Bitcoin (BTC) price topped $25,000 on Feb. 21, accumulating a 53% year-to-date gain at that time. It made sense to expect the rally to continue after the previous week’s US retail sales data far outperformed the market consensus. . This fueled investor hope for a soft landing and possible aversion to a recession in the US economy.

The pinnacle of success for the US Federal Reserve’s strategy would be to raise interest rates and reduce the drawdown on its $9 trillion balance sheet without significantly hurting the economy. If that miracle happens, the outcome would benefit risk assets including stocks, commodities and Bitcoin.

Unfortunately, the cryptocurrency markets took a hit after the $25,200 level was rejected and the Bitcoin price fell 10% between February 21-24. Regulatory pressure, mainly from the US, partly explains investors’ reason for worsening market conditions.

In a February 23 interview with New York Magazine, Securities and Exchange Commission (SEC) Chairman Gary Gensler stated that “everything other than Bitcoin” is potentially a security instrument and is under the agency jurisdiction. However, several lawyers and policy analysts commented that Gensler’s opinion “is not the law.” Therefore, the SEC had no authority to regulate cryptocurrencies unless it proved its case in court.

Also, at a G20 meeting, US Secretary Janet Yellen stressed the importance of putting in place a strong regulatory framework for cryptocurrencies. Yellen’s comments on February 25 followed International Monetary Fund (IMF) managing director Kristalina Georgieva, who noted that “if regulation fails,” then the outright ban “should not be ‘taken off the table’.”

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Demand for Asia-based stablecoins is stagnant

Traders should look at the USD Coin (USDC) premium to gauge demand for cryptocurrencies in Asia. The index measures the difference between China-based peer-to-peer stablecoin transactions and the US dollar.

Excessive buying demand for cryptocurrencies can push the indicator above fair value by 104%. On the other hand, the stablecoin market supply is flooded during bear markets, causing a discount of 4% or more.

After peaking at 4% in late January, the USDC premium indicator in Asian markets has declined to a neutral 2%. Since then, the metric has stabilized at a modest 2.5% premium, which should be read as positive given the recent regulatory FUD.

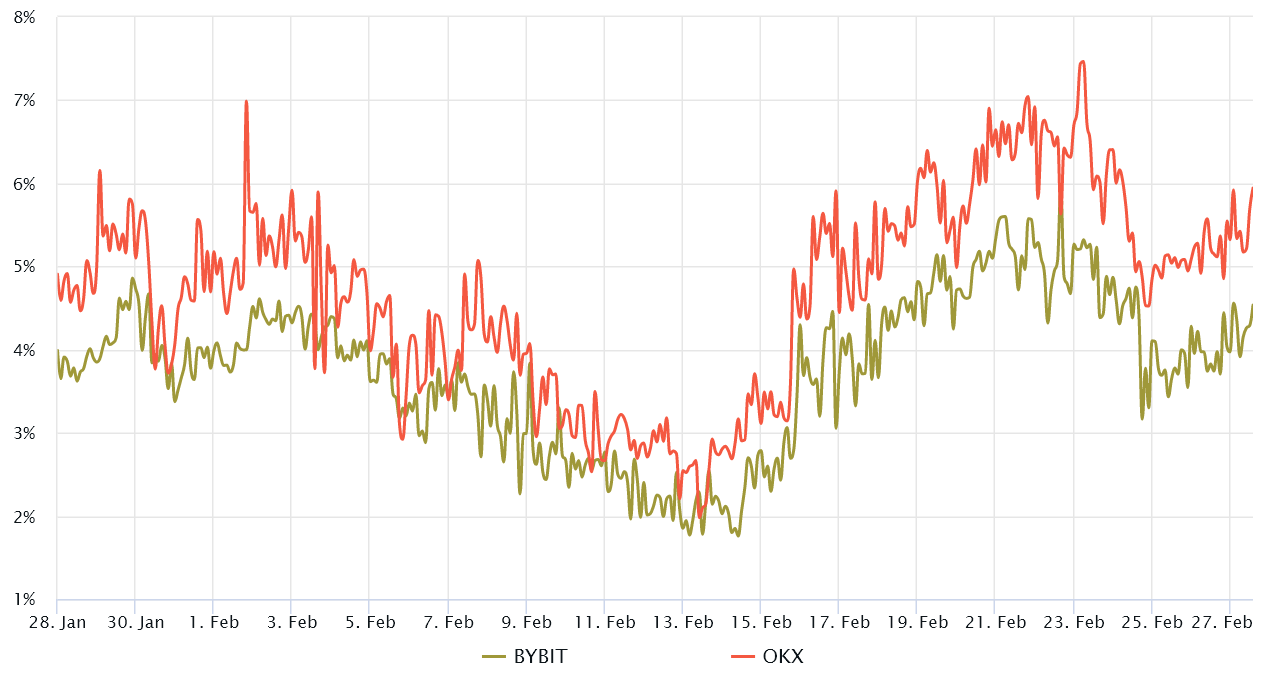

BTC futures premium stalled even after price rejected at $25,000

Quarterly Bitcoin futures are the instruments of choice for whales and arbitrage desks. Due to their settlement date and the difference in prices from the spot markets, they can seem complicated for retail traders. However, its most notable advantage is the lack of a fluctuating financing rate.

These fixed-month contracts are typically trading at a slight premium in the spot markets, indicating that sellers are asking for more money to retain liquidation longer. Consequently, futures markets should trade at a 5% to 10% annualized premium in healthy markets. This situation is known as contango and is not exclusive to crypto markets.

The chart shows traders flirting with neutral sentiment on Feb 19-24 as Bitcoin price held above $23,750. However, the indicator failed to enter the neutral to bearish area of the 0% to 5% due to adding additional regulatory uncertainty, especially after Gensler’s comments on February 23. As a result, it became clear that professional traders were not comfortable with Bitcoin. Price exceeding $25,000.

Related: Is the SEC action against BUSD more about Binance than stablecoins?

Weak economic data shifted control to the bulls

Since February 25, the Bitcoin price has risen 4.5%, indicating that the impact of regulatory news has been limited. More importantly, the global stock market reacted positively on February 27 after the US Department of Commerce reported that durable goods orders fell 4.5% in January compared to the previous month. These data added pressure for the US Fed to cut its interest rate hike program sooner than expected.

With Bitcoin’s 50-day correlation to S&P 500 futures currently at 83%, cryptocurrency traders are more inclined to support stronger risk asset prices on the week. A correlation indicator above 70% indicates that both assets are moving together, which means that the macroeconomic scenario is likely to play a key role in determining the overall trend.

Barring additional pressure from regulators or conflicting economic data, the odds favor Bitcoin bulls considering BTC futures and Asian stablecoin metrics.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER