Bitcoin (BTC) price fell 3.6% to $26,900 after Binance and CEO Changpeng “CZ” Zhao were sued by the United States Commodity Futures Trading Commission (CFTC) on Aug. 27. March. To date, Binance has been investigated by the CFTC, the US Securities and Exchange Commission (SEC), the Internal Revenue Service, and federal prosecutors.

Bitcoin’s price correction may have been limited due to the successful sale of Silicon Valley bank assets to First Citizens BancShares at a discount of $16.5 billion, which received an extraordinary credit line from the Federal Deposit Insurance Corporation (FDIC). to offset possible future losses.

Oil prices also rose 5% on March 27 after Russian President Vladimir Putin escalated geopolitical tensions in Europe. According to Yahoo! Finance, Russia plans to station tactical nuclear weapons in neighboring Belarus, in a move designed to intimidate opposing countries for their support for Ukraine.

Further tension in the crypto industry arose after a US federal judge decided to temporarily halt the proposed sale of Voyager Digital to Binance.US. the 27th of March. Judge Jennifer Rearden of the US District Court in New York granted the request for an emergency stay.

Let’s examine Bitcoin derivatives metrics to determine the current market position of professional traders.

Bitcoin futures show no impact from CFTC-Binance case

Quarterly Bitcoin futures are popular with whales and arbitrage desks, typically trading at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement for a longer period.

As a result, futures contracts in healthy markets should trade at a 5-10% annualized premium, a situation known as contango, which is not unique to crypto markets.

The Binance news had no effect on the Bitcoin futures premium, despite the exchange holding 33% of the $11.2 billion open interest. The premium for the 2-month contract is 3.5%, which is below the neutral threshold of 5%. If there had been any panic selling using leveraged futures contracts, the indicator would have quickly moved to 0 or even negative.

The absence of demand for leveraged longs does not necessarily imply a fall in price. As a result, traders should research the Bitcoin options markets to learn how whales and market makers price the probability of future price movements.

Bitcoin Options Traders Remain Mildly Bullish

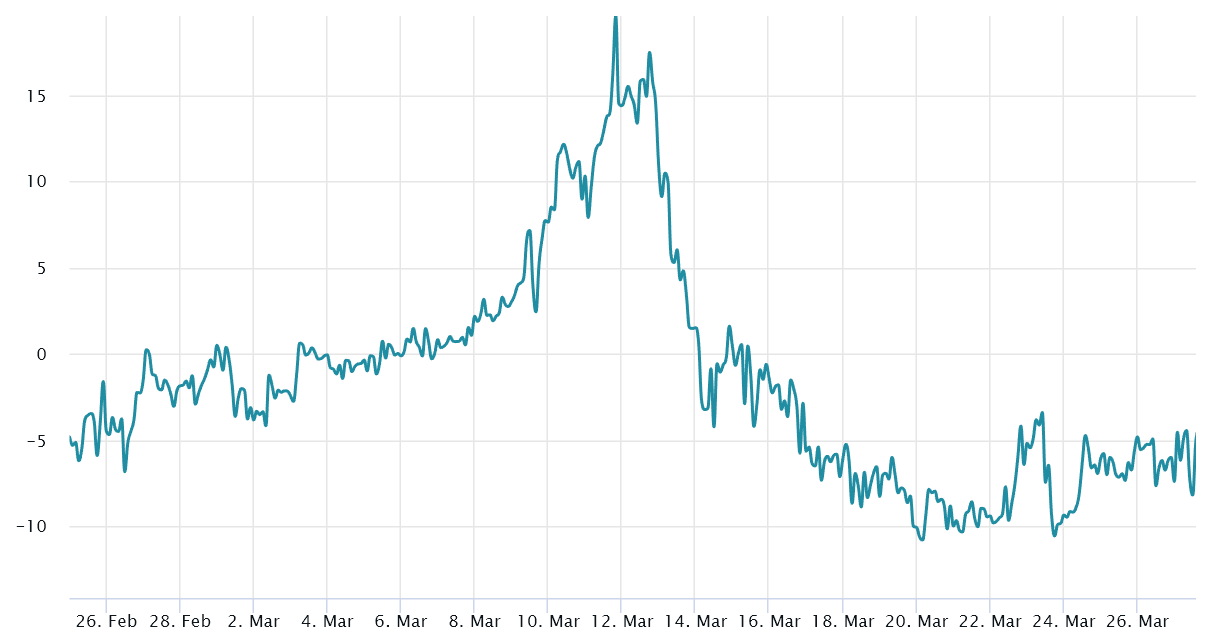

The 25% delta bias is a telltale sign that shows when market makers and arbitrage desks are overcharging for upside or downside protection. In bear markets, option investors give higher odds of a price dump, pushing the bias indicator above 8%. On the other hand, bull markets tend to drive the bias metric below -8%, meaning bear put options are less in demand.

The 25% bias ratio sits at -5, indicating that protective puts are trading at a slight discount, confirming the irrelevance of Binance news. More importantly, the CFTC action had no effect on the 25% bias, so the whales and markets are not pricing in any significant changes in market structure.

Related: Bitcoin Price Will Hit This Key Level Before $30,000, Survey Says

What does not kill you makes you stronger

The fact that the derivatives indicators were hardly affected could be the “remote errors” effect, as analytics and experts assess the odds of Binance and CZ getting more than a million dollar fine and some conduct adjustment.

This type of psychological distortion was first observed in London during World War II, when survivors who did not face imminent loss became even more secure and less likely to feel traumatized.

It seems unlikely that the market will price in further odds for extreme volatility until those whales and the arbitrage desks are faced with a price correction of more than 3.5%.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.