Share this article

Circle brought its native USDC to Arbitrum, Ethereum’s leading Layer 2 scaling solution, making Arbitrum the ninth blockchain to extend support for USDC. according to the official Circle announcement.

The newly enabled feature allows businesses using Circle to conveniently exchange USDC between supported chains, avoiding the costs and delays typically associated with bridging transactions:

3/ With a Circle account, businesses can access Arbitrum’s USDC on-ramps and easily exchange USDC between supported chains, avoiding the costs and delays associated with bridging.

— Circle (@circle) June 8, 2023

After a recent bug in Arbitrum’s Sequencer software that caused A temporary discontinuation of on-chain transaction verification, Circle’s USDC introduction to the Arbitrum network now allows developers, businesses, and users “to access Arbitrum USDC and take advantage of the faster settlement times and lower costs it offers.” the Arbitrum network,” according to the announcement. .

Arbitrum, one of Ethereum’s Layer 2 scaling solutions with a TVL of $2.2bn, leverages Optimistic Rollup technology to increase transaction performance of decentralized applications while maintaining security features of the Ethereum blockchain.

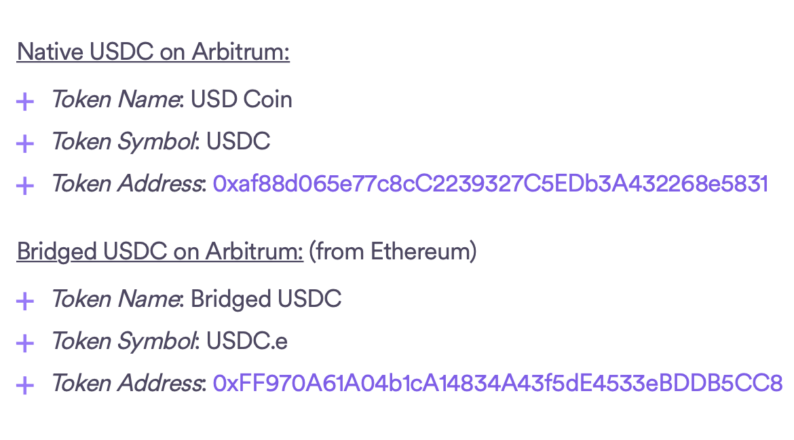

Circle’s implementation of native USDC in Arbitrum maintains a 1:1 ratio with USD, with Arbitrum launching a bridge USDC called USDC.e, not issued by Circle. Plans are in place to smoothly transition liquidity from USDC.to USDC over time:

Circle Account and Circle API to access Arbitrum USDC for various use cases, including schedulable, fast, and global transactions, as well as transactions, lending, and borrowing on DApps such as Camelot, GMX, and Uniswap. Users can also use Arbitrum USDC for e-commerce payments, NFT markets, and gaming.

Circle Account and APIs also simplify the process of exchanging USDC natively on all nine supported blockchains: Aave, Balancer, Camelot, Coinbase, Curve, GMX, Radiant, Trader Joe, and Uniswap.