XRP and Solana led all entries of bags listed in the stock market (ETP) based on Altcoin during the week ending on March 21, with $ 6.71 million and $ 6.44 million respectively, according to the Coinshares digital asset investment signature.

Other Altcoin tickets were relatively Modesto, with Polygon (MBIC) registering $ 400,000 and Chainlink (link) adding $ 200,000.

The feeling towards Altcoins remained mixed in general, since Ethher (eth) only saw significant outputs for a total of $ 86 million. Other notable outputs included Sui (SUI), with $ 1.3 million, Polkadot (DOT), with $ 1.3 million and Tron (TRX) with $ 950,000.

Although Ether's substantial exits drag through the Altcoin sector, digital assets collectively reversed a five -week streak of net exits, registering tickets of $ 644 million. bitcoin (btc) led this recovery with tickets that amounted to $ 724 million, breaking its own five -week negative streak.

ethereum's outlets reduce the performance of ETP Altcoins, but bitcoin has digital assets. Source: Coinshares

As Cointelegraph reported, ethereum has now experienced net weekly exits for four consecutive weeks, while bitcoin registered its largest net entrance since January.

Related: bitcoin ETFS records the first net entries in weeks, while ether exits continue

Feeling in ETP digital assets that changes around the world

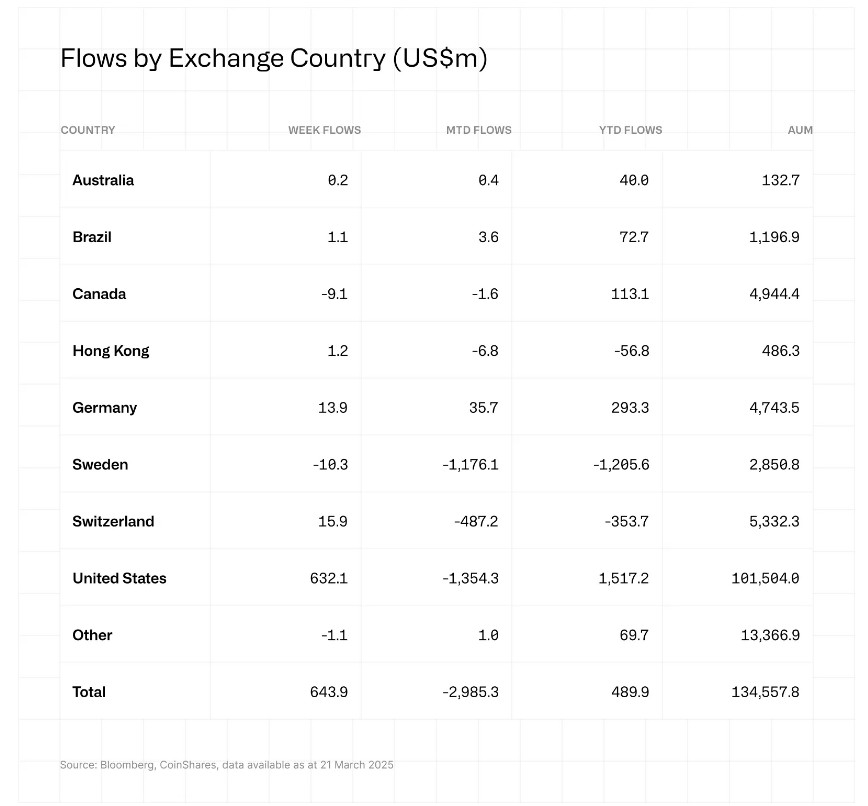

Coinshares said that most tickets originated in the United States, which represented $ 632 million, mainly driven by Blackrock Ishares bitcoin (Ibit) from Blackrock.

However, the positive feeling extended beyond the United States, with Switzerland leading other regions at $ 15.9 million, closely followed by Germany ($ 13.9 million) and Hong Kong ($ 1.2 million).

Canada and Sweden lead the outputs. Source: Coinshares

Stars that are aligned for Solana and XRP

Although Altcoins suffered collectively a net exit flow promoted mainly by the performance of ethereum, Solana and XRP emerged as the leading artists of Altcoin.

In the case of Solana, the US market is ready to introduce its first funds quoted by the exchange of Futures de Solana (ETF), which potentially pave the way for a future ETF of Solana.

Related: XRP and Solana run towards the next approval of Cripto ETF

In the case of bitcoin, the approval of the ETFs based on futures was initially favored by regulators due to the existence of a regulated market (the Chicago Mercantile Exchange), which provided guarantees against the potential manipulation of the market. However, this increased controversy over the continuous rejection of the ETF of bitcoin Spot ETF, which directly support the cryptocurrency.

A fundamental demand of Grayscale successfully challenged this inconsistency, which forced the SEC to visit its position again and, ultimately, racing the way for the approval of the long -awaited ETF of bitcoin.

Meanwhile, XRP has seen a significant impulse of the recent dismissal of the SEC of its long -term demand against Ripple Labs.

Magazine: Memecoins are dedicated, but Solana '100x better' despite the drop in income

NEWSLETTER

NEWSLETTER