This article is also available in Spanish.

Steno Research predicts a fantastic year for cryptocurrencies in 2025, with <a target="_blank" href="https://www.bitstamp.net/markets/btc/usd/” target=”_blank” rel=”nofollow”>bitcoin It is considered to reach $150,000 and ethereum could reach a value of $8,000.

Related reading

This projection is not just speculative; <a target="_blank" href="https://stenoresearch.com/crypto-moves/our-predictions-for-the-crypto-market-in-2025/” target=”_blank” rel=”nofollow”>Steno's analysis. cites a number of positive economic variables, growing institutional interest and the growing presence of cryptocurrency ETFs. However, the question remains: can these digital assets really achieve such amazing milestones?

The Rise of Cryptocurrency ETFs: A Game Changer?

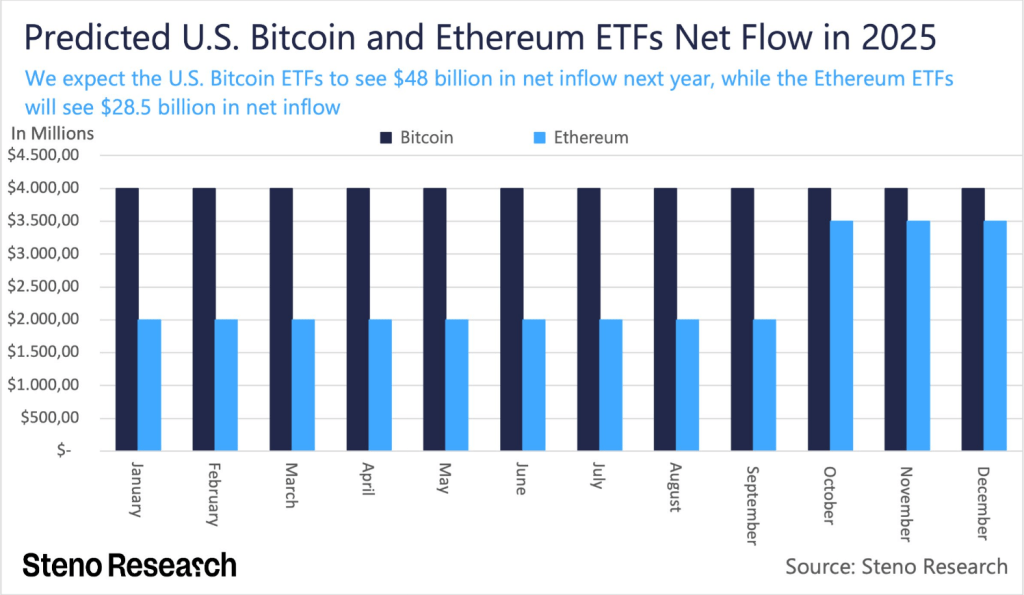

bitcoin and ethereum Exchange Traded Funds <a target="_blank" href="https://www.coinbase.com/learn/crypto-basics/what-is-an-etf” target=”_blank” rel=”nofollow”>(ETF)

<a target="_blank" href="https://www.coingecko.com/en/coins/ethereum” target=”_blank” rel=”nofollow”>ethereum remains a major player, but is expected to rake in $28 billion, thanks to similar trends in usage. These funds could bring a lot of cash to the cryptocurrency market, causing prices to rise even further.

<blockquote class="twitter-tweet”>

As in 2024, we expect US crypto ETFs to take center stage again in 2025, partly because of the direct buying pressure they generate and partly because they serve as a proxy for institutional and retail cryptocurrency interest. non-native in the asset class.

We project that… pic.twitter.com/T8cs5gEbJy

—Mads Eberhardt (@MadsEberhardt) <a target="_blank" href="https://twitter.com/MadsEberhardt/status/1873662797801783536?ref_src=twsrc%5Etfw” rel=”nofollow”>December 30, 2024

Regulations and macroeconomics: the perfect storm

Support rules are another important factor in Steno Research's hopeful forecast. As governments around the world change their views on digital assets, the outlook for cryptocurrencies improves.

bitcoin's strong price performance in particular appears to be related to the growing acceptance of the cryptocurrency as a viable asset class. This, coupled with good macroeconomic conditions, sets up bitcoin and ethereum for huge growth in the coming months.

bitcoin and long-term strategy

The research believes that macroeconomic conditions in 2025 will support the growth of cryptocurrencies. The popularity of cryptocurrencies as a hedge against inflation and a store of wealth is increasing investor confidence.

This implies that traditional investors are more likely to use bitcoin for long-term portfolio diversification, while ethereum's potential for decentralized finance and smart contracts makes it an attractive alternative.

Some analysts believe that the price of bitcoin will rise as institutional and consumer demand grows. The adoption of ethereum in DeFi and nft markets suggest a price increase.

Related reading

Is 2025 the year of cryptocurrencies?

Steno Research's forecasts for 2025 are optimistic, but they are not without risks. These projections could be affected by changes in regulations, market volatility and general economic conditions. However, there is no doubt that bitcoin and ethereum have a great chance of reaching new heights, especially if current trends continue.

According to market forecasts, cryptocurrency markets will soon move towards more widespread use, and new financial products and ETFs will make it easier for institutional investors to participate.

As we begin the new year, the question remains: are we really on the verge of the best year ever for cryptocurrencies, or is this just another speculative bubble ready to burst?

Featured image of Dall-E, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER