Binance Smart Chain (BSC) has demonstrated notable growth in key metrics during the fourth quarter (Q4) of 2023, as highlighted in a comprehensive report from Messari.

As the third largest Layer 1 protocol By market capitalization, BSC saw positive progress across all of its financial indicators, indicating a productive quarter for the blockchain ecosystem.

Record Binance Smart Chain Transactions

He report reveals that BSC's market capitalization saw a quarter-on-quarter (QoQ) increase of 48%. This increase reflects renewed interest in BNB (Binance Coin), BSC's native asset, after two consecutive quarters of decline.

Additionally, BSC's revenue measured in USD saw significant quarter-on-quarter growth of 27%. This increase in revenue, which amounted to more than $39 million in the fourth quarter, indicates increased activity in the protocol and the implementation of various initiatives throughout the year.

Gas rates burned in BNB, a metric that reflects network activity, also saw a notable 21% quarter-on-quarter increase. The increasing number of smart contract transactions and interactions contributed to the increase in gas fees burned, further strengthening the Binance Smart Chain ecosystem.

In addition to financial metrics, the BSC showed impressive improvements in other areas. The number of active validators increased 25% quarter-on-quarter, highlighting growing trust and participation in network protection. BSC's commitment to decentralization was evident as the protocol saw a 54% year-over-year increase in active validators.

According to Messari, throughout 2023, BSC demonstrated its ability to handle increased activity while reducing costs for users. Daily transactions The network witnessed a year-on-year (YoY) increase of 35% and a quarter-on-quarter increase of 30%, averaging around 4.6 million transactions per day in the fourth quarter.

These increases in transaction volume were attributed to enrollment-related activity: the BSC processed a record 32 million transactions on December 7, 2023.

BSC DeFi Ecosystem Reaches $4.6 Billion TVL

Despite a decline in daily average active addresses and new unique addresses, primarily due to users exploring alternative chains like opBNB, BSC's on-chain activity remained strong.

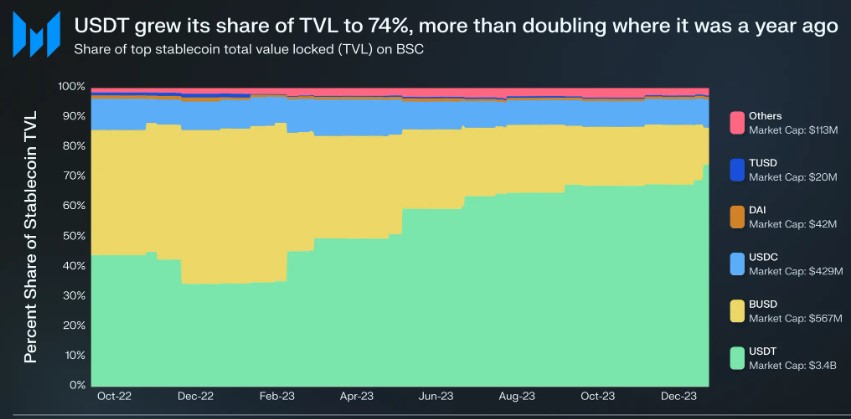

The protocol's stablecoin ecosystem, dominated by Tether USDTreached a total value locked (TVL) of $4.6 billion in Q4, showing a 33% quarter-on-quarter increase in decentralized finance (DeFi) TVL.

While metrics related to non-fungible tokens (NFTs) declined in the fourth quarter, Binance Smart Chain and ethereum (eth) witnessed a resurgence in activity towards the end of the quarter, indicating a possible bullish trend in the next market cycle.

In addition to BSC's growth, BNB also experienced notable price movements. After a sharp drop, BNB rose from $238 to reach the $338 level. However, it later retreated to $287 following a correction.

In the last 24 hours, BNB has recorded a growth of 3.7%, raising its current trading price above $302.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER