Ether (ETH) price turned lower on Dec. 16 and the pre-FOMC rally to $1350 was wiped out after Federal Reserve Chairman Jerome Powell issued hawkish remarks following a 0.50% rate hike of interest.

The price of ether took another hit when Silvergate Capital Corporation decided to voluntarily liquidate Silvergate Bank. Silvergate Bank was one of the top crypto banks before a wave of companies abandoned its services due to liquidity problems.

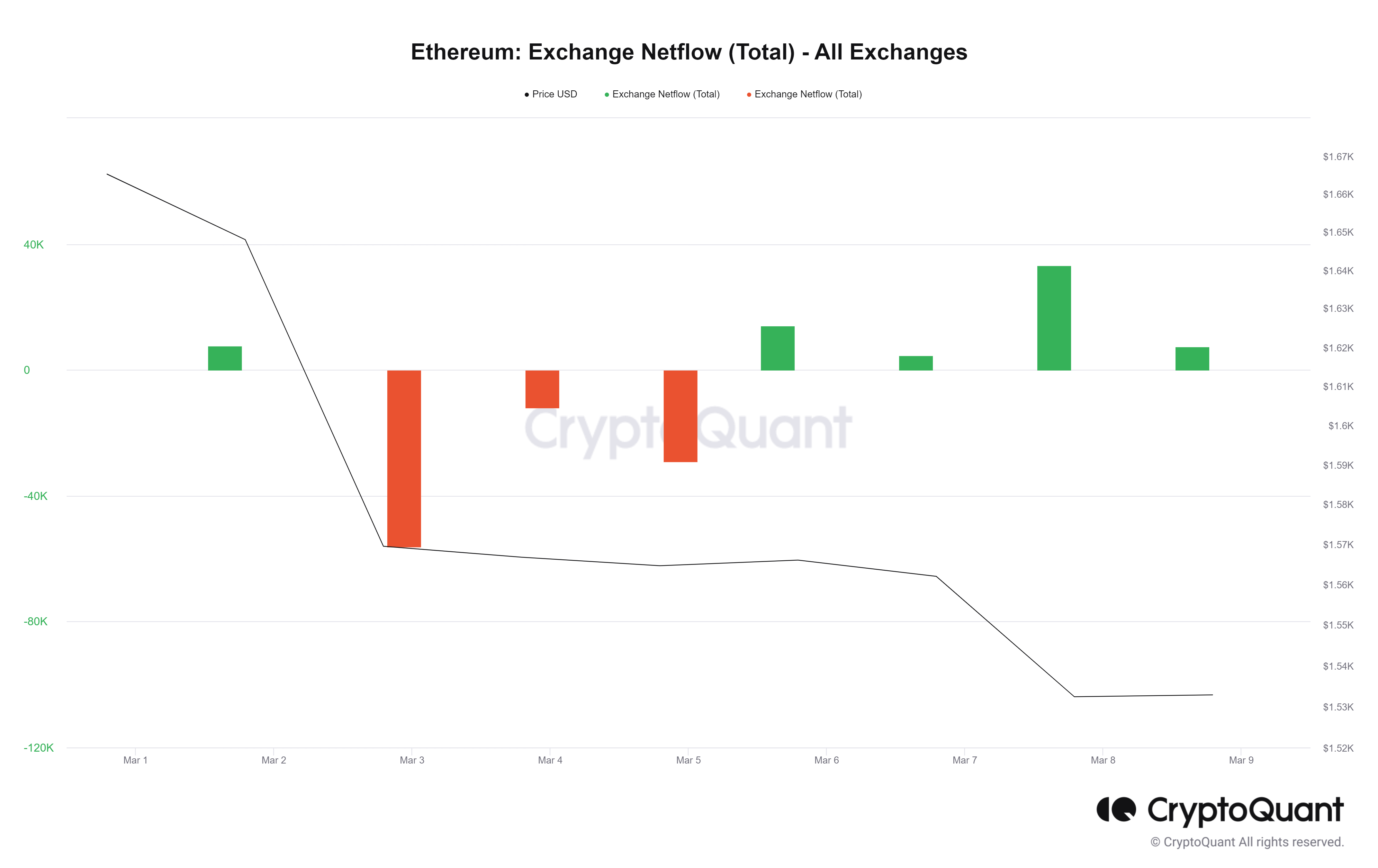

The Ether selloff also triggered a wave of Ethereum long selloffs, totaling $70 million from March 1-8.

The rush of Ether long selloffs comes as Ethereum volume, which could offset selloffs, is down 90% since March 2020.

While some analysts believe that Ethereum still possesses multiple bullish catalysts that justify investing in the asset, on-chain data paints a bleak picture of its near-term price prospects.

Here are three reasons why the Ether price is down today.

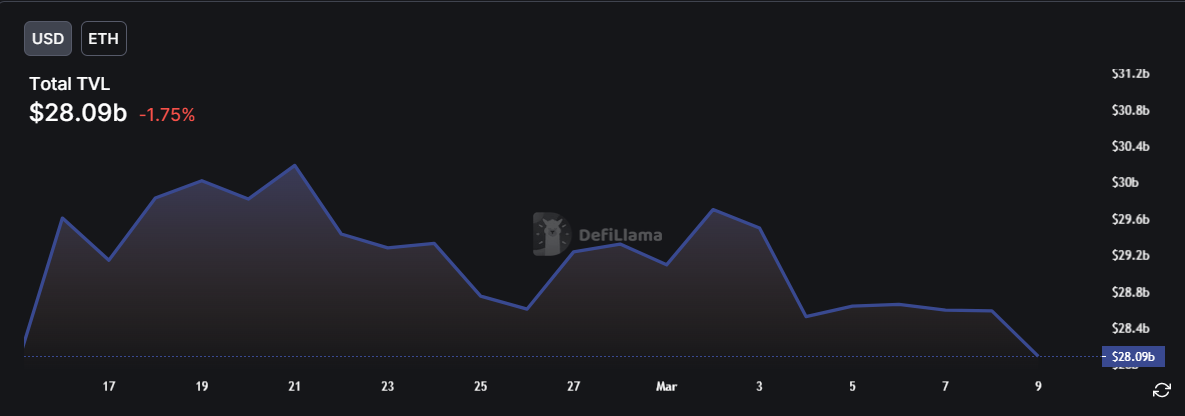

The total value locked in the Ethereum ecosystem decreased in March

The total value locked metric is a common way to examine the health and sentiment of a proof-of-stake (PoS) blockchain like Ethereum. The price of Ether fell as the TVL across the Ethereum ecosystem fell from a monthly high on March 2 of $29.7 billion to a monthly low of $28.1 billion. The monthly low was accompanied by a 24-hour decline of 1.75% in TVL on March 9.

The Ether price drop comes as the centralized exchange net flow shows investors sending more funds to a CEX than withdrawing to a decentralized exchange. On March 7, an additional 21.7 million Ether was sent to centralized exchanges from which it was withdrawn. Typically, investors tend to move funds into a CEX to sell into deep liquidity.

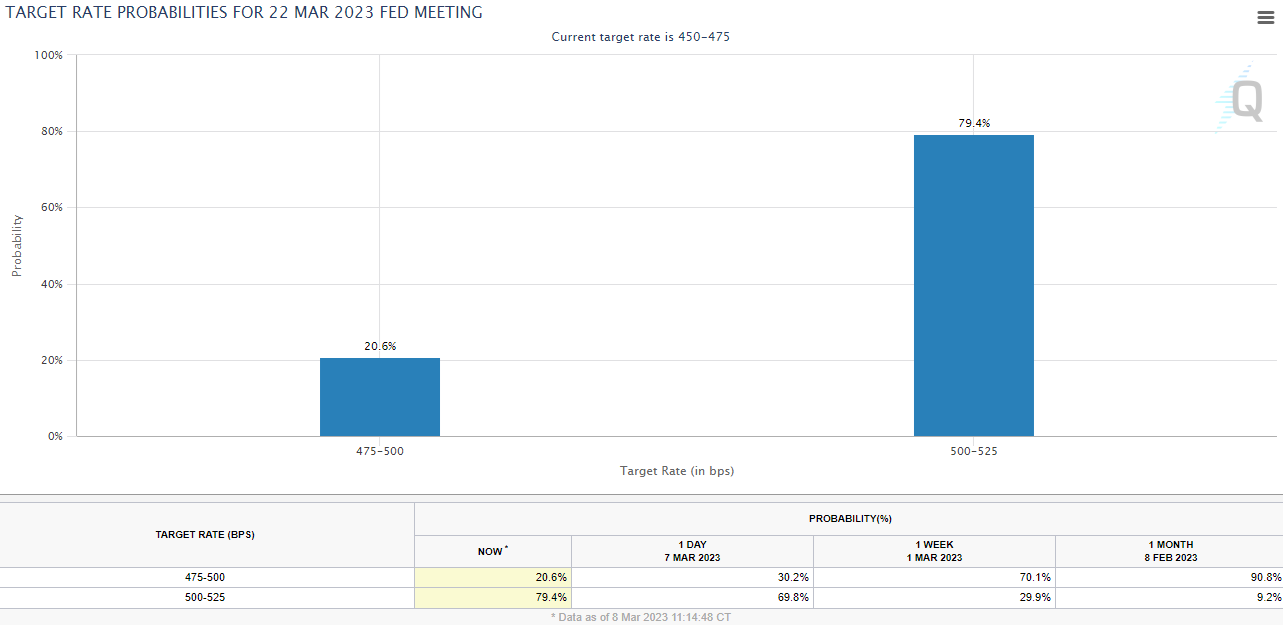

Rising inflation sparks fears of further rate hikes

On March 7, Federal Reserve Chairman Powell addressed the US Senate Committee on Banking, Housing, and Urban Affairs on the Semi-Annual Monetary Policy Report to Congress.

in prepared commentsPowell hinted at higher interest rate hikes to control inflation,

“The latest economic data has been stronger than expected, suggesting that the final level of interest rates is likely to be higher than previously anticipated. If the totality of the data indicates that faster tightening is warranted, we would be prepared to accelerate the pace of rate hikes. Restoring price stability will likely require us to maintain a tight monetary policy stance for some time. Our overall approach is to use our tools to bring inflation down to our 2 percent target and keep long-term inflation expectations well anchored.”

Powell’s comments reverberated throughout the stock market, which correlates closely with the price of Ether. After anticipating an interest rate increase of just 0.25% basis points on March 1, according to CME’s FedWatch tool, the market now expected an interest rate increase of 0.5% basis points.

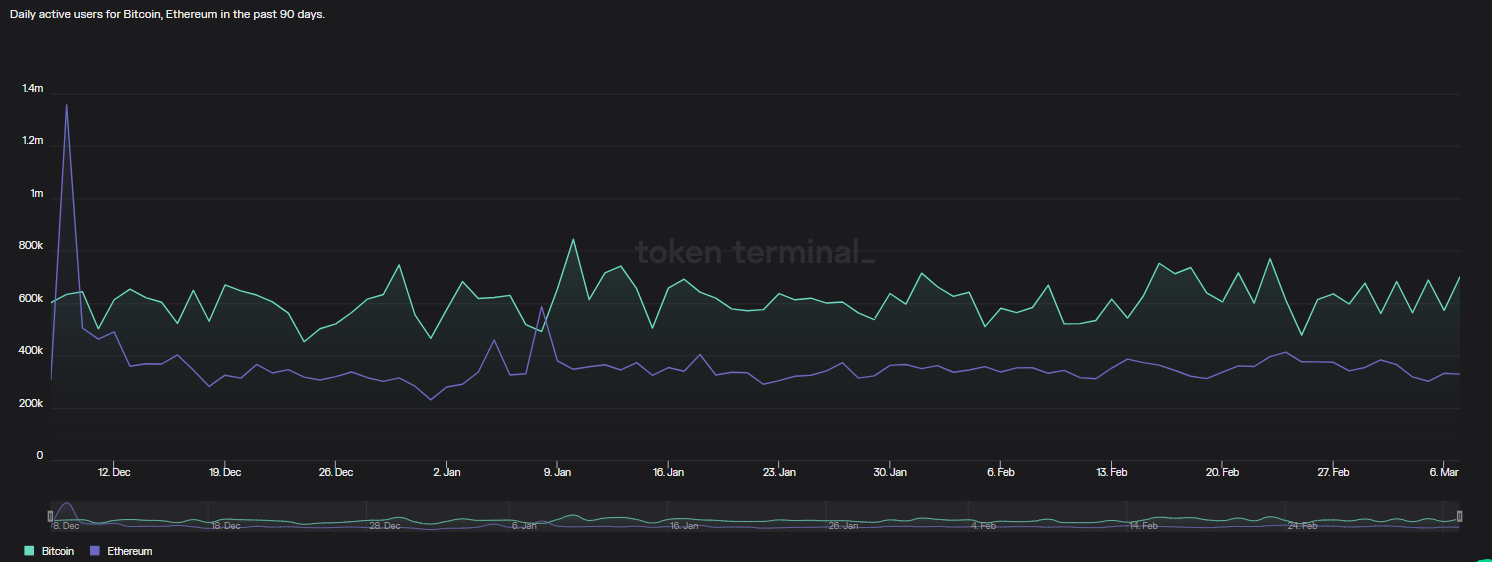

Ethereum Daily Active Users Decline Ahead of Shanghai Update

Despite briefly outperforming Bitcoin (BTC) for most active users on Jan. 8, the Ethereum network continues to see less activity than BTC. In addition to Bitcoin maintaining more active users than Ethereum, one of the top Ethereum-based NFT companies, Yuga Labs launched a BTC blockchain-based NFT auction on March 7 that raised $16.4 million.

Investor expectations for 2023

Initially, the Shanghai hard fork was scheduled for March 14. On March 2, the Ethereum developers announced a delay in the hard fork until April. Despite on-chain data suggesting that the Shanghai hard fork will not generate massive selling pressure, the price of Ether is likely to remain volatile.

While investor appetite for risky assets and interest in DeFi could continue to wane with rising US interest rates, it will prove to be a long-term catalyst for price growth.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER