Every bull run begins with a spark of capital inflows, something that excites those watching enough to cause FOMO. As a result of that FOMO, traders and paper holders get excited about having “this damn currency that just doesn't do anything.” All while watching others line up and then abandon their positions at the wrong magical moment.

It's not about catching the first wave of face-melting gains. It's about using that as an indicator to see how these things have actually worked. However, there is a drawback. You should only try this if you understand to this process to succeed, must be observed and executed with little or no emotion. Also Don't listen to social media either or you will almost certainly fail.

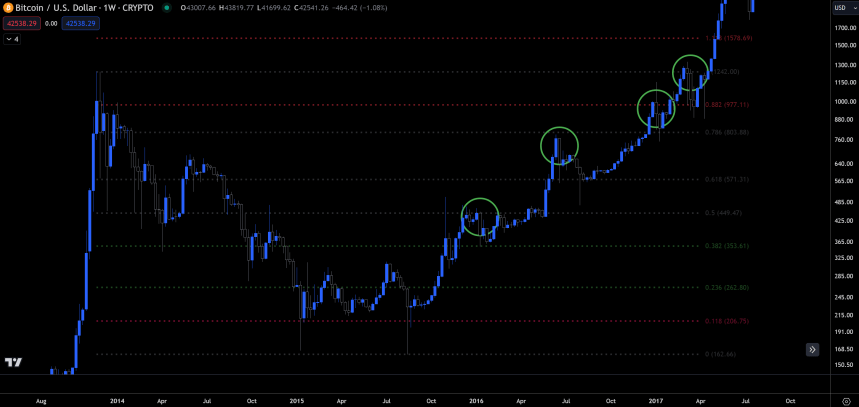

Capital flows downward like water. That being the case, let me tell you what we do know. Every bull run that preceded us began with bitcoin rising to the 0.50 Fibonacci mark. Only when btc crossed that mark did things get exciting. The lockdown from the 15th to the 17th will be the main focus of this article, due to the limit on the word count.

Step one: where do I start?

Since the bear market lows, bitcoin has been the safest bet until .50 lie. After We have to monitor our radar to detect what has technically occurred in mid-cap stocks that are doubling (+/-) btc gains in the same time period. Rotate the allocated trading amount without excuses, no “hodling” based on feelings, or “the team”, etc. It's not so much about that, but about the current eyes on them. Additionally, like Solana this cycle and ethereum during run 15-17, there should be plenty of time to scale. outside.

Step two: rotation time

After that, I scale earnings to the fundamentally stronger large- and mid-cap companies. cCurrently, eth/btc's reversal (since writing price skyrocketed) indicates that, and its strongest within the family are the ones to watch right now (as seen in the chart below).

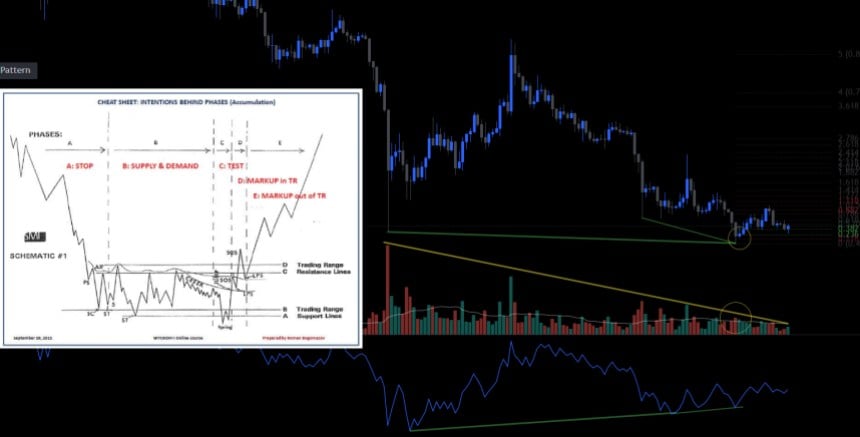

Fortunately, with some education and trading experience, the timing of these things becomes much less of a guessing game. If you study Elliott Wave Analysis, Wyckoff Schemes, Chart Patterns, Volume, etc. When you do it right (as seen in the chart below), you can be at the forefront of these runs. Which leads to a very happy trading account.

Where I move the weight next has been to the clear Fibonacci extensions of the runners, (who I have measured it by its previous movements). I have seen it in this place too many times not to understand and appreciate that history may not repeat itself, but it often rhymes. You can more easily identify the following brokers through their technical breakouts that took place when bitcoin moved up the fib scale and corrected at major interest points (as seen in the chart below).

This mechanic runs the entire line, passing through small caps, microcaps, NFTs, etc. The way to make massive profits is relatively easy in a bull market if you are in it from the beginning. The next trick is to keep the profits.

Step Three: Secure Profits

To retain profits, there are several ways to measure targets, as mentioned above with Fibonacci. extensionsvolume paired with weekly candles, sentiment, Fibs, Elliott Waves and Wyckoff distribution schemes They are more than enough to leave each run with suitcases of benefits. So if that's something that important to you, or take the time put in the work to learn for yourself or always be at the whim of the advice of others.

If you're interested in what I'm doing and when, stay tuned to NewsBTC or follow me on Twitter for breakout charts and other relevant charts when I post them, as the run continues, or text me if you want more information.

I leave you with some warnings that I have tried to share with my students and those close to me, which are expressed from experience and are only expressed in the hope that these words will protect anyone who reads this from the same harsh lessons that I and Everyone I know in this place has found out the hard way, at least once…

When you feel invincible, make profits. When your extended family or friends start asking you for advice on buying cryptocurrency, carry profits, and conversely when they tell you to sell, don't do it. Finally, one of the most useful tips I have learned is: just point for the “meat of the movement”, not the exact top.

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.