Over the past five days, Avalanche network users have collectively paid more than $4 million in transaction fees. This significant expense is primarily attributed to the creation and movement of tokens and non-fungible tokens (NFTs) through inscriptions, a novel method that is gaining ground in the blockchain world.

Signups have emerged as a creative way to bypass networks like bitcoin, which lack native support for tokens. By incorporating text into standard blockchain transactions and employing an external numbering system, these inscription-based tokens offer a unique approach to token creation and movement.

Initially developed for bitcoin, their usefulness has spread to other blockchains such as Arbitrum, Polygon PoS, etc., mainly due to the profitability of transferring these tokens compared to native ones. The recent Avalanche phenomenon stands out in terms of scale and cost.

The Avalanche's unique position in the enrollment phenomenon

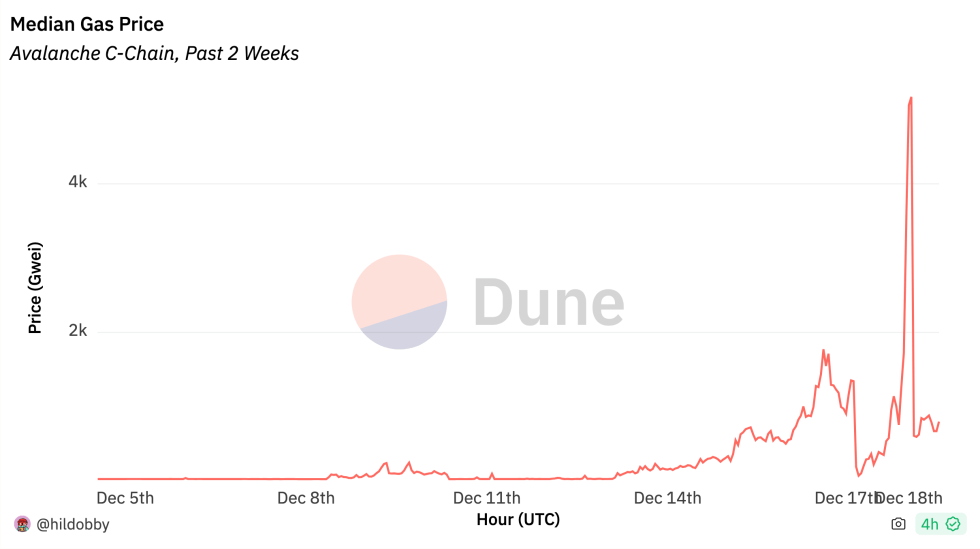

A deep dive into the data reveals intriguing details about this fee increase at the Avalanche. According to Dune Analytics panel Elaborated by Hildobby, the $4.06 million in fees paid on Avalanche constitute 75.32% of all fees related to signing up for multiple blockchains on the board.

This increase in transaction costs is not simply a byproduct of signups, but also the result of a significant increase in overall network transactions, leading to increased demand for block space on Avalanche. This has completed in a dramatic rise in gas prices, with costs soaring to more than 5,000 nAVAX per unit on December 18.

In particular, Avalanche's most recent rate increase indicates a growing trend in the use of network signups. To date, Avalanche has processed 63 million enrollment-related transactions, according to data of Dune Analysis.

Market impact and broader implications

The increase in transaction fees on Avalanche has coincided with notable market movements. The native blockchain token, AVAX, has seen a significant increase in its value, rising over 10% in the last week.

Despite a 6.5% drop in the last 24 hours, AVAX continues to trade above the $39 mark. At the same time, there has been a decline in the asset's trading volume from over $3 billion last week to around $1.3 billion today.

This trend in Avalanche is not an isolated case in the crypto world. Users of various blockchain networks are increasingly facing significant transaction fees. A recent incident involving a bitcoin whale accidentally paying a $3.1 million network fee underscores the potential for high costs in crypto transactions.

Although mining pool AntPool has offered a refund, this incident highlights the complexities and sometimes high risks involved in blockchain transactions.

Featured image from Unsplash, chart from TradingView

NEWSLETTER

NEWSLETTER