On-chain data suggests that Ethereum is in a better long-term growth position than Bitcoin and therefore could see gains even after BTC’s rally ends.

The Ethereum exchange reserve has not increased that significantly yet

As an analyst in a CryptoQuant mail He noted, investors have been depositing Bitcoin on exchanges recently. The indicator of interest here is the “exchange reserve”, which measures the total amount of a cryptocurrency currently stored in the wallets of all centralized exchanges.

When the value of this metric decreases, it means that the given asset is exiting the exchanges at the moment. Generally, when prolonged, this trend can be bullish for price, as it suggests that investors may be hoarding.

On the other hand, the drop in the value of the indicator implies that holders are depositing their coins on these platforms. As one of the main reasons why investors would transfer their holdings to exchanges is for selling purposes, such a trend may turn out to be bearish for the price of the cryptocurrency.

Now, here is a graph showing the trend in the Bitcoin exchange reserve over the past few weeks:

The value of the metric seems to have been sharply going up in recent days | Source: CryptoQuant

As shown in the chart above, the Bitcoin exchange reserve declined at the beginning of the month when the price dipped below the $20,000 level. This suggests that fresh buying was taking place at these lows.

However, since the rally restarted, the value of the indicator also reversed its trend and rose sharply along with the price. This could mean that holders may be rushing to sell their coins while the opportunity for profit remains.

However, it is difficult to say how many deposits are made for this purpose, as the indicator used here measures the reserves of spot platforms (which investors use to buy and sell) and derivatives exchanges.

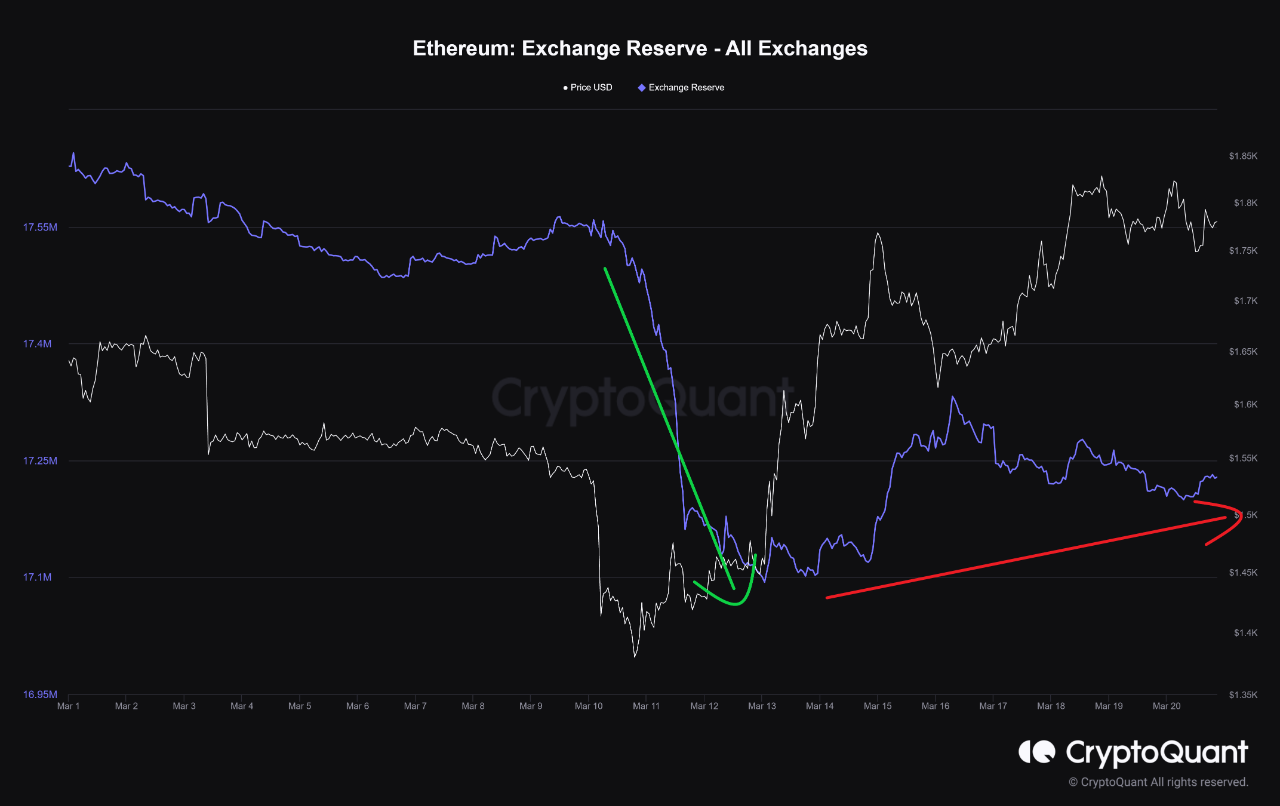

Below is another chart, this time for the Ethereum exchange reserve.

Looks like the value of the metric has seen a slight increase recently | Source: CryptoQuant

From the chart, it is evident that, like Bitcoin, Ethereum’s exchange reserve crashed around recent lows, and the metric has also been on an uptrend during the last price surge.

However, the pace at which ETH deposits have been made is different. The BTC inflows were rapid and the total amount of coins coming in during this surge exceeded the amount withdrawn during the lows. However, the ETH exchange reserve has been growing slowly and is still far from the level seen before the recent lows.

This could suggest that Ethereum is not yet facing selling pressure of the same intensity as Bitcoin. Because of this, the analyst thinks that even after the BTC rally ends, ETH could be expected to continue to see a strong rise.

ETH price

As of this writing, Ethereum is trading around $1,800, up 3% in the past week.

ETH has surged during the last few hours | Source: ETHUSD on TradingView

Featured Kanchanara Image on Unsplash.com, Charts from TradingView.com, CryptoQuant.com

NEWSLETTER

NEWSLETTER