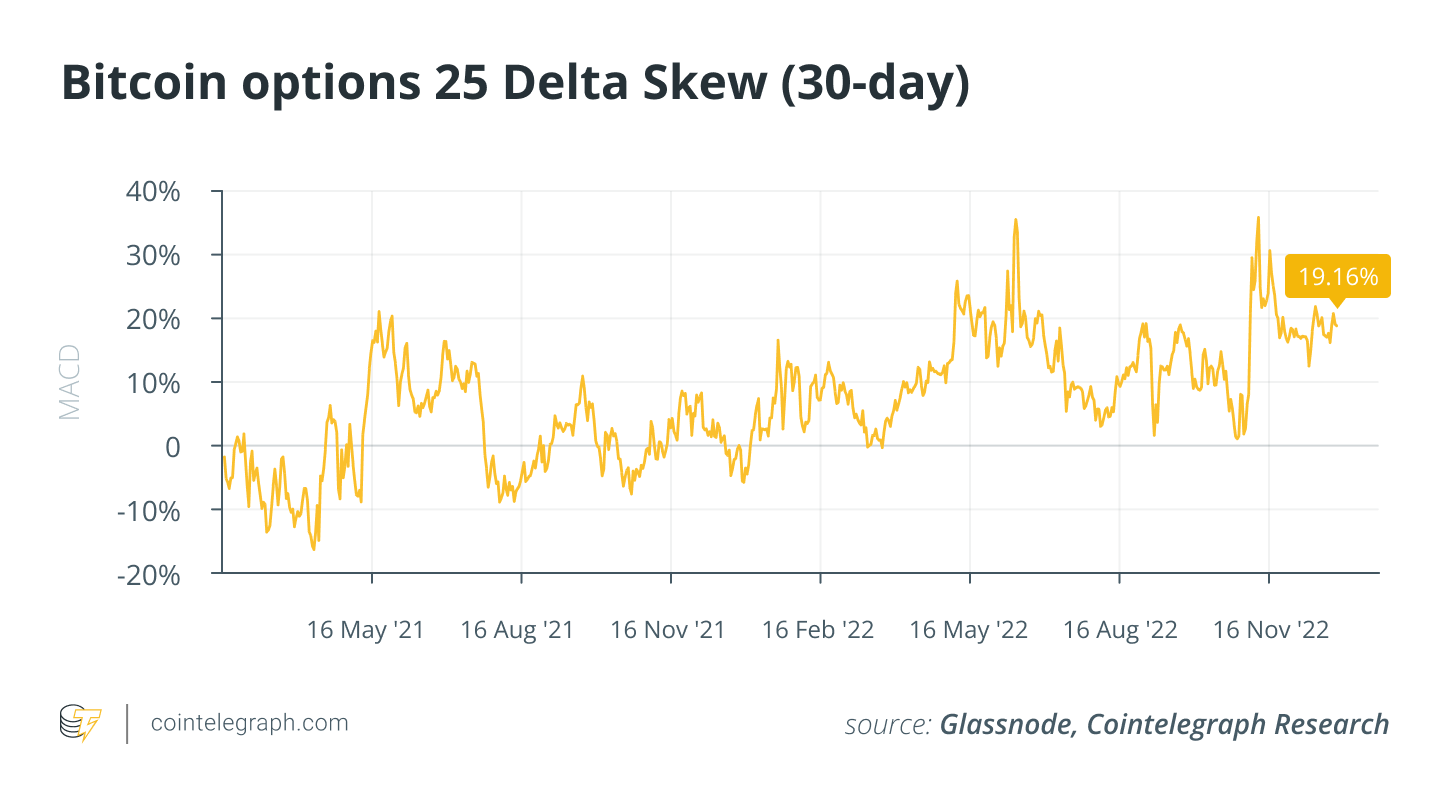

Bias is a key measure of market sentiment and capital flows because it summarizes what people are willing to pay to acquire an asymmetric payout in the up or down market direction. The most common measure of bias is the 25 delta (25D). It involves comparing the implied volatility of the 25% delta out-of-the-money (OTM) call against the 25% delta OTM put option.

Delta can be understood as the probability that the option will expire in the money. A $16,000 week-long call with a price of $16,500 would have a delta close to 100%, while a $36,000 week-long call would have a delta close to 0%. This is because the $16,000 call would almost certainly remain in the money, while the $36,000 call would remain OTM, given the usual volatility.

Below is a chart of 1 million 25D Bitcoin options skewed from February 2021. The Y-axis measures the difference in implied volatility between the 25D call and 25D put option of the same expiration. The negative bias means that the market wants to pay to hedge against further downside risk in the Bitcoin spot price. Over the past two years, the 25D average has been rising, indicating growing bearish sentiment. However, the 25D is 46% better since November, indicating that traders are becoming a bit more bullish.

The Cointelegraph Research Team

Cointelegraph’s Research department comprises some of the best talent in the blockchain industry. By bringing together academic rigor and filtering through hard-earned, practical experience, the team’s researchers are committed to delivering the most accurate and insightful content available on the market.

Demelza Hays, Ph.D., is the research director at Cointelegraph. Hays has assembled a team of subject matter experts in finance, economics and technology to bring to market the leading source of industry reports and insightful analysis. The team uses APIs from various sources to provide accurate and useful information and analysis.

With decades of combined experience in traditional finance, business, engineering, technology, and research, Cointelegraph’s research team is perfectly positioned to put their combined talents to good use with the latest Investor Insights Report.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific investment product or security.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER