The debate over whether or not this policy is a form of quantitative easing misses the point: liquidity is the name of the game for global financial markets.

The following article is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

QE or not QE?

The Bank Term Funding Program (BTFP) is a facility introduced by the Federal Reserve to provide banks with a stable source of funding during times of economic stress. The BTFP allows banks to borrow money from the Federal Reserve at a predetermined interest rate to ensure that banks can continue to lend money to homes and businesses. In particular, the BTFP allows qualified lenders to pledge Treasury bonds and mortgage-backed securities to the Fed at par, allowing banks to avoid current unrealized losses on their bond portfolios, despite historically rising rates. interest rates in the last 18 months. Ultimately, this helps support economic growth and protects banks in the process.

The cause of the tremendous amount of unrealized losses in the banking sector, particularly for regional banks, is due to the historic increase in deposits that occurred as a result of the COVID-induced stimulus, just when bond yields were at their lowest historical.

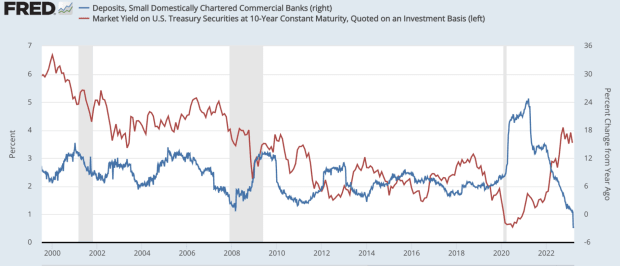

Below is the year-on-year change in locally chartered small commercial banks (blue) and the 10-year US Treasury yield (red).

TLDR: Historical relative increase in deposits with short-term interest rates at 0% and long-term interest rates near their generational lows.

The reason these unrealized losses on bank holdings have not been widely discussed before is due to opaque accounting practices in the industry that allow unrealized losses to be essentially hidden, unless banks need to collect cash.

The BTFP allows banks to continue to hold these assets until maturity (at least temporarily), and allows these institutions to borrow from the Federal Reserve using their currently underwater bonds as collateral.

The impacts of this setup, plus the recent increase in lending at the Fed’s discount window, have spawned a hotly debated topic in financial circles: Is the Fed’s latest intervention another form of QE?

In the simplest terms, quantitative easing (QE) is an asset swap, in which the central bank buys a security from the banking system, and in exchange, the bank gets new bank reserves on its balance sheet. The intended effect is to inject new liquidity into the financial system while supporting asset prices by lowering yields. In short, QE is a monetary policy tool in which a central bank buys a fixed number of bonds at any price.

Although the Fed has tried to communicate that these new policies are not balance sheet expansion in the traditional sense, many market participants have come to question the validity of such a claim.

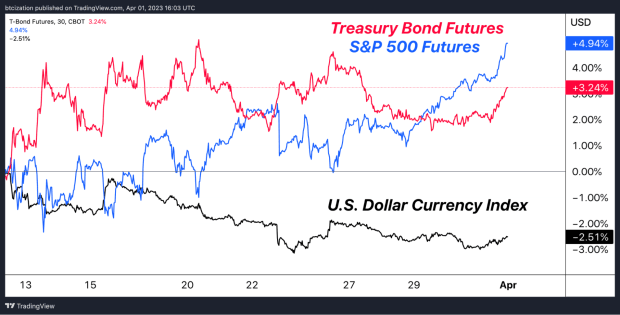

If we simply look at the response of various asset classes since the introduction of this liquidity provision and the new central bank credit facility, we get a rather interesting picture: Treasuries and stocks have caught a bid, the dollar has weakened and Bitcoin has skyrocketed. .

At first glance, the service is purely to “provide liquidity” to financial institutions with constrained balance sheets (read: market-adjusted insolvency), but if we closely examine the effect of BTFP from first principles, it’s clear that the service provides liquidity. to institutions experiencing balance sheet constraints, while also preventing these institutions from liquidating long-duration Treasury bonds on the open market in a liquidation sale.

Academics and economists can debate the nuances and complexities of the Fed’s policy action until they feel sad, but the market’s reaction function is more than clear: Balance sheet number goes up = buy risky assets.

Make no mistake about it, the whole game now is about liquidity in the global financial markets. It didn’t used to be this way, but the largesse of the central bank has created a monstrosity that knows nothing but fiscal and monetary support in times of the slightest distress. While the short to medium term looks uncertain, market participants and marginalized viewers need to be acutely aware of how this all ends.

Perpetual monetary expansion is an absolute certainty. Meanwhile, the elaborate dance performed by politicians and central bankers is an attempt to make it look like they can keep the ship afloat, but in reality, the global fiat monetary system is like an irreversibly damaged ship that has already hit an iceberg. .

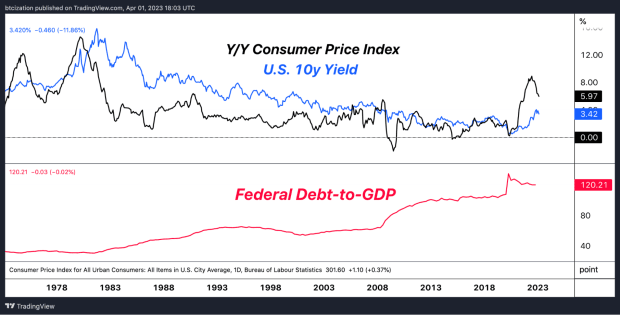

Let us not forget that there is no way to get out of 120% debt-to-GDP as a sovereign without an unforeseen and unlikely massive productivity boom, or a sustained period of inflation above the level of interest rates, which would collapse the economy. Since the latter is extraordinarily unlikely to happen in real terms, financial repression, that is, inflation above the level of interest rates, seems to be the way to go.

Final note

For the layman, there is no pressing need to get caught up in the debate over whether or not the Fed’s recent policy is quantitative easing. Instead, the question worth asking is what would have happened to the financial system if the Federal Reserve hadn’t conjured up $360 billion in liquidity out of thin air over the past month? Widespread bank runs? Collapse of financial institutions? Sky-high bond yields causing global markets to spiral downward? All were possible and even probable, and this highlights the growing fragility of the system.

Bitcoin offers an engineered solution to peacefully opt out of the politically corrupt construct known colloquially as fiat money. Volatility will persist, exchange rate fluctuations should be expected, but the endgame is as clear as ever.

That concludes the excerpt from a recent issue of Bitcoin Magazine PRO. subscribe now to receive PRO articles directly to your inbox.

Relevant past articles:

- Another Fed Intervention: Lender of Last Resort

- Banking Crisis Survival Guide

- PRO Market Keys of the Week: Market Says Tightening Is Over

- Biggest bank failure since 2008 sparks fear across the market

- A Story of Tail Risks: The Fiat Prisoner’s Dilemma

- The Everything Bubble: Markets at a Crossroads

- Not Your Average Recession: Unwinding the Biggest Financial Bubble in History

- How big is the bubble of everything?

NEWSLETTER

NEWSLETTER