This article is also available in Spanish.

Aptos (APT) soared more than 10% in the last 24 hours following Aptos Labs' acquisition of HashPallete. The token leads the market after becoming the biggest gainer among the top 100 cryptocurrencies by market capitalization.

Related reading

Aptos will expand its presence in Asia

On Thursday, Aptos Labs, the developer of the Aptos network, x.com/AptosLabs/status/1841630980333044108″ target=”_blank” rel=”nofollow”>announced had agreed to acquire Japanese Blockchain developer HashPallete, the company behind Japan's Palette Chain and a subsidiary of HashPort Inc.

The agreement aims to become a “game changer for Japan and the Aptos ecosystem”, as the integration with the Japanese blockchain will strengthen its presence in the Asian market:

Japan has long been a center of technological innovation and is no different when it comes to blockchain. The country's unique combination of advanced technology and widespread blockchain adoption makes it a model for Web3 initiatives globally. Today, we are making one of our boldest strategic moves in this market with our agreement to acquire HashPalette Inc.

As part of the acquisition, HashPort Inc. will migrate Pallete Chain and its subsidiary's applications to Aptos Network. The Japanese chain will also have access to the development, scalability and security tools of the Aptos ecosystem.

The migration is expected to be completed in early 2025, in time for EXPO2025 DIGITAL WALLET. Additionally, Aptos Labs partnered with HashPort to support local developers, nft creators, and businesses by “continuing to build blockchain solutions (…) using the Aptos Network infrastructure.”

APT leads the crypto market

Following the announcement, APT price saw a daily increase of 11%, jumping to the $8.66 resistance level before retreating to the $8.51 mark. This performance crowned the token as the leading cryptocurrency amid the market pullback.

APT is among the few cryptocurrencies that post green numbers in most time periods among the top 100 tokens by market capitalization. The altcoin records an increase of 7.5% and 41% in the weekly and monthly timeframes.

Furthermore, its daily market volume skyrocketed 41.7%, reaching a trading volume of $769.6 million in the last 24 hours. The token's performance was highlighted by several crypto analysts, who considered APT to have the “most interesting chart” at the moment.

According to Yuriy of BikoTrading, the cryptocurrency seems x.com/Yuriy_Biko/status/1841788813871362257″ target=”_blank” rel=”nofollow”>strong as increasing trading volume and price performance are “signs of continued growth.” The trader noted that APT price remained above the key resistance zone amid the market pullback, sending the token above Q3 highs.

Similarly, cryptocurrency trader Osbrah x.com/theOsbrah/status/1841819265122332836″ target=”_blank” rel=”nofollow”>fixed that APT has been “secretly climbing its way to the hottest alternative charts.” He noted that after the October 1 market sweep, the token had a “clean bullish retest” above the $8 mark.

For the trader, the next major resistance is at the $9 mark, which could send APT price to the $7.95 support zone if it fails to regain it. Meanwhile, another market observer suggested that the altcoin's performance could be close to a breakout.

Related reading

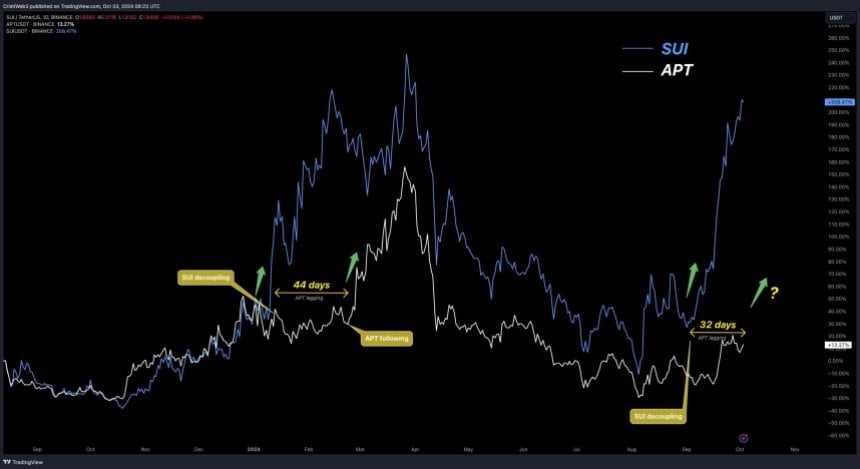

According to the publication, SUI and APT followed a “catch-up” path over the past year, moving closely together until SUI decoupled in early 2024. This led to a 44-day delay period for APT before following the SUI movements. After that, APT rose 98% to its yearly high of $18.8 in mid-March.

Now, APT has experienced a 32-day lag period after SUI undocked again in September, showing “incredible amounts of strength.” Based on this, the analyst suggests that the cryptocurrency could follow SUI's trajectory and start a massive rally in the next two weeks if history repeats itself.

Featured image from Unsplash.com, chart from TradingView.com