On May 6, Ethereum Foundation transferred nearly $30 million worth of Ether (ETH) for cryptocurrency exchange Kraken, sparking market jitters about a possible sell-off event.

ETH price fell 4.8% to $1,900 on the day, but the decline has been negligible so far amid a broader recovery trend.

ETH price with key support

Ether price rallied modestly to $1,920 on May 7 after testing its 50-day exponential moving average (50-day EMA; the red wave) near $1,850 for support a day ago.

Also, price volatility fell on Kraken in said period, as per Bollinger Bandwidth contracting in the chart below. That further shows the calm of traders amid the Ethereum Foundation transfer.

Notably, the 50 day EMA has limited Ether’s downside attempts so far into 2023, barring the early March sell-off that saw the price briefly dip below the red wave. Meanwhile, testing it for support has led ETH price to look for a break above $2,000.

As a result of this support, ETH bulls may try to push the price above $2,000 again.

Conversely, a drop below the 50 day EMA could see traders eye a confluence of support comprising an uptrend line of several months and the 200 day EMA (the blue wave) near $1,700 as the next downside target, roughly 13% below the current price. levels

Even with a bigger drop, ETH would maintain its general recovery trend when measured from its June 2022 low of $880.

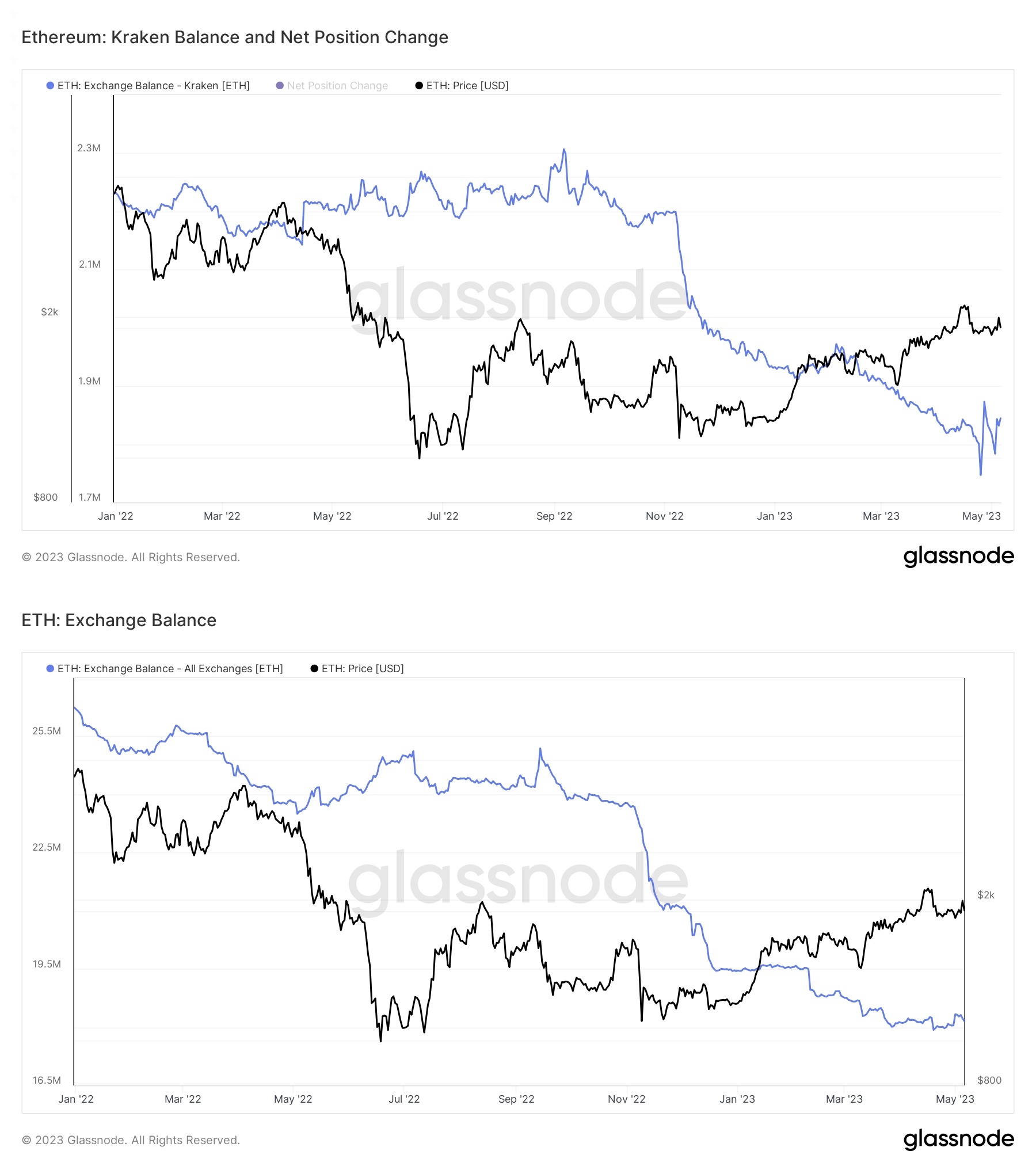

Ethereum Exchange Reserves vs. Kraken Reserves

A rising exchange balance suggests increased potential selling pressure and vice versa. In the case of Ethereum, the balance remained lower across all exchanges despite the fact that the Ethereum Foundation transferred $30 million to Kraken.

For example, Kraken’s Ether balance rose to 1.84 million ETH on May 6 from 1.83 million a day ago.

However, the balance across all exchanges actually fell to 18.15 million ETH from 18.22 million ETH on the day, indicating that any potential selling pressure from the Ethereum Foundation can be easily absorbed.

Not necessarily an ETH market cap

The last major transfer from the Ethereum Foundation was for 20,000 ETH in November 2021, when the price topped $4,850 and declined 80% thereafter. Similarly, the foundation sold 35,053 ETH at the local market high of around $3,500 in May 2021.

Related: Ethereum Up 20% In April While Markets Pro Sees 379% Rise In One Day

Many analysts treated these fractals as a sign of another possible market top formation near $2,000, arguing that the price could fall in the coming sessions.

The Ethereum Foundation sold another 20,000 Ethereum at the recent local high.

Every time the eth/Vitalik/Consensys foundation throws out a massive pre-sale bag, it marks the top.

What is the difference between dumping hundreds of millions into retail and ETH founders doing it? https://t.co/pw8ukMiR8v

— Brad Mills

(@bradmillscan) January 28, 2022

But broader data suggests otherwise. For example, the Ethereum Foundation’s large sales of ETH also occurred during the 2020-2021 bull cycle, driven by increasing demand for risk assets in a macro environment of lower interest rates.

In other words, there is little evidence to suggest that the Ethereum Foundation sales have any impact on the Ethereum price trend. Instead, the cryptocurrency market is currently taking cues from the US banking crisis and whether this will force the Federal Reserve to stop raising and cut interest rates.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER