Bitcoin entered the beginning of a bull market last week. Still, as prices rose, some momentum indicators indicated that Bitcoin could be overvalued in the near term and a correction could be coming.

bitcoin is overvalued

cryptoquantification data The P&L Index gave a formal signal that the bitcoin bull market had started last week. That was identified through the index, which crossed its 365-day moving average higher. Also, the bull/bear market cycle indicator shows that you are now in the bullish stage.

The firm also built a single bitcoin valuation indicator using the MVRV ratio, LTH/STH SOPR, and NUPL. Above 1, the red line, the indicator shows that Bitcoin is overvalued. On the other hand, below -1.38, it is in the green, showing that the price is undervalued. Currently, it is below -1.38, which shows that it is undervalued.

However, there could be a pullback for bitcoin if it has become overvalued any time soon. It is usually the result of the price rising rapidly in a short time.

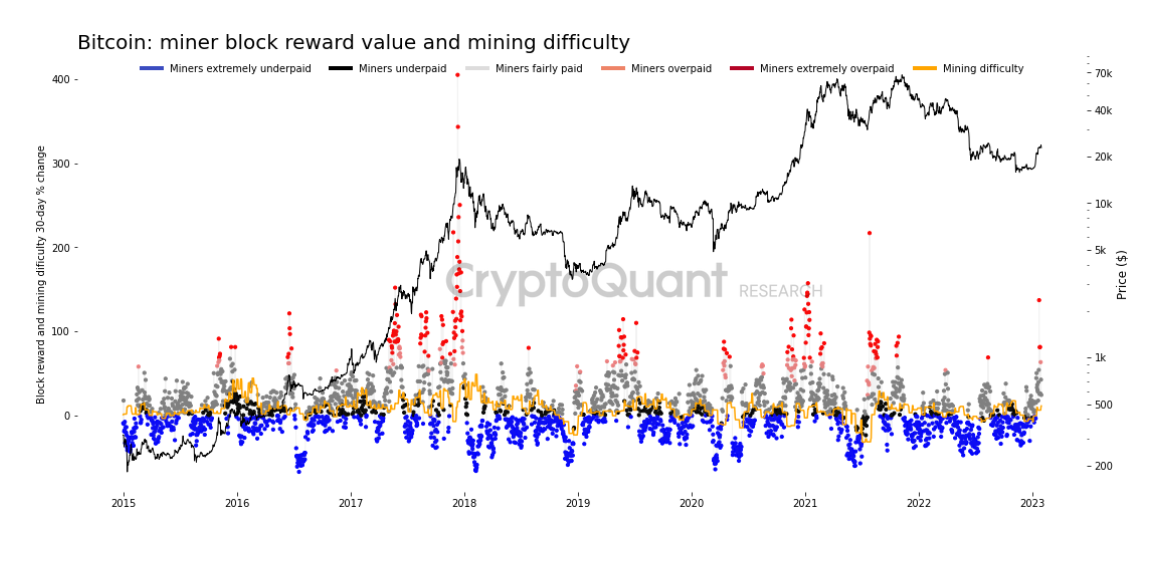

The miners are overpaid

The BTC price increase has led miners to overpay due to the increased difficulty. It is usually a sign of the possibility of a price correction, as mining revenue has grown at a faster rate than difficulty in a short time.

The short-term markup for holders of its coins has been the highest since November 2021, with a markup of 5%. Typically, this type of high-profit spending usually indicates an incoming price correction.

However, large bitcoin holders have kept their coins relatively on par with the recent price rally. Likewise, long-term holders have also not moved their currencies in the last six months or so.

Bitcoin is trading in the red in the last 24 hours

Bitcoin has lost value in the last 24 hours by 0.84% and is currently trading at $23,652. After a night of erasing the latest bullish progress, BTC has headed towards the $23,000 level. The BTC/USD pair reached lows of $23,329 today.

However, it broke above the $24,000 mark yesterday, which buyers were unable to hold amid macro market volatility.

NEWSLETTER

NEWSLETTER