Key control

- Franklin Templeton has expanded its Tokenized Treasury Fund to Solana, which makes it the eighth blockchain platform for Fobxx.

- The firm recorded on Monday the Franklin Solana Trust, indicating plans for an ETF Solana in the United States.

Share this article

Franklin Templeton, managing about $ 1.5 billion in assets, is carrying its tokenized treasure fund to Solana, the company <a target="_blank" href="https://x.com/FTDA_US/status/1889675984137326679″ target=”_blank” rel=”noopener nofollow noreferrer”>announced In x today. The launch occurs after the asset manager registered his Franklin Solana Trust in Delaware on Monday.

<blockquote class="twitter-tweet” data-width=”500″ data-dnt=”true” wp_automatic_readability=”10.955056179775″>

New unlocked chain. Benji is now live <a target="_blank" href="https://twitter.com/solana?ref_src=twsrc%5Etfw” target=”_blank” rel=”nofollow noopener noreferrer”>@Solarium!

Solana is a rapid, safe and resistant censorship layer that encourages global adoption through its open infrastructure.

Download the Benji application here: https://t.co/itah6qmtns

Read more: https://t.co/4j3tdc9vhm pic.twitter.com/3aiodzkk3t

– Franklin Templeton Digital Assets (@ftda_us) <a target="_blank" href="https://twitter.com/FTDA_US/status/1889675984137326679?ref_src=twsrc%5Etfw” target=”_blank” rel=”nofollow noopener noreferrer”>February 12, 2025

The fund, also known as the United States government money fund in Franklin, or Fobxx, is now available in eight blockchains, which previously includes Stellar, Aptos, Avalanche, Arbitraum, Polygon, Base and ethereum.

“Solana is a fast, safe and resistant block chain that encourages global adoption through its open infrastructure,” the firm explained its decision.

Setting in Stellar in 2021, Fobxx has become one of the main funds of the monetary market in the world.

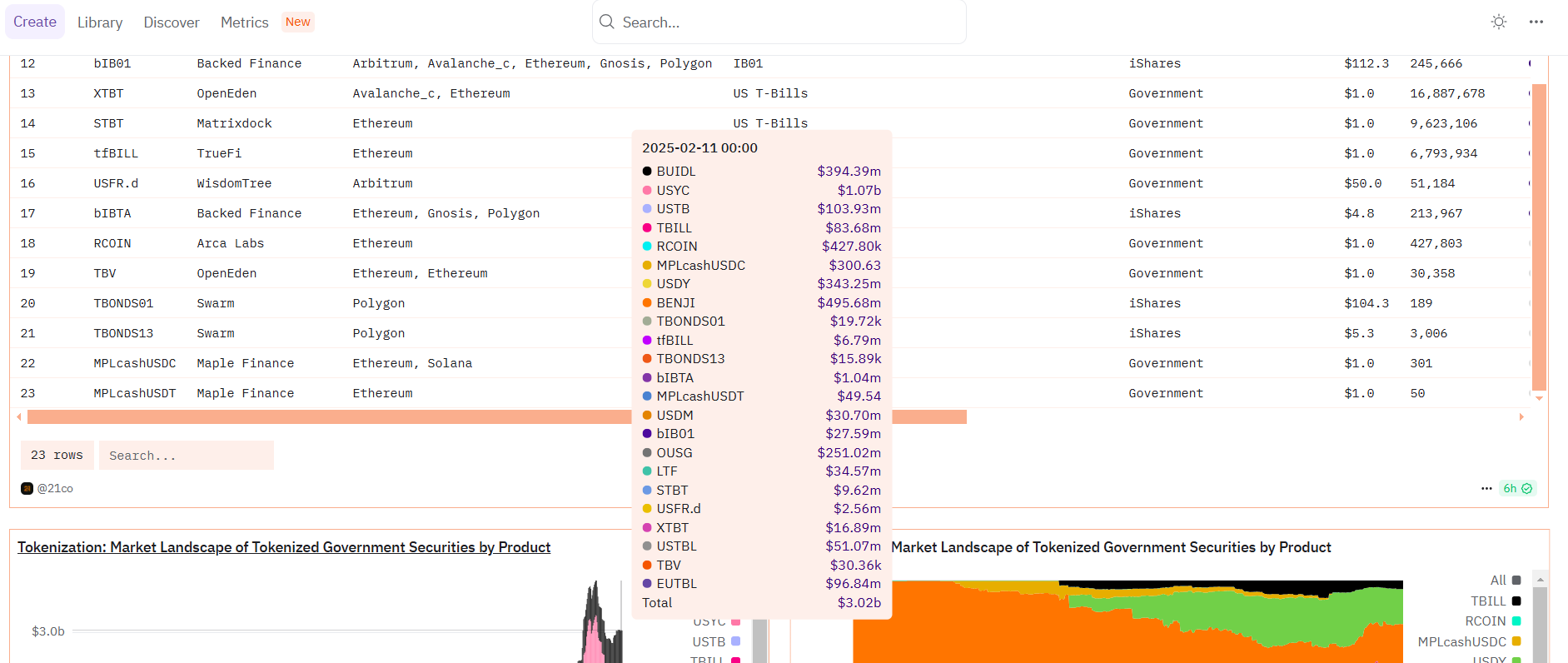

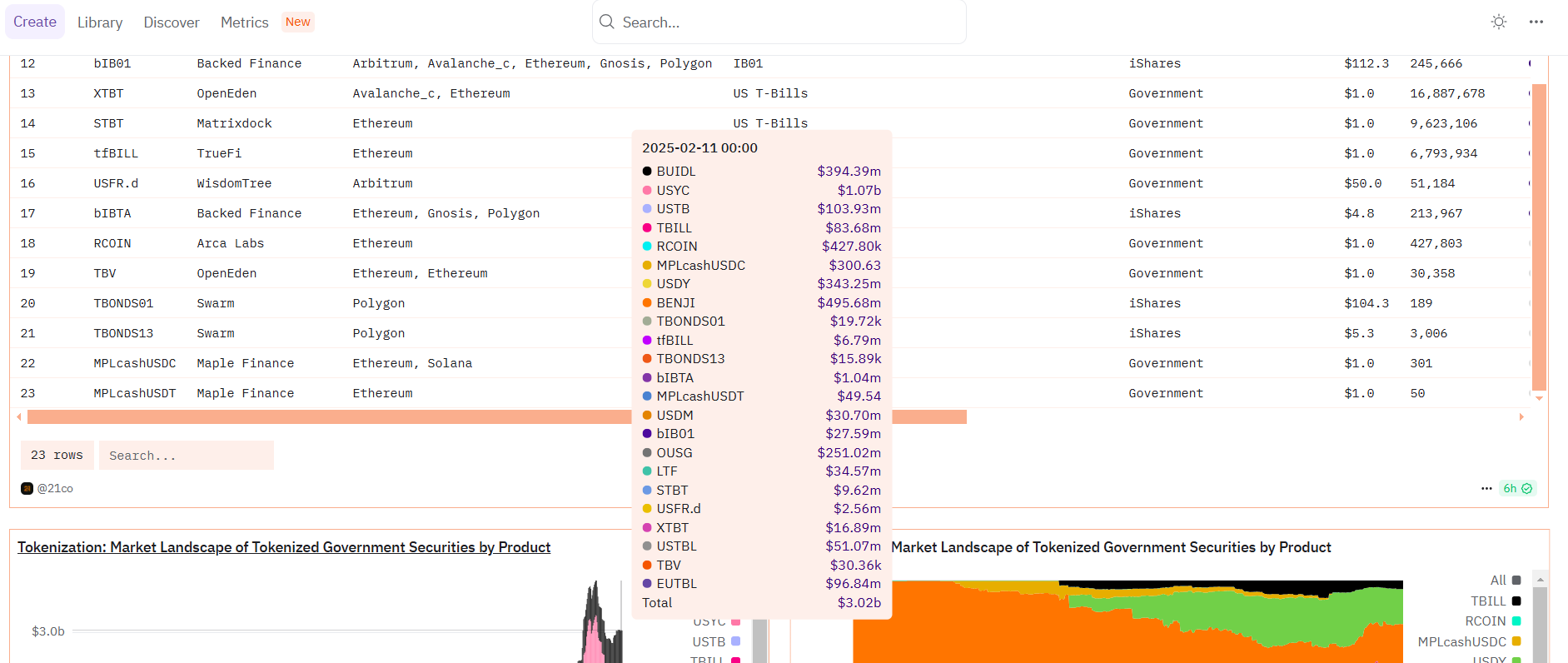

As of February 11, the Fund had around $ 495 million in market capitalization, only behind USYC, the Hashnote International Duration Duration Detention Fund Ltd. (SDYF) chain (SDYF), with a market capitalization higher than $ 1 billion, according to Dune analysis.

The Blackrock's Institutional Digital Liquidity Fund (Buidl), which immediately challenged Fobxx after its launch last year, had approximately $ 394 million in market capitalization as of Tuesday.

Buidl previously exceeded Fobxx to lead the tokenized treasure funds.

Early endorsement

The Wall Street giant has shown a continuous interest in the Solana ecosystem.

After the approval of the bitcoin Spot ETF sec that are quoted in the US, including EZB of Franklin, the firm shared a series of publications in x that were interested in the vision of Anatoly Yakovenko, co -founder of Solarium.

Franklin also pointed out key developments in the Solana ecosystem in the fourth quarter of 2023, such as advances in Depin, Defi, the Meme Coins Market, nft innovation and the launch of the Firecerncer scale solution.

The asset manager established Franklin Solana Trust in Delaware this week, indicating plans to launch a Solana ETF in the United States.

The Registry of the Trust Trust Company CSC has indicates Franklin's intention to present the necessary forms with the SEC to officially introduce the ETF, which aims to trace the sun price movement, the fifth largest cryptography by market capitalization .

Share this article

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER