This article is also available in Spanish.

ethereum analysts are closely monitoring the altcoin, which is stuck in a long downtrend. Some are calling for a major bullish breakout and others are maintaining a cautious stance, warning that this downtrend will continue.

Ali Martínez, a crypto analyst, is optimistic about the coin's price trajectory and states eth/usd/” target=”_blank” rel=”nofollow”>Ether would reach $10,000 in the next bull run.

Related reading

Martínez, whose research often links eth to broader market movements, has compared ethereum's rise to that of the S&P 500, suggesting that a similar breakout could be ahead.

However, not everyone is satisfied with this optimistic outlook. Peter Brandt, another crypto expert, maintains an alternative perspective. Brandt, known for his technical expertise and accurate predictions, has issued a cautionary note regarding a solid bearish pattern on the eth daily chart.

In his most recent analysis, he highlights a “bearish flag”—a descending channel—which he believes indicates potential additional downside risk.

The connection with the stock market

Martínez has based his case on the historical relationship between ethereum and the S&P 500 (SPX). When examining eth alongside SPX Martínez, it was observed that both assets bottomed at the end of 2022 and maintained an increasing trend until 2023.

<blockquote class="twitter-tweet”>

twitter.com/hashtag/ethereum?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow”>#ethereum twitter.com/search?q=%24ETH&src=ctag&ref_src=twsrc%5Etfw” rel=”nofollow”>$eth has been mimicking the S&P500, and this could be the last drop before it triples and hits $10,000! pic.twitter.com/BgpbZQXM6I

– Ali (@ali_charts) twitter.com/ali_charts/status/1853572432646299649?ref_src=twsrc%5Etfw” rel=”nofollow”>November 4, 2024

Based on the recent performance of the S&P 500, he believes this alignment indicates that eth is preparing for a similar breakout. Martinez believes eth could follow a similar trajectory, perhaps reaching the elusive $10,000 mark as the S&P 500 dipped a bit after its advance to around $5,900.

For this trend to continue, then ethereum needs a boost to around 310% higher than the current market price. At the time of writing, Ether was ethereum” target=”_blank” rel=”nofollow”>trading at $2,618an increase of 8% in the last 24 hours.

Martínez is happy with this, especially considering the development ahead in the broader market perspective, although the goal has a very steep curve; However, Brandt's warning is that eth's journey might not be as smooth as expected, especially with the emergence of bearish signals.

A mix of signals

On-chain data from IntoTheBlock indicates that ethereum holders have divided sentiment. Currently, almost 23% of active addresses holding eth are in advantageous positions, indicating that these holders are “in the money.”

While this implies that there is support at a certain level, the breakeven level of 60% of the portfolios implies that the market remains uncertain. The holding of these individuals will determine how to buy more units or sell them should the price of ethereum rise or fall over the coming weeks.

More losses ahead?

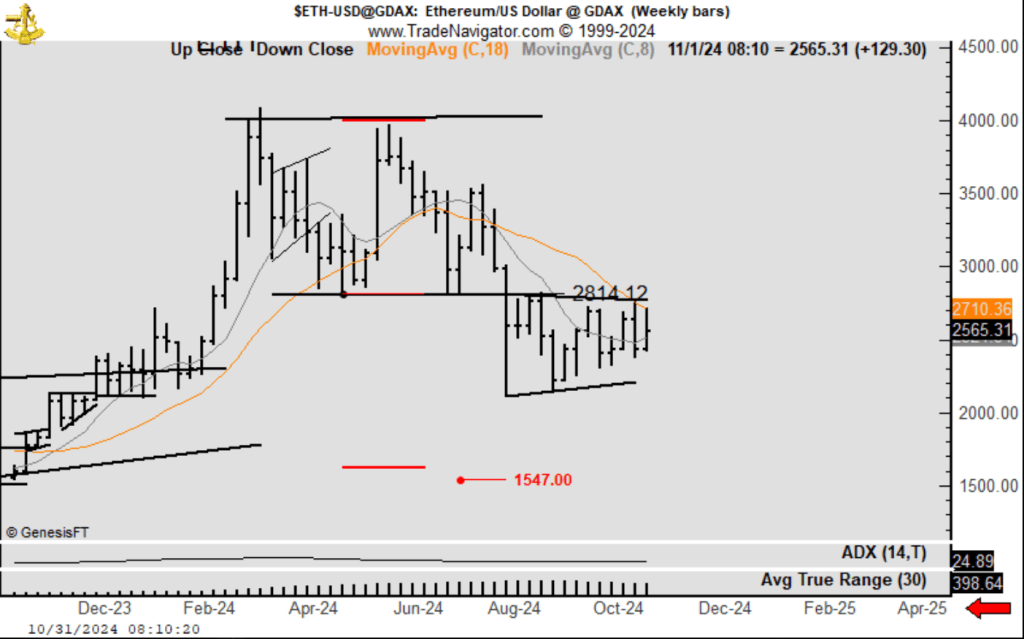

Veteran trader Peter Brandt warns that eth's bearish trend is severe and unlikely to change. Brandt lately saw the negative dominance of eth's daily chart and projected further losses.

<blockquote class="twitter-tweet”>

It is interesting to note that there was no buy signal in twitter.com/search?q=%24ETH&src=ctag&ref_src=twsrc%5Etfw” rel=”nofollow”>$eth

In fact, the chart remains bearish with the target not reached at 1551. pic.twitter.com/sjkXyTQXU2

—Peter Brandt (@PeterLBrandt) twitter.com/PeterLBrandt/status/1852005431213797463?ref_src=twsrc%5Etfw” rel=”nofollow”>October 31, 2024

On October 31, experienced analyst Brandt, known for his accurate forecasts, drew attention to ethereum's bearish trend on x (formerly twitter). The one-day chart of eth starting in August has indicated a downward trend. This “bearish flag” indicates that the decline will continue.

Brandt saw no ethereum buy signals or momentum changes. His negative vision contradicts the speculators' recovery forecasts. Since the chart does not show any reversals, Brandt believes that the eth price may fall below the current support levels.

Related reading

A different perspective

Although both are very contradictory in their opinions, Martínez and Brandt's analysis of what is likely to happen in the next phases of ethereum has revealed such unpredictability. Ether is seen continuing its S&P 500-like climb towards $10,000.

On the other hand, a similar warning given by Brandt suggests that even in the future difficulties may arise due to the continued presence of downward forces.

Featured image of DALL-E, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER