The price of Ether (eth) decreased by more than 11.75% in the last 24 hours to around $ 1,900. In its minimum intradic, the cryptocurrency was quoted for $ 1,755, its lowest price since October 2023.

eth/USD four -hour price chart. Source: TrainingView

Several factors seem to be contributing to eth price losses, which include:

-

The fears of the recession of the United States and its general impact on risk markets.

-

Massive long liquidations in the cryptography market.

-

Cryptographic loans backed by eth as risks of liquidation in collateral.

-

Bassist technicians.

Ether's price decreases with risk assets

Ether's continuous price is reflected a similar decrease in the broader market risk due to unfavorable macroeconomic conditions.

Key points:

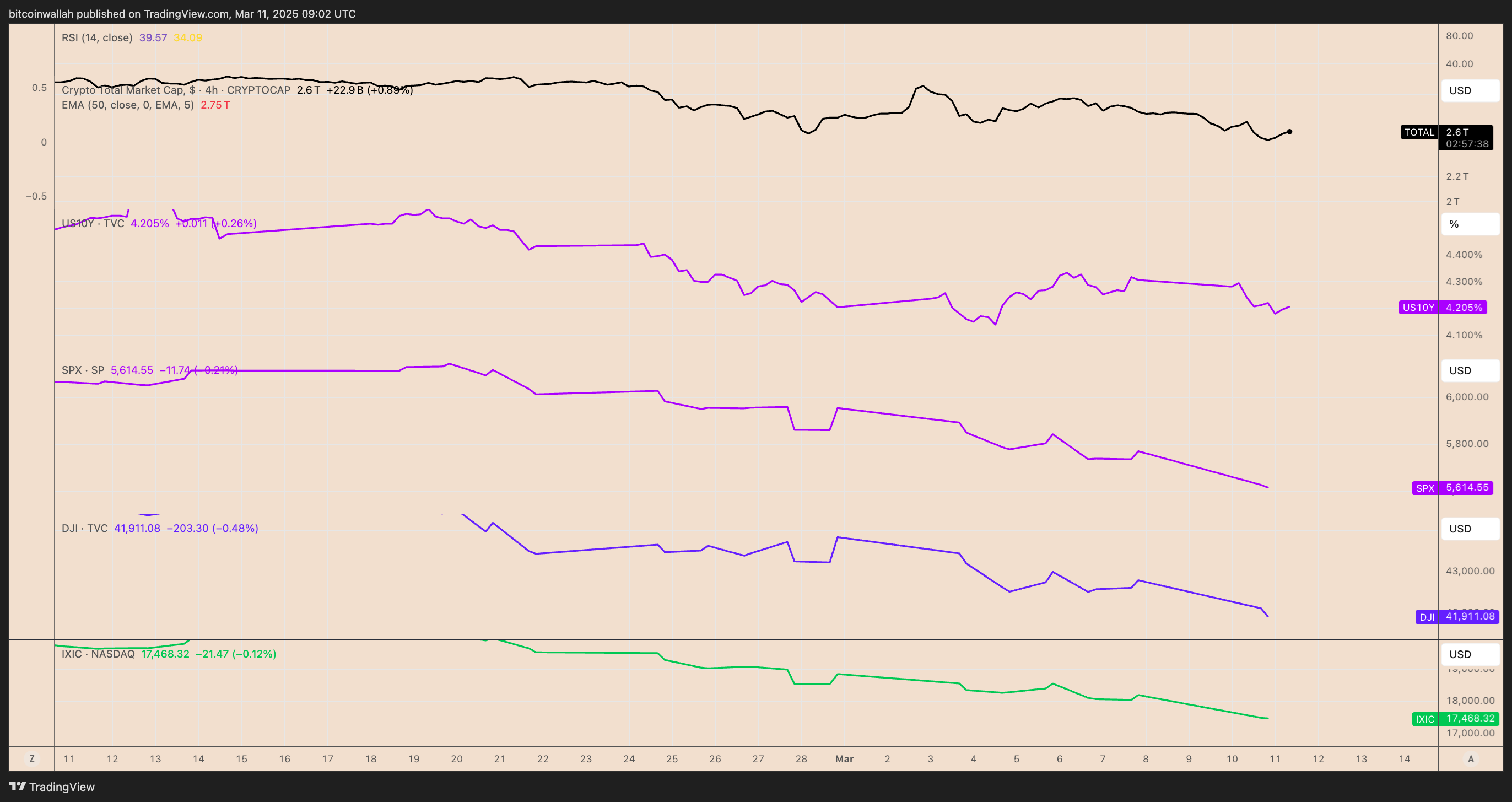

Total crypto Market Cap vs. Nasdaq, Dow Jones, S&P 500 and US 10 years of 10 -year Treasury Note produces a four -hour table. Source: TrainingView

-

JPMorgan increased the risk of recession of the United States to 40% by 2025, compared to 30%, citing the “extreme policies of the United States” by US President Donald Trump as a key risk factor.

-

Goldman Sachs also increased its probability of recession from 12 months to 20%, compared to 15%.

-

At the beginning of March, Trump imposed 25% tariffs on all goods in Mexico and Canada, and 10% of Chinese import tariffs.

-

Canada and Mexico have announced intentions to impose retaliation rates on US assets, increase commercial tensions and generate concerns about a possible commercial war.

-

Meanwhile, China has already retaliation increasing tariffs on multiple American products and imposing export controls and investment restrictions on 25 US companies.

-

These tariffs are expected to increase consumer prices and contribute to the inflation of the United States.

The fears of the United States are affecting ethereum and the cryptographic sector, especially:

-

Ether, bitcoin and other high-ranking cryptographic assets have historically decreased during periods of economic turbulence, for example, the sale of COVID-19 in March 2020.

-

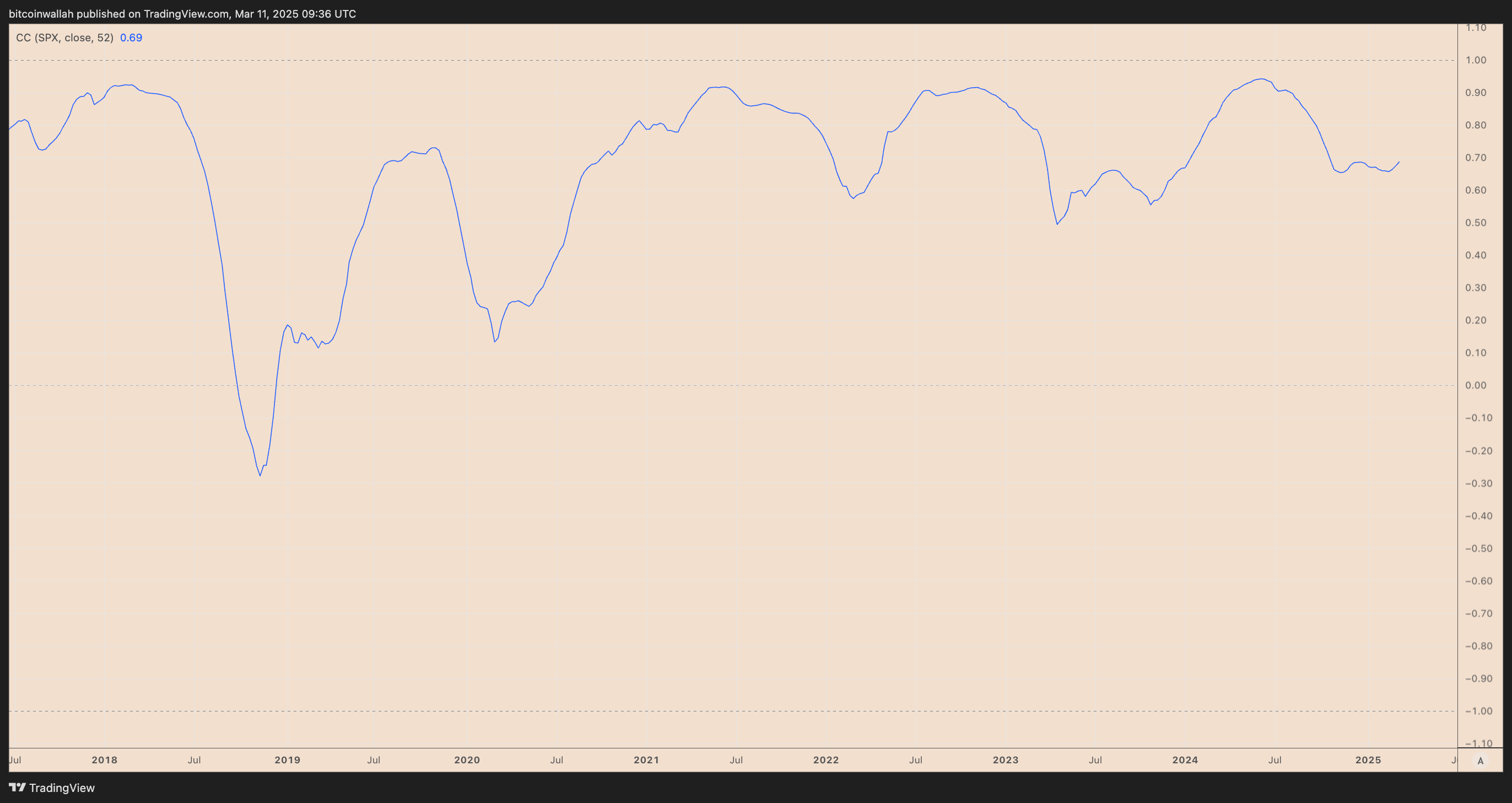

As of March 11, the 52 -week correlation between the cryptographic market and the US reference index, the S&P 500 index, was 0.69.

Total crypto Market Cap and 52 -week correlation coefficient of S&P 500. Source: TrainingView

-

A consistently positive correlation increases the chances of a decrease in the cryptography market if US actions continue to fall, especially as the commercial war drags more thoroughly.

-

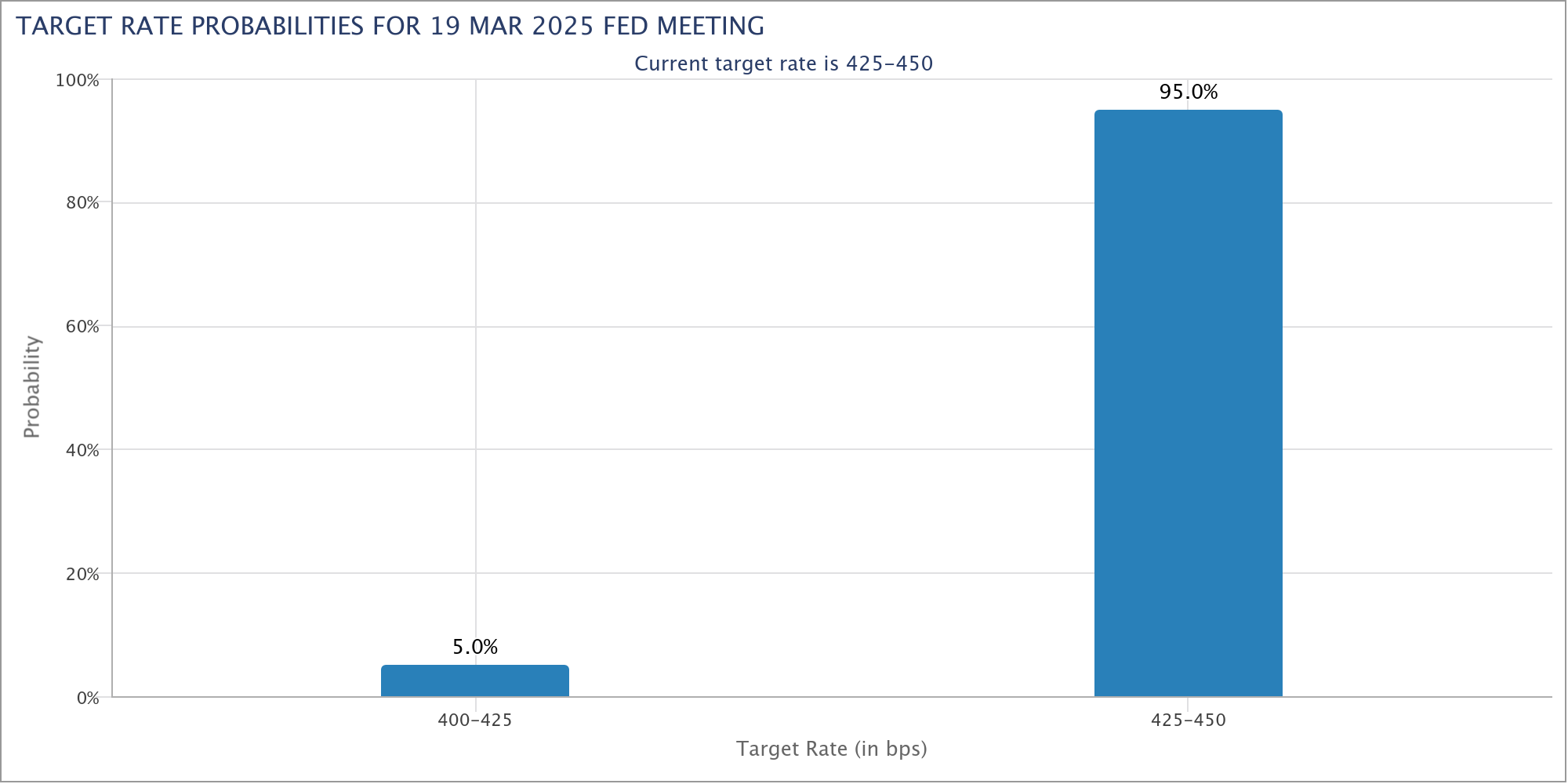

Bond merchants do not see a need for a rate cut before June, with CME data showing 95% and 52.5% probabilities of a pause in the meetings of the march of the FED and May, respectively.

Objective rate probabilities for the March Fed meeting. Source: CME

Defi bad loans increase ether sales pressure

TO <a target="_blank" data-ct-non-breakable="null" href="https://info.sky.money/collateral/core/eth-C/cdps/0x6f8019bb195b47e9f7d7ef65b97e3ad5de3ea843/” rel=”null” target=”null” text=”null” title=”https://info.sky.money/collateral/core/eth-C/cdps/0x6f8019bb195b47e9f7d7ef65b97e3ad5de3ea843/”>Defi loan of $ 74 million In the sky protocol, guaranteed with $ 130 million in eth, it was almost settled after the ether price fell below the liquidation level just above $ 1,900.

As happened:

-

The borrower $ 34 million was added in eth as a guarantee to avoid liquidation.

-

He withdrew $ 1.6 million in USDT from Binance, changed it for DAI and deposited in Maker.

-

The debt reduced to $ 73.1 million, while the eth price continued to decrease.

-

The level of liquidation remained at $ 1,836 per eth, closer to the current price of eth over $ 1,900.

-

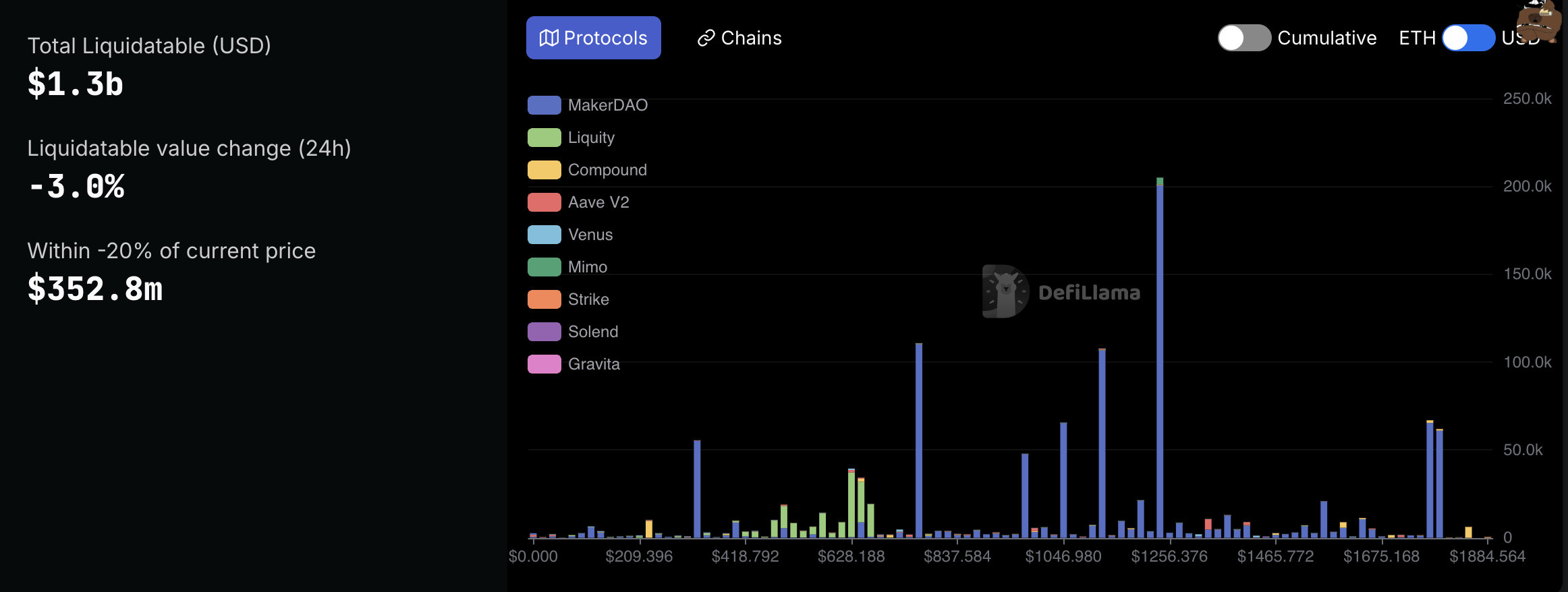

Nearly <a target="_blank" data-ct-non-breakable="null" href="https://defillama.com/liquidations/eth” rel=”nofollow noopener” target=”_blank” text=”null” title=”https://defillama.com/liquidations/eth“>$ 353 million in debt are linked to such loansrisking the liquidation if the price of eth falls 20% from here.

ethereum settlement levels in Defi. Source: Defillama

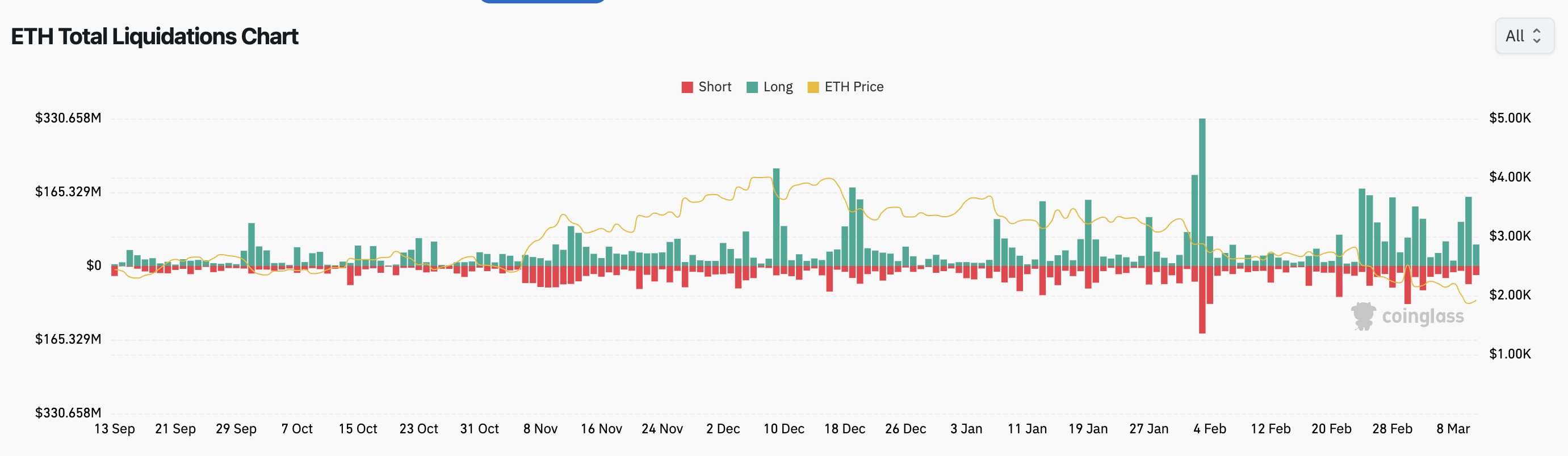

Long liquidations accelerate the descending trend eth

The fall of Ether in the last 24 hours coincided with a wave of long liquidations that forced the merchants to get out of their leverage positions.

Key control:

-

More than $ 240 million were eliminated in eth positions in the last 24 hours, with long liquidations representing $ 196.27 million, or 82% of the total.

eth Total settlement settlement. Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://www.coinglass.com/currencies/eth” rel=”nofollow noopener” target=”_blank” text=”null” title=”https://www.coinglass.com/currencies/eth“>Horn

-

The sharp drop in price triggered a waterfall of forced liquidations since the merchants opted for the increase in ethereum prices.

-

When leverage long positions fail to maintain margin requirements, exchanges automatically sell their holdings to cover losses.

-

These liquidations accelerate the price of the decrease, exacerbating the recession.

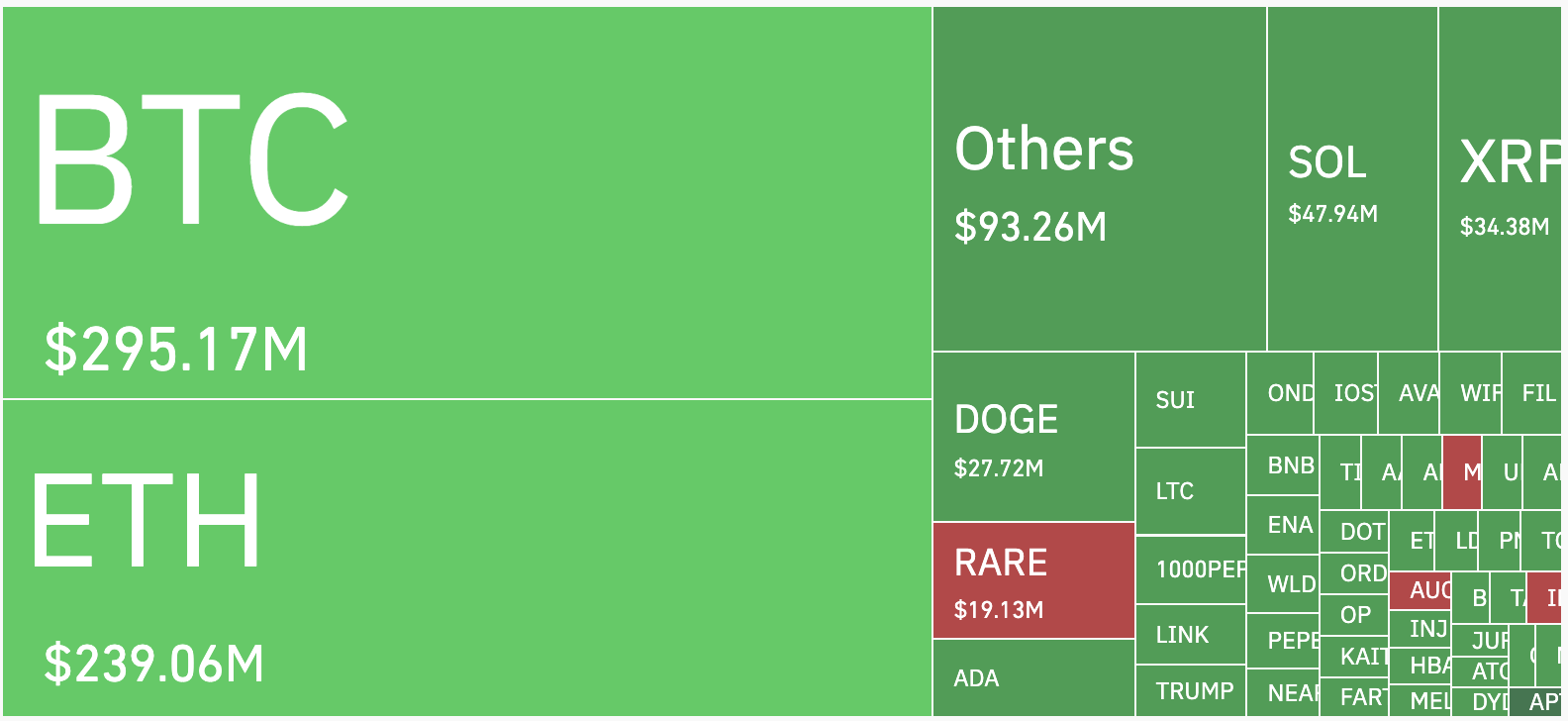

-

The broader encryption market also experienced an acute disappointment eventwith total liquidations that reach $ 897.26 million in assets.

Cryptographic market settlements (24 hours). Source: TrainingView

Ether's eyes decrease even more around $ 1,700

From a technical perspective, the decrease in Ether prices today is part of its inverse-how and management pattern (IC & H).

Key points:

eth/USD daily pricing table. Source: TrainingView

-

A temporary consolidation (mango) was formed about $ 2,700, indicating an attempt to break down.

-

eth broke below the key support levels, confirming the breakdown of IC & H, which led to more losses.

-

The pattern measured movement objective suggests a potential decrease towards $ 1,700, aligning with the dotted support level.

-

The 50 -day EMA ($ 2,600) and the 200 days EMA ($ 2,929) remain well above, reinforcing the bassist feeling.

Key levels to see:

-

eth Price is within a descending channel pattern since the end of February.

-

As of March 11, the eth/USD torque increased after testing the lowest channel of the channel as support.

eth/USD four -hour price chart. Source: TrainingView

-

Such rebounds have brought prices towards the higher trend line in recent history.

-

If the fractal is repeated, the next eth rise target could be around $ 2,000, aligning with the fibonacci recoil line 0.236.

-

A reversal of current price levels could cause eth to test the low IC & H target of $ 1,700.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER