The best crypto exchange in India for 2024 is a hot topic among investors and traders alike. With the ever-growing interest in cryptocurrencies, finding a reliable and secure platform is more important than ever. In this article, we’ll check out the top crypto exchanges in India, evaluating key factors such as fees, security, user experience, and regulatory compliance. Whether you’re a seasoned trader or just starting out, we’ll guide you in choosing the best platform for your needs. Read on to learn about our top picks for crypto exchanges in India.

Key Takeaways:

- Understand the top crypto exchanges in India and their unique features.

- Learn about the regulatory environment and legal risks associated with crypto trading in India.

- Get tips on how to secure your assets and avoid common pitfalls when using crypto exchanges.

Ranking Best Cryptocurrency Exchanges in India for 2024

We have reviewed several of the most popular crypto exchanges in India based on their fees, features, security, and more. Here is our final list of the top 9 best cryptocurrency exchanges in India:

- CoinDCX: Best for low fees

- ZebPay: Best for security

- WazirX: Best for beginners

- Bitbns: Best for diversified investment options

- CoinSwitch: Best for INR deposits

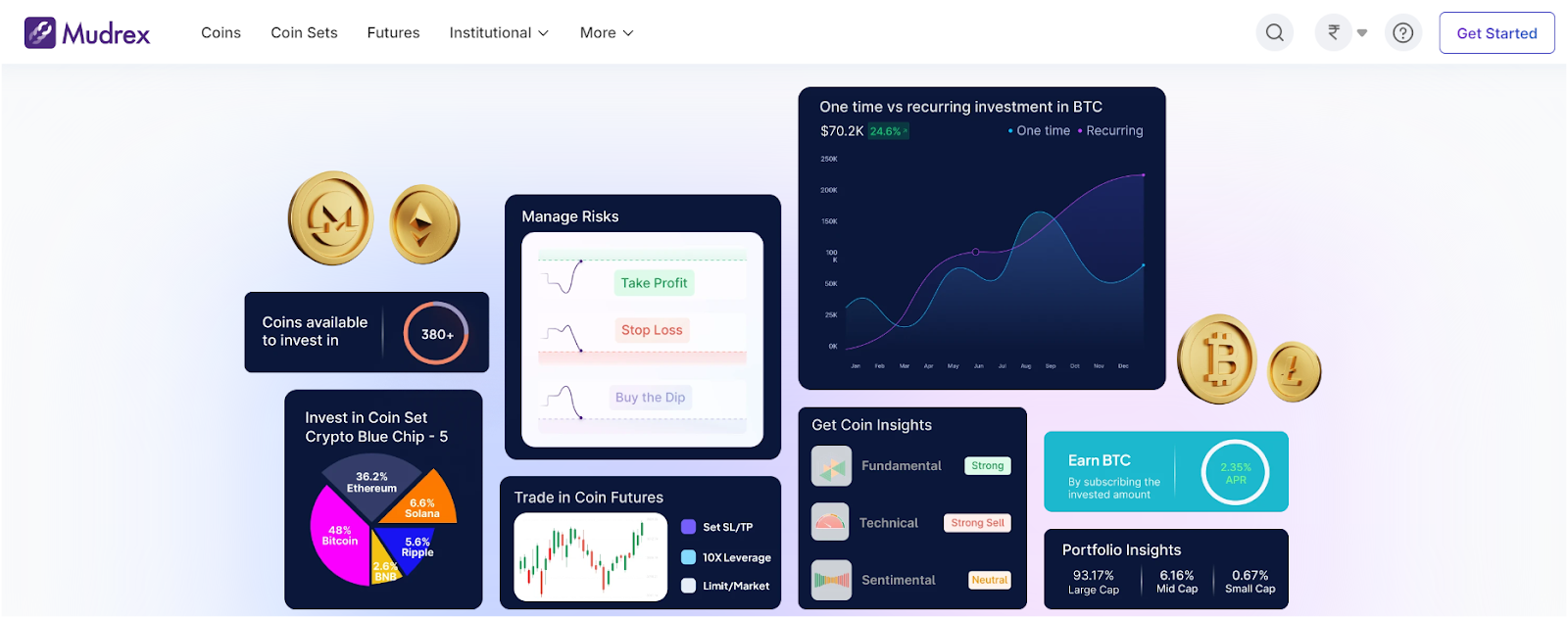

- Mudrex: Best for futures trading

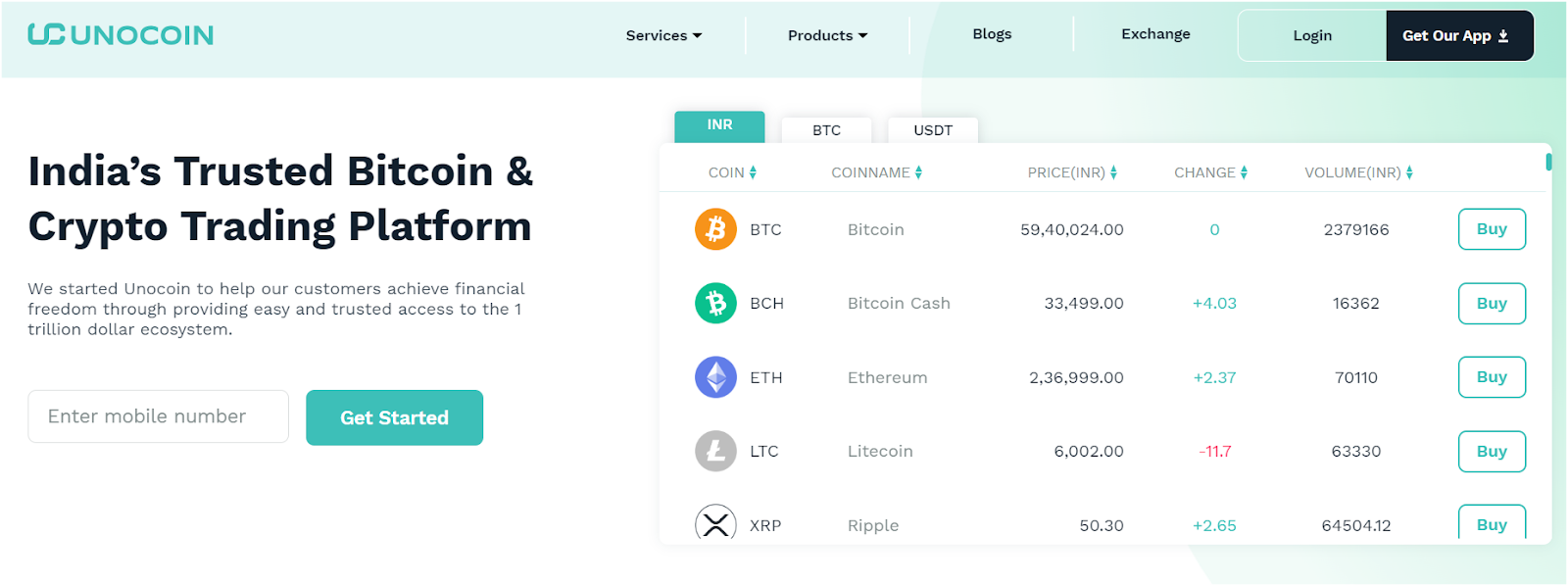

- Unocoin: Best for buying bitcoin

- BuyUcoin: Best for high volume OTC trading

- Giottus: Best for crypto theme investing

Best Indian crypto Exchange for 2024

Here are some of the top crypto exchanges in India for 2024, their unique features, benefits, and what makes them stand out in a crowded market:

1. CoinDCX: Best For Low Fees

For investors who are conscious of trading fees, CoinDCX stands out as one of the best options due to its low fees. The platform charges minimal fees and does not have any deposit fees. This structure is particularly great for frequent traders, as it lowers the cost of each transaction. CoinDCX offers various promotions and bonuses that can also help further reduce trading costs, which is perfect for budget-conscious investors.

CoinDCX uses advanced security measures, including multi-signature wallets and full insurance coverage for user funds. This insurance acts as an additional safety net for users, ensuring that their funds are protected in the unlikely event of a security breach.

CoinDCX also offers extensive educational resources for its users. The platform includes a learning module known as DCX Learn, which provides in-depth guides and tutorials on cryptocurrency trading, blockchain technology, and market analysis.

Fees and Availability CoinDCX charges a 0.1% fee for both makers and takers in spot trading. The exchange is available across India and supports a variety of payment methods, including UPI, NEFT, and IMPS.

Pros

- Extensive range of supported cryptocurrencies

- Advanced trading features

- Strong focus on user education

- Competitive trading fees

Cons

- User interface can be overwhelming for beginners

- Occasional liquidity issues for less popular coins

2. ZebPay: Best For Security-Conscious Investors

For investors who prioritize security, ZebPay is a top choice. Established in 2014, ZebPay is one of the oldest and most trusted cryptocurrency exchanges in India. ZebPay takes security very seriously, using robust security protocols, including 2FA and encryption, to protect user data and funds. The platform’s long-standing reputation for reliability and security makes it a preference for those who want to ensure their investments are safe.

The platform has a user-friendly interface, and offers low fees, which helps users maximize their profits.

ZebPay also has advanced features like recurring buys, which helps users automate their investments and supports a wide range of cryptocurrencies. The platform has a strong customer support team that is available to help users with any issues they might come across, ensuring a smooth trading experience.

Fees and Availability ZebPay charges a 0.15% maker fee and a 0.25% taker fee for spot trading. The exchange also has a subscription-based model where users can opt for a flat monthly fee to enjoy zero trading fees. ZebPay is available across India, making it accessible to a wide range of users.

Pros

- High-security measures, including cold storage

- Simple and user-friendly interface

- Subscription model for zero trading fees

- Wide range of supported cryptocurrencies

Cons

- Limited advanced trading features

- Higher fees for non-subscription users

3. WazirX: Best For Beginners

WazirX is one of the most popular cryptocurrency exchanges in India, and for good reason. Launched in 2017, it has quickly become the go-to platform for beginners entering the crypto market because of its intuitive interface and easy-to-understand features. The platform has a straightforward registration process and guides users through the setup with ease.

WazirX provides a demo trading account, which lets new users practice trading with virtual money. This feature helps beginners learn how to trade without risking real funds, which is a great way to gain experience and build confidence. WazirX also offers various trading options, including spot and futures trading, margin trading, and staking, providing users with multiple ways to grow their investments.

WazirX supports an extensive range of cryptocurrencies, including bitcoin, ethereum, Ripple, and many altcoins. This lets users trade a variety of digital assets easily. WazirX also offers a comprehensive FAQ section and customer support to help new users navigate the platform and understand the basics of trading.

Fees and Availability WazirX is famous for its competitive trading fees, which are among the lowest in the Indian market. It charges a flat fee of 0.2% per trade, which is quite reasonable compared to other exchanges. The platform is available across India and supports multiple payment methods, including UPI, NEFT, and IMPS.

Pros

- User-friendly platform ideal for beginners

- Wide variety of supported cryptocurrencies

- P2P trading feature for seamless transactions

- Strong community and educational resources

Cons

- Higher trading fees compared to some other platforms

- Occasional delays in withdrawals

4. Bitbns: Best For Diverse Portfolios

bitcoin/” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>Bitbns is another top choice for Indian crypto traders, especially those who value innovation and many trading options like spot and futures trading. The platform supports a wide range of cryptocurrencies, including many altcoins not available on other cryptocurrency exchanges. Bitbns also offers several unique features, including crypto lending and staking, which lets users earn interest on their crypto holdings. This is a great way for investors to generate passive income from their digital assets.

The platform has a user-friendly interface, making it accessible for traders of all experience levels. For more advanced traders, Bitbns offers tools like limit orders and stop-loss orders, which can help manage risk and improve trading strategies.

Security on Bitbns is robust, with multiple layers of protection, including 2FA and the use of cold storage for most user funds. The platform also undergoes regular security audits to ensure it remains secure and trustworthy for its users.

Fees and Availability: Bitbns charges 0.2% in crypto exchange fees, is available across India, and supports multiple payment methods, including UPI, NEFT, and IMPS.

Pros:

- Wide range of supported cryptocurrencies

- SIP feature for disciplined investments

- User-friendly interface

- Constantly innovating with new features

Cons:

- Higher fees for certain advanced features

- Limited customer support options

5. CoinSwitch: Best for INR deposits

CoinSwitch is one of India’s most popular crypto exchanges, making it super easy for both beginners and experienced traders to jump into the world of cryptocurrency. With a user base of over 2 crore, it’s clear that many trust the platform for their crypto needs. One of the key features is its support for over 200 cryptocurrencies, so whether you’re into bitcoin, ethereum, or more niche coins like Dogecoin and Solana, you’ve got plenty of options.

Getting started on CoinSwitch is a breeze. The onboarding process, which includes verifying your identity (KYC), takes just a few minutes. You can start trading with as little as ₹100, which is roughly £1 — perfect if you’re dipping your toes in for the first time. The mobile app is available on Android and iOS, allowing you to buy, sell, and track crypto prices with ease. The app also sends price alerts to keep you updated on market movements, which is helpful if you’re not glued to the screen.

On the security front, CoinSwitch is solid. It’s registered with India’s Financial Intelligence Unit (FIU) and complies with KYC and anti-money laundering rules. Plus, it’s ISO/IEC 27001:2022 certified, meaning it follows global standards for information security. They also store your assets with SOC 2 Type II certified custodians, so your funds are in safe hands.

Pros

- Supports over 200 cryptocurrencies

- Easy onboarding with quick KYC

- Low trading barrier (start with ₹100)

- Strong security and compliance with Indian laws

Cons

- Lacks advanced trading tools for experienced traders

- Very new and low-cap altcoins are not supported

6. Mudrex: Best for futures trading

Mudrex is quickly becoming a popular choice for crypto traders in India. It started in 2018 and has grown fast, now with over 2 million users and $25 million in assets under management. The platform is designed to be easy to use, especially for those new to crypto. Based out of Bengaluru, it has backing from major investors like Y Combinator and Nexus Venture Partners.

The standout feature of Mudrex is its “Coin Sets.” These are baskets of multiple cryptocurrencies that help spread out risk, making it easier for you to invest without needing deep technical knowledge. Mudrex supports over 650 cryptocurrencies, including bitcoin, ethereum, and more. The exchange also offers futures trading with 100x leverage.

For Indian users, Mudrex offers zero fees on INR deposits, which is great for getting started. However, you will need to pay 1% when withdrawing INR, along with the usual taxes. If you’re trading or withdrawing crypto, a 2% fee applies. Buying and selling crypto on the platform comes with a reasonable 0.25% fee. Importantly, Mudrex is fully compliant with India’s KYC regulations, ensuring that all transactions are safe and secure.

Pros

- Supports over 650 cryptocurrencies.

- Invest systematically in crypto themes like nfts, DeFi, and more

- Free deposits in INR

- Easy-to-use interface for beginners

- Registered with FIU-India and fully compliant with Indian and European standard

Cons

- A 2% fee on cryptocurrency withdrawals is higher

- 1% fee for redeeming Coin Sets within one month

7. Unocoin: Best for buying bitcoin

Unocoin, launched in 2013, has established itself as one of the top cryptocurrency exchanges in India. It offers a straightforward way for you to buy, sell, and trade a range of digital currencies like bitcoin, ethereum, Litecoin, and Ripple. The platform is designed to make buying crypto easy for Indian users, with over 2 million people already using it.

It offers a unique Systematic Buying Plan (SBP) feature. This lets you invest in bitcoin or ethereum bit by bit, which is great if you want to ease into the market rather than make a big one-time purchase. Plus, if you’re looking to trade in bulk, their Over-the-Counter (OTC) option has you covered. Unocoin also has a mobile app, so you can trade cryptocurrencies anytime, anywhere. For quick transactions, they offer seamless INR deposits and withdrawals.

Security-wise, UnoCoin doesn’t cut corners. They use two-factor authentication (2FA) and multi-signature wallets to keep your assets safe. Businesses can even use UnoCoin’s services to accept bitcoin payments, which is a nice touch for those looking to expand into digital payments.

Pros

- A wide variety of cryptocurrencies to choose from

- Easy-to-use interface, especially with its mobile app

- Earn passive income with crypto staking

- Systematic Buying Plan for steady investments

Cons

- Customer support can sometimes be slow to respond

- Liquidity and trading volume is low compared to other crypto exchanges

8. BuyUcoin: Best for high volume OTC trading

BuyUcoin is one of the top cryptocurrency exchanges in India, founded in 2016. It has gained a solid user base of over 350,000 people. If you’re looking to trade in cryptocurrencies like bitcoin, ethereum, or Litecoin, BuyUcoin offers a range of options with the added convenience of using INR (Indian Rupees). The platform supports several payment methods, such as UPI, bank transfers, and debit/credit cards, making it easy for Indian traders to get started.

It uses two-factor authentication (2FA) and SSL encryption to protect your account and personal information. Most funds are stored in cold storage, which means they’re kept offline for extra safety. You can also use BuyUcoin’s wallet service to store your crypto securely. The exchange offers some of the lowest fees in the market, charging just 0.24% per trade and no fees on INR deposits.

If you plan to make large trades, EZ OTC allows you to do this privately without impacting the public market. BuyUcoin is also looking to add more advanced tools, like algorithmic trading, to help experienced traders.

Pros

- SIP with invest daily, weekly, monthly, and quarterly basis

- OTC desk or derivatives platform for experienced traders

- crypto scratch cards to get your first bitcoin absolutely free on signup

- INR deposits are free, and trading fees are competitive

Cons

- Limited advanced tools for expert traders

- Only supports 130 coins and tokens for trading

9. Giottus: Best for crypto theme investing

Giottus is a growing cryptocurrency exchange in India. Launched in 2017 by two IIM Calcutta alumni, it has quickly gained popularity for its user-friendly interface and focus on security. What makes it especially unique for Indian users is its multilingual platform, supporting languages like Hindi, Tamil, Telugu, and Bengali. This regional language support is a big win for Indian users, making it accessible to a wide audience across the country.

Giottus offers trading in over 100 cryptocurrencies, including well-known ones like bitcoin, ethereum, and a variety of altcoins. It stands out with its features like crypto fixed deposits and staking, which allow users to earn passive income. Additionally, if you’re looking to invest over time, they offer systematic investment plans (SIPs) that allow you to invest in crypto the same way you would with mutual funds.

From a technical perspective, Giottus has developed a robust platform that can handle thousands of transactions per second. The exchange also partners with global leaders like BitGo for security, meaning your funds and data are protected to international standards.

Pros

- Available in multiple Indian languages

- Secure and reliable with global security partners

- 24/7 customer support available via chat and call

- Low trading fees

Cons

- Fewer advanced trading options than some international platforms

- A limited number of trading pairs compared to larger global exchanges

Comparison of Top crypto Exchanges in India

| Exchange | Supported Coins | Trading Fees | Security |

| ZebPay | 50+ | 0.15% maker, 0.25% taker | High security with 2FA, encryption, and cold storage |

| WazirX | 200+ | 0.2% per trade | Moderate security with 2FA, strong community support |

| CoinDCX | 100+ | 0.1% per trade | Advanced security with multi-signature wallets and insurance coverage |

| Bitbns | 300+ | 0.2% per trade | Robust security with 2FA and cold storage |

| CoinSwitch | 200+ | 0.49% | FIU registered, 2FA, and cold wallet storage |

| Mudrex | 650+ | 0.25% | Registered with FIU-India and fully compliant by European standards |

| Unocoin | 50+ | 0.5% | 2FA and cold storage |

| BuyUcoin | 130+ | 0.24% | MFA and FIU compliant |

| Giottus | 100+ | Up to 0.3% | Withdrawal address book, 2FA, and BitGO cold storage |

What is a crypto Exchange?

A crypto exchange is like an online marketplace where you can buy, sell, and trade cryptocurrencies such as bitcoin, ethereum, and others. Think of it as a stock exchange but for digital currencies. These platforms help convert regular money (like INR or USD) into crypto and vice versa.

On a crypto exchange, you can place different types of orders, from buying at the market price to setting a custom price you’re willing to pay. You’ll usually pay some fees for trading or transferring your funds. Beyond the basics, some crypto exchanges also offer advanced features like leverage trading, margin trading, staking, and even crypto lending.

Types of crypto Exchanges in India

In India, you’ve got a few different types of crypto exchanges to choose from. The main ones are Centralized Exchanges (CEXs), Decentralized Exchanges (DEXs), and Peer-to-Peer (P2P) Exchanges.

- Centralized Exchanges (CEXs): These are the most common. They’re run by companies that act as middlemen between buyers and sellers, making it super easy to trade cryptocurrencies. If you’re using platforms like CoinSwitch, CoinDCX, or ZebPay, you’ll need to sign up, verify your identity with KYC, and deposit funds to get started. The good thing? CEXs handle everything – they even keep your private keys safe. But that’s also the risky part, as your funds are held by the exchange, which could be a target for hackers.

- Decentralized Exchanges (DEXs): If you’re in full control over your funds and privacy, DEXs might be your thing. These platforms, like Uniswap or Sushiswap, let you trade directly with other users without needing an intermediary. DEXs run on smart contracts, so no middleman is required. The downside? They’re a bit more complicated, don’t support Indian rupees, and liquidity can be an issue. That’s probably why they aren’t as popular in India just yet.

- Peer-to-Peer (P2P) Exchanges: P2P platforms connect buyers and sellers directly. If you’ve ever used Binance’s P2P system, you’ll know how this works. You find someone to buy from or sell to, negotiate terms, and the platform ensures the trade is secure using an escrow system. This is a popular option in India, especially when banking restrictions around crypto make regular exchanges harder to use.

How to Buy Cryptocurrency in India?

- Choose a crypto Exchange: Start by picking the right Indian crypto exchange. You’ll want something that suits your needs and offers a good selection of coins. The best crypto trading platforms in India are CoinDCX, CoinSwitch, Mudrex, and ZebPay.

- Create an Account and Complete KYC Verification: Once you’ve registered with email, you’ll need to complete the KYC process. It’s a simple step but crucial because it keeps everything legal. Most crypto exchanges in India will ask for your Aadhaar card, PAN card, and a selfie.

- Deposit Funds: After KYC, you can deposit INR into your account. The good news is that Indian exchanges make this super simple with options like UPI, bank transfers, or even net banking.

- Buy Cryptocurrency: You can choose to buy at the current market price or set a limit order if you’re waiting for a better deal. Just pick the coin you want, enter the amount, and hit buy. The exchange will handle the rest and execute your order when the price matches your request (if it’s a limit order).

- Secure Your Cryptocurrency: Once you own your crypto, think about security. You can leave it in the exchange’s wallet for convenience, but many prefer to transfer it to a hardware wallet or cold storage for extra protection. And don’t forget to enable two-factor authentication (2FA) to keep your account secure.

Key Factors to Consider When Choosing a crypto Exchange in India

When deciding on the best Indian crypto exchange, there are important elements to consider. These factors will help you determine which platform best matches your needs:

Fees and Charges

Every crypto exchange has its own fee structure, which can significantly affect your trading profitability. Common fees include transaction fees (charged on each trade), withdrawal fees (charged when you move funds out of the exchange), and deposit fees (sometimes charged when you add funds to your account). Some exchanges might offer low trading fees but charge high withdrawal fees, which could affect your profits if you frequently move assets. Understanding these costs upfront tells you how they will affect your overall trading strategy. Lower fees and zero fee exchanges are generally preferable, especially if you plan to trade frequently.

Security Features

Security is one of the most important features of the best crypto exchanges. The decentralized and digital nature of cryptocurrencies makes them a prime target for hackers and cybercriminals. Look for exchanges that offer robust security measures, such as Two-Factor Authentication (2FA), which adds an extra layer of security by requiring a second form of verification before allowing account access. Also, exchanges that use cold storage (keeping the majority of funds offline) are generally safer because they are less vulnerable to online attacks. Some exchanges provide insurance against theft as added protection for your assets.

User Experience

A user-friendly interface will help your trading experience, especially if you’re new to cryptocurrency. The best exchanges offer intuitive platforms that make it easy to navigate through various functions like buying, selling, and monitoring your portfolio. While most beginners prefer simplicity and ease of use, experienced traders might prefer platforms that offer more advanced tools and features. Some of these include detailed charting software, margin trading options, and API access for automated trading. The exchange you choose should match your expertise and needs.

Supported Cryptocurrencies

Not all crypto exchanges support every cryptocurrency. While major coins like bitcoin (btc) and ethereum (eth) are typically available on all platforms, less popular cryptocurrencies may not be. Before choosing an exchange, make sure it supports the specific cryptocurrencies you’re interested in trading. If you trade a range of different assets, use an exchange with a wide variety of supported coins. This flexibility helps you to diversify your investments and enjoy different market opportunities.

Regulatory Compliance: In India, the regulatory environment for cryptocurrencies is constantly changing. So, try to choose an exchange that adheres to local regulations. This includes compliance with anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and any other relevant legal frameworks. Using a compliant exchange can help you avoid potential legal issues. It’ll also make sure that your trading activities are conducted within the boundaries of the law. Exchanges that follow regulatory guidelines are usually more transparent and trustworthy.

Customer Support: Effective customer support is very important in the world of cryptocurrency trading. The technical issues that can arise are quite complex and having access to responsive and knowledgeable support can make a huge difference. Look for exchanges that offer multiple support channels, such as live chat, email, and phone support, and check reviews to see how responsive and helpful their support teams are. Prompt customer service can help reduce disruptions to your trading activities.

Regulatory Environment for crypto in India

Current Laws and Regulations

Currently, cryptocurrencies in India are not yet fully regulated. This means there isn’t a comprehensive legal framework that clearly defines how cryptocurrencies should be treated under the law. However, the Indian government has shown a keen interest in creating a regulatory environment that balances innovation with protection for investors. This interest is driven by several factors, including the need to prevent financial crimes such as money laundering and tax evasion, and to protect consumers from the high volatility and risks associated with cryptocurrencies.

The Reserve Bank of India (RBI) and other financial authorities are involved in discussions about how to regulate the cryptocurrency market. While there hasn’t been a complete ban on cryptocurrencies, there have been moves to regulate them more strictly. For example, the RBI had previously imposed restrictions on banks from dealing with cryptocurrency transactions, but this was overturned by the Supreme Court in 2020, allowing banks to provide services to cryptocurrency exchanges and traders again.

Despite the lack of a formal regulatory framework, several guidelines have been put in place to help shape the market. For instance, crypto exchanges in India are encouraged to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to ensure transparency and reduce illegal activities. This means that most exchanges will need you to verify your identity before you can start trading, adding an extra layer of security for both the exchange and its users.

The government is also considering the introduction of a Central Bank Digital Currency (CBDC), which could further impact how cryptocurrencies are regulated in the future. The launch of a CBDC might mean stricter regulations for private cryptocurrencies, as the government may seek to promote its digital currency while controlling the use of others.

Taxation and Reporting Requirements

The Indian government has made it clear that gains from cryptocurrency trading are subject to taxation, and failure to comply with tax laws can lead to penalties and legal action.

Cryptocurrency gains are currently considered as part of capital gains tax. This means that any profit you make from buying and selling cryptocurrencies is taxable. There are two types of capital gains tax in India: short-term capital gains (STCG) and long-term capital gains (LTCG).

Short-Term Capital Gains (STCG): If you hold a cryptocurrency for less than three years before selling it, the profit is considered a short-term capital gain. These gains are typically taxed at the same rate as your regular income tax rate, which can be up to 30%, depending on your total income.

Long-Term Capital Gains (LTCG): If you hold a cryptocurrency for more than three years, the profit is considered a long-term capital gain. LTCG is taxed at a lower rate, generally around 20%, with the benefit of indexation. Indexation lets you adjust the buying price of the asset for inflation, potentially reducing your tax liability.

Note that these tax rates and rules can change, so try to stay up-to-date with the latest guidelines from the Indian government and the Income Tax Department. To comply with tax laws, keep detailed records of all your cryptocurrency transactions. This includes the date of each transaction, the amount and type of cryptocurrency bought or sold, the value of the cryptocurrency in Indian Rupees at the time of the transaction, and any fees paid. Proper record-keeping will help you accurately calculate your gains or losses and report them correctly on your tax return.

If you’re unsure about how to handle your cryptocurrency taxes, consult with a tax professional who has experience with digital assets. They can help you understand your tax obligations, ensure you’re compliant with the latest regulations, and potentially minimize your tax liability through effective tax planning.

Security and Compliance Considerations for Indian Investors

Security and compliance are crucial when engaging in cryptocurrency trading, especially in a dynamic regulatory environment like India’s. To protect your crypto investments and ensure compliance with local laws, here are some best practices that Indian crypto investors should follow:

Use Two-Factor Authentication (2FA)

Two-factor authentication (2FA) extra protection beyond your password. With 2FA, even if someone gets your password, they still need a second form of verification—usually a code sent to your phone or generated by an app like Google Authenticator—to access your account.

Enabling 2FA significantly raises the security of your crypto assets. Most cryptocurrency exchanges offer 2FA as an option in the security settings, and it’s highly recommended to enable it immediately after creating your account. This simple step can prevent unauthorized access and protect your funds from potential hacking attempts.

Store Assets in Cold Wallets

Storing your crypto assets in cold wallets, also known as offline wallets, is one of the safest ways to protect your investments. Cold wallets are not connected to the internet, making them immune to hacking attempts and online threats. This type of storage is ideal for long-term Indian crypto investors who do not need frequent access to their funds.

There are different types of cold wallets, including hardware wallets like Ledger and Trezor, and paper wallets where private keys are printed and stored offline. Keep your cold wallet in a secure location and make backup copies of your private keys to avoid losing access to your funds.

If you actively trade, you may need to keep a portion of your funds in hot wallets (online wallets) for quick access. However, try to limit the amount stored online to only what is necessary for immediate trading and keep the rest of your crypto assets offline.

Verify Exchange Compliance

Make sure that the crypto exchange you use complies with local regulations to avoid legal complications and protect your investments. This includes verifying if the exchange has registered with any relevant government bodies or financial authorities and if it follows anti-money laundering (AML) and know your customer (KYC) protocols.

An exchange’s compliance with local laws provides a level of assurance that it operates transparently and ethically. Look for indian crypto exchanges that are transparent about their security practices and have a strong track record of protecting user funds. Reading user reviews and researching the exchange’s history can provide insights into its reliability and security measures.

Stay Informed

The regulatory landscape for cryptocurrencies in India is still changing. Changes in regulations can affect the legality of certain activities, tax obligations, and the overall environment for crypto trading. Keeping up with the news, government announcements, and updates from the exchanges themselves will help you stay ahead of regulatory developments.

Joining crypto communities, following reputable news sources, and participating in forums can also keep you informed about the latest trends and potential regulatory shifts. This awareness enables you to adjust your strategies and ensure that your investments remain compliant with the law.

Best Practices for Using crypto Exchanges in India

To navigate the complex world of crypto trading in India successfully, it’s important to follow certain best practices. These guidelines can help you maximize returns while minimizing risks and ensure that you are making informed and strategic decisions.

Start Small

For newcomers to crypto trading, starting with a small investment is a prudent strategy. The cryptocurrency market is known for its volatility, with prices that can swing dramatically in short periods. Starting small helps you to learn the market dynamics, understand how different cryptocurrencies behave, and get familiar with the trading platform without risking a significant portion of your capital.

As you gain experience and confidence, you can gradually increase your investment. This approach helps mitigate potential losses while giving you the time to develop a solid understanding of the market and refine your trading strategies.

Diversify Your Investments

Diversification is a fundamental principle in investing, and it’s especially important in the volatile world of cryptocurrencies. By spreading your investments across multiple cryptocurrencies, you reduce the risk associated with any single asset. Diversification can help balance your portfolio and protect against significant losses if one of your investments performs poorly.

You can consider spreading your funds across a mix of well-established cryptocurrencies like bitcoin and ethereum, as well as smaller altcoins that have potential for growth. This strategy can increase your chances of capturing gains from various segments of the market while reducing the impact of volatility on your overall portfolio.

Stay Updated

The cryptocurrency market is influenced by a wide range of factors, including technological developments, regulatory news, market sentiment, and macroeconomic trends. Staying updated with the latest news and trends is essential for making informed trading decisions.

Follow reliable news sources, subscribe to newsletters, and use market analysis tools provided by Indian crypto exchanges to keep track of the market. Being well-informed will help you anticipate market movements and make strategic decisions based on data rather than speculation.

Avoid FOMO

FOMO, or the fear of missing out, is a common psychological trap that can lead to impulsive and emotionally-driven investment decisions. In the fast-paced world of cryptocurrencies, it’s easy to get caught up in the excitement of rapidly rising prices and feel pressured to buy in hastily.

To avoid FOMO, it’s essential to have a well-defined investment strategy and stick to it, regardless of market hype. Focus on long-term goals and avoid making decisions based on short-term market movements. Remember that not every investment opportunity needs to be acted upon, and sometimes the best move is to wait for a better opportunity that aligns with your strategy.

Secure Your Account

The security of your crypto exchange account is paramount, as any breach can lead to the loss of your funds. Regularly updating your passwords, using a secure email address, and enabling all available security features are basic but effective measures to protect your account.

Choose strong, unique passwords for your exchange accounts and change them periodically to reduce the risk of unauthorized access. Using a password manager can help manage and generate secure passwords without the need to remember them all. Also, consider using a separate email address exclusively for your crypto activities, which can further enhance security.

Additionally, be vigilant about phishing attacks and other scams. Always verify the authenticity of emails, links, and websites before entering your credentials. Educate yourself about common scams in the crypto space to avoid falling victim to fraudulent schemes.

Understand the Fees and Charges

Different crypto exchanges have varying fee structures, including trading fees, withdrawal fees, and deposit fees. Understanding these costs is crucial as they can significantly impact your profits, especially if you are a frequent trader.

Before committing to an exchange, review its fee structure and consider how it aligns with your trading strategy. Some exchanges offer lower fees for high-volume traders or provide discounts for using their native tokens. Understanding these details can help you choose an exchange that offers the best value for your trading needs.

Practice Risk Management

Effective risk management is key to long-term success in crypto trading. This involves setting clear goals, defining your risk tolerance, and using tools like stop-loss orders to limit potential losses. It’s also essential to avoid over-leveraging, as this can amplify losses and increase the risk of liquidation.

By applying sound risk management principles, you can protect your capital and maintain a balanced approach to trading, which is particularly important in the highly volatile crypto market.

Use Tools and Resources Provided by Exchanges

Many crypto exchanges offer various tools and resources to help users make informed trading decisions. These can include market analytics, trading bots, demo accounts, and educational content. Utilizing these resources can provide valuable insights and improve your trading skills.

For example, demo accounts let you practice trading with virtual funds, helping you understand how the market works without risking real money. Trading bots can automate certain strategies, which lets you trade more efficiently. Taking advantage of these tools can enhance your trading experience and increase your chances of success.

Conclusion

Choosing the best Indian crypto exchange requires you to carefully consider various factors, including fees, security, user experience, and regulatory compliance. By doing your research and following best practices, you can safely and profitably investment in cryptocurrency India. Remember to stay informed, stay secure, and make decisions based on your individual needs and risk tolerance.

Frequently Asked Questions (FAQs)

Which crypto exchange is best for low fees in India?

The best crypto exchange for low fees in India is CoinDCX. It offers competitive trading fees and no deposit fees and is a cost-effective option for investors on a budget.

Which is the safest crypto exchange in India?

CoinDCX and ZebPay are considered the safest crypto exchanges in India. Their strong security measures include two-factor authentication (2FA) and insurance for user funds.

What are the legal risks of using crypto exchanges in India?

The legal risks of using crypto exchanges in India include potential regulatory changes that could affect the legality of cryptocurrency trading and taxation issues. You need to stay current on the latest regulations and comply with all local crypto laws.

How can I verify the security of a crypto exchange in India?

To verify the security of a crypto exchange in India, check for two-factor authentication, cold storage options, insurance for user funds, and regulatory compliance. You can also read user reviews and expert opinions to learn more about the exchange’s security track record.

NEWSLETTER

NEWSLETTER